It was the best of times.

It was the worst of times.

It was the sponsors with conservative leverage and fixed-rate loans.

It was the sponsors with all variable loans and high LTVs.

It was the sponsors with a long-term vision and attentiveness to the market cycle.

It was the sponsors buying properties like there is no tomorrow to generate acquisition and asset management fees.

It was the sponsors with long track records.

It was the sponsors new to the game learning their lessons with investor money . . .

This may not be as poignant as Charles Dickens’ opening of A Tale of Two Cities, but it highlights the importance of finding the right sponsor when investing in private real estate funds and syndications. One important lesson I have learned in passive real estate investing is that finding the right sponsor is more important than finding the right property. If you find the right sponsor, they will bring you the right property.

Sponsor is just another word for the manager of the fund. You will also see them go by the name of General Partner (GP). Most competent sponsors will do well during the good times. Your goal is to find sponsors who will also do well during the not-so-good times when they can salvage a deal that would otherwise be headed to bankruptcy. Inevitably, the difficult times will come. That's a fact we know all too well in 2023 and 2024 as we have seen the adverse conditions that have impacted commercial real estate (CRE) with the current rapid rise in interest rates by the Federal Reserve. Only the quality sponsors will weather the storm adequately.

Sponsors YOLO! and Bedrock

To highlight the importance of the sponsor, I would like to compare two of the sponsors I have invested with during the past few years. My goal is not to promote or punish either one, so we'll call them Sponsor YOLO! and Sponsor Bedrock. These names are selected for illustrative purposes, and I would encourage you to review their performance without prejudice. With both, I chose funds rather than individual syndications (typically one property) to add diversification.

These funds come in different varieties in terms of structure and capital commitment mobilization; one is not necessarily superior to the other. YOLO!’s structure is to take your commitment upfront and invest it in properties over its investment cycle, which typically might be 2-3 years. I made my commitment with YOLO! in 2020 in its Fund II. It already had a few properties in the fund from 2019 and early 2020, and the investment period continued with multiple property purchases in 2020 and 2021 and one smaller property in May 2022. YOLO! purchased a total of 18 assets, six of which have already been sold.

Sponsor Bedrock’s approach is to bring deals with 2-3 properties at the time of purchase, and it does this 2-3 times a year. With Bedrock, my commitments were in December 2020, August 2021, November 2021, and May 2023 for a total of 10 properties.

Both sponsors were selected early in my passive real estate journey, and I did not know which one would be the better investment. Both were selected from an educational class that I took at that time.

More information here:

Diversification Always Matters (My Syndicated Investment Goes to Zero)

How to Think About Risk and Why It’s So Hard to Quantify

Performance

The most dramatic difference between the two sponsors is their current performance. Let's start with that and then review what may have contributed to the difference in results.

Figure 1 compares the different performance and capital stack metrics of these two sponsors.

Figure 1: Comparison of Sponsors YOLO! and Bedrock

Cash Flow/Distributions

Sponsor Bedrock

Nine out of 10 properties are doing well. They have positive cash flow, even during the current high-interest rate environment. Distributions are made from operating income, which is mostly based on rental income. Only one property is struggling and is not providing distributions. It was a value-add property with variable financing. The rise in interest rates has consumed any profit that may have accrued from operations. Value-add properties are those that the sponsor buys with plans of renovations to increase rents. Typically, they are financed with variable loans and typically require a capital expenditure budget for the renovations on top of the loan for the property. The other nine cash-flowing properties are providing income at a return of 2%-10% percent with a median of 4.8%.

These are not eye-popping results, but the vintage of the deals was not great and it’s relatively early during the fund’s life. Vintage refers to when the property was purchased rather than when the property was built. This is consequential in that the prevailing valuations (prices paid) at the time will help determine future returns. Investments made during a high-valuation environment will likely underperform, and low-valuation environments will outperform. This can only be determined retrospectively. Lastly, operating incomes within the properties are in line with projections.

YOLO!

There are currently 12 properties in the portfolio. All have halted distributions. The main reason for halting distributions is that interest rates have risen significantly and sharply over the past 18 months. Since 83% of YOLO!’s loans have variable financing, this has increased the servicing of debt as interest payments increase and deplete any income that may have been provided to the investor. Given the rise in interest payments, renovations have mostly been halted, and YOLO! can't execute its value-add strategy. Operationally, the majority are performing below original projections.

One important caveat to add here is that YOLO! has already exited six properties (18 total properties, now with 12 remaining). Its value-add thesis worked in these exited properties as they sold before the economic tides turned toward a more adverse setting. This was by design. Some of its holds were only meant to be three years rather than due to YOLO!'s caution because of worsening market conditions. Because of these sales, YOLO! is doing well inception to date (ITD). The ITD Internal Rate of Return (IRR) is very good at 13%. However, the problem is that most remaining properties are behaving so poorly that they are bound to drag down this return significantly with time. In fact, capital losses (partial or complete) in some or most of these properties may be the most likely case.

Bedrock has not had any exits to date.

Adding one additional point: YOLO! came out with a Fund III in 2022-2023. These have all the challenges of Fund II, without any of the upsides of some exited properties which provided some cash flow. Fund III is only full of properties with suspended distributions, and it is even more challenged than Fund II. Most likely, it will do very poorly.

How did these two sponsors arrive at such disparate results? Looking at their capital formation and strategy may offer some clues.

Capital Stack

Bedrock typically used low-leverage loans with fixed financing. Its current portfolio only has one property with variable financing (1/10 properties). Its Loan to Values (LTV) has a median of 56% with a range of 43%-62%. The interest rates on these loans vary and have a median of 2.9%. Only one property has a high interest rate of 7%—the one with variable financing. The rest have an excellent interest rate ranging from 2.6%-4.4%. The fixed loans are typically for 7-10 years. Bedrock has utilized low leverage and locked in the generationally low rates that were prevalent at the time of purchase. Having low interest rates allows Bedrock to continue to provide distributions during times of higher interest rates. Having these rates fixed for 7-10 years allows it to be flexible and gives it the option of holding the properties for many years until the CRE market becomes more favorable in which to sell.

YOLO! used variable financing in 83% of the loans and used higher LTVs. Its LTVs had a median of 75% and a range of 64%-83%. Two of its loans had an LTV above 80%. Two other loans have Preferred Equity. For the most part, these behave as loans as well. If you add these Preferred Equities, the LTV will come to an astonishing 90% and 92% for these properties. For CRE, I prefer an LTV of less than 65%-70%, and I would prefer less than 65% for most. This provides a margin of safety in case things do not go as planned or projected. You cannot use an LTV of 80% as you would for a residential mortgage.

Next, reviewing the interest rates on YOLO!’s loans: it had a median of 5.0% and a range of 2.8%-7.6%. These rates have increased as the Secured Overnight Financing Rate (SOFR) has increased in lock step with the raising of rates by the Federal Reserve (Figure 2). Also, these rates were partly achieved by purchasing rate caps at the time of loan origination. These set an upper limit to how high the rates can go and cap it at a certain upper limit. It is like insurance against rising interest rates. It is a sensible thing to do, but it also comes at a cost. As a result, the borrowing costs are somewhat more than what the 5.0% median rate suggests. In addition, rate caps have a term which commonly was 2-3 years for YOLO!. The lenders’ covenants will require the renewal of these rate caps. This is a significant problem because the current lending environment is less favorable. It will cost multiples more to purchase new rate caps as it did during loan origination. Rate caps cost much more now than they did in 2019-2021. This is one reason capital calls are initiated on some properties, and some may even require further capital injections with Preferred Equity raises.

During 2019-2022, investor capital was readily available, and risk was ignored. These led to the poor capital structure formation described above for YOLO! (Click the image below to enlarge.)

Figure 2: Secured Overnight Financing Rate (SOFR) 2021-2024

Strategy and Classes

Multi-family apartment investments can be divided into different strategies and classes.

Class A/A- properties typically are newer and in desirable locations, and they have most of the high-end amenities. They require minimal renovations.

Class B properties are usually older and are typically located in less desirable locations, and they have fewer amenities.

Core and Core Plus strategies typically purchase Class A/A- properties and attempt to optimize operations. Value-add strategies typically would purchase a class B property and perform renovations (capital expenditures) to increase the desirability of the property and increase rents and NOI. And then it sells based on the higher NOI dictating a higher sales price.

YOLO! and Bedrock use both strategies. Bedrock has 30% of its assets with a value-add strategy, and 70% with a Core/Core Plus strategy. YOLO! is more of a value-add shop with only one of its current 12 properties being Core/Core+. As valuations (prices) increased during the low-rate environment, Bedrock pivoted to more Core/Core+ strategies in mid-2021 as they are lower risk in general with less execution risk. YOLO! continued its heavy reliance on value-add projects regardless of the market cycle. This was inherently riskier. On top of that, it further increased risk with high LTV and variable financing. Another additional layer of risk was added in that some of its properties were properties from the 1960s that needed heavy renovations.

This is like Virchow’s Triad for CRE: old properties, high LTV, variable financing. It was set up for failure with the slightest provocation.

More information here:

How Real Estate Investments Go Bad

The 60+ Worst Mistakes You Can Make in Real Estate Investing

Sponsor Terms/Expenses: You Don’t Get What You Pay For

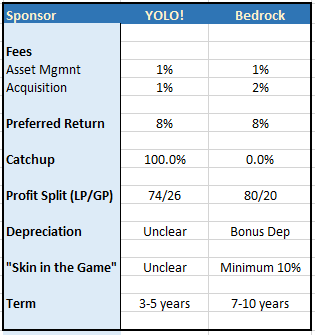

Jack Bogle, in his classics The Little Book of Common Sense Investing and Common Sense on Mutual Funds, espouses the benefits of keeping costs low. All sponsors will have a cost, as it is essential for operations and is needed to incentivize the pursuit of profit. Figure 3 below compares the costs between the two sponsors. A review of the table shows that the costs are similar for both. You may argue that one is slightly more favorable than the other, but they are relatively close. Despite disparate skill and experience, you are paying about the same price for both of their services.

There is significant inefficiency in the price you pay to sponsors for their services. You do not get what you pay for. You have professional sponsors with a long track record who have similar costs as you do with sponsors fresh out of college or MBA school starting their first fund. The newer and less skilled sponsors are not any cheaper than the elite sponsors.

In assessing the sponsor’s track record, a long record of excellent performance is obviously a positive since it suggests that it has an adequate skill level and can execute its strategy. Having gone through a significant recession or crisis is also a plus as it illustrates how they navigate adverse economic circumstances. Bedrock has been in business since 1992. Its average annual return is 32%. It has not lost investor principal in its history which has included the dot.com bubble, the 2008 financial crisis, and COVID.

YOLO! has been in business since 2007. Its average annual return is 38%. It has lost investor principal only once. As with many measures, the devil can be in the details. YOLO’s deals were on the smaller size with typical purchase prices of less than $5 million up until 2016. Only then did it start with most deals being above $10 million. Its original track record was different from its current practice as a large syndicator.

Business Model/Incentives

It is important to have some alignment of interests between the sponsor (GP) and investor (LP). It is impossible to have 100% alignment, but more is better. Looking at both sponsor incentives and business practices may help us better estimate who is in better alignment with the Investors/Limited Partners.

A review of 2022’s activities is helpful in this regard. In 2022, Bedrock had fewer transactions than typical, and it was selective in what it bought. YOLO! continued to purchase properties at the high rate it was accustomed to without consideration of the market environment. Fund II was barely closed when Fund III was started, and Fund IV was started soon after Fund III closed. YOLO! was striking while the iron was hot. Investor appetite was high for private real estate in early to mid-2022, and YOLO! was more than happy to accommodate this demand by indiscriminately buying properties. Bedrock, on the other hand, explained in its quarterly newsletter that the numbers at the valuations available at that time did not “pencil in,” and it refrained from excessive buying. To Bedrock, reputational harm was more important than missing out on the readily available investor equity that was available at the time.

During the global financial crisis of 2008, former Citigroup CEO Charles Prince said, “When the music stops, in terms of liquidity, things will be complicated. But as long as the music’s playing, you’ve got to get up and dance.” YOLO!’s business model was to continue dancing. It continued buying properties as long as investor demand and easy debt were available. Risk was minimized or ignored altogether. If it did not do this, those investor dollars would go to another sponsor. If investor dollars were available, YOLO! would find a property to buy.

But Bedrock sat out the dance and had the foresight and prudence to realize the risk entailed. Bedrock capped the contributions and turned down money as there was more investor demand than equity that was available. It only made transactions when properties that had sensible valuations were available rather than when investor funds were available.

In addition to the business model, “skin in the game” is another helpful measure to gauge the alignment of the GP and LP. A good starting point for how much the sponsor has contributed is 5%-10%. For very large deals, smaller numbers than this might be acceptable. It is important that this “skin in the game” has the same terms as the LP terms. If the sponsor has its own money at stake with the same terms as the LP and it is a significant amount of money, this naturally would incentivize the sponsor to optimize performance from both an LP and GP perspective—or at least more so than otherwise would be expected.

Miscellaneous

Bedrock’s quarterly reports are professional, regular, and consistent, and they have minimal errors. YOLO!’s provides its reports irregularly. The content is inconsistent in its format and information, and there are more frequent errors. Sometimes, valuable information is missing. Quarterly reports may not be the most important thing for investors, but inattentiveness to detail for small stuff may manifest in inattentiveness to major stuff like strategy, market cycles, and other investment decisions. Requesting a current quarterly report before investing is a good practice.

Other factors to consider include a sponsor's “skin in the game,” the length and result of prior track record, depreciation schedule, tax structure, 1031 possibilities, and how “sales-y” their marketing is.

More information here:

A Personal Journey in Real Estate Investing

Conclusion

In comparing these two sponsors, the data shows that Bedrock is clearly the better sponsor. This is manifested by properties that continue to have healthy cash flows even during the current downturn in commercial real estate (CRE). It was judicious in the use of debt and currently has low fixed-rate financing with a low LTV for the next 5-8 years. This gives Bedrock flexibility for when to sell its properties. It also gives it favorable upsides as rents will likely increase long term. It has not required capital calls or Preferred Equity raises. Bedrock was nimble and attentive to market cycles, and it adapted to the CRE climate as it changed. It had a long-term vision, sensibility, and wisdom in its investment decisions. I feel confident that results will continue to be favorable as the funds continue to progress to their eventual sales.

YOLO! had a good start with six properties sold and a very good IRR of 13% to date. However, in the current state, I could only describe its fund as a hot mess. None of the remaining properties are providing a distribution. This is due to poor borrowing with a high LTV and variable financing as well as poor execution of its value-add plan. A capital call has been issued for six properties to inject more capital to keep these properties afloat. In addition, as of this writing, a preferred equity raise is being done for three of these properties to inject further capital. This preferred equity has a preferred return rate of 18%. This is essentially a loan at 18%. This appropriately expresses how much risk is in these projects, as an 18% yield is needed to attract investors. It also tells you that there is likely not much upside left to the original equity investors since an 18% loan will not leave much cash flow to them. Loss of capital in multiple properties is a definite possibility with this fund. With time, the remaining properties and the current lack of cash flow will significantly drag down the overall fund’s IRR.

YOLO! is certainly not alone in having major challenges during the current market environment. A considerable number of sponsors have the same challenges of variable financing that were taken prior to the current Fed cycle escalation with high LTVs (a low margin of safety). Capital calls have become relatively common in this landscape. In addition, some sponsors have defaulted and have had to return properties to lenders, and some have been shut down due to outright fraud. On the other hand, there also continues to be a subset of stable, professional sponsors like Bedrock that continue to provide adequate cashflows and appear to have stable operations and a good chance at a profitable exit in the future. The disparate results highlight the importance of finding the right sponsor to make your investments.

If you believe in the importance of finding the right sponsor first, you might ask, how would I go about finding the right sponsor(s)? That is the hard part. There is no other way except to put in the time and do your extensive due diligence. To start with, educate yourself—which can be done with classes, books, or courses. All that education will not be enough, though; you will then need to get your hands dirty. Read and critically review multiple different Offering Memos from multiple different sponsors. With time, you can critically assess different sponsors and different deals. This does not happen overnight, but with enough time and review, your assessment abilities will improve. This takes time, and it's a commitment that not all will want to undertake. Another option would be to discuss and obtain the opinions of colleagues, friends, and like-minded investors. This can be done by joining investment clubs, some of which are specific to private real estate. You may soon build a network of friends who may actually enjoy researching investments.

Despite my advocacy for finding the right sponsor, it is also important to consider sponsor diversification. This is important because no sponsor will be infallible. They will be subject to risks, such as success breeding complacency and bureaucratic bloat, loss of innovation, and key person risk. Diversification with sponsors would be beneficial. However, diversification in private real estate is far more difficult than diversifying in public REITs, for example. With private real estate, entry levels are high with minimums typically in the $50,000-$250,000 range. Significant illiquidity is required as these funds can have terms lasting 3-10 years during which you will not have access to your principal. Because of this, you might not achieve sponsor diversification at the start. It might be reasonable to start with 1-2 excellent sponsors and expand as more funds are available to allocate to real estate.

An alternative approach to relying on the sponsor to find you a good investment would be for you to do the research and find the property yourself regardless of the sponsor. To do this, one would have to research markets and sub-markets. You would have to research demographics, jobs, crime rates, and construction/absorption ratios, and you would have to make inferences based on this data and prior trends. I do not think it is reasonable for a doctor doing this on the side to pick the next best market or property. In fact, I do not think any sponsors can reliably do that without risk. No one can reliably predict the future. Even the professionals might not prospectively predict where the next Austin, Texas will be. Finding a trustworthy sponsor is more sensible instead.

The Bottom Line

The private real estate investment world contains a large and varied number of sponsors. There is significant variability in the skill level of these sponsors. Finding the right sponsor is of paramount importance, and it may be the most important decision you make in investing in this space. The right sponsor will provide good to great results during salutary times and, just as importantly, they will salvage deals made during inevitable poor times. Find the right sponsor, and they will find you the right deal.

Obtain the education, get your hands dirty by reviewing real-life offerings, and discuss extensively with colleagues and clubs to find the right sponsor. It will be time well spent.

What has been your experience with real estate funds and syndications? How is the current market dictating your approach in this asset class? What kinds of mistakes have you made in the past when selecting a sponsor?