By Eric Rosenberg, WCI Contributor

By Eric Rosenberg, WCI ContributorIf you’re self-employed, you may be looking for tax-advantaged ways to save for retirement. Fidelity is a top choice for retirement plans, including self-employed 401(k) accounts, thanks to low fees and helpful tools to keep you on track for retirement. Here’s a closer look at how to open a solo 401(k) at Fidelity to get you started with one of our favorite retirement plan providers.

What Is a Solo 401(k)?

A solo 401(k) is a retirement account for self-employed business owners, including some doctors and other medical professionals. In a legal sense, it’s the same as a standard 401(k) for larger businesses but only has one member: the business owner.

With an individual 401(k) plan, you can invest in stocks, bonds, ETFs, and mutual funds easily with the tax advantages of a 401(k). For most people, that means contributing pre-tax dollars to your retirement account. Contributions are tax-deductible and lower your taxes in the year you contribute. When you withdraw in retirement, withdrawals are considered taxable income, but you’ll likely pay a lower tax rate than during your working years.

More information here:

Multiple 401(k) Rules – What to Do with Multiple 401(k) Accounts

How to Open a Solo 401(k) at Fidelity

If you’re a self-employed doctor meeting specific requirements, you could potentially open your account entirely online. Listed below are the requirements to open a solo 401(k) online—you must meet all of the following criteria:

- You are the plan administrator and plan participant.

- You are a US citizen.

- Name your spouse as your primary beneficiary if you are married.

If you don't meet those criteria, you must submit a paper form to establish your account. The three forms required for a solo 401(k) at Fidelity are:

- Self-employed 401(k) adopting agreement

- Trust agreement

- Self-employed 401(k) account application

If you can go through the process online, which is the easiest way forward, start by going to the signup page here. Then, follow these steps:

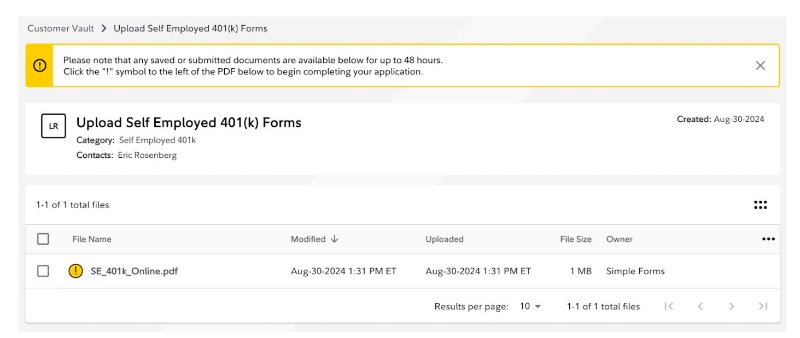

#1 Enter Your Basic Contact Information and Get Access to the FidSafe Vault

You’ll start by entering your basic personal information, such as your name and email address. You’ll then be taken to the FidSafe Small Business Vault, an online system where you can submit your forms. Click on the plan name to get to the view below, where you can access your plan document's PDF. You can download and complete the forms or click the pencil icon on the next page to “Initiate e-sign.”

#2 Download and Complete the Application Form

The main application is a fillable PDF you can download and complete on your computer. It’s a lengthy document—22 pages long—but the parts you’ll need to fill in are simple enough. You can complete the form in one sitting if you have your personal and business tax information readily available.

Establish the Plan

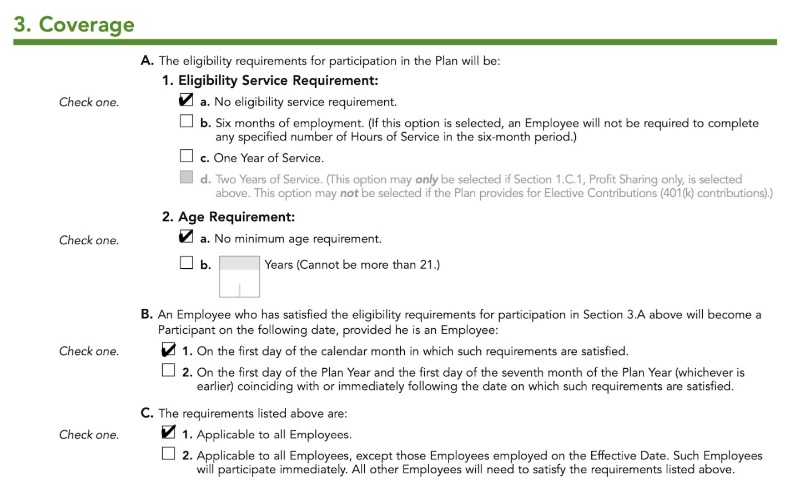

You’ll have to make a few decisions as you complete the paperwork, but it’s mostly straightforward. Because you’re the only covered employee, you can set up the plan to be effective immediately, and you’re automatically included. If you have other employees, you may want to fill out the forms so you’re the only person eligible for the plan.

The first eight pages are the “Profit Sharing/401(k) Plan Adoption Agreement,” outlining the plan details and who is eligible to participate. Consulting with a trusted tax or legal professional may be helpful if you have questions about any section.

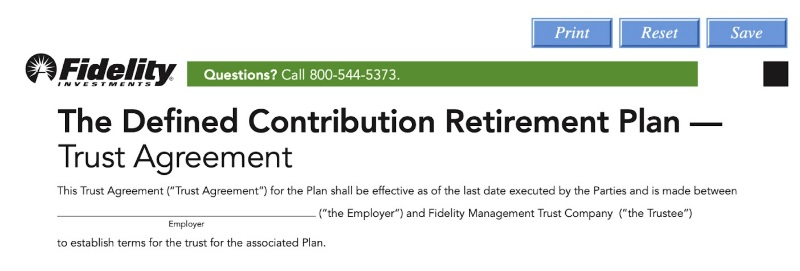

Trust Agreement

After that, you’ll enter information in the Trust Agreement section, which establishes a legal trust that can hold funds on behalf of the employee (you) for purposes of the retirement plan.

Fidelity’s part of the form is pre-filled and names a person (currently a VP of Operations) as the trustee. All you have to do for this section is enter your business information and complete a signature section.

Create Your Fidelity Account

The following section in the PDF creates your Fidelity account. It’s much like other Fidelity brokerage accounts, and it has no setup or recurring fees to maintain. You’ll enter some personal and business information to complete this section. It’s helpful to have your spouse’s Social Security number available, too, as you’ll need that for the beneficiary section.

At the bottom is a trusted contact form, where you can designate someone to provide additional security for your account. This is helpful if Fidelity suspects fraudulent activity or if you may be a victim of a scam.

Complete and Upload to Fidelity Vault

I completed the entire form on my laptop in less than 15 minutes. It’s a straightforward set of forms. If you have your signature already saved on your computer, completing the PDF is easier, as you don’t have to print and scan the document.

#3 Fund Your New Account

When you get confirmation that your account is open, you can log into the Fidelity website to make your first contribution. As with any other 401(k), you can make contributions, and the business can contribute. You can roll over your balance or assets to your new 401(k) if you have other pre-tax retirement accounts.

Fidelity Solo 401(k) Costs and Fees

The Fidelity solo 401(k) stands out in its class, with no recurring fees or commissions for stock and ETF trades. You can also buy and sell most Fidelity mutual funds without transaction fees. If you’re not a fan of Fidelity, the Charles Schwab solo 401(k) could be a reasonable alternative.

While you may run into fees for less everyday activities, many small business owners can use this individual 401(k) plan for free. That’s a big win for your finances and retirement. Future you is unlikely to regret saving more for retirement with a tax advantage.

More information here:

How to Do a Backdoor Roth IRA at Fidelity

Tax-Loss Harvesting with Fidelity

Is a Fidelity Solo 401(k) Right For You?

If you’re a high-earning professional looking to maximize your retirement savings, a solo 401(k) plan could be the best way forward. While a SEP-IRA is easier to set up at Fidelity and elsewhere, a solo 401(k) has higher contribution limits, which can be a significant advantage over time. If you’re looking for a solo 401(k) provider, we have no hesitation in suggesting Fidelity as a top choice.

If you need extra help with planning for retirement or have questions about the best way to save your money in tax-protected accounts, hire a WCI-vetted professional to help you figure it out.

The White Coat Investor is filled with posts like this, whether it’s increasing your financial literacy, showing you the best strategies on your path to financial success, or discussing the topic of mental wellness. To discover just how much The White Coat Investor can help you in your financial journey, start here to read some of our most popular posts and to see everything else WCI has to offer. And make sure to sign up for our newsletters to keep up with our newest content.