By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI Founder

I recently wrote about how whole life insurance is a crappy way to get a permanent death benefit or decent investment returns. In recent years, there has been a push to use a whole life insurance policy for a different reason- for “banking.” It has been popularized as the “Infinite Banking Concept” or “Bank On Yourself.” There is a great deal of marketing and hype involved, and even some scams, but the basic scheme itself is pretty interesting.

Bank On Yourself by Using Life Insurance Policy

Instead of borrowing money from a bank to buy your next car or other large expense, you borrow it from your life insurance policy. You can pay it back whenever you like. But you actually never have to pay it back if you don't want to. Even for those, like me, who say “I don't borrow to buy cars, I just save up the money,” advocates like to point out that you may be able to save up the money more profitably inside the life insurance policy than inside the bank account (especially given current interest rates.) They say it's like getting interest free loans with an added death benefit.

Non-Direct Recognition

The key to making this all work is to get a “non-direct recognition” whole life policy. With a “direct recognition” policy, when you borrow money from your policy the insurance company first subtracts the amount of the loan from the cash value, then calculates the dividend on the lesser amount. With an “indirect-recognition” policy, the insurance company doesn't. Cool huh. If you have $100K in there, they'll let you borrow about $90K, but still pay you dividends as though there were $100K in the policy.

Paid Up Additions

The problem with most whole life insurance policies is that it takes forever to get any decent cash value in there. For example, a policy provided to me by a WCI life insurance agent as the “best” $1 Million non-recognition policy he could find [MassMutual Whole Life Legacy 100] for a healthy 30 year old male in New York, demonstrates that the cash value doesn't equal the premiums paid until year 12. I'll need another car before then! That's a pretty lousy way to “bank.” So we have to figure out a way to get the cash into the policy sooner.The way you do this is with Paid Up Additions, meaning you dump more than you have to into the policy, ostensibly because you want a higher death benefit, but in reality because you want more cash growing in the policy so you can “bank” with it.The IRS limits how much more money you can put in. Per the IRS, at a certain point it's no longer a life insurance policy, but an investment called a Modified Endowment Contract (MEC), and it loses the tax benefits accorded to life insurance policies. Ideally, you fund the policy right up to the MEC line to decrease the amount of time it takes until your policy has significant cash value. Another benefit of maximizing Paid Up Additions instead of just getting a bigger policy, is that the agent commission on a PUA is lower than a larger policy, so more of your money goes to work for you, not to mention the required ongoing premiums are lower.

Borrowing Money from Life Insurance Policy

After 3 or 4 years of paying premiums and buying healthy paid up additions, you've got a tidy sum of money in the contract. Now you can borrow it tax-free at a certain interest rate, say 5%. Now that 5% doesn't go toward your cash value, it goes to the insurance company, but since this is a non-direct recognition policy, the insurance company is still paying dividends, say 5%, on the money you borrowed, so it's a wash to you. You've got yourself an interest free loan. Kind of cool huh. Of course, borrowing money from your bank account is also an interest free loan, but proponents of Bank on Yourself like to point out your bank account isn't paying 5% interest. If you kick the bucket during this process, your heirs still get the death benefit (minus the loan amount of course). The insurance company doesn't guarantee death benefit increases each year, but they generally do.

Tax and Asset Protection Benefits

Insurance policies have four main tax benefits. First, you can borrow from the policy tax-free. You have to pay interest on it, but you don't have to pay taxes on it. That's of course no different than “borrowing” from your bank account or from the bank itself, but it is different from cashing out of an investment with capital gains. Second, money compounds in a tax-free manner within the policy; there's no annual capital gains or dividend taxes on growth. Third, the death benefit is income tax-free to your heirs. Fourth, if you cash out, your basis is determined by the entire premiums paid, not just the portion that went to “the investment part.”

In many states, cash value in your insurance policy is protected from creditors up to a certain amount. Those of us constantly concerned about being sued see that as a benefit. The money isn't FDIC insured like a bank account, but states generally guarantee up to a certain amount from insurance company insolvency.

The Downsides of Using Life Insurance to Bank On Yourself

You can understand why at this point people are often pretty excited about this whole concept. Higher banking returns and tax-free growth all combined with a “free” death benefit. There's got to be a catch, right? Of course there is. Let's talk about catches.

The “Load”

When you put $10K into your bank account, the next morning there's $10K there. When you pay a premium into a life insurance policy or buy a PUA, the whole premium doesn't go into the policy. Like with a loaded mutual fund, a small percentage of that money goes toward the costs of the policy and toward the commission of the salesman. If the policy is paying 5% a year, and the “load” is 10%, it'll take 2 years just to break even.

Loan Rate vs Interest Rate on Whole Life Insurance

In my scenario above, I used 5% for both the loan rate and the interest rate. It's quite possible that the dividend rate can be higher than the loan rate or vice versa. Obviously borrowing at 5% and earning 2% is a losing proposition. In the policy discussed above the loan rate is variable, currently set at 4%. The current dividend rate is below 6%. It's easy to envision a scenario where those numbers reverse.

You Still Have to Pay the Life Insurance Premiums

Buying a life insurance policy is a long-term deal. Those premiums come due every year, whether you like it or not and without concern for your current financial situation. Lose your job? Disabled? Retired? Wanted to cut back? The policy doesn't care. With this particular policy you pay until you're 100. I'm sure you can get one that is paid up sooner, but the shorter the payment term, the higher the premiums for the same death benefit. If you stop paying the premiums, any loans you've taken out become fully taxable, at least the portion above and beyond the premiums paid. This factor alone is the single biggest downside to this idea. This would keep a wise doc from putting a whole lot of money into a policy. But I worry more for the average earner that this idea is sold to. The guy who's putting $500 a month of his $4000 a month salary into whole life insurance. One new expense and all of a sudden his whole financial system is collapsing around him.

MEC Calculations Are Complicated

The point at which the contract becomes an MEC is influenced by the amount borrowed and the current dividend rate. With all these moving parts, it's not that hard to accidentally make the proceeds of your policy taxable. The insurance company and agent are supposed to ensure this doesn't happen, but there may be times when you may be required to unexpectedly pay back a loan or contribute more money into the policy to prevent it.

Source of Funds

You have to take the money from somewhere in order to dump it into a life insurance policy. Proponents often recommend pulling it out of your 401K, IRA, house (via refinancing or a home equity loan) etc. When it's pointed out that there are serious opportunity costs, interest costs, or tax costs to doing this, they finally settle down to “put your emergency fund and/or short term savings in it.” But for a doctor, how much money is that really? $10-50K? Maybe $100K if you're doing really well? Making an extra 4% on $20K is only $800 a year. Not exactly the difference between poverty and financial bliss for a doctor. It especially bothers me to see people recommending you stop contributing to a retirement account that provides tax protection, asset protection, and solid returns in order to buy more life insurance, that has nowhere near the same tax benefits, asset protection, or estate planning benefits. Risking your house to invest in life insurance seems even more stupid.

Takes Time to Get Money from Life Insurance Policy

Loans from an insurance policy are a bit less liquid than what I think an emergency fund should be. I've never borrowed from one, but I understand it's a matter of days to weeks to get your money from the company. That's not the place for an emergency fund. Perhaps if you know a big purchase is coming a few weeks early it could work.

Additional Complexity Borrowing from Life Insurance Policy

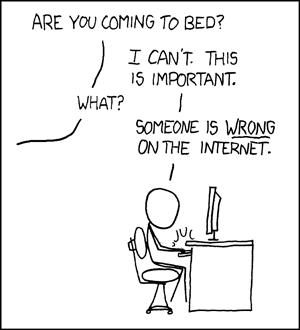

Everywhere else in the financial world additional layers of complexity favor salesmen and the companies they represent. Why would this be any different? In fact, as you search the internet, you quickly realize that any discussion of these comments quickly breaks down into the proponents who suggest you need their expertise to understand it, and the detractors, who don't seem to completely understand it. I couldn't find anything anywhere that seemed to be a straightforward, unbiased analysis. The sales methods and opaque nature all screams “SCAM” to me. That doesn't necessarily mean it is, but as a general rule good financial products are bought, not sold. If an extensive sales process is required, or if I can't explain it to my wife in less than 2 minutes, I try not to have anything to do with it. There's a lot of people in this world smarter than the average insurance agent and it doesn't seem to me that very many of them are banking on themselves. I can't believe it's simply a matter of bias or the word simply “not getting out.” Good ideas don't stay hidden long.

Purpose

The books and websites that most push this concept like to talk about buying cars, as if saving up to buy a car vs taking out a car loan is the biggest financial concern in the world. Most doctors can buy a decent used car out of last month's paycheck. Maybe save up for 3 months if you want a new one. You've got to think about what you're actually going to borrow money for. If you're going to borrow it to pay off credit cards, don't you think it might be smarter to pay off credit cards at a guaranteed “investment” rate of 15-30% than to buy a whole life policy? When is the last time you went car shopping? All the signs and ads I see are advertising 0% APR car loans. Why bother dealing with an insurance policy when the car dealer will give you 0% right now? A mortgage? Why pay “myself” 5% when I can pay a bank a tax-deductible 2.75%? It just doesn't pass the sniff test. I don't really finance much anyway, why do I need a “new, innovative” way to do so?

Ongoing Interest Payments on Life Insurance Loan

Let's say you want to take some money out of the policy and NOT pay it back. You still have to make the interest payments each year. My goal is to minimize my fixed expenses, especially the closer I get to retirement. If you don't make enough payments, not only does the policy risk collapsing, but that death benefit starts decreasing too.

I'm obviously not running down to the local whole life salesman to start banking on myself. I don't think you'll benefit much from it either. In my opinion, the downsides outweigh some significant positives. You're better off not mixing investing and insurance.

What do you think? Do you have a whole life policy you use for “banking?” Do you still feel like it's a good idea? Comment below.

find somebody else.

find somebody else.