By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderA frequent request from investors who recently learned about tax-loss harvesting is for a list of “tax-loss harvesting pairs.” Unfortunately, this issue is not so simple that one can just issue a list without any explanation whatsoever. The list varies by asset class, by where your taxable account is located, by whether you are using traditional mutual funds or ETFs, and by what investments you hold in your IRAs (and depending on how you feel about the spirit of the law, your 401(k)s, HSAs, 529s, etc.).

What Is Tax-Loss Harvesting?

Tax-loss harvesting is intentionally selling shares of a security (stock, mutual fund, or ETF) with a loss in order to use that loss against capital gains and up to $3,000 per year of ordinary income on your tax return. If you have a $30,000 capital gain and book a $40,000 loss that same year, you do not have to pay capital gains taxes on that $30,000 gain (reducing your tax bill by as much as $7,140). You can apply $3,000 of the capital loss to your ordinary income (reducing your tax bill by as much as $1,623), and you can carry forward the remaining $7,000 in loss indefinitely until you can use it. You need to ensure that you do not perform a “wash sale” (when you buy shares of a security within 31 days before or after selling other shares of that security) and that you do not turn what would otherwise be a qualified dividend into an unqualified dividend by holding that security for less than 60 days around the ex-div date. The IRS has specifically said that buying a security within an IRA while selling it in a taxable account constitutes a wash sale, so be careful if you have the same holding in an IRA and a taxable account—especially if you are reinvesting dividends. The IRS has not specifically said that about HSAs, 529s, 401(k)s, or other employer-provided retirement accounts.

Tax losses are useful to offset a little bit of ordinary income; the usual capital gains that occur from time to time for investors; and large capital gains that may be due from the sale of a business, investment property, or a highly appreciated home.

Why Do You Need a Tax-Loss Harvesting Partner (or Pair)?

To avoid a wash sale, you have to wait 31 days after selling a security before buying it back. Since tax-loss harvesting usually occurs after a sharp decline in market value, the most likely thing for that security to do in the next 31 days is to increase in value. You're shooting yourself in the foot selling low if you're just going to turn around and buy those shares back at a higher price 31 days later. Maybe you get lucky and the shares are even cheaper in 31 days, but I wouldn't count on it.

A better plan is to simply sell one security and buy another one at the same time. You want this security to be similar to and, in fact, to have correlation with the original security of better than 0.99. But it cannot be, in the words of the IRS, “substantially identical.” For practical purposes, substantially identical means the exact same thing, i.e. a security with the same CUSIP number. You cannot exchange the mutual fund share class of the Vanguard Total Stock Market Index Fund (VTSAX) for the ETF share class (VTI) of that same fund. But you could exchange VTSAX for the 500 Index Fund or the Large Cap Index Fund. You could exchange VTI for the iShares version of a Total Stock Market ETF (ITOT).

Lots of people worry that, in an audit, the IRS would look closely at this issue and declare those losses invalid due to the securities being substantially identical. This seems extremely unlikely to me for several reasons:

- I've asked for years if anyone knows anyone that this has happened to, and I have yet to find a single investor.

- The IRS has far better things to do. There are people out there just totally cheating on their taxes that need to be caught.

- This doesn't make a big difference for many people. The losses aren't that big, and if they sell the security later, they're just delaying the taxes anyway.

- Understanding this requires a certain level of sophistication that many IRS auditors simply don't have.

If the brokerage is not reporting it as a wash sale on your tax paperwork, nobody else cares. Unless your IRA is at the same custodian, nobody (including you) is likely to notice an inadvertent wash sale.

So, if you want to do tax-loss harvesting, you're going to need a substitute investment to swap into.

More information here:

Is Tax-Loss Harvesting Worth It?

Why You Just Need 1 Tax-Loss Harvesting Pair per Asset Class

Some people think they need three, four, or even five tax-loss harvesting partners in an asset class. What if you tax-loss harvest and then it drops again in value before 31 days have passed? Don't you want to capture that loss too? Having done this dozens of times in my investing career, the answer is no. You don't. This is a good place in personal finance to be a satisficer and not an optimizer. It takes time and effort to monitor markets and go in and physically make the trades, and the more of them that you make, the more likely you are to accidentally create a wash sale or turn a qualified dividend into an unqualified one.

Your goal is simply to collect the BIG losses available to you over the years as you invest. Those typically only occur in the bear markets that occur on average about once every three years. If the downturn lasts longer than a couple of months, sure, tax-loss harvest those shares back to the original holding. If it goes two more months and continues to trend down, then exchange into the partner again. But frenetically tax-loss harvesting every few days (much less hiring a robo advisor to do it for you multiple times a day) is overkill. You can get 95% of the benefit with 2% of the work.

What Is an Ideal Tax-Loss Harvesting Partner?

The ideal partner

- Has the same structure (traditional fund or ETF) as the original security,

- Is free to buy and sell (with the possible exception of a small bid/ask spread),

- Is highly liquid,

- Has 0.99 correlation with the original security, and

- Is an investment you would be willing to hold the rest of your life (broadly diversified, low cost, etc.) or for which you have a plan to get rid of (donate to charity after one year).

What Asset Classes Are You Likely to Need a Partner For?

If you don't have a taxable account or do not wish to tax-loss harvest, you don't need a tax-loss harvesting partner at all. However, for every asset class in your taxable account which can be easily tax-loss harvested and which is likely to have a loss from time to time, you need a partner. For the most part, we're talking about tax-efficient stock asset classes like a Total Stock Market Fund or a Total International Stock Market Fund.

In 2022, however, many of those who owned municipal bond funds also had significant harvestable losses. Some people with a large taxable-to-tax-protected ratio in their portfolios may have other asset classes in taxable such as small value funds, small international funds, emerging market funds, or even REITs.

Note that tax-loss harvesting with individual stocks is much harder than with index mutual funds or ETFs. While you can tax-loss harvest from Facebook to Twitter or Home Depot to Lowe's, they are not even close to 99% correlated. You shouldn't be investing in individual stocks anyway. Speaking of investments you shouldn't be buying, you also do not need a partner for cryptoassets. You can simply buy back the Bitcoin immediately after selling it without creating a wash sale. Nobody really tax-loss harvests privately traded real estate either. The liquidity is too low, and the transaction costs are too high. This is really only done with publicly traded securities.

Where Are the Best Places to Look for Tax-Loss Harvesting Partners?

As a general rule, you're going to look at the same places you would look for investments originally. We're talking about index mutual funds from Vanguard, Fidelity, and Schwab. We're talking about ETFs from Vanguard, BlackRock, State Street, Fidelity, Schwab, DFA, and Avantis. Most white coat investors investing in traditional mutual funds do so at Vanguard, and luckily, Vanguard has at least two highly correlated funds within each major asset class. White coat investors who use ETFs tend to use a Vanguard ETF and either another Vanguard ETF or a BlackRock (iShares) ETF—whether their money is held at Vanguard, Fidelity, Schwab, eTrade, or somewhere else. This just isn't that complicated most of the time. If you're having a hard time finding a tax-loss harvesting partner, you should probably ask yourself whether you should be investing in that asset class in the first place.

What Tax-Loss Harvesting Partners Do the Dahles Actually Use?

As a reminder, our asset allocation is as follows:

60% stocks, 20% bonds, 20% real estate broken down as:

- 25% Total US Stock Market

- 15% Small Value Stocks

- 15% Total International Stock Market

- 5% Small International Stocks

- 10% Nominal Bonds (split between the TSP G Fund and a Vanguard intermediate muni bond fund)

- 10% Inflation Indexed Bonds (split between the Schwab TIPS ETF, individual TIPS at TreasuryDirect, and I Bonds)

- 5% Publicly traded REIT Index Fund

- 10% Private Equity Real Estate (split between various funds, REITs, and syndications)

- 5% Private Debt Real Estate (split between three funds)

In recent years, our taxable-to-tax-protected ratio has increased dramatically. Now, the following asset classes are in taxable:

- Total US Stock Market

- Total International Stock Market

- Small International Stocks

- Private Equity Real Estate

- Most of our Small Value Stocks

- Most of our Nominal Bonds

- Some of our TIPS and all of our I Bonds

- Some of our Private Debt Real Estate

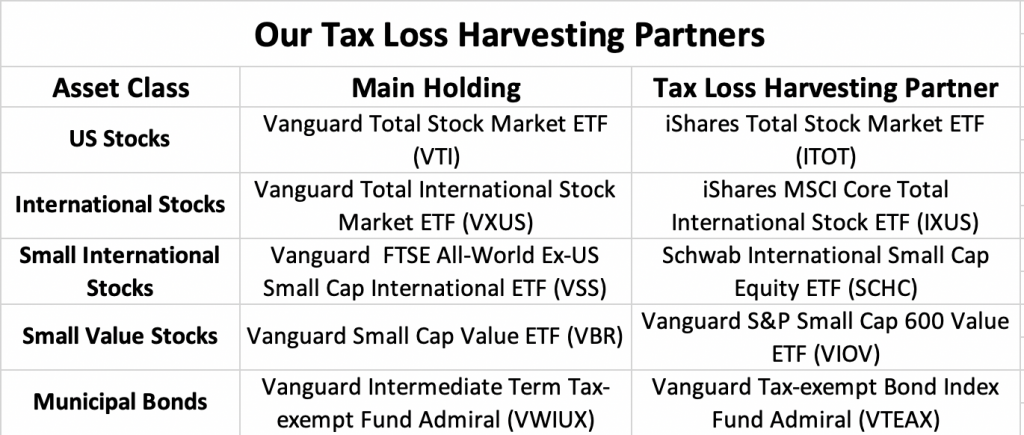

The private equity real estate, private debt real estate, and I Bonds really don't lend themselves to tax-loss harvesting. That leaves us six investments for which we need tax-loss harvesting partners—of the six listed below, we've tax-loss harvested five of them (all except the TIPS) in the last year, so these are the actual partners we use.

These funds are all very liquid, very low cost, and very broadly diversified, and I am perfectly happy to hold any of them for the rest of my life. The only one I am not totally satisfied with is SCHC since VSS includes emerging markets and SCHC does not. Some people prefer smaller and more value-y small value funds. I am content with these.

More information here:

The Case Against Tax-Loss Harvesting

Tax-Loss Harvesting with Fidelity

How to Tax-Loss Harvest with Vanguard

What Should You Use?

Now that you have all of the information you need, let's make that list you requested of possible tax-loss harvesting partners to consider.

US Stocks/Large Cap

There are a gazillion potential options for this asset class in both traditional mutual fund and ETF forms. Here is a partial list of great choices:

Funds:

- Vanguard Total Stock Market Fund Admiral (VTSAX)

- Vanguard Large Cap Index Fund Admiral (VLCAX)

- Vanguard 500 Index Fund Admiral (VFIAX)

- Fidelity Total Market Index Fund (FSKAX)

- Fidelity Zero Total Market Index Fund (FZROX)

- Fidelity 500 Index Fund (FXAIX)

- Fidelity Zero Large Cap Index Fund (FNILX)

- Schwab Total Stock Market Index Fund (SWTSX)

- Schwab S&P 500 Index Fund (SWPPX)

ETFs:

- Vanguard Total Stock Market ETF (VTI)

- Vanguard Russell 1000 ETF (VONE)

- Vanguard Large Cap ETF (VV)

- Vanguard S&P 500 ETF (VOO)

- Vanguard Mega Cap ETF (MGC)

- iShares Total Stock Market ETF (ITOT)

- iShares Russell 3000 ETF (IWV)

- iShares Russell 1000 ETF (IWB)

- iShares S&P 100 ETF (OEF)

- iShares Cores S&P 500 ETF (IVV)

- SPDR Portfolio S&P 1500 Composite Stock Market ETF (SPTM)

- SPDR S&P 500 ETF Trust (SPY)

- SPDR Portfolio S&P 500 ETF (SPLG)

- SPDR Dow Jones Industrial Average ETF Trust (DIA)

- Schwab US Broad Market ETF (SCHB)

- Schwab US Large Cap ETF (SCHX)

- Schwab 1000 Index ETF (SCHK)

See my point? There is no shortage here. There are probably a dozen more reasonable choices for a “total stock market” substitute. These are all low cost and broadly diversified, and they all have 99% correlation with each other.

International Stocks/Large Cap

Fewer choices here, but still plenty whether you use funds or ETFs.

Funds:

- Vanguard Total International Stock Index Fund Admiral (VTIAX)

- Vanguard FTSE All-World Ex US Index Fund Admiral (VFWAX)

- Fidelity Total International Index Fund (FTIHX)

- Fidelity Zero International Index Fund (FZILX)

- Schwab International Index Fund (SWISX)

ETFs:

- Vanguard Total International Stock ETF (VXUS)

- Vanguard FTSE All World Ex-US ETF (VEU)

- iShares Core MSCI Total International Stock Index ETF (IXUS)

- Schwab International Equity ETF (SCHF)

We're already done for most of you. Since most investors have a significant portion of their portfolio in retirement accounts and since TSM and TISM make up a large portion of most portfolios, chances are you don't need any more than the partners above. But if you have a particularly complex portfolio, continue reading. Recognize that the more esoteric the asset classes you are using, the more likely it is your investment and its partner will be an ETF.

US Nominal Bonds (Taxable)

Very few people hold this asset class in a taxable account. Those in a low enough tax bracket to make it a proper holding generally don't have much of a taxable account. But we'll identify a few partners anyway.

Funds:

- Vanguard Total Bond Market Index Fund Admiral (VBTLX)

- Vanguard Intermediate-Term Bond Index Fund Admiral (VBILX)

- Fidelity US Bond Index Fund (FXNAX)

- Fidelity Total Bond Fund (FTBFX)

- Schwab US Aggregate Bond Index Fund (SWAGX)

ETFs:

- Vanguard Total Bond Market ETF (BND)

- Vanguard Intermediate-Term Bond ETF (BIV)

- iShares Core US Aggregate Bond ETF (AGG)

- iShares Core Total USD Bond Market ETF (IUSB)

- Fidelity Total Bond ETF (FBND)

- Schwab US Aggregate Bond ETF (SCHZ)

- SPDR Portfolio Aggregate Bond ETF (SPAB)

Lots of options for something few ask for.

Municipal Bonds

While it is unusual to tax-loss harvest bonds at all, the bonds most likely to show up in a taxable portfolio are muni bonds. Individual munis aren't a great holding (for more reasons than the illiquidity preventing easy tax-loss harvesting), so we're just talking about funds here.

Funds:

- Vanguard Intermediate Term Tax-Exempt Admiral (VWIUX)

- Vanguard Tax-Exempt Bond Index Admiral (VTEAX)

- Schwab Tax-Free Bond Fund (SWNTX)

- Fidelity Tax-Free Bond Fund (FTABX)

ETFs:

- Vanguard Tax-Exempt Bond ETF (VTEB)

- Schwab Municipal Bond ETF (SCMB)

- iShares National Muni Bond ETF (MUB)

- SPDR Nuveen Bloomberg Municipal Bond ETF (TFI)

- SPDR Nuveen Muncipal Bond ETF (MBND)

- Avantis Core Municipal Fixed Income ETF (AVMU)

International Bonds

Let's do international bonds while we're at it. If you wanted to split bonds up into short-term and long-term bonds, corporate, Treasury, and mortgage-backed bonds, etc., we could also do that. You would find 2-3 good choices in each category from the usual places.

Funds:

- Vanguard Total International Bond Index Fund Admiral (VTABX)

- Fidelity International Bond Index Fund (FBIIX)

ETFs:

- Vanguard Total International ETF (BNDX)

- iShares Core International Aggregate Bond ETF (IAGG)

Large, Mid, Small, Value, Growth Stocks

We could also do this for every category from large growth stocks to small value stocks. The process would be mostly the same, so let's just do it for one of the most common “tilts” out there: small value. I highly recommend ETFs over funds in these types of asset classes. You will have many more good choices.

Funds:

- Vanguard Small Cap Value Index Fund Admiral (VSIAX)

- Fidelity Small Cap Value Index Fund (FISVX)

ETFs:

- Vanguard Small Cap Value ETF (VBR)

- Vanguard Small Cap S&P 600 Value ETF (VIOV)

- Vanguard Russell 2000 Value ETF (VTWV)

- iShares S&P Small Cap 600 Value ETF (IJS)

- SPDR S&P 600 Small Cap Value ETF (SLYV)

- DFA US Small Cap Value ETF (DFSV)

- Avantis US Small Cap Value ETF (AVUV)

- Wisdomtree US Small Cap Dividend ETF (DES)

REITs

REITs are generally considered fairly tax-inefficient and are usually one of the last asset classes to be moved to taxable. However, their income is eligible for the 199A deduction through 2025 and part of their yield is depreciation passed through in the form of a non-taxable return of capital distribution, so maybe they're not as bad as is classically taught. If you hold REITs in taxable, you're almost surely going to want to tax-loss harvest them from time to time since their share price can be quite volatile. Again, an ETF makes sense here in taxable.

Funds:

- Vanguard Real Estate Index Fund Admiral (VGSLX)

- Fidelity Real Estate Index Fund (FSRNX)

ETFs:

- Vanguard Real Estate ETF (VNQ)

- Schwab US REIT ETF (SCHH)

- iShares Core US REIT ETF (USRT)

- iShares Cohen & Steers REIT ETF (ICF)

- iShares US Real Estate ETF (IYR)

- SPDR Dow Jones REIT ETF (RWR)

- Fidelity MSCI Real Estate Index ETF (FREL)

- Fidelity Real Estate Investment ETF (FPRO)

- DFA US Real Estate Index ETF (DFAR)

- Avantis Real Estate ETF (AVRE)

TIPS

These are not frequently held in taxable, and they don't usually have big losses to harvest anyway. But if you are in taxable, you have a few choices. You can invest directly into TIPS at auction at TreasuryDirect. If you have a loss, sell what you own and buy the next TIPS available at auction. It won't be exactly the same, but it would work. If you're buying individual TIPS on the secondary market at Vanguard, Fidelity, Schwab, or another brokerage, you could sell a TIPS you own and simply buy a similar one issued a year earlier or a year later. It would be a little more convenient to use a fund or preferably an ETF if you really plan to tax-loss harvest with minimal cost. Note that these options are all for intermediate-term TIPS. There is also a decent set of funds (mostly ETFs) for short-term TIPS including one from Vanguard.

Funds:

- Vanguard Inflation-Protected Securities Fund Admiral (VAIPX)

- Fidelity Inflation-Protected Bond Index Fund (FIPDX)

- Schwab Treasury Inflation Protected Securities Index Fund (SWRSX)

ETFs:

- Schwab US TIPS ETF (SCHP)

- iShares TIPS Bond ETF (TIP)

- SPDR Portfolio TIPS ETF (SPIP)

- SPDR Bloomberg 1-10 Years TIPS ETF (TIPX)

Small International

Few mutual fund houses have more than one of these, so your best bet is again going to be an ETF to minimize transaction costs and maximize tax-efficiency.

Funds:

- Vanguard FTSE All-World Ex-US Small Cap Index Fund Admiral (VFWAX)

- Fidelity International Small Cap Fund (FISMX)

ETFs:

- Vanguard FTSE All-World Ex-US Small Cap ETF (VSS)

- Schwab International Small Cap Equity ETF (SCHC)

- iShares MSCI EAFE Small Cap ETF (SCZ)

- SPDR S&P International Small Cap ETF (GWX)

Emerging Markets

Quite a few choices here, but given that most mutual fund companies only have one, you're again probably going to want to use the ETF if investing in this asset class in taxable.

Funds:

- Vanguard Emerging Markets Stock Index Fund Admiral (VEMAX)

- Fidelity Emerging Markets Index Fund (FPADX)

ETFs:

- Vanguard FTSE Emerging Markets ETF (VWO)

- iShares Core MSCI Emerging Markets ETF (IEMG)

- iShares MSCI Emerging Markets ETF (EEM)

- SPDR Portfolio Emerging Markets ETF (SPEM)

- Avantis Emerging Markets Equity ETF (AVEM)

- DFA Emerging Core Equity Market ETF (DFAE)

- Schwab Emerging Markets Equity ETF (SCHE)

International Small Value

Now we've gotten to the point where Vanguard doesn't even have an index fund in this asset class. Use an ETF.

ETFs:

- DFA International Small Cap Value ETF (DISV)

- Avantis International Small Cap Value ETF (AVDV)

- Schwab Fundamental International Small Company Index ETF (FNDC)

- WisdomTree International Small Cap Dividend ETF (DLS)

We could keep going with this exercise, but I think it's clear at this point how I'm doing it. Select the asset class. Then, check with all of the usual low-cost index fund/ETF providers for whether they have a fund/ETF in that asset class. If there are multiple, choose based on convenience, cost, and liquidity.

What do you think? What tax-loss harvesting partners do you use? Do you need help choosing between the options above? Is there an asset class not listed above where you could use help finding potential partners?