By Eric Rosenberg, WCI Contributor

By Eric Rosenberg, WCI ContributorIf you’re looking for a simple option to save for retirement with low fees, you should know about Vanguard LifeStrategy Funds. This family of funds offers a mix of stocks and bonds optimized for various risk tolerances and stages in your retirement journey. Here’s a closer look at the Vanguard LifeStrategy Funds offering, fees, and how they may fit into your investment strategy.

What Are Vanguard LifeStrategy Funds?

Vanguard LifeStrategy Funds are a family of mutual funds that invest in a mix of stocks and bonds. Each LifeStrategy Fund holds a combination of Vanguard Total Market funds for domestic and international stocks and bonds.

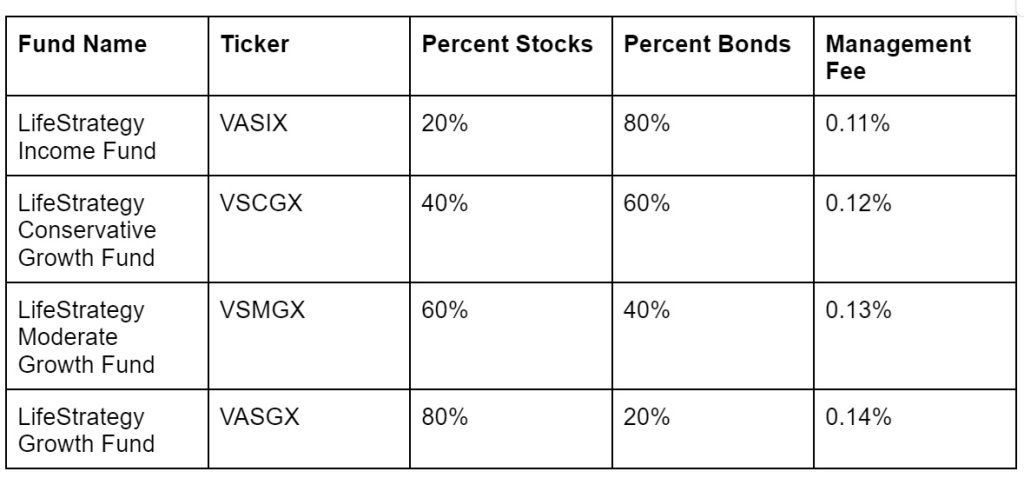

Each holds a target allocation percentage of stocks and bonds, such as 80% stocks and 20% bonds or 40% stocks and 60% bonds. In practice, they work like broad market target date funds. You can choose the fund that makes the most sense for the number of years until your planned retirement. All funds expose you to the entire stock and bond markets but weight the holdings differently based on your risk tolerance and investment goals.

The funds charge between 0.11%-0.14%. It's not the lowest-cost Vanguard offering, but it’s reasonable compared to many competing options.

More information here:

Breaking Down LifeStrategy Funds Options

If you’re interested in investing, consider these key features of the different LifeStrategy Funds family:

Each fund follows a specific benchmark index, such as the Income Composite Index (VASIX) or the Conservative Growth Composite Index (VSCGX). If you know your target asset allocation, buying just one of these funds is easy. For some investors, getting by with only one of these funds in their portfolio may be possible.

Vanguard LifeStrategy Funds Costs and Fees

The fees for these funds are between 0.11%-0.14%. The average Vanguard mutual fund charges 0.09%, a bit above the average. According to Vanguard, the average fee industry-wide is 0.50%.

With Vanguard Exchange Traded Funds (ETFs), you may find even lower fees, sometimes less than half of what you would pay for a LifeStrategy fund. The lowest-cost Vanguard consumer ETFs charge just 0.03%, about a quarter of the cost of the LifeStrategy offerings. You could put together your own portfolio using VOO, VTI, and BND and pay 0.03% in fees for each, for example.

For a $10,000 investment, you would pay $11-$14 per year in fees.

More information here:

FXAIX vs. VOO: Which Index Fund Is Best?

Vanguard LifeStrategy Funds Alternatives

If you’re looking for alternatives to LifeStrategy Funds, Vanguard, Fidelity, Schwab, and iShares are good options. Remember, unlike a mutual fund, an ETF allows you to usually buy and sell shares with no commissions at nearly any large brokerage.

- VTI and BND: With a fee of just 0.03%, VTI is an ultra low-cost Total Stock Market ETF. The fund offers exposure to more than 3,600 stocks. It’s market-weighted, and the top 10 holdings comprise about 30% of the portfolio. BND also charges 0.03% and holds more than 17,500 different bonds. You could make your own allocation using these two funds and get a similar result to the LifeStrategy funds at a lower cost.

- iShares Target Date ETFs: In 2023, iShares launched the first family of target date fund ETFs, known as iShare LifePath funds. The funds start younger investors at the start of their career with about 99% stocks and slowly shift to 40% for retirement. You can choose one based on your target retirement year. For example, ITDF is the iShares LifePath Target Date 2050 ETF, designed for people who plan to retire around the year 2050. Management fees are comparable to LifeStrategy Funds.

- Fidelity Freedom Funds: Fidelity’s target date mutual funds are a bit more conservative than the iShares Target Date ETFs, but they follow the same general principle of adjusting your portfolio to hold a lower portion of stocks and more bonds over time. However, costs are much higher than Vanguard’s LifeStrategy Funds, with fees of around 0.75% per year.

- Fidelity ZERO Funds: If you have an account at Fidelity, you can buy its zero-fee mutual funds. The four funds are broad market funds, and you could use them to mimic the stock portion of a LifeStrategy Fund without paying any ongoing fees.

The Bottom Line: Are Vanguard LifeStrategy Funds Right for You?

While these funds are OK, they’re not my favorite. I’d instead use a combination of VTI and BND to get the same results at a lower cost or look for low-fee target date funds, like the iShares LifePath target date ETFs.

For retirement investing, where you want a single fund managed to meet your needs, iShares LifePath ETFs are likely a better choice. And for Vanguard loyalists who don’t mind tinkering a bit with the allocation over time, VTI and BND are a solid option. But if you pick a LifeStrategy fund, its relatively low cost and diverse holdings make it a reasonable choice for many investors.

The White Coat Investor is filled with posts like this, whether it’s increasing your financial literacy, showing you the best strategies on your path to financial success, or discussing the topic of mental wellness. To discover just how much The White Coat Investor can help you in your financial journey, start here to read some of our most popular posts and to see everything else WCI has to offer. And make sure to sign up for our newsletters to keep up with our newest content.