Kaiser is a very large employer of physicians (almost 25,000) in several states. It's perhaps most prominent in California, and (conflict of interest alert) it has, at least in the past, hired a WCI-owned company (StudentLoanAdvice.com) to provide services to its doctors. As a nonprofit, its employees qualify for Public Service Loan Forgiveness (PSLF) for their loans. Unlike most private employers these days, Kaiser also offers a pension, and we are occasionally asked if “the pension is worth it?”

I'm never really quite sure how to answer that question, mostly because nobody ever defines “it,” and even if they did, a pension has different value to different people. For example, the more you value guaranteed sources of income in retirement and the less investment risk you are willing to take, the more value you should see in a pension. Plus, the longer you live, the more a pension pays you, theoretically making it more valuable for those who live the longest. However, there are methods of quantifying the value of a pension, and once you have done that, you can compare it to whatever “it” you wish, assuming, of course, you can also quantify the “it!”

What Is a Pension?

Years ago, retirement funding in America was viewed as a three-legged stool. The first leg was Social Security (basically a government-run pension program), the second leg was your employer-provided pension, and the third leg was your own retirement savings (whether or not in any sort of tax-advantaged account). Over time, employers, in an effort to lower their costs and risks, eliminated pensions or defined benefit plans (where the employer takes the investment risk) in favor of defined contribution plans (where the employee takes the investment risk). For most, the three-legged stool became a two-legged stool, and because most people lack financial literacy and discipline, it was actually a one-legged stool for at least 40% of retirees. However, there are a few people out there—primarily government employees but also employees of organizations like Kaiser—who still have access to all three legs of the stool.

While pensions can often be converted to a defined contribution plan (and cash balance plans are actually a defined contribution plan masquerading as a pension), the classic pension provides a stream of income guaranteed by the employer until the day you die. Pensions are often indexed to inflation in some manner, and they may even include some healthcare benefits to age 65 or beyond.

More information here:

Comparing 14 Types of Retirement Accounts

How to Value a Pension

It used to be easier to value a pension because you could buy an inflation-indexed pension from an insurance company. They are called Single Premium Immediate Annuities (SPIAs). A few years ago, it became harder and harder and then eventually impossible to buy an inflation-indexed SPIA. So, while you can still use this method, you are really comparing apples to oranges. It can still be a useful exercise, however.

Let's say you are considering getting a pension that will pay you $48,000 a year from age 65 until your death. What is that worth? Well, how much does it cost to buy it from an insurance company? One of the easiest places to get that information is a website from an annuity sales company called immediateannuities.com (no financial relationship). It looks like this:

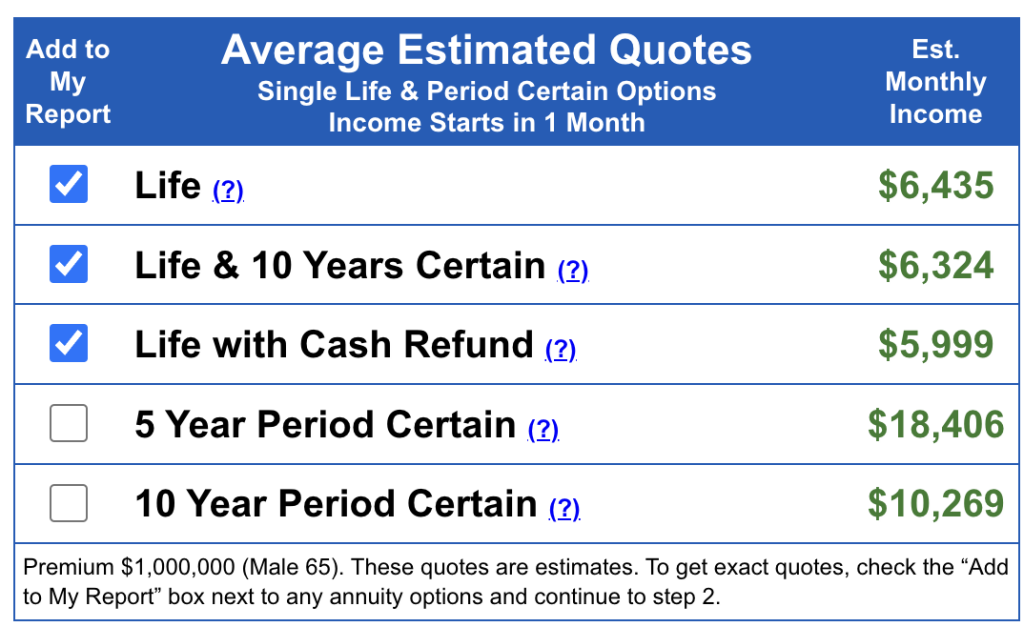

and then spits out this:

On April 30, 2024, when I ran this quote, a 65-year-old could buy an annuity that pays $6,435 per month ($77,220 per year). Using either trial and error or algebra (X = $48,000 × $1,000,000 ÷ $77,220), you discover that a pension that pays $48,000 per year would cost $621,601. Adjusting that for inflation, of course, requires a functioning crystal ball, and it is an exercise best left to a team of professional actuaries. But suffice it to say that a pension that was indexed to inflation would be worth significantly more than $621,601. As an aside, note that delaying Social Security to 70 is a far better deal than buying a SPIA. Delaying is clearly the “best-priced annuity” out there. That's because everyone gets Social Security but only healthy people buy SPIAs! In fact, there is data suggesting that annuitants actually live longer.

It gets even more complicated if the pension includes healthcare, like the military pension plan that also provides Tricare to its retirees. Basically, you would need to see what purchasing a similar healthcare plan on the open market would cost and add that value to what the pension is paying.

There are other methods of valuing a pension. For example, you can take the annual pension amount and divide it by a reasonable rate of return and then multiply it by a percentage probability the pension will be paid until death, as promised. That's right, sometimes companies stop paying. Due to that possibility, some people, such as Dave Ramsey, advocate you ALWAYS take the lump sum in exchange for your pension and invest it yourself any time you can. I don't feel that strongly about the subject (especially given the usefulness of pensions in mitigating Sequence Of Returns Risk [SORR]), but it is something to keep in mind.

Just like you spend 457(b) money first, maybe you don't want to rely on your employer for decades after retirement. But you're not completely reliant on your employer. There is the Pension Benefit Guaranty Corporation, which is basically a pension insurance company. In exchange for premiums paid by the company/plan, it guarantees some of your pension payment. That amount varies, but it is often thought of as up to $12,870 per month for a 30-year employee—less with fewer years of service and more with more years.

At any rate, this formula could be used as follows: $48,000 per year ÷ 2.5% × 90% = $1.73 million.

If you feel like that overstates the value (since a pension leaves nothing behind when you die), you could multiply it by 50%, leaving a final valuation of $864,000. That percentage should be lower the older or sicker you are. The obvious question becomes what rate of return to use? Certainly, you don't want to use something like the average return of stocks, but perhaps something like the 10-year Treasury bond yield, which was at 4.63% when I first wrote this post. If you used that instead of 2.5%, you'd get:

$48,000 ÷ 4.63% × 90% = $933,000

As you can see, it's clearly a garbage in/garbage out process.

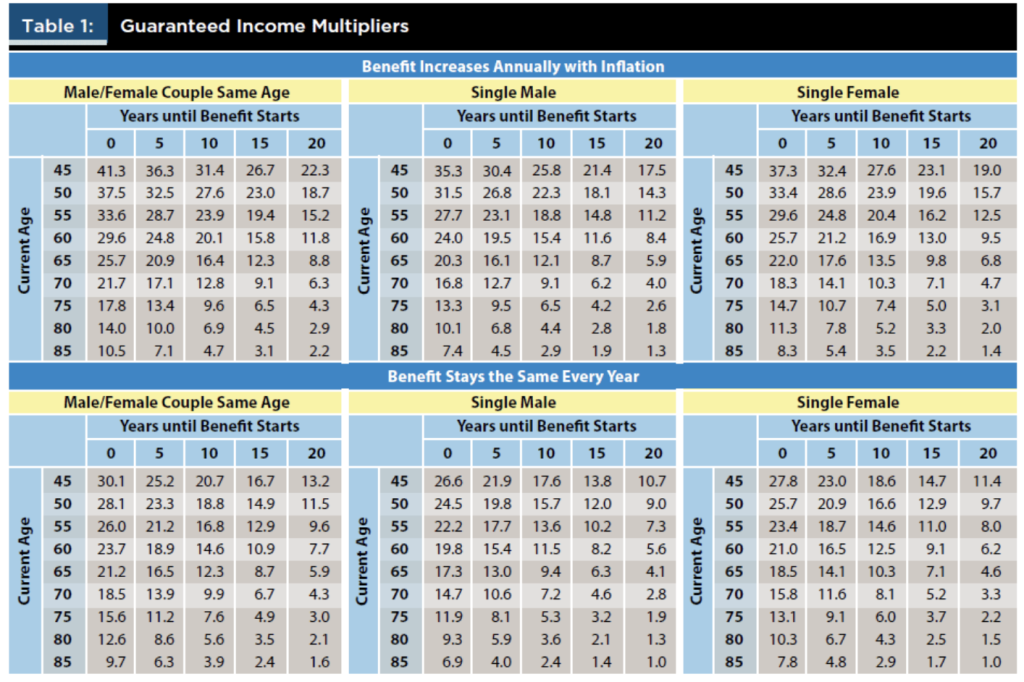

A better method is described here, and it uses charts to determine a guaranteed income multiplier.

If you are a 65-year-old male, you'd multiply the annual pension amount by 17.3 (20.3 if indexed to inflation) to determine its value.

So, a $48,000 pension would be worth $48,000 × 17.3 = $830,400 ($48,000 × 20.3 = $974,400 if indexed to inflation).

How Does the Kaiser Pension Work?

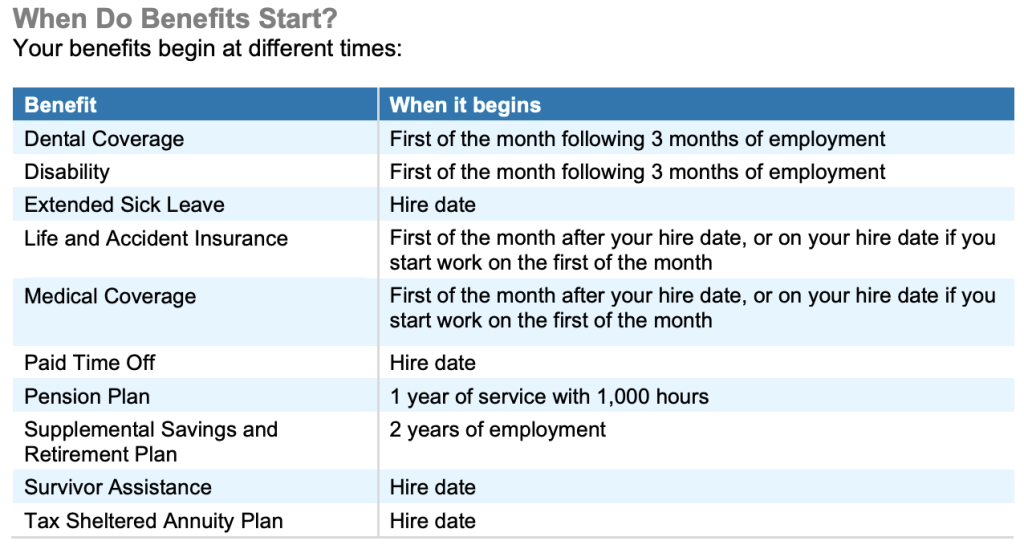

Let's start with a pamphlet handed out to Kaiser employees in northern California. It doesn't tell you much, only that you don't even start qualifying for the pension plan until you've been working for at least a year (1,000+ hours) and that it takes five years of employment (six?) before you're vested in it at all:

Interestingly, I found one of those pamphlets for residents and fellows, and this same chart DID NOT include the pension plan. Several Kaiser websites did say you could request documents from HR that explained the pension, but I couldn't find them online anywhere. All I could find was a few forum posts alluding to how it works.

Basically, you get 2% of your salary (it's unclear if any sort of bonuses or incentive payments are included) per year for each year of employment for the first 20 years and then 1% after that. So, if you work for Kaiser for 10 years, you get a pension paying 20% of your salary (presumably your last year's salary or an average of the last three years or something) starting at age 65 (although there is apparently a way to get the full pension as early as 60). While it's probably important to understand exactly how it works if you are a Kaiser employer, the exact details aren't all that important for our purposes today, and I'm sure they'll rapidly show up in the comments section of this blog post.

But let's say you make $250,000. Twenty percent of that is $50,000. As noted in the calculations above, that sort of pension is probably worth a high six-figure amount, possibly a low seven-figure amount.

More information here:

How Much Money Does a Doctor Need to Retire?

What Is “It?”

However, the question we're asking is whether the Kaiser Permanente pension is “worth it.” We still have no idea what “it” is. Certainly, the pension has value. All else being equal, if you get a pension at one employer and don't at another employer, the employer offering the pension is a better deal. However, all else is never equal. For example, maybe you're comparing an employer that offers a higher salary to a Kaiser job (but somehow magically all else is equal). How much more does that job need to pay to be worth taking over the Kaiser job? Assuming you have the financial literacy and discipline required to actually save for retirement effectively on your own, how much more would you need to be paid to save up an equivalent amount to that pension? Let's say the pension is worth $1 million. To have $1 million after 20 years of earning 5% real on your savings, you would need to save

=PMT(5%,20,0,1000000) = $30,242 per year.

To do that, you probably need to be paid something like $55,000 extra per year in pre-tax salary, depending on your marginal tax rate (which is not insignificant in a state like California). If the other job pays you $325,000 and the Kaiser job pays $250,000, then no, the pension isn't “worth it.” But if the other job only pays $280,000, then yes, the pension is “worth it.”

All employers offer different salaries, work environments, and benefit packages. Comparing one to another feels impossible because it is impossible. However, I hope this post gives you a sense of what a pension can be worth to help you make decisions that are a little bit more informed than just guesswork. Kaiser Permanente has a lot of fans, both among their insureds and among their employees. A generous traditional pension is just one reason why. But that doesn't mean that a Kaiser job is somehow better than every other job out there.

What do you think? Do you work for Kaiser Permanente? How exactly does your pension work? What value do you place on it? Why is it important to you to work for an employer that offers a pension?