By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderThe financial news has been full of articles recently about spot Bitcoin ETFs. Mostly, the articles explained that the recent dramatic rise in the value of Bitcoin was because of the imminent approval of spot Bitcoin ETFs by the US Securities and Exchange Commission (SEC). Bitcoin spot ETFs have been available in other countries previously, but not here. The theory is that because Bitcoin will be so much easier for people to invest in (particularly within their retirement accounts but also just using a general brokerage account rather than a specialized crypto account on a crypto exchange), more money will be invested into Bitcoin causing its value to rise.

This makes those who already own Bitcoin in whatever form feel good about their investment. So, they read all these articles. Which causes those writing these articles to keep writing about this subject to keep the eyeballs on their websites.

But what's really going on now that Bitcoin ETFs have been approved and what, if anything, should you do about it?

What Is a Spot Bitcoin ETF?

A spot Bitcoin ETF holds Bitcoin as its primary asset. This has never been done by a mutual fund or an ETF. Thus, there will be a relatively direct connection between the price of Bitcoin and the price of these ETFs. This will make it even easier to speculate on the price of Bitcoin with your portfolio.

How Are Spot ETFs Different from Previous Bitcoin ETFs?

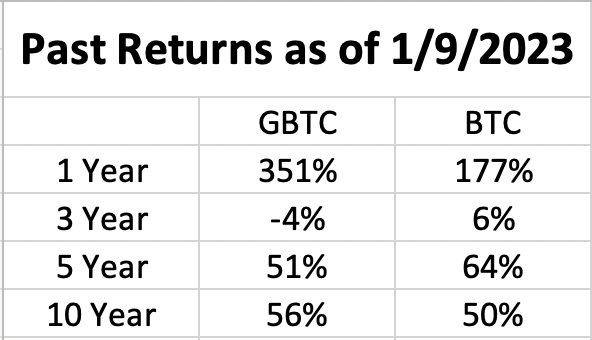

You may have heard of Bitcoin ETFs previously. GBTC (Grayscale Bitcoin Trust) and similar ETFs. Most of these are “futures ETFs” that rely on future Bitcoin contracts, kind of like the commodities markets. There are also other types of Bitcoin related investments, such as GBTC which is actually a closed end unit trust. We tried using GBTC as our Bitcoin proxy in the WCI monthly newsletter market report (sign up here) but quit doing it after a while (in favor of the actual price of Bitcoin) because it really didn't track the value of a Bitcoin very well due to variance between the NAV and the actual value of the underlying BTC. For example, here are the returns of GBTC compared to the returns of Bitcoin in the recent past:

In addition to futures ETFs and closed end unit trusts, some Bitcoin investors simply invest in companies that profit from a rise in the price of Bitcoin, such as a crypto exchange company or Bitcoin mining companies as a proxy for Bitcoin. Or perhaps they invest preferentially into companies that own a lot of Bitcoin.

More information here:

What You Need to Know About Cryptocurrencies Like Bitcoin

Who Is Creating Spot Bitcoin ETFs?

Many investment companies, where the job is to gather assets and charge fees on them, began putting these together in a competition for market share once the SEC approved them. These include some big players. The most complete list I could find includes:

- Blackrock (iShares)

- Fidelity

- VanEck

- Ark Invest

- Wisdom Tree

- Valkyrie

- Invesco

- Franklin Templeton

- Bitwise Asset Management

- Hashdex

- Grayscale Investments

Proposed expense ratios range from 0.24%-1.5%, and those companies currently offering futures ETFs are considering converting their futures ETFs to a spot ETF.

Of note, as soon as approval occurred, Vanguard not only announced that they wouldn't be creating one, but that they wouldn't even let them be traded on their platform. So if you really want a Bitcoin ETF in your portfolio, you'll need an account somewhere besides Vanguard.

Did the SEC Really Approve These?

While the SEC demanded a few changes here and there, it approved Bitcoin ETFs on Wednesday, January 10, though not everybody at the SEC feels great about it.

What Will Happen to the Price of Bitcoin Now That Spot ETFs Are Approved?

It will fluctuate. While the hope of many Bitcoin fanatics is that the price will zoom to the moon as soon as these are approved, that's not exactly how markets work. Functioning markets incorporate all known information into the price of a given security. It was pretty clear that these were coming for some time, so while this may be the explanation for the past rise in the price of Bitcoin, that information has really already been incorporated into its price.

That doesn't mean it won't get a significant bump in the next few days after approval as everyone gets excited about it, but like the IPO of a stock, that's likely temporary. In the long run, it's much harder to predict the future of Bitcoin. Note that the approval of an ETF just makes it easier to speculate on Bitcoin; it actually doesn't improve its functionality in any way, shape, or form. These sorts of ETFs are exactly why Jack Bogle criticized the invention of the ETF in the first place: it provides a tool for speculation but does little for the long-term investor.

More information here:

A Neurologist’s Road to Becoming a Bitcoin Maximalist

What’s the Future of Cryptocurrency? These Fanatics Say It’s Pretty Darn Bright

Should You Now Invest in Bitcoin If You Didn't Before?

If you are a serious investor and have not yet “invested” in Bitcoin, it is unlikely that the reason is that it was too hard before. However, this SEC approval is likely to draw in people who are not particularly serious investors and encourage them to “invest” in Bitcoin. Some people who currently own Bitcoin in other forms (particularly futures ETFs) are likely to change over to the spot ETFs. Some who “invest” directly in Bitcoin might change some or all of their investment into Bitcoin ETFs. Certainly, some will use this opportunity to avoid crypto exchanges with their relatively short (and particularly bad) track records.

More information here:

13 Lessons to Learn from Sam Bankman-Fried and the FTX Meltdown

What Are the Advantages of a Bitcoin ETF Over Just Buying Bitcoin?

The main advantage of a spot Bitcoin ETF is simply convenience. Instead of having to open a new account at a new-fangled crypto exchange, one can simply use their Vanguard, Fidelity, or Schwab account to buy a Bitcoin ETF. While these may or may not make it into the lineup of a 401(k) run by a serious fiduciary any time soon, one could easily add them to an IRA (not even a more expensive and complex self-directed IRA) and any 401(k) with a brokerage window such as Schwab's PCRA or Fidelity's BrokerageLink. The Bitcoin fanatics hope to see these options added to 401(k)s, 403(b)s, HSAs, and 529s, further increasing demand for Bitcoin. Rebalancing a portfolio with a set percentage of Bitcoin in it will be much easier using an ETF like you are using in the rest of the portfolio.

Another advantage is that you no longer have to worry about losing your Bitcoin keys. Estimates are that about 6 million BTC, 30% of the current supply, has been lost forever. An ETF isn't going to misplace your keys.

There is potential to diversify your Bitcoin using an ETF. For example, there's nothing that says an ETF has to JUST hold Bitcoin. It could hold Bitcoin and tech stocks or Bitcoin and Bitcoin miners or whatever. Although the recently approved ones will ONLY have Bitcoin in them per their prospectuses.

Increased tax efficiency could be another benefit of a Bitcoin ETF, particularly for rapid traders. While investing directly in Bitcoin can be very tax-efficient (there are no dividends to tax and it is subject to long-term capital gains rates if sold after at least a year), it would be even more tax-efficient to invest in it using tax-protected retirement, healthcare, or education accounts.

What Are the Disadvantages of a Bitcoin ETF Over Just Buying Bitcoin?

Unfortunately, there are also disadvantages. Holding Bitcoin off an exchange has no fees. But if you use an ETF, there's going to be an annual expense ratio you will need to pay. There will also be a bid:ask spread and potentially commissions depending on what brokerage you use.

ETF inaccuracy might be another disadvantage. Certainly, it was a huge disadvantage with futures ETFs but should be less of an issue with spot ETFs. But the ETF may have other holdings, poor management, and some cash drag. Of course, the fee drag may cause the ETF to not track the price of Bitcoin very well. There are also likely to be leveraged and inverse ETFs eventually with the usual tracking challenges they face, particularly in the long term.

It may also be more difficult to trade from one cryptocurrency to another. At a typical crypto exchange, you can swap Bitcoin for Ethereum with ease. Not so much if your Bitcoin is at your Fidelity brokerage account in an ETF.

Cryptocurrency is exempt from the 30 day wash rule when tax loss harvesting. I don't think the new Bitcoin ETFs will be exempt from that, although it appears there will be plenty of tax loss harvesting partners to use!

Perhaps the biggest downside, however, is that you no longer own Bitcoin. For many people, the point of Bitcoin isn't so much to speculate on its price but to actually use it or at least be able to potentially use it in a massive economic crash. If the economy and markets are no longer functioning, you can't liquidate your Bitcoin ETF very easily. Plus, it's harder to hide it from criminals and the government. It's also not as portable as owning Bitcoin directly might be if you need to flee the revolutionaries who have just taken over your country.

While this is an exciting development for the Bitcoin fanboys, the development and approval of spot Bitcoin ETFs is more of a “so what” yawner moment for long-term investors, especially those who have avoided Bitcoin in their portfolios up until this moment. However, if you've been wanting to “invest” more in Bitcoin but have all your money tied up in retirement accounts, this may be a very welcome development for you.

What do you think? Will the approval of spot Bitcoin ETFs cause you to invest more in Bitcoin? Will you switch your current Bitcoin investments to the new ETFs?