Every year, nearly 200 million people face one of the most challenging mathematical algorithms in all of personal finance, as we are forced to participate in the terminology-rich and concept-laden obstacle course that we call open enrollment. During this uniquely bizarre annual ritual, our human resource departments ask us (force us?) to navigate the Bermuda triangle of the American healthcare system, the US tax code, and our personal financial planning goals.

Nowhere in the open enrollment process do we face a more complex decision than whether to enroll in a High Deductible Health Plan (HDHP) and contribute to the companionate Health Savings Account (HSA) or to elect the more familiar non-HDHP and contribute to its companion the Flexible Spending Account (FSA).

A well-known and highly regarded financial advisor was recently asked how much he would charge to do this analysis as a standalone service each year, and he said, “$10,000, and neither of us would probably get our money’s worth.”

That may sound ridiculous, but after wading through this for myself and with clients, I understand the sentiment. I have heard the complexities of this choice described as three-dimensional chess, which aligns with my personal experience for my family that has a special needs child and for my clients at large who struggle to understand the myriad variables that go into this decision.

My goal today is to share my approach to this annual calculus exam in hopes of making the decision a little less complicated for a few of you.

Before the Math Begins

Before I launch into a nerdy math-based analysis, let me first offer a few non-numerical considerations and observations.

- Josh Katzowitz wants me to write shorter columns, so I’m going to skip over the 2,000 words I want to write next to orient everyone to this conversation. Therefore, this is not an “Intro to HSAs” article. This is not HSAs 101 for beginners. If you don’t understand the next sentence, please read this, this, this, and this first. OK, here's a quick sentence on HSAs. An HSA is a triple tax-protected account that can act as a Stealth IRA and is thus considered by many financial professionals to be the most tax-efficient retirement account available to high earners when used optimally over decades (optimally = maxing out annually, not withdrawing the money for annual healthcare costs, investing aggressively, saving your healthcare receipts, etc.).

- There is data to suggest worse health outcomes for those on HDHPs, because they delay seeking medical care compared to those on non-HDHPs. If you die at 45 with colon cancer, no one cares about your triple tax savings. If you can’t trust yourself to go to the doctor when you have a concerning symptom because it will cost you a few hundred bucks and, thus, you miss out on the most tax-efficient account in the land by going with a non-HDHP, that is fine. It is a bummer from a financial optimization perspective, but please choose life over tax efficiency.

- HSAs are amazing, but you don’t need to use them to reach goals. This is not mandatory. You should start your decision tree by determining which health insurance is best for your family (carriers, convenience, staying with your doctors, etc). If the HDHP/HSA is reasonable through that lens, please read on.

The Math

I approach the question of, “Is an HSA right for me next year?” with a six-part mathematical analysis.

Part A – What Are the After-Tax Premiums for All Plans?

If the non-HDHP is $10,000 a year and the HDHP is $6,000, that is a $4,000 PRE-tax difference. With a 40% marginal tax rate, the after-tax difference is $2,400 in saved premiums. This highlights the point that it is critical to know your premiums. An HDHP should have lower premiums because you are paying more costs up front (therefore saving the insurance company money). However, that is not always the case, and sometimes the HDHP premiums are inexplicably large—which means that it is less likely the math will come out in your favor.

Part B – How Much Does the Employer Contribute to the HSA?

Assuming the premiums on the HDHP are lower, the employer is incentivized to have employees choose the HDHP because they save money on the portion of the premiums they are paying for you. Thus, it is common to see employers make contributions to the HSA to entice employees to use it. This is “free money,” just like a 401(k) match that functionally raises one’s compensation. I often see $500-$2,500 put in annually by an employer. For our example, let’s say the employer puts in $1,500.

Part C – What Are the Tax Savings from Maxing Out the HSA?

The 2025 limit for a family is $8,550, which includes employer contributions. [2025 — visit our annual numbers page to get the most up-to-date figures.] In our example, that leaves $7,050 for the family to contribute and deduct at their 40% marginal tax rate. This saves the family $2,820 in taxes.

Part D – HSA and FSA Contributions

HSA and FSA contributions are not just exempt from income taxes but also from payroll taxes if contributions are made via payroll withholdings and not “manually.”

Since the HSA contribution limit ($8,550) is larger than the FSA contribution limit ($3,300), that’s ($8,550 – $3,300 = $5,250) $5,250 x 7.65% = $402 additional savings in favor of the HDHP*.

[AUTHOR'S NOTE: *S-Corp shareholders with 2% or greater ownership are not exempt from FICA taxes for HSA contributions. However, there appears to be a workaround discussed by WCI Forum user guru spiritrider.]

Now, add up Parts A, B, C, and D to get a ($2,400 + $1,500 +$ 2,820 + 402) = $7,122 “head start” for the HDHP/HSA. That’s a heck of a head start, and it’s critical to remember this when you find yourself frustrated at the pediatrician's office paying the entire $400 bill for taking the baby in with strep throat under your HDHP instead of the $30 co-pay on the non-HDHP.

But the analysis is not complete yet. What are our costs with potentially higher deductibles on the HDHP or the missed opportunities with no FSA contributions?

Part E – What's the Difference in Family Deductibles?

You have to figure out the difference between the non-HDHP family deductible (or out-of-pocket max, whichever you prefer to compare based on projected healthcare usage) and the HDHP family deductible. If the non-HDHP has a deductible of $1,000 compared to $3,000 on the HDHP, that’s $2,000 in favor of the non-HDHP.

Part F – What Are the Tax Savings If an FSA Were Used Instead of an HSA?

In our example for 2025 with a $3,300 FSA limit and a 40% marginal tax rate, the answer is $1,320.

That means our net difference is $7,122 – $2,000 – $1,320 = $3,802 in favor of the HDHP/HSA in this example.

This is often what I see when I do these evaluations and why I disagree with the statement I hear thrown around a lot that “if you are chronically ill and continually exceed the out-of-pocket deductible of an HDHP, the choice is obvious. You don’t enroll in the HDHP.” That is absolutely not true for many of my people. I have several clients with a chronic illness (i.e., MS) who have really expensive medications that cause them to hit their deductible and out-of-pocket max in the first quarter of each year. But they still use an HDHP/HSA because this net math shows it’s the right choice.

More information here:

Social Security Is Not Going Away (But You Might Have to Adjust Your Plans)

Impact of Healthcare Spending

The analysis above is useful for understanding the general value of an HSA vs. a non-HSA in a given year, but the specific value can only really be understood in hindsight once we know how much our healthcare spending was for the year.

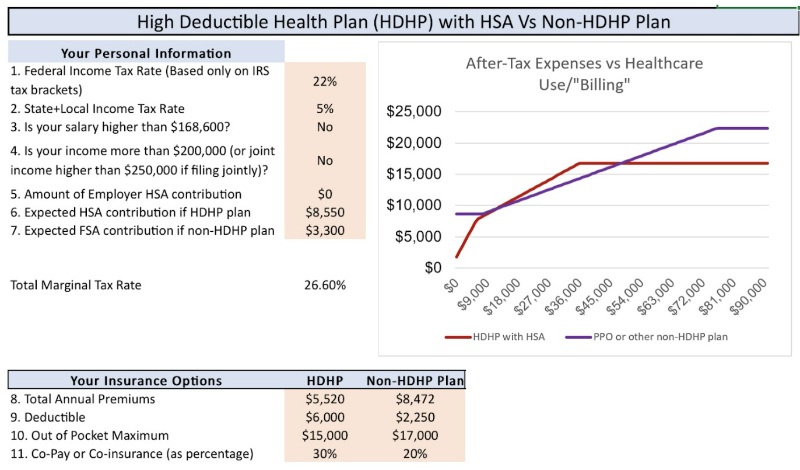

Depending on the details of your health plan, your income, your tax rates, and your spending, you may find that an HDHP is “worth it” only at certain levels of healthcare expenses.

For example, look at the chart below that represents our family’s specific situation for 2025. The X-axis represents how much healthcare we are billed, and the Y-axis represents our total after-tax out-of-pocket costs. You can see that at lower levels of healthcare spending (up to ~$8,000) and at high levels of healthcare spending (above ~$50,000), the HDHP “wins.” Also, for moderate levels of spending (~$8,000-$18,000), the plans are tied. As discussed in the next section of the post, the tie goes to the HDHP/HSA due to the power of tax-free growth and tax-free withdrawals.

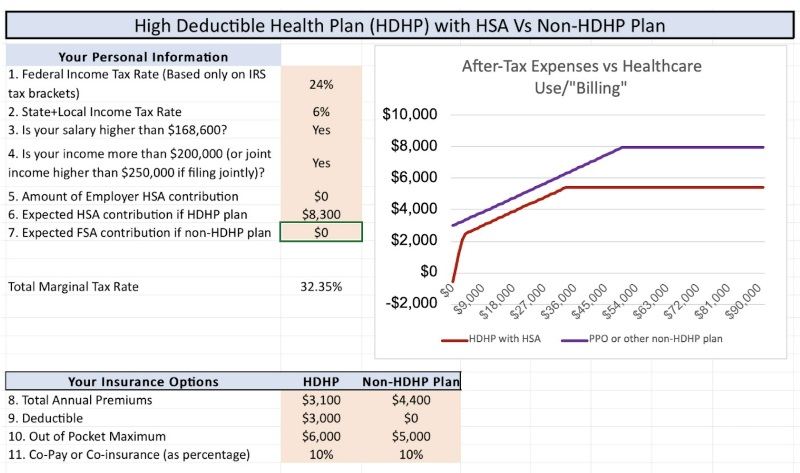

This next graph uses a different set of details and circumstances in which the HDHP always wins, regardless of healthcare spending. This simply highlights the point that you must run the numbers for yourself to understand the nuances and details of your particular situation.

Value of Tax-Free Growth

But wait . . . there’s more!

The FSA is use-it-or-lose-it (you can carry over $660 of unused FSA money into the new year), and the HSA can be invested for 20-30 years with tax-free growth and tax-free withdrawals. How much is that worth?

Of course, no one knows because we don’t know what market returns will be, but the answer is “more than $0, probably a lot more than $0.”

Let's say that $8,550 is invested every year, increasing each year for inflation adjustments, increasing again for catch-up contributions at age 55, compounding tax-free over a 30-year period at ~7%. That's right around $1 million in the HSA that can be withdrawn tax-free if you save your receipts. Compare that to the non-tax-free growth in a taxable account using the same assumptions except for a 5% after-tax return. You get ~$700,000 that will be withdrawn at long-term capital gains rates (yes, I know there are many ways to avoid capital gains taxes, but again, I’m trying to keep this short). That ~$300,000 of additional growth in the HSA that can be taken out tax-free is a strong tie-breaker if the math outlined above is close in a given situation.

Also, once your adult kids gain tax independence, they can make their own $8,550 contribution until they turn 26, and then, they can be on pace for a million dollars in their HSA when they reach retirement age. That is a huge advantage in favor of the HDHP.

More information here:

Beware! An HSA Is Great But . . .

Should I Get an HDHP Just to Use an HSA?

TC; DR (Too Confusing; Didn’t Read)

- You knew this debate was complicated, but it’s probably more complicated than you realized. I have tremendous empathy for families who have to navigate this choice every year during open enrollment.

- Start by getting the health insurance that is best for your family and your peace of mind; let the math come after those critical considerations.

- Rule of thumb: There is no rule of thumb. You must know all the details of your various health insurance options and run the numbers. Gratefully, someone made a calculator that can help.

- If the net difference comes out close to $0 (maybe +/- $1,000), choose the HDHP and HSA. Tax-free growth and tax-free withdrawals will likely make up the difference over time.

- Venmo me my $10,000 at your convenience.

What do you think? Do you have the HDHP/HSA vs. non-HDHP debate every year? What has your decision been?