By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderIRS Form 5500 is an information-only return that must be filled out by 401(k) administrators. Many small business owners are also de facto 401(k) administrators, and they may be required to fill out this form. I have been recommending that physicians use individual 401(k)s instead of SEP-IRAs for a long time. That allows them to max out the account ($69,000 for 2024) at a lower income and doesn't mess up their Backdoor Roth IRA. However, if they are making substantial contributions to the 401(k) or have had it for a long time, they likely need to fill out some version of the 5500 each year. For most of us, that's the 5500-EZ.

It's taken me literally just five minutes to fill out. It's not a big deal, and it's not worth paying hundreds of dollars to a tax preparer to do. In this post, I'm going to show you how to fill out IRS Form 5500-EZ for the typical physician using an individual 401(k). First, some helpful links:

- Here's where you find the form: IRS Form 5500-EZ

- Here are the IRS Instructions: 5500-EZ Instructions

- Here is a helpful tutorial from The Finance Buff. However, it's a few years old. My tutorial today is based on the 2023 form.

Do You Have to File Form 5500?

The good news is you don't have to file this form at all if your individual 401(k) has less than $250,000 in it at the end of the year. If you're only putting a few thousand into the plan each year, it may be decades before you have to do this form. If you're maxing it out each year, it'll probably still be 4-5 years before you have to do it. If you are maxing it out for you and your spouse, however, you may have to start filing after just three years or so. We started our plan in 2013, and the first year we had to file the 5500-EZ was for tax year 2016.

More information here:

Can You Use Form 5500-EZ?

5500-EZ is for a one-participant plan. That means, in the words of the IRS:

“A retirement plan (that is, a defined benefit pension plan or a defined contribution profit-sharing or money purchase pension plan), other than an Employee Stock Ownership Plan (ESOP), which:

1. Covers only you (or you and your spouse) and you (or you and your spouse) own the entire business (which may be incorporated or unincorporated); or

2. Covers only one or more partners (or partners and their spouses) in a business partnership; and

3. Does not provide benefits for anyone except you (or you and your spouse) or one or more partners (or partners and their spouses).”

As you can see, that means if it only covers you or your spouse, you get to use Form 5500-EZ. If you file it on paper, you send it to:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0020

You can also file your Form 5500-EZ electronically by using the EFAST2 website.

If you have other employees, you are stuck using the 5500-SF (short-form) or, even worse, the real form 5500—both of which are longer, more complicated, and filed electronically.

When Does Form 5500-EZ Have to Be Filed?

According to the IRS:

“Form 5500-EZ must be filed by the last day of the 7th calendar month after the end of the plan year that began in 2023 (not to exceed 12 months in length).”

What does that mean? If you're on the calendar year like most, it means you need to get it in by July 31 of the next year. That means for tax year 2023, it's due July 31, 2024. I make a habit of filling it out the same week Vanguard sends me its little 5500 packet, usually in late March.

What's the Penalty for Not Filing Form 5500-EZ?

It's a massive penalty, and ignorance of having to fill out the form is no excuse. If you haven't filled Form 5500-EZ and you've had more than $250,000 in your solo 401(k), the penalty is $250 per day up to $150,000 for every late 5500-EZ, plus interest.

Luckily, there's a remedy. If you realize you're delinquent in filling out Form 5500-EZ, you can submit Form 14704. That will drop your penalty to $500 per year for every year that you didn't send in 5500-EZ, and it maxes out after three years. Even if you have missed 20 years of 5500-EZs that you were supposed to complete, you only have to pay $1,500 max if you fill out Form 14704.

Here's what WCI guest writer Steffan Weiner wrote in late 2022:

“If you believe you do have a reasonable cause for the late 5500-EZ filing, the IRS offers guidance to avoid penalties. Your reason must show that ‘you used all ordinary business care and prudence to meet your Federal tax obligations.' Example reasons include fire, casualty, natural disaster, lack of access to records, death, severe illness, and incapacitation. Typically, you will be required to provide supporting documentation and to establish facts substantiating your claim of reasonable cause.

The IRS instructions to apply for a reasonable cause can be found here: Penalty Relief Due to Reasonable Cause

If you make a request to waive the penalty due to a reasonable cause and that request is denied, you are no longer eligible to use form 14704. Being that the worst scenario payout using Form 14704 is $1,500 and late 5500-EZs can result in hundreds of thousands of dollars worth of penalties, you should scrutinize this option carefully.”

More information here:

The 1 (Weird) Tax Trick the IRS Hates

3 Big Tax Deductions for Doctors

What Does the Form Look Like?

There are two pages. Here is the complete form for your reference:

How to Fill the Form Out

Let's take it section by section and fill out the form.

Part I

If you're on the calendar year and this isn't the first time you've done this form, then you can probably ignore all of Section I. If this is the first time, check box A(1).

Part II

Section II is pretty easy. If this isn't your first year, pull out last year's form and you can probably just copy most of it. Your plan has a name; be sure to use it. Vanguard sends me paperwork in March each year with the name of my plan. It's “The White Coat Investor, LLC Individual 401K Plan.” Since this is the first plan this business has ever had, its three-digit number (1b) is 001. It first became effective January 1, 2013. Fill out the name, address, and the EIN of your business. (You do have one, by the way; you couldn't have opened an individual 401(k) without an EIN.) The “business code” is used on other forms as well. For a business like WCI, it's 519100. The list starts on page 9 of the IRS instructions.

You can probably ignore lines 3 and 4.

Line 5 for us reads 2, 2, 2, 2, 0. If your spouse isn't in the business, then yours probably reads 1, 1, 1, 1, 0. “Active participants” are basically those who are still working.

Part III

The form starts to get more interesting here. Your individual 401(k) provider probably sent you a form with the information needed to fill out this section. Here's one from years past when Vanguard sent me a 10-page form (don't be intimidated, most pages are blank or boilerplate). Page 5 looked like this:

In those 10 pages, only four numbers were actually needed to fill out 5500-EZ. Two of those numbers were the assets in the plan on December 31, 2016, and on December 31, 2017; in our case, that was $293,701 and $471,720. (You can see those at the bottom of the page). Those go on line 6a columns 1 and 2, respectively. 6b was zero for us (since we didn't have any outstanding 401(k) loans), so 6c just equals 6a.

Line 7 listed that year's contributions. I got the other two numbers I needed from page 7 of what Vanguard sent me:

See those two numbers under the “contributions” section? That's what we're looking for. Line 7a is the employer contribution ($72,000 in our case) and Line 7b is the participant contribution ($36,000 in our case). If you rolled an IRA into your plan, like many docs are trying to do with Backdoor Roth IRAs, that would go on 7c.

Part IV

This section seems a little bit mysterious. You'll likely need to refer to your instructions to get this one right. It's helpful to look at both the Vanguard and the IRS instructions. The Vanguard instructions said:

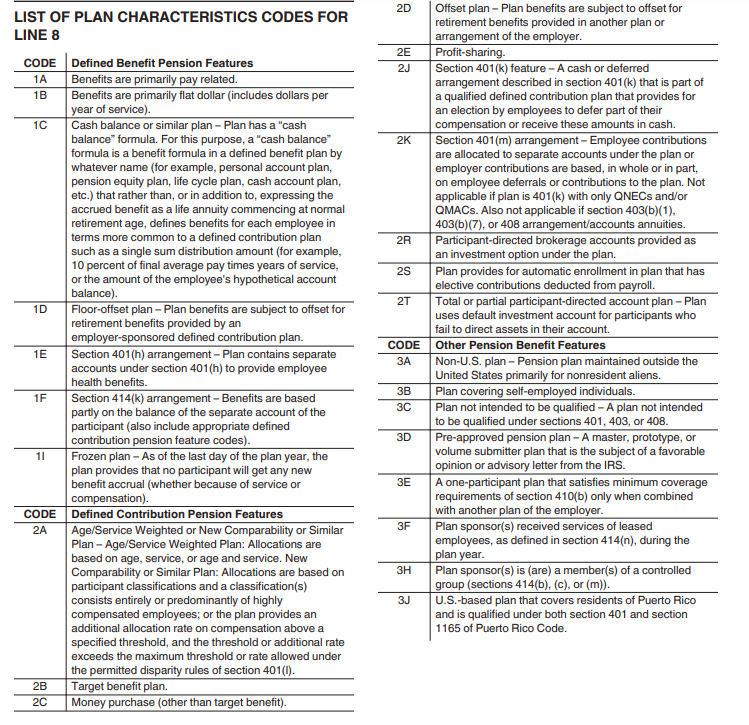

Vanguard said enter codes “2E, 3D, and 2J” for individual 401(k)s. If you go to the IRS instructions, you'll see the following list:

Clearly, Vanguard is right about 2E as we have a profit-sharing component, about 3D as we have a pre-approved plan (the standard Vanguard one), and 2J as we have a 401(k) feature. As I scanned the rest of the list, the only other one I saw that applied to our plan was 3B since we're self-employed. I included that one with the three others.

Part V

Part V was very easy for us. Lines 9, 10, and 11 are all “No.” In 2023, the IRS added a new requirement for question No. 12 that reads, “If the plan sponsor is an adopter of a pre-approved plan that received a favorable IRS Opinion Letter, enter the date of the Opinion Letter and the Opinion Letter serial number.” Depending on what brokerage you use, the IRS has a list of all those dates and serial numbers.

Here's what that looks like.

Then, you sign the bottom, drop the mic, and walk off stage.

What do you think? Have you filled out 5500-EZ? Was it as easy as I made it out to be? Have you paid someone to do it for you? What did they charge? Do you have any questions about the form?

[This updated post was originally published in 2018.]