Over the last couple of years, I’ve noticed a new kind of question cropping up from fourth-year medical students in the personal finance class I co-direct. Just before Match Day, they’ll approach me, spreadsheet in hand, and ask:

“Should I rank the program that offers a retirement match higher?”

It’s a good question—and not one I ever considered when I was applying to residency. Back then, an employer retirement match for residents or fellows was practically unheard of. But in recent years, a slow but noticeable shift has occurred. I don’t know of any national data that tracks how many residency and fellowship programs now offer a retirement match, but anecdotally, the number seems to be growing. Still, these programs remain in the clear minority.

As someone who spends a lot of time thinking about financial wellness in medicine, I wanted to understand the real value of a residency retirement match. So, I ran the numbers.

The Financial Power of an Early Match

Let’s suppose your residency offers a 10% employer match on your salary. That might not sound like much—after all, PGY-1s earn around $67,000 a year—but small contributions made early can grow massively over time.

Assume a resident earns $67,000 annually and receives a 10% employer match throughout training. What’s that worth by retirement?

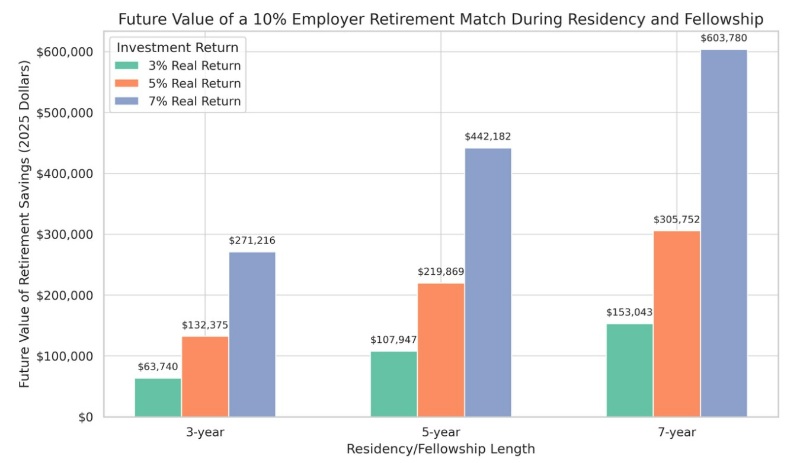

Using current AAMC resident and fellow salary data and conservative assumptions, I modeled the future value of those employer contributions by age 67. All figures are adjusted for inflation and presented in 2025 dollars, using real (after-inflation) investment return rates of 3%, 5%, and 7%. I looked at three-, five-, and seven-year training paths. The results are shown in the figure below:

As you can see:

- A three-year residency match will grow to $132,375 with a 5% real return by retirement.

- A five-year residency/fellowship match will grow to $219,869.

- A seven-year training path would yield $305,752.

- At a 7% real return, the value of a seven-year match exceeds $600,000.

- If the resident also contributes 10% of their salary and receives the full match, the combined total could exceed $1.2 million.

That’s a serious head start on retirement savings—especially for money you didn’t even have to earn yourself.

More information here:

Financial Benefits During Residency That Are Vastly Underrated and Overrated

How Personal Finance Influenced My Residency Rank List

Use Roth Contributions to Maximize Value

Most residents are in the lowest tax bracket they’ll ever see in their careers. That’s why employer-sponsored Roth retirement plans (like Roth 403(b)s or Roth 401(k)s) are especially valuable during training.

If you have access to a Roth plan and your institution offers a match, this is the perfect time to take advantage. Not only do you get the match, but your own contributions grow tax-free for decades. Even if you can only contribute a few thousand dollars a year, the long-term impact is profound.

Think of it this way: a dollar saved in a Roth account during residency could be worth far more than a dollar saved later as an attending.

Should You Choose a Residency Based on a Retirement Match?

Now for the big question: Should a retirement match affect how you rank programs?

My take: all else being equal, yes, go with the program that offers a match. But of course, all else is rarely equal.

As a fellowship program director myself, I would strongly encourage students to keep the bigger picture in mind. The quality of training, alignment with your long-term goals, culture, and location (especially proximity to family or a support system) matter far more in the long run. A strong program that sets you up for a fulfilling and well-compensated career will more than make up for any missed employer match during residency.

That said, the match does matter. And it’s not just about the money. Offering a retirement match signals that a program views its trainees as true employees, that they're worthy of the same benefits offered to attendings and staff.

More information here:

From Fourth Year to the Real World: Transitioning from Med School to Residency

From Fourth Year to the Real World: An $80,000 Wedding Causes a Downward Spiral

Beyond the Dollars: Behavioral Benefits Matter, Too

Importantly, the impact of offering a match extends beyond the dollars saved. It encourages earlier participation in retirement savings, reinforces long-term investing habits, and allows residents to gain market experience while the stakes are relatively low. These early lessons—compounding, dollar-cost averaging, staying the course—are powerful. And though these behavioral benefits aren’t captured in the financial modeling above, they likely enhance the overall value of retirement match programs considerably.

The Bottom Line

I hope we one day reach a point where all residents and fellows are offered the same retirement benefits as their supervising physicians. The cost to institutions is relatively modest, but the long-term benefit to trainees is enormous.

Until then, if you’re a med student reviewing your rank list—or a resident advising those coming up behind you—know that a retirement match during training is more than just a perk. It's far more valuable than a better call room, free meals, or premium parking. That said, it should still take a back seat to the quality of education, mentorship, and clinical experience a program offers.

In the hierarchy of residency benefits, a retirement match is one of the few no-strings-attached investments your future self will thank you for—again and again.

What do you think? Were you offered a retirement match in residency? How did it affect where you went for training? How much could it have affected your financial journey?