[FOUNDER'S NOTE BY DR. JIM DAHLE: Many high-income professional investors first learned about the Backdoor Roth IRA on this site. One of my most popular posts is the tutorial on the process. In the lengthy comments section of that post, many people asked how to handle a Backdoor Roth IRA (especially form 8606) if you contributed in the next calendar year. While it is “cleaner” to make your contribution and your conversion all in the same calendar tax year, you can make your contribution up until your tax filing date of the next year. I was going to write a post on the subject and then, lo and behold, a guest post on the subject showed up in my email box.]

Maybe you are a new reader and just saw the light this January. Maybe you were reading up on the Backdoor Roth and December 31 flew by you. Maybe you are new to financial planning and weren’t sure if you’d have enough money to make the $6K contribution this year. (Not very WCI of you! See, that’s where the planning portion kicks in.) Or maybe you were waiting to see if you could afford your new boat and still have enough left over from your bonus to make the Backdoor Roth happen (please, please don’t let this be the reason—and if it is, for Pete’s sake, don’t admit it here!).

Whatever the reason, you have found yourself ready to do a Backdoor Roth for the previous year. You’re wondering if you can make a non-deductible contribution in 2015 to your 2014 traditional IRA and still get in the back door. If so, how do you do this?

How to Fill Out Form 8606 for Backdoor Roth Late Contributions

Great question. If you’re like me, you re-read the posts on Backdoor Roths here a million times trying to find the answer. You scour other websites but find yourself back here. You locate WCI’s generous image postings of how to fill out Form 8606 but can’t find an example of a procrastinator such as yourself who is contributing late. So instead, you head over to the IRS website, pull down the Form 8606 yourself, and try to make heads or tails of what seems like a foreign language, realizing, of course, that you are not a CPA but just a DIYer (that is my caveat emptor, by the way).

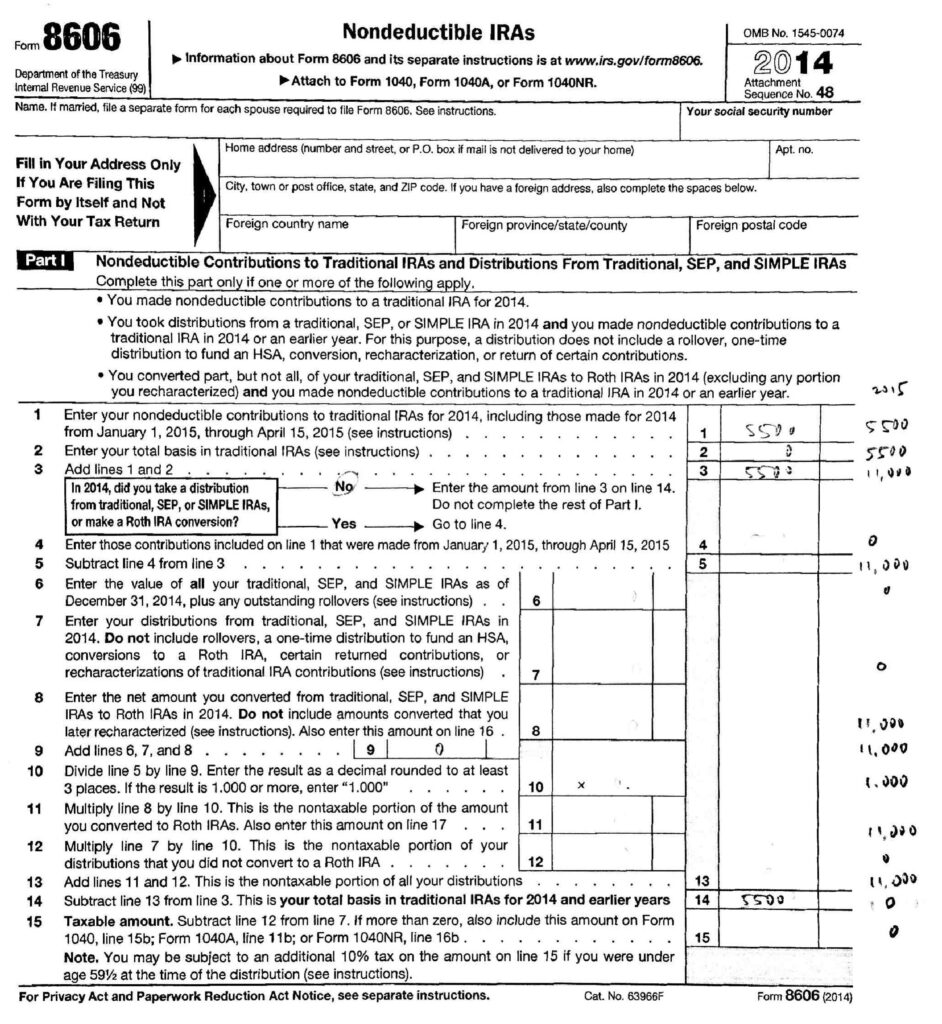

Below, you will see a Form 8606 filled out with 2014 values in the appropriate boxes, and the numbers for your 2015 Form 8606 in the margin on the right. Don’t worry, I’ll step you through it. Please note that this setup shows a conversion when there have been no gains in the prior year contributions so that there are no taxes due on gains.

Line 3 is your total tIRA contributions, including previous and current year. For 2014, that would be only the $5500. For 2015, that would be the $5500 for last year and the $5500 for this year. For the 2014 year, the answer to the Question in Line 3 is NO, so you enter the amount from Line 3 into Line 14 and skip the rest of Part 1. For your 2015 taxes, Line 4 represents the late contributions you made in 2016 to your 2015 tIRA ($0 since you were diligent this year) and Line 5 represents the late contributions you made in 2014.

Line 6 is the total value of your tIRA on December 31st, this is the information that will affect the pro rata rules. Since you have no previous non-deductible contributions because you have been a good little WCI minion and cleared out previous IRA accounts, this will be $0 as well.

Line 8 you skipped for 2014 because you answered NO to Line 3. In 2015, you will be converting the full amount in your tIRA to a Roth.

Line 11 is the non-taxable portion of your conversion — which, if you’ve done things right, should be the full amount you are converting — $11,000.

Line 14 is the basis in your tIRA for the current year and prior — which should now be $0 in 2015 because you just converted all of it to a Roth (remember, previously it was $5500 for the contribution year 2014 before you converted.)

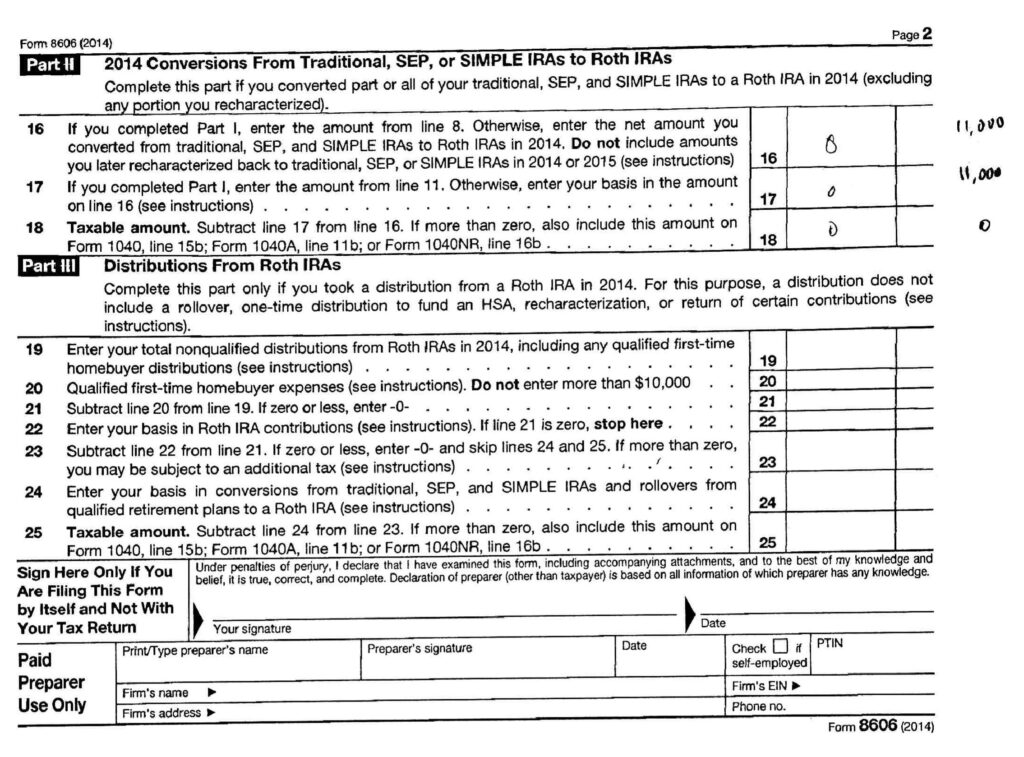

Line 16 is the amount you converted to Roth. For 2014, that is $0, for 2015 that should be the full $11,000. Line 17 is the non-taxable portion that you converted. This should be $0 for 2014 and $11,000 for 2015. Line 18 is the taxable portion of your conversion. This should be $0 for both years since you did not do any conversion for 2014 and you converted only non-taxable (i.e. already taxed) portions of the tIRA for 2015. [FOUNDER'S NOTE BY DR. JIM DAHLE: Whether you're doing your own taxes or paying someone else to prepare them, be extra sure to check that line and make sure it is zero. Many doctors have accidentally paid taxes twice on their Backdoor Roth IRA money.]

Line 16 is the amount you converted to Roth. For 2014, that is $0, for 2015 that should be the full $11,000. Line 17 is the non-taxable portion that you converted. This should be $0 for 2014 and $11,000 for 2015. Line 18 is the taxable portion of your conversion. This should be $0 for both years since you did not do any conversion for 2014 and you converted only non-taxable (i.e. already taxed) portions of the tIRA for 2015. [FOUNDER'S NOTE BY DR. JIM DAHLE: Whether you're doing your own taxes or paying someone else to prepare them, be extra sure to check that line and make sure it is zero. Many doctors have accidentally paid taxes twice on their Backdoor Roth IRA money.]

Looking Ahead

That should be it, you’re done! Now make sure to make your contributions in the future during the year for which you are contributing—remember, it’s time IN the market that counts, not timing the market!

What do you think? Any questions? Are you doing a Backdoor Roth IRA? If not, why not? Is there anything we can do here at WCI to make it easier for you?