Whole life insurance is often marketed as more than just life insurance; it’s pitched by commission-seeking agents as a wealth-building tool with guaranteed benefits, tax advantages, and cash value growth. On the surface, it can sound like a great financial strategy.

Supporters of whole life insurance often highlight its guarantees:

- Guaranteed premiums,

- Guaranteed death benefit, and

- Guaranteed cash value accumulation.

For some people, especially those who are risk-averse or dislike the volatility of the stock market, this can feel like a safe place to park money. The problem is that safety comes at a price: negative initial and modest long-term returns. Modest returns on a large portion of the portfolio MUST be paired with a massive savings rate in order to reach your goals. The same guarantees that provide safety come at a cost—specifically, a lost opportunity. Dollars allocated toward a permanent life insurance policy could have been invested elsewhere—such as in the stock market, where the potential for long-term growth is generally much higher.

Skeptics, and there are many, seem to hate this financial product more than any other, but it has its legitimate uses. Let’s take a closer look at whole life insurance—including the pros, cons, and financial realities—so you can decide if and how you might use it.

TL; DR Version

The short version of this post is that you will probably neither need nor even want a whole life insurance policy once you understand how it works. Mostly, these policies are designed to be sold (for huge commissions), not bought. Most white coat investors have a much better use for their money, whether that's paying down debt, maxing out retirement accounts, or investing aggressively. There are a few completely reasonable niche uses for whole life insurance, even if just being a doctor is not one of them. However, since the purchase of a whole life insurance policy is, like marriage, a lifelong financial commitment, it should be approached with a similar amount of due diligence.

Note that the decision to cancel a whole life insurance policy that perhaps you should never have bought is not the same as the decision to avoid the purchase in the first place. The low returns on a policy are heavily front-loaded, so sometimes it makes sense to hold on to a policy you never should have bought. Make sure you have any needed term life insurance in place prior to cancelling a whole life policy.

What Is Whole Life Insurance?

Whole life insurance is a permanent life insurance policy that provides a guaranteed death benefit for life and builds cash value. Unlike term life insurance, which lasts for a set number of years (typically 5-30 years), whole life insurance never expires. The main reason it costs so much more than term life insurance is because it will eventually pay out for everyone who buys and maintains a policy. Most term insurance policies never have to pay anything to a beneficiary, because they expire before the insured dies.

How Whole Life Insurance Started

Whole life insurance got its start in the 19th century, when life insurance evolved as a way to provide financial security to families after the death of a breadwinner.

By the mid-19th century, insurance companies, particularly mutual life insurers, began offering whole life insurance as a way to combine life insurance protection with a savings mechanism. The idea was that policyholders could pay fixed premiums, accumulate cash buildup, and receive guaranteed lifetime insurance coverage—a structure that appealed to those seeking both financial protection and long-term wealth accumulation. The alternatives for investment for many decades afterward were much less attractive than what is available today.

Before the 1980s, whole life insurance made a little more sense. It was a simpler time: high commissions; no index funds; no Roth IRAs; no 401(k)s; and limited access to low-cost, diversified investments. Most people didn’t have the tools or knowledge to effectively invest in the market. Whole life offered a way to build savings in a tax-deferred, guaranteed vehicle with some forced discipline. It wasn’t a great investment, but for many, it was one of the better ones available.

Things are different now. Today, we have access to a plethora of financial tools and investment vehicles that make it easier than ever to grow wealth more quickly and at least as tax-efficiently.

Whole Life Insurance from Mutual vs. Stock Companies

This evolution also led to two types of insurance providers: mutual and stock companies—each with distinct approaches to policy ownership, dividends, and cash value growth.

- Mutual companies (e.g., MassMutual, Guardian, New York Life): Owned by policyholders, these companies typically offer participating whole life policies that pay dividends, which can increase cash value or reduce premiums.

- Stock companies (e.g., MetLife, Prudential): Owned by shareholders, whole life policies from these companies are often non-participating, meaning they grow based on guaranteed interest and do not pay dividends. However, some stock companies do offer participating whole life policies—often through legacy policy blocks or specialized product lines, which can pay dividends that enhance cash value growth. Because of this variability, it's important to carefully review each policy’s dividend status and structure.

At first glance, it might appear that one should always purchase insurance from a mutual company, but that is not always the case. There is far more nuance to this issue than may first appear. The specifics of the policy matter as much, if not more, than the structure of the company standing behind it.

How Whole Life Insurance Works

Whole life insurance has some distinguishing features.

Fixed Premiums

The payments will stay the same for life, but they are much higher than term life insurance.

Guaranteed Death Benefit

The death benefit will be paid no matter when you pass away, as long as premiums are paid.

Cash Value Growth

Part of the premium builds tax-deferred savings, which can be borrowed against or withdrawn. Note that this cash value is not separate from the death benefit. Accessing it via policy loans or partial surrenders reduces the death benefit accordingly.

Dividends

Some policies from mutual insurance companies pay non-guaranteed dividends, which can be used to grow the policy’s cash value and death benefit or can even be taken and spent as a non-taxable, “return of premium” cash payment. A dividend interest rate (DIR) is the rate mutual life insurance companies use to calculate dividends paid to eligible whole life policyholders. These dividends aren’t guaranteed, but when declared, they reflect the company’s overall financial performance—including investment returns, mortality experience, and operating expenses. Policyholders can use dividends in several ways:

- Reduce premiums

- Take as cash payments

- Purchase additional paid-up insurance

- Leave them on deposit to earn interest

Note that illustrations shown by a selling agent generally assume these dividends are reinvested into the policy by purchasing additional paid-up insurance. While the DIR gives a general idea of how a policy may perform, the actual dividend amount depends on the specifics of each policy. Note that the DIR is not the same as the return on your “investment” of policy premiums paid. It often takes 5-15 years or more to “break even” on a whole life “investment” despite being paid dividends each year.

Not All Permanent Insurance Policies Are Whole Life Insurance

There are other types of permanent (lifelong) insurance policies, including variable life insurance and various types of universal life insurance. These policies work differently from whole life insurance. They may offer more flexibility, but they generally offer significantly fewer guarantees. Further discussion of their nuances is beyond the scope of this post, but the same general level of caution should be applied to their purchase as with whole life insurance.

Advantages of Whole Life Insurance

Whole life does have some advantages over a term life policy.

Lifetime Coverage

Term life expires after a set period, and if you try to renew it, the premiums skyrocket, so most people let it lapse. Whole life, on the other hand, is significantly more expensive upfront, but the premium stays level and the coverage lasts your entire life as long as you keep paying.

Cash Value Accumulation

Cash value builds over time, and it grows in a tax-protected manner. It can be borrowed against or withdrawn. Growth is guaranteed at a minimum rate.

Tax-Advantaged Partial Surrenders

You can partially surrender a policy, allowing you to access cash value in a tax-advantaged way. Note that a partial surrender means your death benefit (and also premiums due in the future) are reduced. When partially surrendering a policy, the cash is accessed using the “First-In, First-Out” (FIFO) method rather than the “First-In, Last-Out” (FILO) method used by annuities. This means that withdrawals are taken from the basis or principal (the total of premiums paid) first (tax-free) before accessing any gains (fully taxable at your ordinary income tax rates). This tax advantage is unique to permanent life insurance.

Loans

Another method of accessing the cash value is to borrow against the value of the policy at pre-determined terms. While this can provide access to funds, it's important to understand that interest on the loan is generally paid to the insurance company, not back into your policy. Even though you're borrowing against your own cash value, the insurance company treats it as a loan using your policy as collateral. Some policies offer a feature known as “non-direct recognition” of policy loans, and if you plan to access your cash value via loans, this is often a very important feature for your policy. With non-direct recognition, your policy, in essence, continues to pay dividends as though you had not borrowed against it.

Guaranteed Growth

Growth in the policy cash value is guaranteed at a very low rate. While policies usually outperform the guaranteed rate, calculating the “return on investment” of your premiums paid can be a sobering experience, even when the policy is held for many decades. Two percent per year would not be unusual.

Fixed Premiums

Like with a level premium term policy, whole life premiums remain level for the duration of the policy.

Potential Dividends

Some policies pay dividends that can be used to reduce premiums, increase cash value, or be taken as cash. Dividends are not guaranteed and are dependent on company performance, but they are usually non-taxable, as they represent a return of premiums paid.

Asset Protection

In some states, whole life insurance cash value is protected from creditors in a bankruptcy situation.

Disadvantages of Whole Life Insurance

As you have probably guessed, there are a whole lot of drawbacks to whole life insurance as well.

High Premiums

Whole life insurance costs significantly more than term life for the same death benefit in the short term. For example, a $1 million 20-year term policy for a 35-year-old might cost $700 annually, while a $1 million whole life policy could cost as much as $15,000 per year, more than 20 times as much. In other words, you could either buy a $100,000 whole life policy or a $2.1 million term life policy for the same price. One of those will provide dramatically more benefit to your heirs in the event of your untimely death. Thus, we see recommendations for “buy term and invest the rest.” If you actually invest the difference in premiums in some sort of reasonable manner, you are highly likely to come out ahead.

Low Investment Returns

The “return on investment” (not counting the value of the insurance) of your whole life premiums, even when held for decades, is likely to be in the range of 2%-5%—much lower than stock market returns and, in the initial years, even lower than typical bond returns. Depending on the policy’s structure in the first 10-20 years, returns are often negative due to the cost of insurance and commissions. It's a terrible short-term investment and not that great of a long-term investment UNLESS you highly value the permanent death benefit or some other feature.

Complexity and Limited Flexibility

Many policyholders don’t fully understand policy mechanics. For example, borrowing against the cash value reduces the death benefit unless the loan is repaid. There are not two pools of money; there's only one. Another example is that dividends are only paid on the cash value, not the entire premium amount paid.

Policy Lapses, Surrender Rates, and Satisfaction Surveys

Lapses and surrenders are high for many insurance products. Many policyholders drop their policies due to high costs.

Here are the lapse rates (according to a 2005 study done by LIMRA):

- Whole life: 25% lapse within three years, 40% within 10 years, and a majority (around 80%) before any death benefit is ever paid.

- Universal life: 88% of policies don’t pay a claim due to lapse.

- Indexed universal life (IUL): High lapse rates due to market volatility and increasing costs.

- Term life: Term life also has high lapses, particularly at the end of the term. Ten percent lapse annually; end-of-term lapse occurs at the end of the level premium period, when term rates skyrocket, with rates between 30%-50% and even higher depending on the length of the term. Of course, a term policy lapsing when no longer needed is far different from a permanent policy like whole life, which is designed to be held until death, lapsing. Upon lapsing, any gains in a whole life insurance policy are taxable at ordinary income tax rates, eliminating much of the benefit of the prior decades of tax-protected growth.

Informal surveys of white coat investors have suggested that 75% of those who have purchased a whole life policy regret the purchase. Comments left on this website, in WCI forums, and in emails suggest a frustratingly high number of doctors have purchased/been sold whole life insurance inappropriately.

Should Doctors Buy Whole Life Insurance?

There are situations where whole life may be a suitable option. These are almost all situations where a permanent, lifelong death benefit is needed or at least desired. When evaluating solutions for the needs outlined below, it’s important to consider all available options, but don't expect to hear about the other options from an insurance agent.

Tax-Efficient, Liquid Estate Planning Guarantees

If your estate will be large enough to generate either federal or state estate taxes, you may wish to move assets into an irrevocable trust so future appreciation is outside of the estate. Life insurance is often used to fund these trusts, called Irrevocable Life Insurance Trusts (ILITs), for three reasons. The first is the guarantee. Investments take time to grow, even if they have a higher expected return than life insurance at the grantor's (funder of the trust) life expectancy. If the grantor dies early, the life insurance will still ensure a large amount of money in the trust. The second reason is simplicity and tax efficiency. Not only is a life insurance death benefit tax-free (and investments in an irrevocable trust do not get a step up in basis at death), but it grows in a tax-protected way until then. The third reason is liquidity. Life insurance death benefits are paid out in cash, which can be used to pay estate taxes or other expenses more easily than illiquid assets like real estate or private businesses (which may also be part of the estate). This liquidity feature is also often used outside of an irrevocable trust for very illiquid estates, like a large family farm that would need to be sold to provide inheritances for multiple heirs or to pay estate taxes.

Alternatives to consider: Traditional investments, gifting strategies, guaranteed universal life, credit lines, trusts, staggered liquidation of assets.

Business Owner Buy-Sell Agreements

Whole life insurance guarantees a payout for buy-sell agreements, making sure that business partners can buy out a deceased owner’s share so they do not have to be in business with the heirs or, even worse, sell or close the business. Buy-sell disability insurance policies can also be purchased for similar purposes.

Alternatives to consider: Term life insurance, buyouts over time, guaranteed universal life.

Key Person Insurance

For businesses reliant on a specific individual, life insurance can provide funds to replace them or to replace lost value for the heirs. While term life can be used during typical working years, whole life may be a good option for older key employees, as term life can become prohibitively expensive after age 60.

Alternatives to consider: Term life insurance, self-insuring (large quantity of cash), guaranteed universal life.

Asset Protection

While returns on a whole life policy “investment” are not very high, some people are willing to give up returns to protect assets in a bankruptcy situation. People buying whole life insurance for this reason need to make sure 1) their state actually protects whole life cash value in bankruptcy and 2) they have already taken all other asset protection moves appropriate for their situation first, such as Roth conversions and asset protection trusts.

Alternatives to consider: Liability insurance, homestead laws, retirement accounts, Roth conversions, family limited partnerships, family LLCs, Intentionally Defective Grantor Trusts (IDGT) such as Spousal Lifetime Access Trusts (SLAT), domestic asset protection trusts, foreign asset protection trusts, annuities.

Bond Replacement

Even long-term whole life returns pale in comparison to those available from stock index funds and well-managed real estate, but they are not so different from bond returns, especially for those in high tax brackets who must invest in those bonds in a taxable account. While muni bonds pay federal (and sometimes state and local) tax-free interest, long-term returns in a whole life policy may be higher, especially for those who don't anticipate spending the interest or principal from those bonds during their life.

Alternatives to consider: Bonds, asset location strategies.

Providing for Dependents with Special Needs

Life insurance can guarantee a set amount of funds for a special needs child or dependent, regardless of when the insured passes away. While a disabled heir can live just as well on the proceeds of a term life policy or your leftover nest egg, a whole life policy is a reasonable choice for this need, especially for someone who does not become financially independent until late in life (or never) or has a small nest egg and is primarily living on Social Security or a pension in retirement. While the nest egg would be available to the disabled heir, the Social Security and pension would not.

Alternatives to consider: Term life insurance, traditional investments, ABLE accounts, special needs trusts.

Juvenile Policies in Families with Inherited Health Issues

If a child has a family history of health conditions, a whole life policy with a guaranteed insurability rider can help secure future coverage, whereas term life typically isn’t available for children. While it is generally a mistake to buy life insurance on someone if nobody depends on their income and while buying life insurance on children is generally a sign of financial illiteracy, there are a few policies out there where you are primarily buying a large amount of guaranteed insurability later rather than a death benefit now. These are generally whole life policies.

Alternatives to consider: Self-insure, seek employment only with employers offering life insurance as a benefit, convertible child riders on parental term policies.

Forced Savings with Guarantees

Some individuals appreciate stability, and whole life insurance provides a safe, predictable option compared to market volatility. The tradeoff is potentially missing out on significantly higher returns that could be achieved by taking those same dollars and investing in stocks or real estate. Skeptics would argue that those who need to be “forced” to save with required whole life premiums are also those most likely to let that policy lapse anyway, leading to dire consequences.

Alternatives to consider: Traditional investments, automated saving program, retirement accounts.

Charitable Gifting

Whole life insurance can provide a guaranteed gift to a charity by naming it as the policy beneficiary. The key is that you must value the guarantee, as traditional investments are likely (but not guaranteed) to leave more to the charity. Life insurance can even be used in Charitable Remainder Trusts of traditional investments for similar reasons.

Alternatives to consider: Traditional investments, Donor Advised Funds (DAF), charitable foundations, charitable trusts.

Bank on Yourself/Infinite Banking

Some people use a specialized whole life policy instead of a bank. They use features like maximizing paid-up additions, non-direct recognition loans, and wash loans to minimize commissions and the amount of time required to break even. While there is a lot of hype and salesmanship around these ideas, you are basically trading poor short-term returns for higher long-term returns on cash.

Alternatives to consider: Typical cash investments such as high-yield savings accounts, money market funds, and CDs.

When Whole Life Insurance May Not Be the Best Choice

Given the size of the commissions offered on these policies (as much as 50%-110% of the first year's premium), one should not be surprised to see agents become highly motivated to sell them. It's very important to recognize if you are one of the people who should not buy them. Let's go through those groups of people.

Almost Everyone

Your default position when evaluating one of these policies should be that it is NOT right for you because it is not right for almost everyone one and you're probably in that vast majority. Just being a doctor or other high-income professional or high-net-worth person is not enough reason to buy a whole life policy.

Physicians and Young Professionals Needing Income Replacement

Whole life insurance is often sold inappropriately to early-career physicians with multiple better uses for their money. I consider it financial malpractice to sell a policy to those with 5%-10% student loans. These docs often do need solid life insurance coverage, but that should almost always be provided with term insurance. All of the following uses of money are common for young physicians and are generally better uses of their money than whole life insurance:

- Create (or boost up) an emergency fund

- Pay off credit cards

- Pay off auto loans

- Replace a beater car

- Pay off student loans

- Max out Health Savings Accounts (HSAs)

- Max out retirement accounts

- Do Roth conversions upon leaving training

- Save up a down payment for a mortgage

- Invest in stock index funds in a taxable account

- Buy investment real estate

- Put money away for children in 529s, UTMAs, or Trump Accounts

For those early in their careers, especially physicians with high student loan debt, term life insurance is the more affordable choice. It provides higher coverage at a lower cost, allowing more money to go toward loan repayment, investments, and retirement savings. Since most professionals only need coverage until they reach financial independence (FI), term life should be strongly considered over whole life insurance. If you really think you might want a whole life policy later, you can always add a conversion rider (it's often free) to your term life insurance and later convert it to a whole life policy without a medical exam if your circumstances change and whole life becomes appropriate.

Those Seeking Higher Investment Returns

Whole life policies build cash value slowly, often don’t break even for 10-15 years, and have modest returns even if held for years. If you need your money to do a lot of the heavy lifting to build your retirement portfolio, you need to be investing in stock index funds +/- real estate, not whole life insurance. Traditional investments are likely to offer higher returns and more flexibility.

Anyone Who May Struggle with Premiums

Whole life costs 10-20x more than term for the same coverage. If keeping up with premiums becomes difficult, policyholders risk lapsing or surrendering the policy, often at a loss. If future affordability is a concern, term life is the better approach. You don't want a high premium-to-income or premium-to-savings ratio when buying these. If 1/4 or more of your savings or more than 5% of your gross income is going to whole life insurance, you're probably buying way too big of a policy. Physicians who mistakenly commit to premiums of $30,000, $40,000, or more per year generally regret the purchase and end up surrendering the policy at a loss within a few years.

Paying for College

Some agents have even advocated purchasing whole life insurance to pay for college (using loans). The problem is that the amount of time most parents save for college is about the amount of time required for a whole life policy to break even. Most people just need higher returns than that to meet their goals. Besides, a 529 account offers even more tax advantages than a whole life policy.

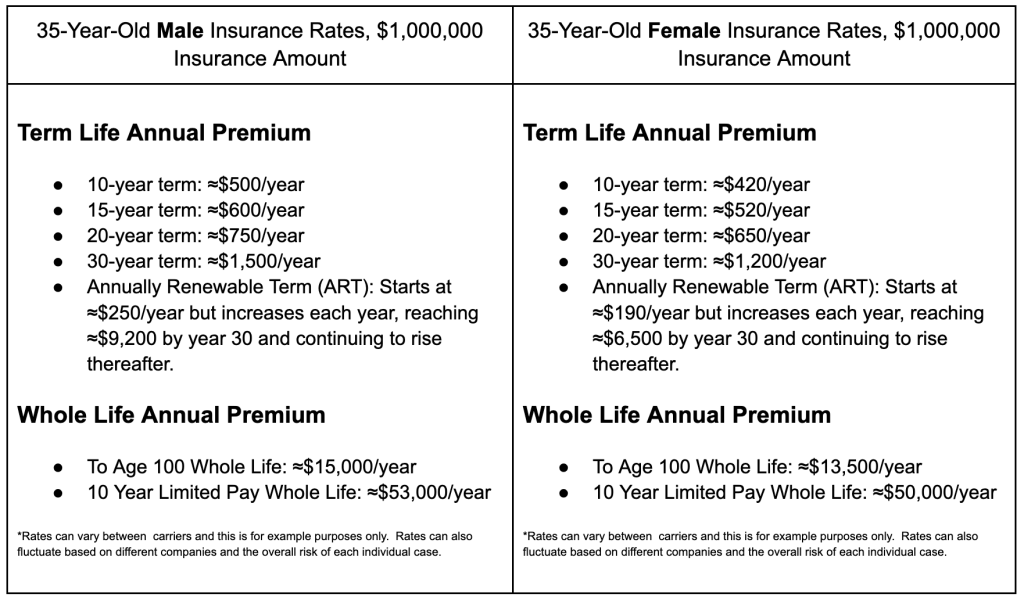

Comparing the Annual Cost of Whole Life vs. Term Life Insurance for a 35-Year-Old (Preferred Risk Class)

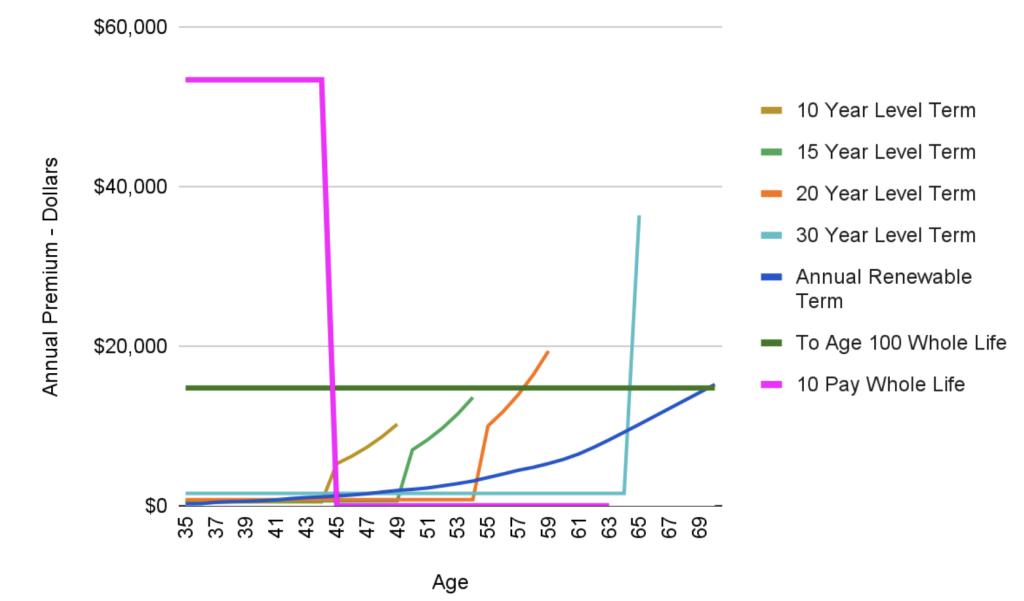

The chart below shows the annual premium for a $1 million policy on a 35-year-old “preferred-risk” (i.e., low risk) male or female. Females in the same class pay slightly lower rates.

- Level-term options (10, 20, and 30 years), where you lock in a fixed premium for the entire term.

- Whole life options offer different premium structures. For this example, a “to-age-100” plan, where you pay annual premiums until age 100, and a “10-pay” plan, which carries substantially higher annual premiums but is fully paid up after 10 years.

Term life is straightforward: pick your term, and your premium stays level throughout the term. With whole life, you choose how long you’d like to pay, spreading costs over a lifetime or concentrating them into a shorter period—with the tradeoff that shorter pay-up periods carry higher annual premiums. The following chart demonstrates how premiums change over time with the various types of term and whole life policies.

As you can see below, just as disability insurance is more expensive for women, life insurance is cheaper. Women live longer on average, even if they are more likely to become disabled.

What Happens When the Term Life Insurance Ends?

Term policies can typically be renewed once the term ends, but the premium increases significantly:

- 10-year term: In year 11, the premium jumps to over ≈$5,000 and continues to rise annually.

- 15-year term: In year 16, the premium increases to over ≈$7,000 and rises each year thereafter.

- 20-year term: In year 21, the premium increases to over ≈$10,000 and continues to rise every year after.

- 30-year term: In year 31, the premium spikes to over ≈$36,500 and keeps increasing.

- Annual renewable term: Continues to rise every year.

Because of the sharp increase in cost, most people choose not to renew their term policy. In fact, bought correctly (i.e., to cover the period until you hit financial independence), it should be canceled before the term is up. However, there are exceptions—especially in cases of serious illness or when new insurance is no longer an option and circumstances or poor planning meant there was still a need for a death benefit when the term expired.

In contrast, the whole life premium can be level for life. For an elderly person still paying premiums, whole life might offer the lowest annual premium at a certain point.

A Real-Life Example

A man was diagnosed with terminal colon cancer just before his term policy was set to expire. He had been paying just a few hundred dollars per year for a $1 million policy. When the term ended, the premium jumped to nearly $1,000 per month. Although the cost was steep, he and his wife chose to continue the coverage. Given his diagnosis, he wouldn’t qualify for a new policy, and his death was imminent. In that situation, paying the higher premium made sense, whether the insurance was still needed (in this case, it was).

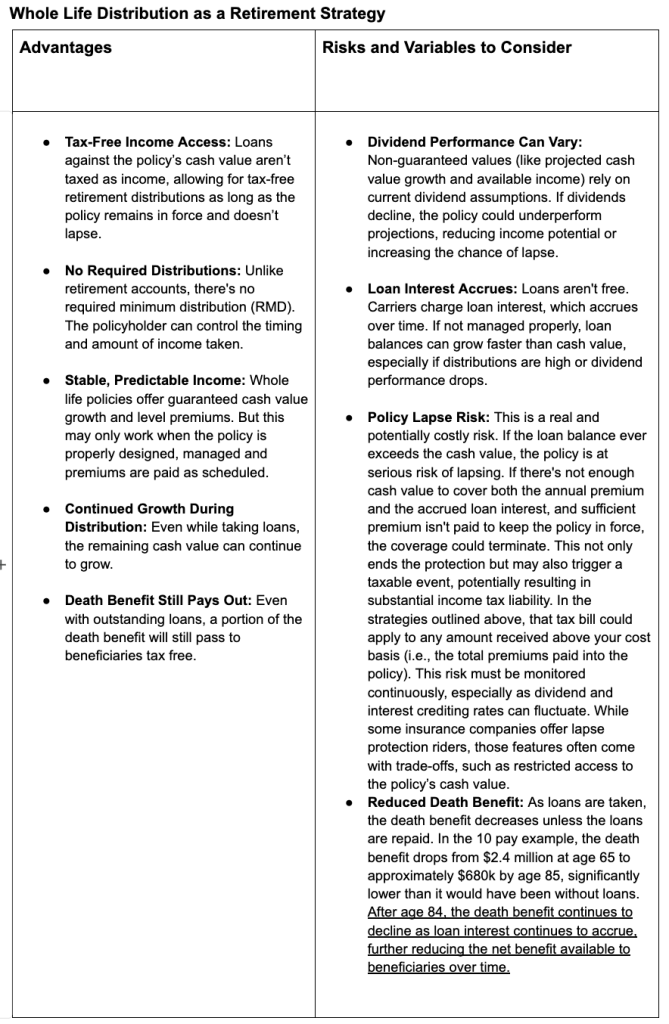

Whole Life as a Retirement Strategy

Whole life insurance is often pitched as a method of saving for retirement, particularly to doctors who have already maxed out retirement accounts and don't realize that you can always invest more in a taxable account.

Note that this use of whole life was not listed above as one of the “acceptable” uses for whole life insurance. Any fair comparison of whole life insurance to saving for retirement using retirement accounts and using reasonable assumptions shows such a dramatic advantage to the retirement account approach that anyone choosing to skip a retirement account contribution to pay whole life premiums would look like a fool. Even outside retirement accounts, if you are investing aggressively (mostly stocks and real estate) and tax-efficiently (index funds, low turnover, taking advantage of depreciation to shield rental income, lower long-term capital gains tax rates, lower qualified dividend tax rates, tax-loss harvesting, specific identification of high basis shares when selling to spend, using low basis shares for charitable donations, etc.), the advantage of traditional investments due to higher returns compounded over many years will also be quite evident.

Of course, a whole life insurance policy works best when designed for its anticipated use in advance. If your goal is to maximize your death benefit, design the policy that way from the beginning. If you plan to borrow against the cash value frequently (including to pay retirement expenses), it should be designed to minimize commissions, maximize cash value, and minimize the cost of those loans using features such as non-direct recognition of loans, paid-up additions, and wash loans. Whether you anticipate accessing the cash using partial surrenders (interest and tax-free but reducing the death benefit) or loans, the policy should be designed to facilitate that method. Unfortunately, too few purchasers of this complicated product ever hear about any of these features and how they will impact policy performance decades from now. Frankly, too few sellers of this product understand the impact of policy design on future performance.

The primary benefits of a whole life policy come from its guarantees. The more you value those guarantees, the more likely you are to be happy with the policy after purchasing it.

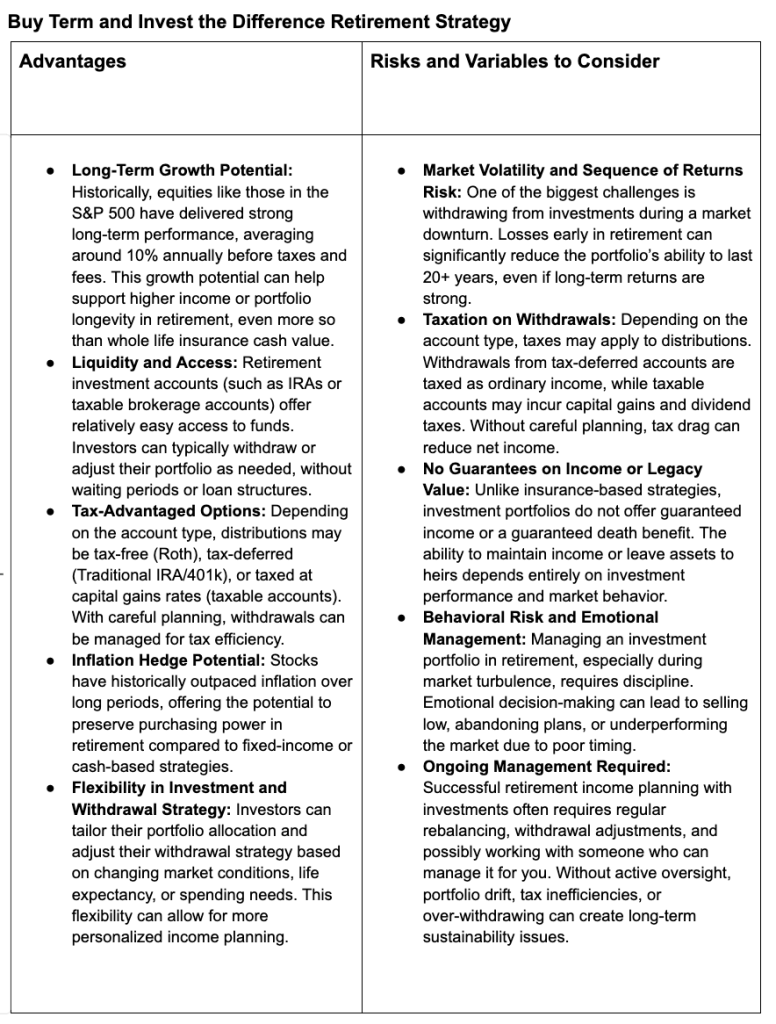

When comparing whole life insurance strategies to a buy-term-and-invest-the-difference approach, each offers distinct advantages depending on the individual’s goals, risk tolerance, and financial discipline. Whole life insurance provides permanent death benefit protection, stable growth through guaranteed values, and potential tax-advantaged access to cash value, particularly later in life. However, early cash value growth is often slow, and long-term outcomes depend on non-guaranteed dividend performance. In contrast, the term and investment strategy can result in significantly higher projected account values and greater flexibility, especially when market returns align with historical averages. It also allows for the potential to generate substantial retirement income, though it lacks guaranteed coverage and carries more exposure to market risk. Ultimately, these strategies reflect different philosophies: one prioritizes guarantees and lifelong insurance coverage, while the other is all about investment growth and control. There are tradeoffs on both sides.

A simple comparison between a whole life policy and a typical investment in a Roth account is easily made. A “10-pay” whole life policy with a $1 million death benefit may have an annual premium of $53,000 for 10 years. That $53,000 could also be contributed to Roth accounts for 10 years via the Backdoor Roth IRA process; the Mega Backdoor Roth IRA process; Roth conversions; and Roth employee deferrals to 401(k)s, 403(b)s, and 457(b)s. While $53,000 might be more than many people can get into Roth accounts in a given year (without conversions), Katie and I can currently contribute $185,000 to Roth accounts in a single year. So, $53,000 is certainly available to lots of people.

Over 30 years, that 10-pay policy at current dividend scales would grow to $700,000 on the guaranteed scale and $1.65 million on the projected scale. Meanwhile, the Roth account growing at an annualized 8% return would grow to $3.58 million, over twice as much as the projected scale and five times as much as the guaranteed scale. The Roth money can be accessed interest-free and tax-free in retirement. The whole life money could only be accessed via partial surrenders (which would lower the death benefit) or via policy loans (which charge interest), although both of those methods would also be tax-free. As a retirement investment, the comparison isn't even close.

What the Roth account does not provide, of course, is a death benefit. However, as long as that death benefit is not needed after the initial 30 years, it is easily purchased using an inexpensive term policy. Thus, it is easy to see that if you are not purchasing a whole life policy because you place a high value on the permanent death benefit, you are probably going to come out behind financially.

Advantages and Risks of Whole Life During Retirement Years

It’s not just about what you accumulate by age 65—it’s about how effectively you can turn that value into income you won’t outlive. This section takes a closer look at how whole life insurance and investment-based strategies perform when used as income sources in retirement, outlining the key advantages, potential risks, and variables that can affect long-term outcomes.

Annuities Are for Income

It's worth noting here that the insurance product best for providing guaranteed income in retirement is not whole life insurance. It's actually an annuity. While whole life insurance provides cash at death, the classic income annuity insures against you running out of cash before you die. Annuities can be purchased with funds from any source, including a taxable account, a retirement account, or a 1035 exchange from the cash value of a whole life policy.

The Bottom Line

Far too many whole life insurance policies are sold without proper education or understanding, and with commissions as high as they are, agents often have a strong incentive to make a sale. At The White Coat Investor, we believe in empowering you through education. Whole life insurance is a complex product, combining guarantees, fees, and long-term commitments. It rarely plays an important role in certain financial plans and only when you fully understand how it works and how it fits into your overall strategy.

For most physicians and high-income professionals, term life insurance combined with disciplined investing can lead to better long-term growth. Whole life, on the other hand, is not an investment, and it shouldn’t be treated like one.

That said, if you fully understand the structure, take comfort in the tradeoffs, and it aligns with your long-term goals, buy as much whole life insurance as you want. The key is informed decision-making, not one-size-fits-all ideas.

WCI-vetted insurance agents can answer your questions and help you make the right decision if whole life is something you are considering. They will inform you on the ins and outs of all life and disability insurance options. Before you buy whole life, ask yourself:

“Would I still want this policy if I had to keep it for many decades until death?”

If the answer is no, term life is probably the better fit.

Do you have or have you had a whole life insurance policy? Has it worked out for you? What have been the benefits? What have been the downsides?