About a year ago, with the help of 20 fellow white coat investors, I created a new (hypothetical) investment called the White Coat Investor Fund (WCIF) to see how it would perform against VTSAX (the Vanguard Total Stock Market Index Fund) and FSKAX (the Fidelity Total Market Index Fund).

Here’s how I spawned WCIF: During the week of WCICON23, I asked a slew of attendees and speakers to give me their favorite individual stock—whether it’s something they invest in or whether it’s just a company they happen to admire. What they chose made up our pseudo-index fund.

Nobody was allowed to pick any stock that was in the top 10 of VTSAX at the time. That meant Apple, Microsoft, Amazon, NVIDIA, two different classes of Alphabet, Tesla, Berkshire Hathaway, Facebook, and Exxon Mobile were ineligible to be used in WCIF.

WCI Founder Dr. Jim Dahle had some concerns—he said it was basically like gambling (or The Stock Game) because it was a short-term exercise and that I wasn’t accounting for expenses or risk—but we basically ignored him and went forward with the exercise. Why? Because sometimes when we write about personal finance, we should have fun, even if it means getting some readers mad at us.

Here are the 20 individual stocks that WCICON attendees chose to live in WCIF and their explanations for why they were picked.

The Walt Disney Company (DIS): “They always rip me off when you go to their park, so they’re probably making a profit. Plus, their Disney+ app is so brilliant.”

International Business Machines Corp. (IBM): “IBM is one of the oldest stocks on the exchange. Let’s throw in some old-school flavor into the WCI Fund.”

New York Times Company (NYT): “I still love newspapers. And I think the NYT has proven that it knows how to increase online subscribers to continue bringing in new readers (and their money).”

General Electric Company (GE): “It’s the pinnacle of stocks. That’s all you need. It will never go bankrupt. People were saying it would 10 years ago. But that’s all trash.”

Lululemon Athletica Inc. (LULU): “The reason I started wearing their stuff is because I’m very tall and they have long stuff. They’re narrow, but they fit me.”

Masimo Corporation (MASI): “They make ICU monitoring devices. They took off during COVID. I bought shares for $80 five years ago. Now it’s worth about $180. Fingers crossed for another pandemic, and I will be sitting pretty with my 10 shares.”

Dick’s Sporting Goods Inc. (DKS): “We have two boys, and we basically keep Dick’s afloat. The boys always need clothes or a new basketball or a new water bottle or a new something.”

Target Corporation (TGT): “It makes shopping so much easier and so much more convenient. It’s more expensive than Walmart, and they basically have the same stuff. And yet I still go to Target.”

Vail Resorts Inc. (MTN): “It’s something I understand. You’re not supposed to invest in stuff you don’t understand. I understand the culture. I understand their business model [of providing season ski passes to several different resorts all under the same account]. I think it’s a good idea. I’ve watched it just take over in the ski culture. A competitor has emerged, and the rest of the resorts that didn’t get purchased by Vail banded together to counter it. But Vail is first to market.”

Adverum Biotechnologies Inc. (ADVM): “The technology is really intriguing. It’s a gene therapy that is a permanent fix for macular degeneration. For people who have gotten it, it’s still working three years later. I found it compelling, and the need is there. They tried it for diabetic retinopathy, and a patient went blind. Since then, the stock has plummeted. But the potential is there. It just got some bad PR.”

The Coca-Cola Company (KO): “Everybody in the world loves Coca-Cola. Everybody in the world sings that they love Coca-Cola. No matter what’s happening in the world, everybody loves an ice-cold Coke.”

Moody’s Corporation (MCO): “They’re still a toll-taker for the financial industry. They’re still essential.”

National Storage Affiliates Trust (NSA): “We have an immense need for storing things. When the economy goes bad, people lose houses and move into apartments or their parents need to downsize. What do you do with all of that stuff? You put it in storage. When the economy is going up, people are buying more stuff. What do you do with that stuff? You put it in storage.”

Walmart Inc. (WMT): “They’re a safe bet. They’re getting into healthcare, and people are going to buy cheap groceries.”

McKesson Corp (MCK): “They’re recession-proof for the most part. People need meds. The value for them keeps going up because the prices on meds keep going up.”

Paramount Global (PARA): “They’re just gobbling up a lot of content from HBO and Netflix that actually belongs to Paramount. They’re getting a larger amount of the market, and they’re hurting their competition.”

Palantir Technologies (PLTR): “They’re into data mining, and they have a lot of government contracts. They’ve opened up their technology to private investment. If you want to spy on someone or you want technology to data mine, that’s basically the company.”

Roblox Corporation (RBLX): “My kids have loved it for years. I imagine they’ll eventually outgrow it, but there’s always a new generation of kids that will discover it and then love it themselves.”

Chewy, Inc. (CHWY): “Oh my goodness, we spend so much money buying our dogs medicine, toys, and treats through Chewy and getting it delivered right to our house. It’s Amazon for pets. They just make it so convenient.”

Peloton Interactive, Inc. (PTON): “Like so many others, we bought a Peloton during the pandemic, and like so many others, it now just sits there in our basement, hardly ever getting used. How high did it go up at one point? To, like, $150? (Editor’s Note: its highest stock price was $162.72.) Well, you can get the stock pretty cheap now. Peloton continues to survive, and I think getting it now at a low price is a good value.”

How Did WCFI Perform After a Year?

The stock market was fantastic in 2023. The S&P 500 nearly set record highs (and it, along with the NASDAQ, and the Dow Jones Industrial Average did set those records in 2024). The S&P 500, NASDAQ, and the Dow Jones rose 24.23%, 43.42%, and 13.8%, respectively, in 2023.

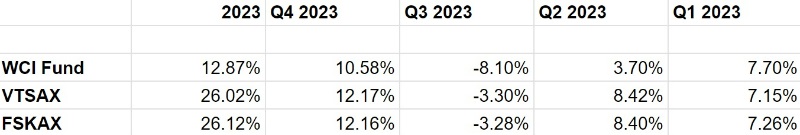

Sadly, WCIF couldn’t outperform VTSAX or FSKAX. So much of the stock market’s recent records is because of the Magnificent Seven, all of which are in the top 10 of the total stock market funds in Vanguard and Fidelity. Thanks to my limitations on what could be in the WCIF, it was going to be nearly impossible to beat VTSAX or FSKAX, because of how powerful those seven stocks have proven to be.

And though we had a rather profitable year overall, we didn’t come all that close to competing with those two index funds.

We gave it a good run, though, especially in Q1 of 2023, when we actually beat both index funds. We also had a solid Q4 with a nice rally. Sandwiched in between that . . . well, I wouldn’t call it a disaster, but things did not go well.

There was plenty of turbulence this year with Disney (its tangles with Florida Gov. Ron DeSantis, its criticized succession plan, and the attempt by two activist investors to infiltrate the board). Somehow, Disney was up slightly on the year, so that wasn’t a big drag on the success.

The big winners in the WCIF in 2023 were Roblox (up 58.1%), General Electric (up 55.3%), the New York Times (up 49.8% (yay for journalism!)), and Moody’s (up 37.8%). The only two major losers were Chewy (down 37.8%) and Masimo (down 21.6%).

Overall, I’m pleased with our performance, and I’m officially happy to announce the WCIF experience is complete.

But let’s revisit the point of why I undertook this exercise in the first place. I wanted to answer my own suspicions about whether passionate white coat investors could do a better job of equity investing than those managers who run two of the best index funds in existence. I figured we wouldn’t, and I was right.

From interviewing the WCIers who gave me their choices, transcribing their quotes, researching all the prices, updating all the percentages, ignoring Jim’s criticisms, and writing two columns and two updates on how the fund was performing, I spent probably 20 hours on this project in the last 12 months.

Sure, we made money. But it turns out I would have done so much better financially if I had just poured my money into those index funds. And to complete that task, it would have taken me less than five minutes.

There’s a lesson there.

Money Song of the Week

My family experienced a monumental occasion earlier this month when my son and I drove seven hours roundtrip so he could see his first-ever punk rock show. It was NOFX’s last ever stop in Texas, and somehow, I convinced him to ride with me so we could watch one of punk’s most influential bands of the last three decades play one of its final shows.

But today, let’s dissect a song from one of the concert openers, Lagwagon, which had a solid run in the 1990s punk scene and scored a minor hit with the song “May 16” in 1998.

Four years prior to that, Lagwagon released “Know It All,” a tune that touches on the well-worn topic of fans who decry a band for “selling out,” even though “selling out” could, you know, allow that band to make a living and afford to stock a refrigerator.

As Joey Cape sings,

“[College radio is] supposed to serve as a means to expose new bands without prejudice/But it makes no sense/Safe harbor for the underground/'Til the alternative becomes the popular sound.

“The bands are good 'til they make enough cash to eat food/And get a pad/Then they sold out and their music's cliché/Because talent's exclusive to bands without pay.”

Selling out was certainly a controversial topic in the punk scene in the ‘90s. NOFX famously never joined a major label and put out its own records. That’s probably why it never got nearly as famous as bands like Green Day or The Offspring. Lagwagon never struck a major label deal either, which is probably why most of the people who remember Lagwagon are now in their 40s and 50s and can’t mosh for more than a minute without exhausting themselves and why Green Day is still playing stadium shows.

All of that is fine with Cape.

As he told PunkNews.org in 2004, “I believe every band sells out as soon as their recording is marketed and sold, but that is how music reaches people. So be it. I never cared how popular a band was or who was marketing or manufacturing a record. I only consider the music. I think it is sad when people have any other criteria to choose their music. It's also sad when music is pure marketing like boy bands. Some bands see a major label as their only chance to reach more people. It is not an absurd argument. We are fine with what we have accomplished. I never desired fame, so Fat [Wreck Chord Records, NOFX's independent label] has been perfect for me. We have had as much exposure as I ever wanted.”

Ah, but can you make a living solely from being in a band like Lagwagon?

“I can now and have been for 10 years,” he said. “Things will change in the next few years. I don't know what I will do. That's OK. I have [had] a very good run. I will never complain.”

More information here:

Every Money Song of the Week Ever Published

Tweet of the Week

Hopefully, everybody stayed safe during the solar eclipse earlier this month and didn’t look directly at the sun. But if you did . . . you know who to call.

Optometrists right now… pic.twitter.com/9kkauoYtpy

— Douglas A. Boneparth (@dougboneparth) April 8, 2024

Was this WCIF project doomed to fail from the very beginning? What individual stocks would you have included?