By Travis Christy, White Coat Insurance

By Travis Christy, White Coat Insurance

As a physical therapist, your work revolves around bringing back mobility and movement, alleviating pain, and enhancing the quality of life for patients. Whether you’re helping someone recover from an injury, surgery, or chronic condition, your expertise is worth so much to many. But what happens if you’re the one facing unexpected health challenges?

Disability insurance can be a physical therapist’s monetary and temporal deliverer when the tables are turned and the PT finds themselves as the patient and unable to work. It’s not just about protecting paychecks; it’s a lifeline that ensures you can continue caring for others—even when life throws you a curveball. Imagine a scenario where an injury or illness prevents you from practicing physical therapy. How would you manage financially? How would you support your family?

In this guide, we’ll explore disability insurance tailored specifically for physical therapists. We’ll delve into the ins and outs, show you what to look for, and equip you with the knowledge needed to make informed decisions. Just as you empower your patients to regain strength, disability insurance empowers you to face the real risks we all face in our working years with the peace of mind that your paycheck will continue.

Illness or Injury Risk in a Physical Therapist's Working Years

Disability can strike unexpectedly, affecting individuals of all ages, including physical therapists. Despite focusing and promoting health and mobility, physical therapists are not immune to the possibility of disability. It may be striking, but 1 in 4 people ages 20 and over across all occupations will experience a disability before reaching retirement age. These disabilities can arise from various causes—such as musculoskeletal problems, serious medical conditions, or mental health issues. As physical therapists work with patients, they may also encounter injuries or health challenges that impact their own well-being. The chances are high.

Your ability to earn an income is your greatest asset! As of 2024, the average salary for physical therapists falls between $73,070-$110,903. Physical therapists face unique demands in their profession, including lifting patients, standing for extended periods, and performing manual therapy techniques. These tasks can lead to injuries or strain. If you couldn't work due to a disability, your family’s financial stability could be at risk. Disability insurance provides income protection, ensuring you can meet essential expenses even if you can’t work. Whether you’re a seasoned therapist or just starting your career, safeguarding your financial well-being with disability insurance is crucial. The bottom line is that a PT's ability to work is their greatest asset. You need to protect it!

More information here:

How to Buy Disability Insurance

Disability Income Protection Available to Physical Therapists

American Physical Therapy Association “APTA” Plan

The APTA (American Physical Therapy Association) Plan for Long-Term Disability Income Insurance is available to active APTA members under age 65. As a resident of all the states (excluding New Hampshire, Nevada, and Vermont), you can apply for coverage if you work at least 20 hours per week in the physical therapy field. The monthly benefit can be up to $10,000, and the program offers a 30% premium credit. However, consider potential drawbacks, like an offset with group coverage, rate increases, the lack of true own occupation definition of disability, limited partial benefits, no cost-of-living rider, and portability limitations. Weigh these factors carefully when choosing disability insurance options.

Employer Group Disability Insurance

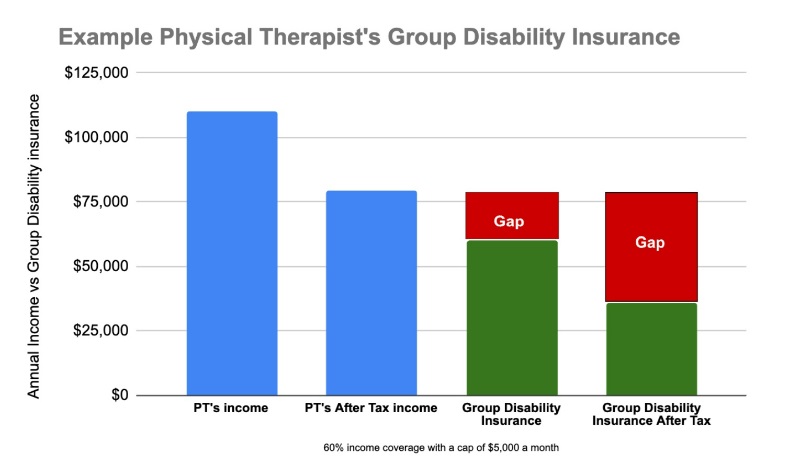

I recently had a conversation with a franchisee owner of a local physical therapy group, and he expressed satisfaction with their employer group disability insurance, which covered all employees and owners. Upon closer examination of the plan, however, we discovered some notable limitations. Benefits were capped at $5,000 per month with coverage limited to 60% of one's salary. Additionally, any benefits received would be subject to taxation because the business was deducting the premiums, and income exceeding $100,000 was not covered. Here’s an example of what the plan would look like and how big a gap there would be after taxes in the event of disability (assuming a 27% tax bracket).

Employer group disability insurance offers convenience by typically featuring automatic enrollment without individual underwriting or medical exams, and the employer often covers the costs. But there are significant drawbacks. Coverage is usually not portable, customization options may be limited, and benefit amounts are subject to caps, as you can see above. Moreover, there's a dependency on the employer to maintain the coverage. One is at the mercy of their employer to maintain the plan. In addition, most times the benefit is taxed.

Knowing all this, it's a good idea for physical therapists to view group disability insurance as a foundation and to consider supplementing with individual coverage to address any income protection gaps. This approach offers a more comprehensive and resilient safety net against the risks of illness and injury.

Individual Disability Insurance from the Big 5 Disability Carriers

Your profession and job duties matter a lot when it comes to disability insurance. This is because your job’s nature and the associated risks can influence the insurance premium you pay.

If we talk about physical therapists, the scenario gets a bit more complex. Insurance companies don’t have a one-size-fits-all approach here. They consider various factors like your educational qualifications, your workplace, and even your specialization in therapy.

For instance, an insurance company might categorize physical therapists all the same. Another might differentiate based on your degree—a higher degree might land you in a higher class. In addition, your workplace can also play a role. Therapists in hospitals or clinics might be categorized differently from those providing home healthcare where a PT may be lifting more patients. This could result in some carriers not being as willing to cover someone doing home health vs. those working in a clinical setting.

These categories are important because they can influence your insurance rate. The Big 5 insurance companies will assign occupation classes of 1-6 generally. Usually, a higher category means a lower rate. But it’s important to remember that each insurance company has its own classification system. It’s wise to understand these classifications and compare different plans before making a decision.

More information here:

People Aren’t Buying Disability Insurance, But They Should

A Pain in the Butt – My Dental Disability Story

Physical Therapist Disability Insurance Design and Riders to Consider

Physical therapists should ensure their disability insurance policy includes key features and riders that offer robust support and adaptability. These features are things to consider for financial security and peace of mind during an unforeseen sickness or injury:

Must Choose:

- Elimination Period: How long can you wait to get your first check? Choose a waiting period that balances lower premiums with financial readiness—typically 90 days—to manage expenses before benefits begin.

- Benefit Period: How long do you want to get paid? Opt for a benefit period that extends to age 65 or beyond to ensure long-term support in case of a lasting disability.

- Benefit Amount: How big of a benefit do you want or need? Secure a benefit amount that aligns with your income and the flexibility to increase coverage as your career advances.

Optional Riders:

- True Own Occupation Coverage: This is essential for specialists, ensuring you receive benefits if you can’t perform in your specific field, even if you can work in another capacity.

- Non-Cancelable and Guaranteed Renewable: Guarantee your policy’s terms and rates won’t change and the insurance company can’t cancel your policy as long as you pay premiums.

- Partial/Residual Rider: Consider a rider that provides benefits for partial disability, reflecting a loss of income due to reduced capacity.

- Recovery Benefit Rider: Ensure your policy includes a recovery benefit, offering financial support as you transition back to work post-disability.

- Future Increase Option/Benefit Update Rider: This rider allows you to increase your coverage amount as your income grows, without additional medical underwriting. It’s particularly useful for early-career professionals who expect their earnings to rise.

- Cost of Living Adjustment (COLA) Rider: With this rider, your disability benefits will increase annually to keep up with inflation, protecting your purchasing power during a long-term disability.

These riders and policy features provide a safety net, allowing physical therapists to focus on recovery without the added stress of financial concerns. It’s advisable to consult with an insurance expert to tailor a policy that best fits your individual needs and circumstances.

In addition, Business Disability Overhead Expense (BOE) protection is an essential insurance policy for physical therapists who own their practice. It’s designed to cover the ongoing operational costs of the business if the therapist becomes disabled and can't work. This type of coverage typically includes the lease or mortgage payments of the practice’s location, the salaries of employees to maintain care and operations, the utilities to keep the practice running smoothly, the payments for leased equipment, and the insurance premiums for other business-related policies. Additionally, it can assist with loan payments on any business debts. With BOE protection, physical therapists can know that their practice’s financial obligations will be taken care of in the event of their sickness or injury, allowing them to focus on their personal recovery without the stress of business expenses.

Disability Insurance Costs a Lot — But There’s a Reason Why

Your ability to earn an income is your greatest asset. Think of your paycheck as the foundation that allows you to own a home, have a car, and cover essential expenses. Without a steady income, groceries, college tuition, and bills become unmanageable. Additionally, investing in the stock market, 401(k)s, IRAs, and other financial vehicles requires money.

However, sickness or injury can disrupt this financial stability. As a breadwinner, you have a lot at stake. Properly insuring your income is crucial, but it can be costly. For instance, a 30-year-old physical therapist might pay approximately 2%-5% of their gross pay in disability insurance premiums annually. If you earn $100,000 per year without group disability insurance, expect to pay anywhere from $2,000-$5,000 annually to protect your income. To put it in simpler terms, for every $100 you want to protect, the cost ranges from $2-$5. Even after paying for insurance, you’ll still have $95-$98 left, and if you ever need to use your disability insurance, you’ll be covered.

Why does disability insurance cost so much? The answer lies in its utilization. The Big 5 disability insurance carriers pay out hundreds of millions of dollars annually in disability claims. Given the high statistics of disabilities during working years, taking disability insurance lightly is not advisable.

More information here:

How Much Disability Insurance Should You Buy?

The Bottom Line

As a physical therapist, your expertise in restoring movement and improving the quality of life for others is invaluable. Yet, it’s essential to recognize that life’s unknowns can place anyone in a position of need, including those who dedicate their lives to healing. Disability insurance protects paychecks, ensuring that if you face health challenges, your financial stability will remain intact.

This guide has highlighted the critical aspects of disability insurance tailored specifically for physical therapists, showing the important features like elimination and benefit periods, true own occupation coverage, and various riders that provide comprehensive protection. Securing the right insurance and fortifying your greatest asset—your ability to earn an income—against the unpredictable allows you to continue making a difference in the lives of others with confidence and security. It's empowering.

Remember, investing in disability insurance is not just a financial decision; it’s a commitment to your future and the well-being of those who depend on your paychecks.

Obtaining quality disability insurance is a must for any physician or physical therapist, so you can be sure to protect your hard-earned income. Get a quote from one of our recommended insurance agents and cross this task off your to-do list today!

What other questions do you have about physical therapists and disability insurance? Do you have disability insurance? Is it something you need to purchase? Why or why not?

The White Coat Investor may receive compensation from White Coat Insurance Services, LLC; licensed in all states including MA and DC; CA license #6009217; NY license #1758759 (exp. 6/2025); Registered address: 10610 S. Jordan Gateway, #200 South Jordan, UT 84095. This does not affect the cost or coverage of insurance.