Ditch the spreadsheets and go beyond savings and investments with Boldin financial planning software. Empower yourself as a DIY investor to take control of all the variables that impact your wealth, retirement timing, and long-term financial security.

Get Started for Free

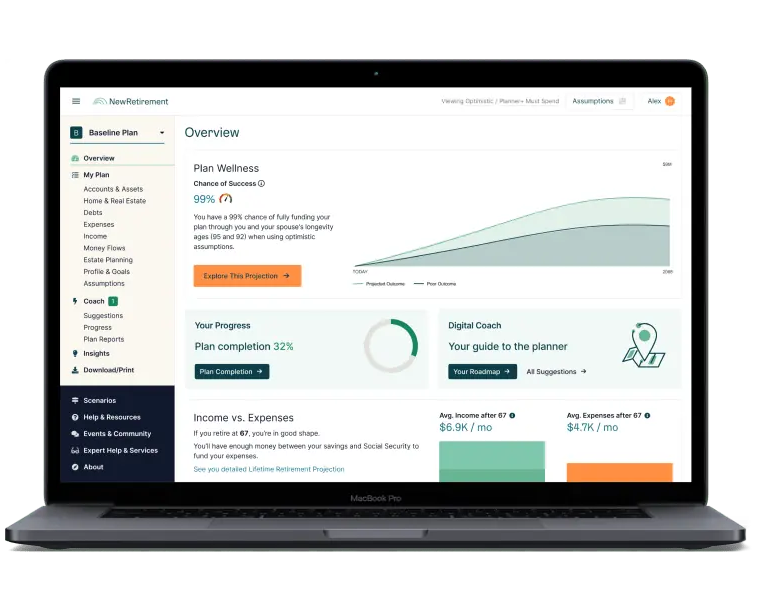

Using the Boldin planning software, you will organize all of your finances in one place, and you'll have the insights, support, and resources to navigate little decisions, big life changes, and the unexpected things that pop up along the way.

The White Coat Investor has partnered with Boldin to bring you the ultimate financial planning software designed with high-income do-it-yourself investors in mind. This robust, easy-to-use tool is much more than a retirement calculator, and it enables you to do better with your money, time, taxes, housing, insurance, and much more.

Get Started for Free