Since mid-2024, BlackRock has been offering lifecycle-style ETFs that include an income annuity as part of the mix of assets. Now, it looks like Vanguard wants to get in on the action, announcing in December 2025 a new series of target retirement funds called Target Retirement Lifetime Income Funds.

How Are These Different from the Other Target Retirement Funds?

You should know two things about the Target Retirement Lifetime Income Funds. The first is that this is a new series of funds. We're not talking about all of Vanguard's target retirement funds that were introduced in 2003. Totally different funds. I have no idea why Vanguard used such a similar name, but there will be substantial confusion—especially since the existing target retirement funds include one that is called Target Retirement Income Fund. The key difference is the word “lifetime” in the title.

The second thing is that these funds will only be available in employer-sponsored plans like 401(k)s and 403(b)s. That seems kind of silly, so hopefully that's a temporary thing. The reason it's silly is that when people leave their employers to retire (i.e., the time when an immediate annuity of some kind actually makes sense), they usually roll their 401(k) or 403(b) money to an IRA to allow for more control, more investing options, and often lower fees. Now there's an option available in the 401(k) but not the IRA? What a pain. Perhaps the reason these funds will be a 401(k)-only option is because they are not actually mutual funds. They are Collective Investment Trusts (CITs). Here is an excerpt from a future WCI post on CITs, currently scheduled for publication in March 2026:

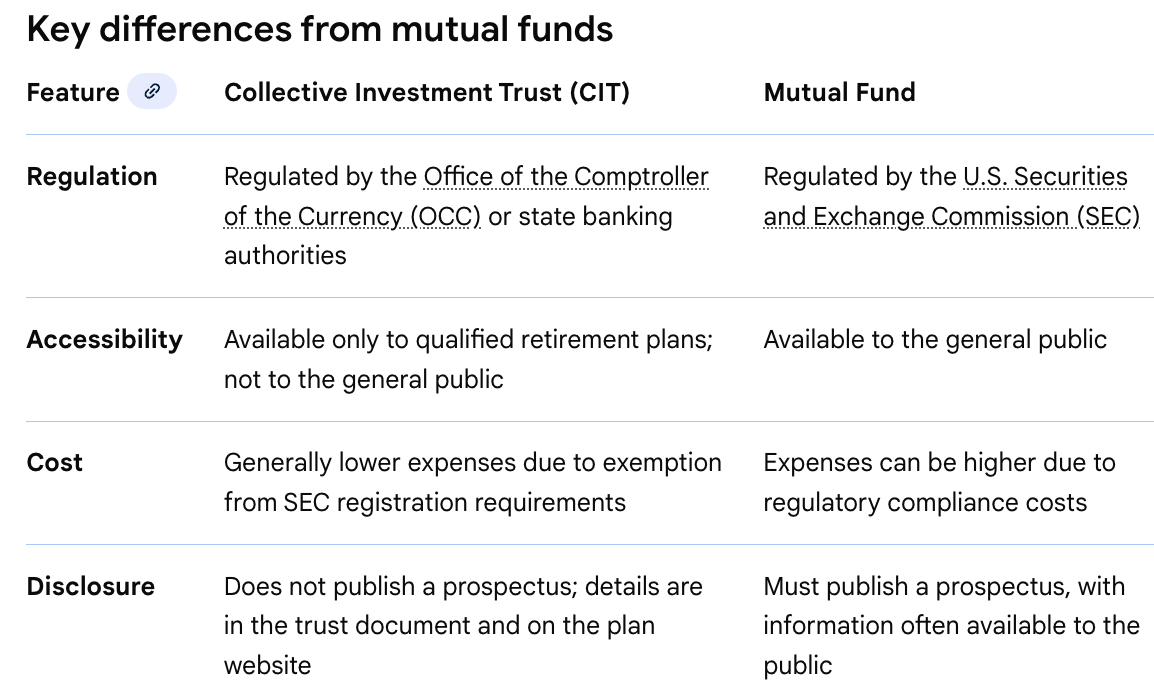

A CIT is a mutual fund alternative that only exists inside qualified retirement plans, like your 401(k). It's best to just consider it the same thing as a mutual fund, but there are a few minor differences, none of which are really bad. Google lists them well:

Bottom line, sometimes CITs are put into 401(k)s instead of mutual funds because they're slightly cheaper. Most of them are index funds or lifecycle-style balanced funds, which is generally a good thing for 401(k) participants. However, because they don't have ticker symbols like mutual funds and stocks, CITs can be a little harder to research on the internet (such as Morningstar and similar resources). More frequently you'll just have to obtain and review the information provided by Human Resources at your company or the 401(k) provider to learn more about the investments.

Why Would They Put Annuities into a CIT in My 401(k)?

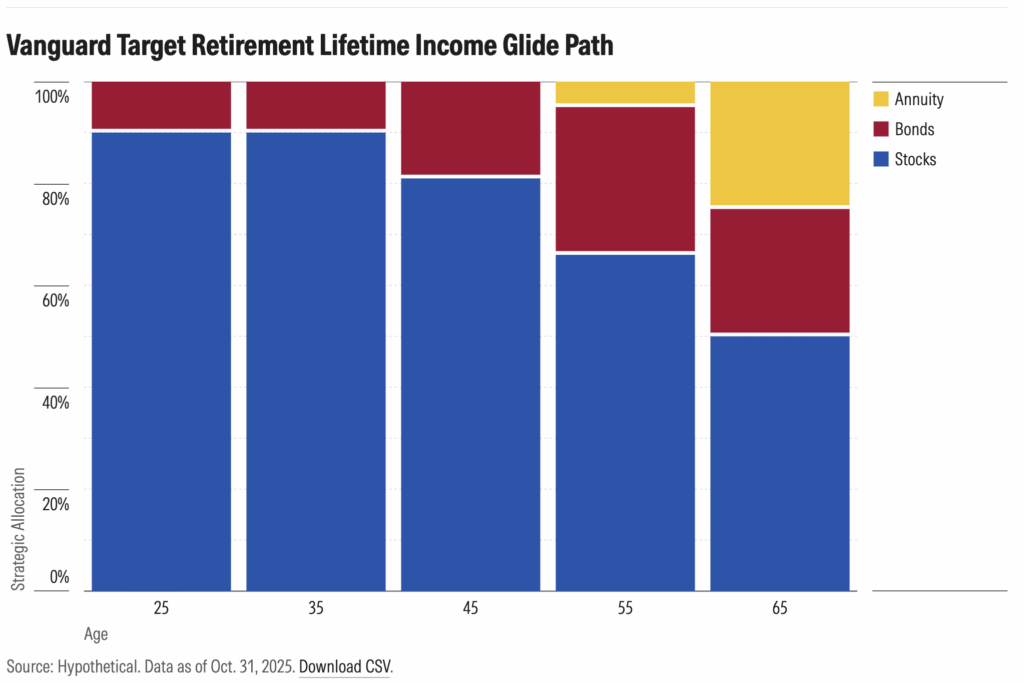

The plan for Vanguard is for these new target retirement funds to look like the older ones, at least until you hit the age of 55. Then, it'll start replacing some of the assets with an immediate annuity to provide more guaranteed income. Morningstar hypothesized that it would look like this:

The annuity portion will apparently be run by TIAA-CREF. The idea is to provide a more stable income during those years when you really want a stable income: during your retirement. Perhaps it will help reduce the Sequence of Returns Risk a little better than the mix of stocks and bonds in the older version of target retirement funds.

More information here:

Best Investment Portfolios — 150+ Portfolios Better Than Yours

The 15 Questions You Need to Answer to Build Your Investment Portfolio

Should You Buy the Vanguard Target Retirement Lifetime Income Funds?

Probably not. Few have. They're brand new. That's reason enough for me not to buy them. Besides, for most WCIers, lifecycle funds are something they grow out of by necessity as their retirement account situation becomes more complex. It's fine for your Roth IRA in residency. Not so fine when you have a 403(b), a solo 401(k), Roth IRAs, a 457(b), a cash balance plan, and a big taxable account.

Target retirement funds are all-in-one solutions that function great when all of your investments are in retirement accounts that offer them. That's not the case for most WCIers by the time they're 55, when this new series of target retirement funds would even start incorporating the annuities. I don't necessarily think these annuity-containing lifecycle funds are a terrible idea, but they also feel like a solution looking for a problem. I suspect most WCIers who want to annuitize a portion of their retirement assets are going to do it directly rather than via a target retirement fund—especially since you can't even buy these things in an IRA.

It's good to know these Vanguard Target Retirement Lifetime Income Funds exist, but I think you can pass on them for now.

What do you think? Are you interested in lifecycle funds that contain annuities? Why or why not?