Officially, the poverty line in the US for a family of four is an income of $32,150. But in a Substack post that went viral at the end of 2025, Michael W. Green, chief strategist and portfolio manager for Simplify Asset Management, says, based on historical measurements, the poverty line actually should be much higher—more than four times higher at about $140,000.

Considering the median household income in 2024 was $83,730, that means a whole bunch more people than we thought might be living below Green’s supposed poverty line. And considering the average fourth-year resident makes about $70,000, does that mean doctors still in training who are single or whose spouse earns little to nothing in salary are actually living in poverty?

Are Resident Physicians Living Below the Poverty Line?

As noted by Green, the formula for determining the poverty line was created by a Social Security Administration economist named Mollie Orshansky in 1963. Green writes,

“In 1963, she observed that families spent roughly one-third of their income on groceries. Since pricing data was hard to come by for many items (e.g. housing), if you could calculate a minimum adequate food budget at the grocery store, you could multiply by three and establish a poverty line . . . She was drawing a floor. A line below which families were clearly in crisis.

For 1963, that floor made sense. Housing was relatively cheap. A family could rent a decent apartment or buy a home on a single income, as we’ve discussed. Healthcare was provided by employers and cost relatively little (Blue Cross coverage averaged $10 per month). Childcare didn’t really exist as a market—mothers stayed home, family helped, or neighbors (who likely had someone home) watched each other’s kids. Cars were affordable, if prone to breakdowns. With few luxury frills, the neighborhood kids in vo-tech could fix most problems when they did. College tuition could be covered with a summer job. Retirement meant a pension income, not a pile of 401(k) assets you had to fund yourself.

Orshansky’s food-times-three formula was crude, but as a crisis threshold—a measure of “too little”—it roughly corresponded to reality. A family spending one-third of its income on food would spend the other two-thirds on everything else, and those proportions more or less worked. Below that line, you were in genuine crisis. Above it, you had a fighting chance.”

But we don’t live in 1963. In 2026, food costs as a percentage of the family budget are much lower.

From Green:

“For most families, it’s 5%-7%. Housing now consumes 35%-45%. Healthcare takes 15%-25%. Child care, for families with young children, can eat 20%-40%.”

These days, you can’t multiply how much you spend on groceries by three to get an accurate portrayal of the poverty line. According to Green, you’d have to multiply your grocery bill by 16. Hence, his $140,000 number.

Green has received plenty of pushback for his calculations (one fellow at the American Enterprise Institute called it “the worst poverty analysis I have ever seen”), and it’s made observers question what poverty really means (is it a dire emergency, or is it that you’re living paycheck to paycheck and just scraping by?).

While residents who earn $70,000 or slightly less might not be in that emergency status, it’s clear many of them feel they should be paid more. In a 2024 Medscape report, a fourth-year plastic surgery resident said the salary numbers were “a disgrace,” while a third-year in psychiatry said, “There is no need to provide slave labor in order to learn a trade.”

In 2023, a fourth-year medical student in Arkansas named Humam Shahare and some of his peers created a research poster that showed that the average PGY-1 salaries of $65,000 made by plastic surgery residents left them with more than $23,000 after cost-of-living expenses.

“It’s not how much you make, it’s how much do you have at the end of the day,” Shahare said, via the AMA. “That’s what is going to answer, ‘Are your bills taken care of?’”

Add in student loan payments, housing costs, and potential child care for a family that could be adding more kids by the year, and you can see how a resident who’s putting in, say, 60-80 hours a week and still getting paid five figures feels pinched—no matter where the poverty line truly lies. Or as one survey-taker in that Medscape resident salary survey said, “I am barely surviving.”

Here are some of the other random thoughts that have been floating through my head recently. In old-school sports writer parlance, we call it emptying out the notebook.

A Space Patch from a WCI Friend, Doc, and Astronaut

As I wrote about seven months ago, Gretchen Green is one of the coolest doctors around, especially since she went to space as part of the Blue Origin NS-32 mission last year and became the first commercial woman physician astronaut. You can read more about it in her recent WCI guest post called Redefining Risk: Lessons from Medicine, Money, and Spaceflight.

After telling her about my interest in space (mostly through my father, who designed a few crew patches for those who launched during the space shuttle era and who designed the original building of the US Astronaut Hall of Fame in the 1990s), she generously sent me one of her personalized patches that she flew into space on May 31, 2025.

Here it is in all its glory.

A couple of notes on the patch. The space suit with the chest radiograph was designed to honor her radiology career, and part of the color palette of the patch is Radiology Green (hex #00A676).

As the famous saying goes, you can take the astronaut out of the doctor but you can't take the doctor out of the astronaut.

What Are WCI Readers Actually Reading?

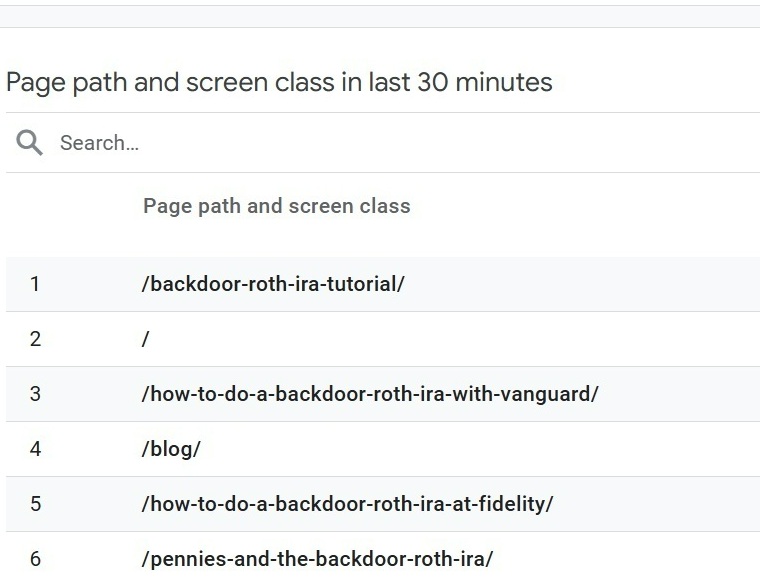

I always find it amusing that we annually get tons of traffic to all of our Backdoor Roth IRA posts from December to February, no matter when those posts were actually written (which is why we are constantly updating and republishing them every few years). Anyway, I happened to be checking WCI’s website traffic on January 1 at noon CT, and here’s what I found. The top four most-trafficked posts were all related to the Backdoor Roth IRA.

Yes, everybody loves a Backdoor Roth IRA after all the champagne has been imbibed and the New Year’s balloons have been deflated.

Just in case you want easy access to all those Backdoor Roth posts, here you go:

- How to Do a Backdoor Roth IRA

- Vanguard Backdoor Roth Tutorial

- How to Do a Backdoor Roth IRA at Fidelity

- Pennies and the Backdoor Roth IRA

Flipping into the HOF

A hearty congratulations goes out to Dr. Flip Homansky, who is part of the class of 2026 for induction into the International Boxing Hall of Fame. Though I’ve been a HOF voter for about the past decade, I did not vote in the Non-Participant category, which is where Homansky was elected.

After finishing his internal medicine residency in 1979, Homansky moved to Las Vegas and served as ringside physician for two decades. As noted by the IBHOF, he “was at the forefront and instrumental in many protocols to enhance boxer safety, including reducing championship rounds from 15 to 12 and mandatory HIV and anabolic steroid testing.”

Here’s Homansky in action from the Mike Tyson-Orlin Norris bout in 1999.

More information here:

Your Crystal Ball Predictions for 2026

What Is the Worst Financial Advice You Ever Got?

Money Song of the Week

As we bid a fond farewell to Grateful Dead guitarist/vocalist Bob Weir after his long, strange trip, let’s rewind to the time he and Jerry Garcia were being interviewed about the jam band’s wild success from the 1960s onward. Basically, he was asked what it was like to be rich and famous, and Weir, who died last month at the age of 78, replied with an interesting answer about pistachios.

Sometimes, when you have enough money, small bothers aren’t even worth considering.

In 1974, the Grateful Dead released the song Money Money, co-written and sung by Weir, and it tells the tale of a man hounded by his partner for, you guessed it, money.

As the song goes,

“She say, ‘Money, honey,’ I'd rob a bank/I just load my gun and mosey down to the bank/Knocking off my neighborhood Savings and Loan/To keep my sweet chiquita in eau de Cologne.”

The tune hasn’t aged well, and many fans think the messaging is outdated and misogynistic (though some say it was actually more of a jokey song). The band apparently played it live only three times, so apparently, the members didn’t like it much either.

But then again, The Dead weren’t known for its 4 minute, 24 second deep cut songs. It was known for its outlandishly long concert jams that compelled their fans to travel all around the country to listen to them live. And to give the band their money for years and years.

More information here:

Every Money Song of the Week Ever Published

Tweet of the Week

Apparently, it pays to be a pilot.

A Miami-based American Airlines Boeing 737 captain has posted their salary pay statement on reddit, leaving many people speechless.

The pilot’s total year to date compensation was $458K, with the hourly pay being $360+ (flight hours only).

Some comments suggest the pilot isn’t… pic.twitter.com/3yH1Z5zB1s

— Breaking Aviation News & Videos (@aviationbrk) December 23, 2025

As one Redditor pointed out, though, “Starting from absolute zero, plan on ~$150,000 investment into your certifications and 10 years of low paying entry level jobs before you break even on that investment. Then another 5-10 years before you’re making this kind of money.”

How pinched did you feel as a resident? Do you think it’s imaginable for a family of four to live on about $32,000? What about $140,000?