Long-term WCI readers are well-versed in why they should invest at least some of their portfolio in low-fee index funds. While the S&P 500 gets the most attention, it’s far from the only option. The NASDAQ 100 index includes the 100 largest companies on the NASDAQ exchange, excluding financial companies. That leaves investors with a diversified portfolio of companies heavily weighted in the technology and consumer discretionary sectors.

QQQ and QQQM are both Invesco ETFs tracking the NASDAQ 100. But why would one investment firm offer two ETFs tracking the same index? Here’s a look at QQQ vs. QQQM to understand the differences and help you understand which may be a better fit for your goals.

What Is a NASDAQ 100 ETF?

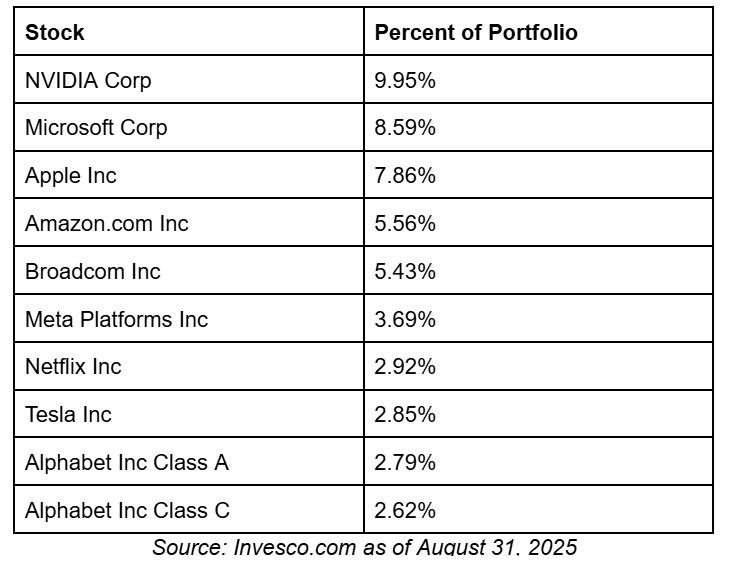

The NASDAQ 100 index is a market-weighted index comprising the 100 largest companies listed on the NASDAQ exchange, excluding financial stocks. As of this writing, the top 10 holdings include:

The 100 stocks and their weights can change at any time, but the biggest names in the portfolio are likely companies you’re very familiar with, and there’s quite a bit of overlap with the S&P 500 and other broad market index funds.

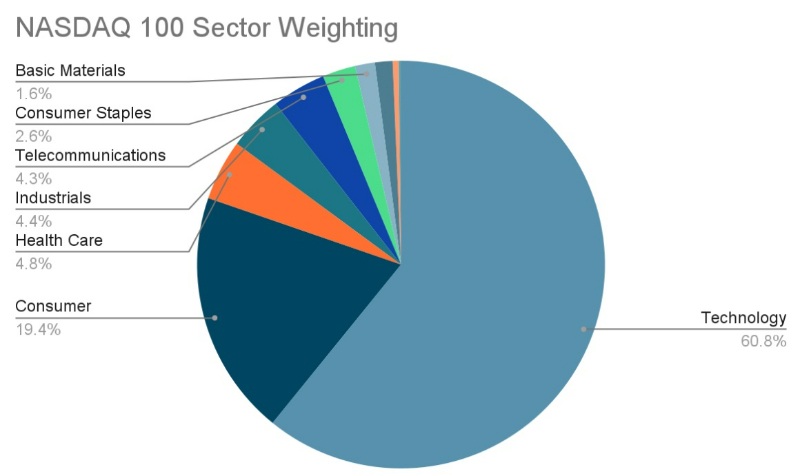

With an investment in the NASDAQ 100, your holdings break down by sector as follows:

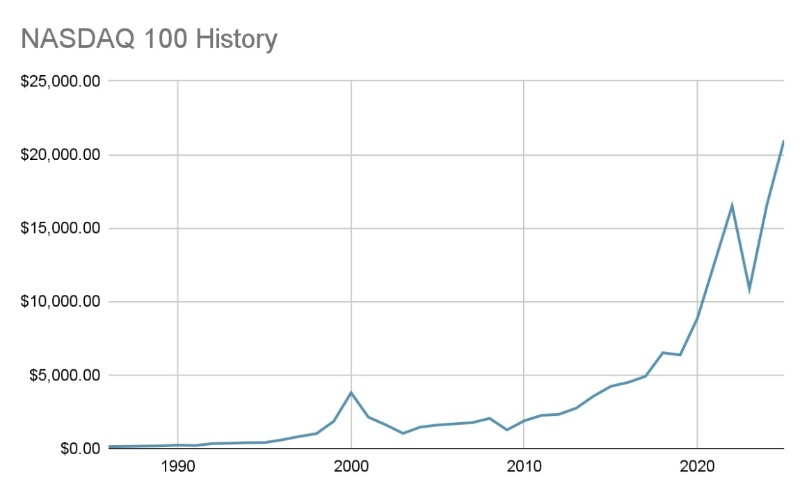

If you strongly believe in the top technology and consumer companies, which can be tied closely to the overall economy, you may find the NASDAQ 100 is a good fit for your portfolio. Here’s how the index has performed since its inception in the 1980s:

The index has performed exceptionally well since the technology sector stabilized at the end of the 2000s, following the bursting of the Tech Bubble—with a notable exception in 2023, when the index dropped largely due to the post-COVID effects of rising inflation and interest rates.

If you are looking to invest in the NASDAQ 100, Invesco’s QQQ and QQQM are both popular and low-fee ETFs.

Tip: For tax-loss harvesting purposes, these two funds are materially similar and are likely too similar to use for this purpose.

More information here:

Is Anybody Else Getting Nervous About an AI Bubble in the Stock Market?

How Do You Evaluate and Compare Mutual Funds and Exchange Traded Funds?

What Is QQQ?

QQQ is arguably the best-known NASDAQ 100 index fund. It’s a highly traded ETF commonly utilized by active traders and options traders to (hopefully) profit from swings in the price of 100 NASDAQ 100 stocks.

When we say it’s highly traded, we’re not exaggerating. It’s the second-most highly traded ETF in the entire market, trailing only the popular S&P 500 fund, SPY. That makes it highly efficient and a helpful proxy for valuing the largest NASDAQ companies over time.

It’s also relatively low-cost with an annual expense ratio of 0.20%, making it a low-cost holding as well. But despite the low cost of QQQ, Invesco made an even lower-cost version for longer-term traders with QQQM.

What Is QQQM?

QQQM is almost identical to QQQ but with a lower expense ratio of just 0.15%. That’s 25% less than you’d pay to hold QQQ. While QQQM is a lower-cost option, it’s also traded at a lower volume. That makes it less ideal for high-speed trading, automated trading, and active trading schemes. Having to potentially wait a fraction of a second longer for a trade to execute could cost millions of dollars at high volumes, so QQQM’s lower cost isn’t worthwhile for that specific goal.

In summary, QQQM is basically identical to QQQ but with a lower average daily trading volume and a lower expense ratio charged by investment fund manager Invesco.

QQQ vs. QQQM: Which Should I Choose?

If you’re a regular reader of The White Coat Investor, you’re likely focused on more reliable long-term results instead of risky short-term gains. In that case, QQQM is definitely a better choice. Saving 25% on fees in exchange for slightly slower trade times is absolutely worthwhile.

Here’s how we would decide between the two:

- Long-term and passive investing: QQQM

- Short-term and active trading: QQQ

QQQ vs. QQQM Example

While a 0.05% difference in expense ratios may seem trivial, it can add up to a significant amount over the course of several decades. Both QQQ and QQQM track the same index, so the only difference in long-term returns is the cost you pay to hold them. With QQQ’s expense ratio at 0.20% and QQQM’s at 0.15%, QQQM charges 25% less in annual fees. Those savings compound just like your investment returns, meaning even a fraction of a percent matters for investors who plan to hold for many years.

For example, if you invested $100,000 and earned an average 8% return over 30 years, the difference between the two funds would be about $15,000. With QQQ, your ending balance would be around $930,000, while you’d finish closer to $945,000. Both results are strong, but why give up an extra $15,000 for the same set of stocks? For most long-term investors, those savings make QQQM the more cost-efficient choice.

More information here:

ETF vs. Mutual Funds: Pros and Cons

QQQ vs. QQQM: Which Is Better?

QQQ and QQQM both give investors access to the same group of innovative, market-leading companies in the NASDAQ 100. The choice really comes down to how you invest. For long-term, buy-and-hold investors, QQQM’s slightly lower expense ratio makes it the smarter pick. Those small savings can compound into thousands of extra dollars over time. For active traders, however, QQQ’s higher liquidity and tighter spreads make it the more practical option—especially for strategies involving frequent trades or options.

No matter which you choose, investing in the NASDAQ 100 offers a concentrated bet on the technology and consumer sectors that have driven much of the market’s growth in recent decades. If you want exposure to many of the world’s most influential companies without picking individual stocks, either QQQ or QQQM could be a valuable addition to your portfolio. The key is aligning the fund with your investment horizon and goals.

Do you invest in the NASDAQ 100? How do you do it? Do you use QQQ or QQQM? Which do you like better? Which will make you more money?