Not everyone needs a financial advisor, but for many, the value of working with a professional is real—whether it’s optimizing decisions, avoiding costly mistakes, or simply reducing stress and freeing up time. For those who do opt to delegate, one question should be front and center: What is a fair price for quality guidance?

Financial planning and investing can get complex. That’s why communities like WCI exist: to demystify the choices and pitfalls that physicians face at every stage. It’s fair to assume that more complexity justifies a premium price for expertise. But does that mean fees should rise as your wealth grows, even if your level of complexity stays the same?

Most WCI readers are familiar with the industry standard fee model: Assets Under Management (AUM) fees. Here, financial professionals charge a percentage of your portfolio on an ongoing basis. This structure means your costs can increase over time as your savings and the market grow.

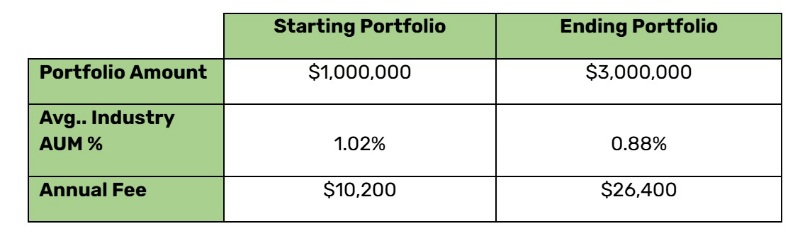

Suppose a disciplined physician in their early 40s has accumulated $1 million in investable assets (a plausible milestone for many). If they continue to save aggressively and benefit from even modest market growth, it wouldn’t be unreasonable for that portfolio to reach $3 million or more by age 50.

Under a typical industry blended AUM fee, here’s what the annual advisory cost looks like, via AdvisoryHQ:

Industry average advisory fee data, sourced from AdvisoryHQ. Fees and returns are for illustration only; actual advisor costs and results will vary.

That’s more than doubling annual fees, even if nothing else about your financial life has changed.

But there’s another way. It’s increasingly familiar to informed investors, though it's still rare in the industry: the flat-fee model.

Only 8% of advisors operate without any AUM-based fees, making truly flat-fee firms the exception, not the rule. A flat-fee structure charges a set, transparent dollar amount for services, regardless of portfolio size. Many flat-fee firms also offer the options of ongoing, single-project, or hourly engagements to match your needs.

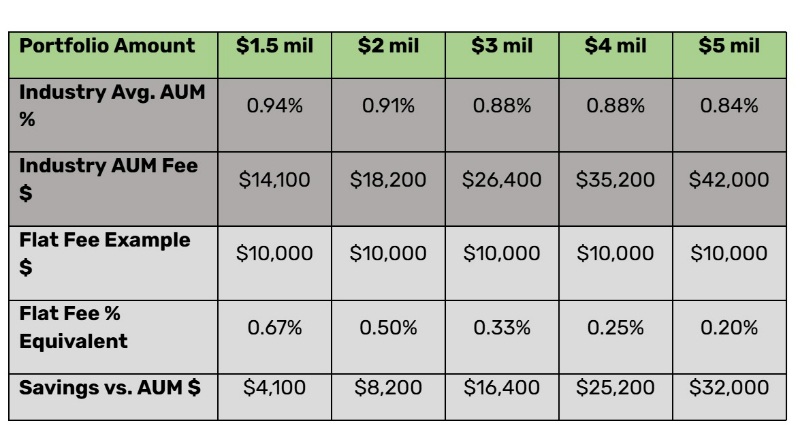

To see the contrast, let’s extrapolate from the earlier example:

Industry average advisory fee data sourced from AdvisoryHQ. Fees and returns are for illustration only; actual advisor costs and results will vary.

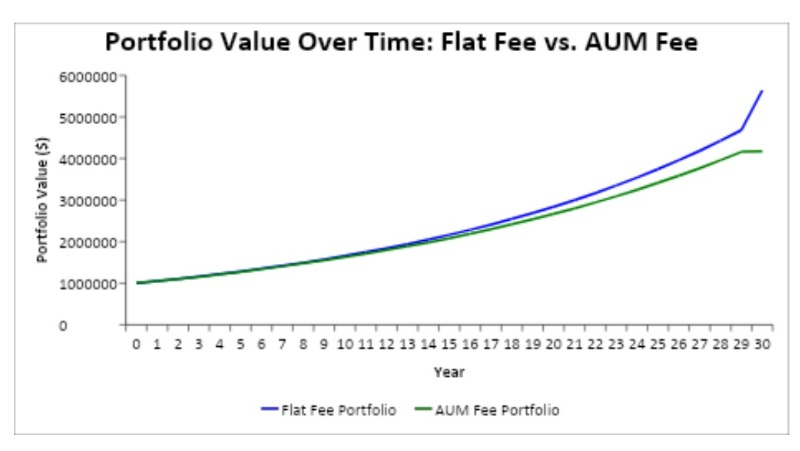

Under a flat-fee structure, your fee is predictable, and it doesn’t function like a wealth tax simply because you saved more or the market went up. The difference becomes even more striking when you look at the compounding effect of keeping more of your assets invested.

For simplicity, the following example assumes no additional contributions—just a one-time investment growing over time. The result: a portfolio that ends up more than $580,000 larger under the flat-fee model compared to the industry-average AUM fee.

Assumptions: $1 million starting balance, 6% annual return, $10,000 annual flat fee, industry-average AUM fees per AdvisoryHQ. Fees are deducted annually. No additional contributions or withdrawals. Educational illustration only—not financial advice. Actual fees and outcomes will vary.

But costs and pricing are only one aspect of the story. Most physicians have seen how incentives shape behavior in healthcare. The same is true in finance: the way your advisor is paid inevitably influences their recommendations, even when everyone means well.

How Incentives Shape Advice

Most advisors, whether fiduciary CFPs or fee-only RIAs, genuinely want to do right by their clients, and many do. But the compensation structure always matters. Even with the best intentions, AUM incentives can quietly (even unconsciously) influence recommendations.

Take this scenario: You inherit a significant sum and want to buy a mountain house—both as a family retreat and a rental property. Naturally, you ask, “How much should I put down? Should I use some of my portfolio, or should I leave investments untouched and take on a bigger mortgage?” On paper, this is just a financial planning question. But for an advisor who is paid on assets under management, every dollar that moves from the portfolio is a direct reduction in ongoing fees. Even if the advisor fully discloses this and tries to remain objective, there is a subtle friction at play. It might show up as a gentle nudge to leave more invested, a suggestion to make a smaller down payment, or a focus on the opportunity cost of pulling funds from the market.

This same AUM-driven tension can influence advice around:

- Using investment assets for a practice buy-in or business opportunity.

- Paying off student loans or wiping out a mortgage with portfolio withdrawals.

- Purchasing a second home, vacation property, or rental real estate.

- Building a larger cash reserve for career flexibility, self-insuring, or peace of mind.

The good advisors disclose these conflicts and clearly lay out the options and impacts. But disclosure alone does not erase the underlying structural issue. This is not about bad actors. It is about the way incentives shape advice, often beneath the surface.

When you consider both the compounding cost of AUM fees and the subtle ways they can shape your advisor’s recommendations, you have to wonder why the industry hasn’t shifted. The reason AUM still dominates is not about logic or client outcomes. It comes down to the business realities and incentives that keep the model firmly in place.

More information here:

What Would Your Ideal Financial Advisory Firm Look Like?

Why Flat Fees Are Rare—And AUM Persists

Allow me to digress for a moment. Today, low-cost, broadly diversified investing is common sense, but we almost forget how radical it was for decades after Mac McQuown launched the first (non-retail) index fund in 1971. Indexing didn’t spread like wildfire; it spread like molasses. The financial industry is slow to change, especially when the status quo is profitable.

In the 1990s, you could find a fiduciary financial advisor, but it wasn’t easy. Almost everything was commission-driven and transaction-focused: front-loaded mutual funds, trailing commission fees, and insurance products. The conflicts were obvious, but it took time (and a lot of disappointed investors) before consumers started demanding something better.

When true financial planning finally moved into the spotlight, the AUM model was a progression. It aligned advisor incentives more closely with clients. It offered ongoing service. And it was more comprehensive. But as technology advanced and firms could serve more clients at scale, the AUM fee structure didn’t change. It became more entrenched, more lucrative, and harder to pivot away from.

Today, the vast majority of the wealth management industry is built around AUM. Large national wealth management relies on this model to fund advisor salaries and parent company profits. At independent firms, it underwrites staffing, operations, and owner compensation. Moving to a flat-fee model isn’t just a pricing change; it’s a full business model reset.

If you need proof that AUM is the industry’s golden goose, just look at private equity. PE firms aren’t acquiring wealth management practices at a record pace because of their transparency or client-first values. They’re buying revenue streams that scale and grow automatically as markets rise. There’s little incentive to change course when the model works.

Change in financial services has never come from the top down. Indexing took decades to go mainstream, and flat-fee planning will follow the same path. The catalyst is always the same: informed investors who ask better questions, compare their options, and demand something better.

More information here:

How to Get Real Financial Advice If You Need It

Delegator, Validator, or DIYer? Take This Quiz to Find Out What You Are

Second Opinions Matter—Especially When It Comes to AUM Fees

Every physician knows that when the stakes are high, a second opinion isn’t just smart; it’s standard practice. That same habit of skepticism is just as valuable when it comes to evaluating financial advice.

If you’re already working with an advisor or considering hiring one, don’t assume that the industry’s standard model is automatically the best fit for you. Ask the questions that matter:

- How, exactly, am I paying for advice? Will my fee grow as my wealth grows, even if my complexity stays the same?

- What services do I actually receive for what I pay? Is it comprehensive planning or just investment management?

- If I make big life decisions (pay off a loan, buy into a practice, take on a second home), does my advisor’s compensation change?

- Do I need ongoing services? Can I get hourly or single-project planning? How are those fees structured, and what’s included?

- Can I compare a flat fee to what I’d pay under an AUM model? Are there situations where a flat fee could be higher?

- If my needs or circumstances change, is the model flexible, or am I locked into a single fee arrangement?

Flat-fee planning isn’t right for everyone, but clarity and alignment should be non-negotiable. In a world where fees quietly compound and business models shape advice, it pays to question what’s become industry habit.

If you want to compare advisor models, organizations like NAPFA allow you to search for flat-fee, hourly, or project-based financial planners.

The best outcomes come from being an informed, proactive participant. Giving the AUM model a second opinion might not lead to industry change, but it will make sure you’re getting the right advice for the right reasons at the right price.

[FOUNDER'S NOTE BY DR. JIM DAHLE: It's important to recognize that any time money changes hands, there is a conflict of interest. While an AUM model has its conflicts, so does a flat fee model. For instance, an AUM model incentivizes an investment manager to get higher returns. The flat fee model does not. That said, I still prefer the flat fee model simply because most using an AUM model do not adequately adjust the percentage for the wealthiest clients. (The clients usually don't do the math to determine the fee either.) Most AUM-charging advisors think they're doing you a favor when the second million fee decreases from 1% to 0.9%. It would be much fairer if it decreased to 0.25%.]

What do you think? If you have a financial advisor, do you pay an AUM fee or a flat fee? Does one save you money over the other?

This article is for educational purposes only and does not constitute individualized financial, tax, or investment advice.