For years, my husband and I have been real estate curious. We liked real estate investing for all the usual reasons: the tax benefits, the possibility of more passive income, the investment diversification. I’ve written about how we were accidental landlords, and in 2023, we bought the office building that houses my husband’s practice. We have REITS in our portfolio, although these really behave more like stocks than like real estate, and we have none of the tax benefits of direct real estate ownership. Until this year, we had never owned an actual residential investment property—meaning a property that we bought with the sole intent of renting out.

In April 2025, we finally found a property that actually met all our criteria. In June, we closed, and now we are official landlords. I’m going to describe how we learned about real estate and how we analyzed this property, but first, I’m going to discuss all the ways we don’t invest in real estate.

How We Don't Invest in Real Estate

Remotely

Buying property using an agent in another city or across the country, maybe even sight unseen, is a much-touted way to get into investing. The REI websites, podcasts, and discussion forums hype this up with headlines like, “Don’t miss out on the next top cash-flowing markets!” I don’t believe this kind of real estate hype any more than I believe “this stock is the next big thing!” because 1) if it’s really that great, people in the know are busy investing and not writing about it; 2) no one really knows for sure; and 3) I need to really know and understand a market (or a company) before I invest.

Real estate is local and sometimes hyper-local. Two blocks can be the difference between a profitable investment and a money pit. Where I live (Vermont) is not generally favored by big-time investors because prices are high compared to the Midwest and the South. But I know the state and the neighborhoods. I also have a local lawyer, a lender, and a guy who can repair anything. His name is Kyle. I’m sure there are Kyles in Ohio. I just don’t know how to find them.

Passively

There is even more hype about passive real estate investing. You can put money into funds or syndications that build, flip, or rent apartment buildings, houses, mobile home parks, or short-term rentals in any part of the US or the world. These funds generally promise big returns with little risk and less effort.

I don’t trust these either. Private real estate funds have little regulation. If the fund's “sponsor” (the general partner, or the person running the show) doesn’t know what they are doing or gets caught by a change in market conditions, you may get a capital call asking for more money. Or you may just lose your whole investment.

I have looked into a handful of these, and some of the fund sponsors have only been doing this for a few years and have never weathered a downturn. Also, they are all in different parts of the country (see above).

If you are starting to think I am fundamentally untrusting and curmudgeonly, you are right.

In Short-Term Rentals

STRs are wildly popular because they can be very profitable, even if the early days of sky-high returns are probably a thing of the past as markets get saturated and regulated. You can also get the tax advantages of ownership of a STR with fewer hours than you can with long-term rentals (100 hours of participation annually instead of 750). The downside of STRs is that you are basically running a hospitality business or paying someone else to run it for you. I don’t want to run a hospitality business. Again, the hotspots for these rentals are generally in the South and West. (Why would you not want to visit Vermont? You can ski, eat ice cream, and have a picnic with golden retriever puppies.)

For Appreciation Only

In expensive real estate markets, it can be very hard to find rental properties that actually produce income. In other words, the rental income doesn’t cover the mortgage and taxes. People who want to invest can go one of two routes: buy in other markets or stay local and hope the property appreciates enough to sell at a profit in the long term.

This strategy doesn’t appeal to me for two reasons. First, I don’t want a cash drain. Second, I’m not convinced that any market will continue to go up forever. I have benefited from real estate appreciation in my own family’s properties, but I don’t want to count on it. Hope is not an investment strategy. So, I only considered properties that would cash-flow from the start.

You may take an entirely different approach. You may be highly proficient in running short-term rentals in another state, and more power to you. None of these appealed to us, and so we arrived at our own criteria.

More information here:

How to Start Investing in Real Estate

Do’s and Don’ts for Docs: Real Estate by the Decade

How We Wanted to Invest in Real Estate

Between 2 and 4 Units

Anything over four units is considered a commercial property, and it would need a commercial mortgage. These typically have a five-year fixed rate and then a balloon payment, at which point the owner can either pay off the loan or refinance. There’s nothing wrong with this strategy, but for my first foray into REI, I wanted something more familiar. Staying at four units max kept us in residential loan territory. As it turned out, we got a 20-year commercial loan because the terms were better than residential mortgages at that time (thanks, local lender Jason), but the teaching point still stands.

Minimal Renovation (If Any) Needed

Buying a fixer-upper is a legit strategy, but I don’t have the bandwidth. I'm too busy frolicking with golden retriever puppies, which is what we do up here in Vermont.

Cash-Flowing

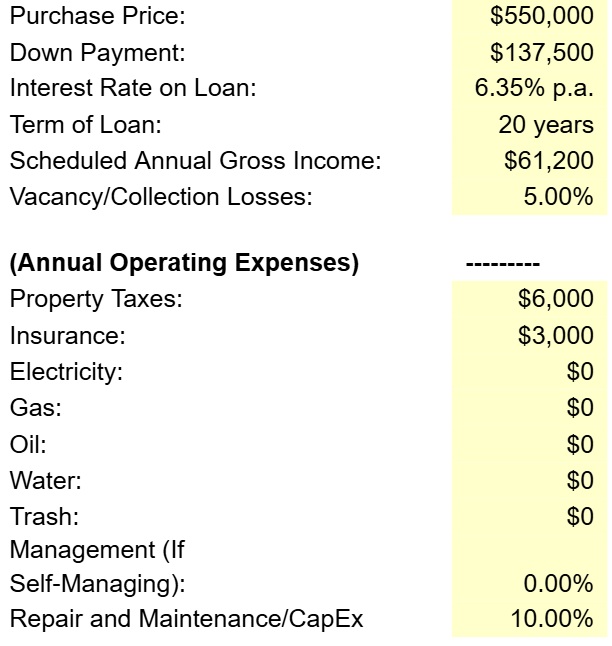

This is the part that makes people like me the most nervous. How do you know if a property will make money each month? There are the 1% or 2% rules, but these are just a starting place. You can buy access to a rental calculator that will take local rents into account, or you can do what I did and use a free online spreadsheet. You use the current rents (if there are tenants in place) or a local average. If you are not sure what local averages are, do an online search or just check out similar rentals in the area. This is where buying local makes things easy. We wanted at least a 7% cap rate (for explanation of cap rates, see below).

More information here:

How the IRS Treats You as a Real Estate Investor

The 60+ Worst Mistakes You Can Make in Real Estate Investing

Our Hunt for Real Estate Properties

Once we settled on our criteria, we started looking for properties—right around the time interest rates went up and created a seller’s market. In hindsight, I’m glad that none of the dozens of properties I looked at over the past five years panned out, because during that time, I got a great education. I read blogs and websites, listened to podcasts, and perused listings (you could also take WCI’s real estate course). I set up a couple of searches on realtor.com and now get daily emails with new listings. Most of these I skipped, some I looked at, and maybe 10% I actually ran the numbers on. Out of all of these, I went and looked at fewer than 10 properties. This is considered normal in the real estate investing world, if my podcasts are to be believed. There is even a name for this: the “deal funnel,” which just means that you should start by looking at a lot of properties to end up with just one.

When we finally found a property that worked, we moved quickly and confidently. I still had some serious agita the night before closing, but that’s just me. Here’s how the numbers looked.

You’ll notice that the residents pay all their own utilities. This helps the bottom line a lot.

The spreadsheet then spit out these metrics.

Capitalization Rate: 8%

Capitalization rate (or cap rate) is the equivalent of yield in stock investing. Cap rate is the Net Operating Income (income minus expenses, but not mortgage payment and interest) divided by the purchase price. This can be multiplied by 100 to give a percentage. The cap rate is the return you would get if you paid all cash for a property (no mortgage). This is a standard measure of profitability, because every investor will have different financing. This is nice to know, but since most of us buy property using a mortgage or other leverage, we need to factor financing in our calculations. That brings us to . . .

Cash on Cash: 4.34%

Cash-on-cash return (COC) is annual cash flow (income minus expenses, this time including mortgage payment and interest) divided by the cash you paid (down payment + initial expenses). COC accounts for financing in both the mortgage payment (higher payment + interest = lower COC) and the down payment (lower down payment = higher COC).

Cash Flow: $5,964 Per Year

This is just how much you pocket at the end of the year.

Return on Equity: 26.64%

Return on Equity (ROE) is the total return of the property (cash flow + tax reduction + debt reduction + appreciation) divided by the equity you have put in (down payment + capital improvements). This accounts for both actual profit (in the form of cash flow and reduced taxes) and paper gains (paydown of debt and appreciation), which you don’t realize until you sell. If you are buying for appreciation rather than cash flow, this is the key metric.

You might look at these numbers and think that this seems like a lot of effort for 4% return on your cash outlay, per year. And you would not be wrong exactly, but this is where the other metrics, like cap rate and return on equity, come into play. Stock market investing is a lot easier. That’s why investing in real estate is optional. It’s also slow. The power of real estate investing is in the growth over time, both in rents and in one’s investment portfolio. There are also economies of scale that kick in when you have more than one property.

That’s how, on June 18, we became actual real estate investors by buying a cute duplex in a sleepy cul-de-sac. On June 20, one of our tenants was arrested by federal agents in a massive drug and firearms raid. We added another local lawyer (Marc) to the team. Read more in my next column: What We Learned When Our Tenant Was Arrested on Drug Charges.

Would you rather be a direct real estate investor or utilize more passive activities like syndications or funds? Have you bought a property for the sole purpose of renting it out? What was your experience? How did you make the numbers work?