By Eric Rosenberg, WCI Contributor

By Eric Rosenberg, WCI ContributorIf you want to make the most of charitable donations, you should know about donor advised funds. A donor advised fund, or DAF, is a method of lumping your charitable contributions into a single year to maximize tax gains while also supporting the causes most important to you and your family.

To help you understand the benefits of a DAF, I chatted with a nonprofit CEO and vice president at Fidelity Charitable for tips and tricks to ensure you and your favorite charities get the best benefit from every dollar donated.

What Is a Donor Advised Fund?

To start, let’s understand a DAF and how it works. A DAF is an account held by a nonprofit or through a brokerage like Fidelity, where you can make lump-sum donations and spread the distribution out over a number of years.

For example, if you would donate $5,000 per year to charities, you may instead prefer to donate $25,000 every five years. There are a few reasons to do this. The top reason is to save on taxes, as you may only qualify for itemized deductions in certain years (more on that below). Once funds are donated through the DAF, you have the power over distributions, and you may have more leverage over how the funds are used by your chosen charities.

Robert Derdiger, CEO of the nonprofit Alpha Epsilon Pi Fraternity, explained that the fraternity’s fund “is a segregated fund or account within the 501(c)3 that’s restricted, so the donor’s intent is taken under advisement prior to the release of funds to the charity.”

If you use an account through Fidelity Charitable or similar investment managers, “the charity or financial firm that manages the holder of your DAF serves as a second set of eyes to your donations. They can help ensure your funds only go to vetted charities and worthwhile causes.”

More information here:

Should You Use a Donor Advised Fund?

Running Your Own Donor Advised Fund

Two of the largest DAF providers are Fidelity Charitable and Vanguard Charitable. Either allows you to make lump donations using cash or securities and distribute the funds to your chosen charities over time.

“Fidelity Charitable started in 1991 with the goal of helping grow the American tradition of philanthropy,” said Brandon O’Neill, a vice president at Fidelity Charitable and Charitable Planning Consultant. “Donor advised funds started in the 1930s and were usually locally focused. Fidelity wanted to be the first national program without a geographic restriction.”

You can move funds into your Fidelity Charitable account and choose from a suite of investment options. Your investments can grow over time, and you can distribute them to your chosen 501(c)3 charitable organization at any time. Religious, educational, and hospital organizations are also eligible. “I like to think of it as a charitable IRA,” O’Neill shared.

Donor-Advised Fund Tax Benefits

The biggest reason to use a DAF rather than make direct annual donations is the tax benefits, which may help both you and the charity. These are the major tax benefits you may see:

- Qualify for itemized deductions: If you don’t regularly qualify for itemized deductions and usually take the standard deduction, you may have to make larger donations every few years to qualify to itemize. “The ability to time your donations and lump give is a strategic advantage for some people’s tax returns,” said Derdiger. “But you don’t give up the contribution to the charity or philanthropic work on an annual basis. You can put it all in a holding account and disperse over five years, for example.”

- Avoid capital gains: O’Neill explained that he tells “clients to put the checkbook down when supporting charity. Cash only offers a single tax advantage. If you give a stock, you get the deduction and avoid capital gains taxes you would have owed.” You can “effectively turn a capital gain into a charitable gain.”

- Grow donations tax-free: During the months and years your funds sit in the DAF, the assets can grow tax-free. If the markets have a great year, that’s a tax-free win for your favorite causes.

More information here:

How to Donate Vanguard Assets to a Vanguard Charitable Donor Advised Fund

Fidelity Charitable Walkthrough

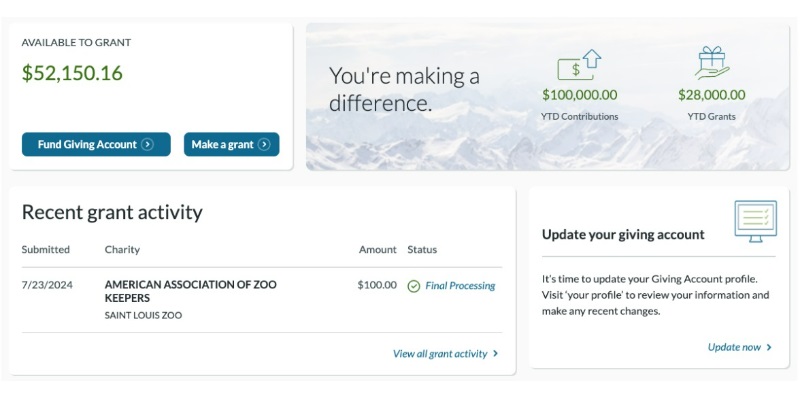

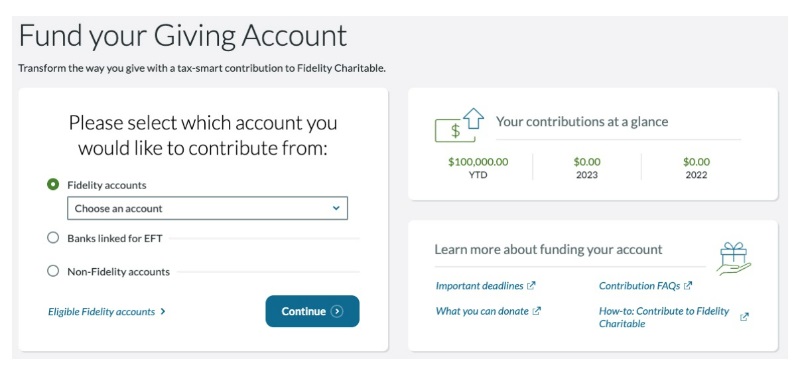

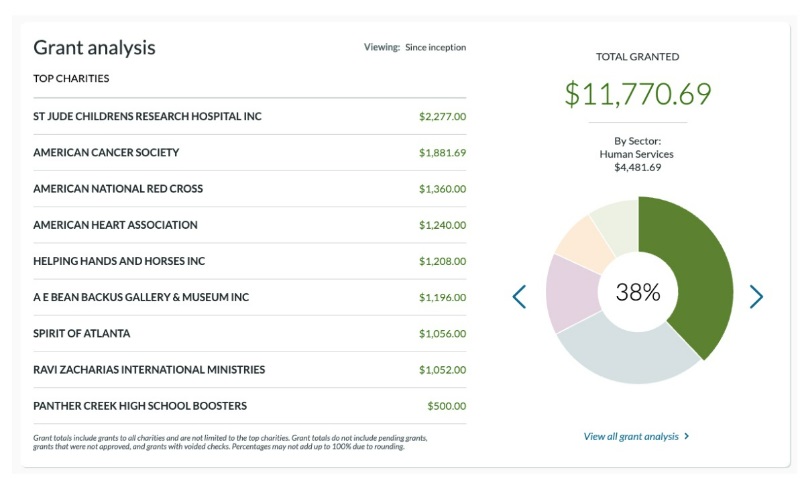

Here’s a look under the hood at Fidelity Charitable to help you understand what you have access to with an active account.

The grants section allows you to find any 501(c)(3) and other eligible organizations and schedule a one-time or recurring donation. You can choose to make your donation anonymous or let them know it was you.

An analysis on the account homepage shows how much you’ve given to each charity and offers a breakdown by sector.

On the investments screen, you can choose between a list of different asset allocation options and specific funds—including a breakdown between equities and fixed-income funds—along with specific domestic stock, international stock, and bond funds.

Make the Most of Your Donations

Charitable donations can be gratifying in many ways, as you can help make a difference where it matters the most to you. But if you’re going to donate anyway, you’re likely better off using a DAF in many situations, as it can help you save on taxes while maximizing your impact. That’s a win-win for you and your favorite causes.

The White Coat Investor is filled with posts like this, whether it’s increasing your financial literacy, showing you the best strategies on your path to financial success, or discussing the topic of mental wellness. To discover just how much The White Coat Investor can help you in your financial journey, start here to read some of our most popular posts and to see everything else WCI has to offer. And make sure to sign up for our newsletters to keep up with our newest content.