By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderI am continually surprised by the amount of panic in white coat investors who see news announcements that might affect their financial plans. Please remember that there is almost NOTHING that needs to be done RIGHT NOW in any sort of reasonable, long-term financial plan as a result of something you read in the news. You don't need to email me immediately wondering how this might change your financial plan. You don't have to know all the details tonight.

As I tell our content director, we don't need to run a post immediately about these sorts of announcements. Sure, it might help our search engine optimization (SEO) a little bit and get a little traffic, but the truth is that we're not going to compete with CNN, the BBC, MSNBC, or Fox News when it comes to breaking news. People come to WCI because they want an in-depth, opinionated discussion of what to do. It takes time to get details and to form opinions, so please have a little patience with us.

- You don't need to do anything STAT about your PSLF plan just because WCI runs a post called “PSLF Canceled!” that you didn't realize was an April Fools' Joke for an hour or two.

- You don't need to do anything STAT because the FTC voted to pass a rule banning most non-compete agreements.

- You don't need to do anything STAT because Vanguard sold off its small business retirement plan division to Ascensus.

Settle down; take a deep breath. If something is obviously going to affect a lot of WCIers, you can be assured we'll be talking about it on the blog, in the newsletters, and on the podcast. But it probably won't be on the day the news breaks. You're going to have time to adjust your written financial plan in an intelligent way.

The History of the Vanguard Individual 401(k)

I used to have a Vanguard individual 401(k). Many WCI staff members and their spouses still have a Vanguard individual 401(k). It's never been perfect. The people who picked up the phone at Vanguard (eventually) gave the wrong answers to WCIers all the time. A few years ago, you couldn't buy the cheaper admiral shares of the mutual funds; you had to pay a higher expense ratio for the investor shares. For many years, you couldn't roll an IRA—even a SEP-IRA—into the plan.

Thankfully, both those things eventually went away, although I'm not sure the customer service ever really got any better. But it was good enough that Vanguard became my top recommendation for an inexpensive, “cookie-cutter,” “off-the-shelf” individual/solo 401(k). But it wasn't perfect. You didn't have to spend much more to get a customized individual 401(k) that would allow you to make Mega Backdoor Roth contributions and invest in private investments. But it was basically free and provided by a company that, despite its well-known customer service and IT issues, you felt you could trust.

More information here:

Who Is Ascensus?

Ascensus isn't some fly-by-night company. It's actually the largest retirement account company in the country, and it's already been working with Vanguard for years. It runs the Vanguard 529 (aka the Nevada 529) and many other great 529s across the country. It's not a household name like Vanguard or Fidelity, but it's not some sort of weird Ponzi scheme that you need to worry is going to steal your money. Ascensus has a lot of experience running retirement plans, and frankly, it's probably better at it than Vanguard is. I suspect anyone who just sticks with what they have is going to notice timelier, more accurate customer service than they were getting from the Vanguard Small Business Plan folks.

What's the Deal with the Sale?

Vanguard periodically changes its business models, focusing its effort and resources on what it does well, what it feels its owners (us) need most, and (frankly) what brings in the most revenue. That's why you saw the push toward brokerage accounts and away from its old mutual fund accounts. That's why you see it pushing its advisory services. And that's why you see it getting out of the small business retirement accounts business. Vanguard doesn't do it well. Few of its clients need the service, and it's probably a money loser. I just can't see where it's making any money from its plans. It charges no fees and lets you have the same super low-cost investments you can get in a Roth IRA or a taxable account. It was like Vanguard was running a charity. The company is supposed to operate at cost, but this division clearly wasn't.

The sale will close in the third quarter of 2024. (Again, you don't have to do anything immediately about any of this. You probably don't even have to do anything about it in 2024.) After that point, all Vanguard solo 401(k) owners will no longer have a Vanguard solo 401(k); they will have an Ascensus solo 401(k). Those solo 401(k)s are still going to have a lineup of Vanguard funds in them, so your investments are unlikely to change at all. However, you will likely be using a different website to make your contributions, calling a different number to get help, and probably paying more in fees (although I suppose those fees could be reduced or waived temporarily). I'm sure those who own Vanguard solo 401(k)s will be getting lots of emails and letters about this in the coming months describing the changes they should expect.

Note that this change doesn't affect single-member SEP-IRA owners. You can keep that SEP-IRA at Vanguard, no problem. It only affects SEP-IRAs that are used by multiple people at a small business.

Some advisors are telling their clients they'll need to opt-out by July 12 or the transition to Ascensus will happen automatically on July 19.

More information here:

Vanguard: Growing Pains or Abandonment of Its Mission?

Financial Products That Are Even Better Than Vanguard’s

What Should I Do About Ascensus Buying Vanguard Small Business Division?

Again, you don't have to do anything right now. However, at some point later this year, you will likely want to consider your options:

- Just let your Vanguard individual 401(k) become an Ascensus individual 401(k) and keep moving forward. This is the best option for the inertia crowd, and it will likely be what the majority will do. It will likely involve the least amount of hassle.

- Roll your Vanguard individual 401(k) into your employer 401(k) or 403(b). This will be an option for some. For the WCI employees who used to be WCI independent contractors and still have an old Vanguard individual 401(k) hanging around, this is what they're going to do. They'll get better asset protection in some states, more investment options, and better service, and they will still have access to those same low-cost Vanguard index funds they had before.

- Roll your Vanguard individual 401(k) into an IRA. This will be an option for some as well, especially those who are nearly done working or who have no interest in doing Backdoor Roth IRAs. Remember that tax-deferred IRA balances cause pro-ration of the conversion step of the Backdoor Roth IRA process.

- Switch your Vanguard cookie-cutter individual 401(k) to a Fidelity or Schwab cookie-cutter individual 401(k).

- Switch your Vanguard individual 401(k) to a customized solo 401(k) plan.

- Cash out. It'd be a terrible idea for most, but I guess if you're retiring this year and need to pull the money out of a tax-deferred account anyway, this could be a simplifying move.

My guess for what people will do?

- #1 60% (inertia is powerful)

- #2 3%

- #3 2%

- #4 20%

- #5 15%

- #6 < 1%

What Is the Ascensus Individual 401(k) Product Likely to Look Like?

While it's possible it could change or even be different for those who come from Vanguard, I think your best bet on what your new Ascensus individual 401(k) is going to look like is what it currently looks like. Three individual 401(k)s are available at Ascensus right now.

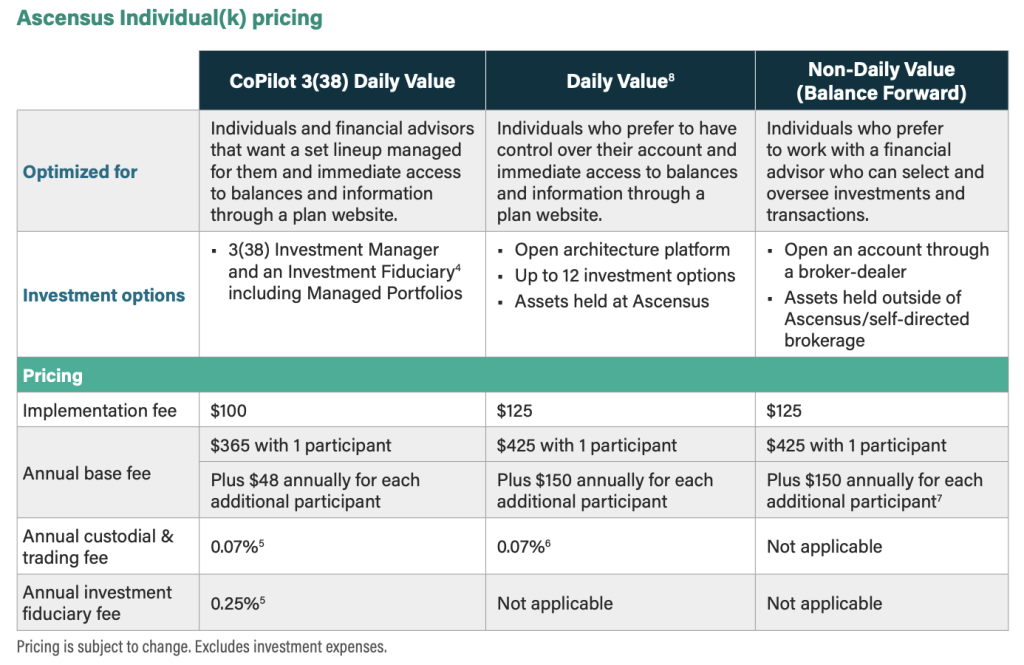

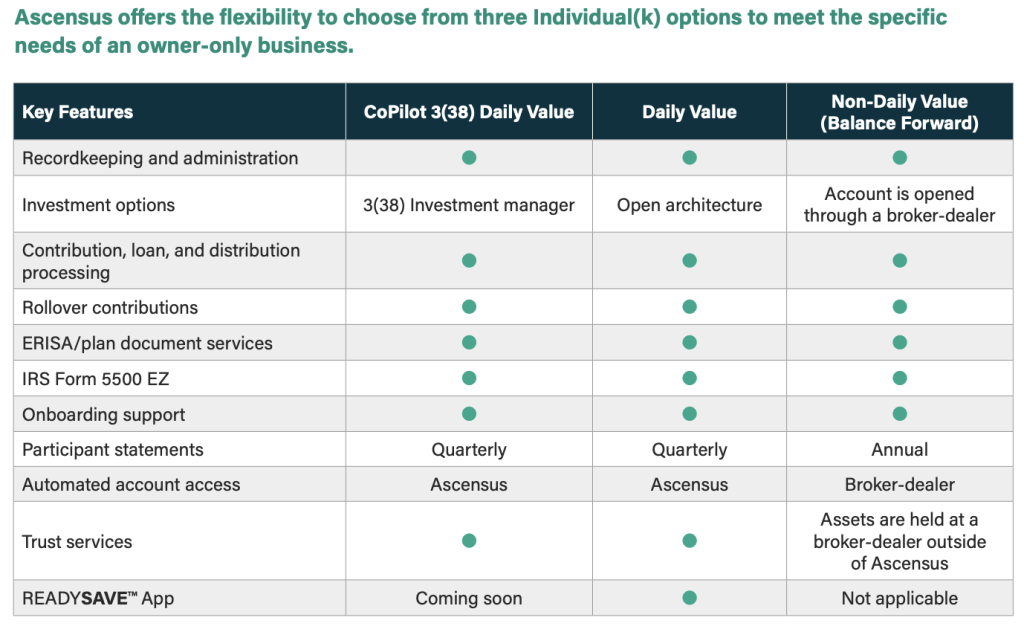

The first option is what they call its CoPilot account. This gives you a 3(38) investment fiduciary that will help share the liability with you. Frankly, I don't see a lot of liability in a solo 401(k) like with an ERISA 401(k). But one of the most knowledgeable posters on this subject on the WCI forum, spiritrider, thinks very few people are actually capable of running their own solo 401(k) because it's mostly the same thing as an ERISA 401(k) as far as compliance goes. At any rate, this one will cost you $100 to start, $365 ($413 with a spouse) per year PLUS 0.32% of AUM. That's not very attractive to me at all because I know I can go to Fidelity or Schwab and pay nothing OR I can go to a customized provider and pay something like $500 to set up and $150 a year and get an even better solo 401(k). I guess what you're getting for your extra 0.25% is someone to help you choose funds for your 401(k). Every time I realize people are willing to pay that much for that service, I wonder if I'm in the wrong business. But such is life.

The second option “Daily Value,” its cheapest, will be similar to the prior Vanguard solo 401(k), but it will come with a $125 set-up fee, a $425 ($575 with a spouse) annual fee, AND a 0.07% AUM fee. While that's obviously cheaper than the CoPilot plan, at least for a large 401(k), it's still more than free and doesn't give you the same options you can get with a truly customized plan. Plus, it costs more than a truly customized plan.

The third option is the most expensive once you add in the fees you pay an advisor, and it probably isn't going to be attractive to most DIY investors. If you've already got a financial advisor managing your solo 401(k), why are you reading this article? Part of the reason you're paying that person is so you can spend your time doing something else.

All three plans allow for rollovers and one 401(k) loan per year. They also all offer “IRS Form 5500 EZ.” I think that means Ascensus is going to file it for you, which is something Vanguard did not do, so that's nice. I think it also offers Roth contributions for all the plans.

I found another Ascensus 401(k) online, called the “Individual 401(k) Featuring Vanguard Investments.” This is also the plan you are sent if you try to open a new individual 401(k) at Vanguard today. I'm not sure how it's related to the other three 401(k)s, but I suspect it's a variation on the “Daily Value” plan. Maybe this is where Vanguard folks are being transitioned. It notes a fee of $20 per person and $20 per fund in the plan per year. I'm not sure if those fees are in addition to the above fees or in place of them, but either way, it's not free like it was at Vanguard (at least once you had $50,000 in the account). That paperwork also says this:

That's no different than what Vanguard used to do for you. I'm not sure if that's just how this plan works or if it's how all of the Ascensus plans work. It also says this:

That kind of stinks.

More information here:

Comparing 14 Types of Retirement Accounts

The Bottom Line

If you're willing to make the effort to move your individual 401(k) now that Vanguard is forcing you to Ascensus, you've got two decent options. The first is to move your 401(k) to another free cookie-cutter 401(k). Schwab is probably best since it recently changed to allow Roth contributions. E-Trade and Fidelity are other options. But I've heard lots of complaints about E-Trade and doubt it's better after merging with Morgan Stanley, and Fidelity, for some dumb reason, still doesn't allow Roth contributions. Like Vanguard, none of them allows 401(k) loans.

The better option is to just get a customized individual 401(k) from somebody off of our recommended list. If you're going to pay money (and it's really not all that much), you might as well get a 401(k) with all the best features available such as:

- Roth contributions

- Mega Backdoor Roth capability

- 401(k) loans

- Self-directed investment availability

- Somebody else to file your 5500-EZ

If you can get all that for a similar or cheaper price than Ascensus and you don't mind dealing with the hassle of changing, why wouldn't you?

What do you think? Have you worked with Ascensus before? If you have a Vanguard solo 401(k), what are you going to do with it this year?