By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderOccasionally, I hear an investor say they invest in individual municipal bonds to get a higher return than they would get by using a high-quality municipal bond fund. There's a good chance they're mistaken due to ignorance of how the municipal bond market works. Even if they aren't, it probably still isn't a good idea. Let's explore why.

What Are Municipal Bonds?

Before we get into our subject today, let's provide a little background context. At its most basic, a bond is a loan to an entity. Treasury bonds are loans to the federal government. Corporate bonds are a loan to a corporation. Mortgage bonds are loans to individuals with their house as collateral. Municipal bonds are loans to state and local governments. Each of these bonds performs slightly differently, and they're taxed differently. Corporate and mortgage bonds are fully taxable. Treasury bonds are state and local tax-free. Municipal bonds are federal tax-free, and if the bond is in the state of your residence, it's also state tax-free. Due to their tax-free nature, municipal bonds are purchased by high tax bracket investors because their after-tax return is higher than that of the other types of bonds, despite the pre-tax yield being lower.

What Is a Bond Fund?

A bond fund is a mutual fund that buys bonds. Mutual funds are a group of investors that band together to hire a professional manager and share costs. A mutual fund provides professional management, extensive diversification, daily liquidity, and lower costs—all in exchange for a fee to the manager known as the expense ratio (ER). The best bond funds, such as those available from Vanguard, are very passive and very low cost. A typical expense ratio for these funds is 0.10%. So, it costs you $10 per $10,000 invested per year. That means all those benefits of using a fund are essentially free.

More information here:

The Nuts and Bolts of Investing

Why I Hate Total Bond Market Index Funds

What Is the Problem with Bond Funds?

If bond funds are so awesome, why would anyone want to avoid using them and invest in individual bonds? There is just one problem with a good bond fund. Unlike investing in individual high quality bonds, the investor in a bond fund is not guaranteed to never lose principal. If you hold a bond until its maturity, you will get all of your principal back (at least nominally, i.e. before inflation) so long as the bond does not default. In a bond fund, it's possible to lose principal, even if none of the bonds default.

This generally occurs in times of continually rising interest rates. As interest rates rise, previously owned bonds with now submarket rates are worth less. Since a bond fund tends to buy bonds of a certain age and then sell them as they age out of the target range of the fund, it's possible they can buy bonds, watch them depreciate due to rising rates, and then sell them. Buy high, sell low. Not a winning strategy. Of course, as rates fall, just the opposite occurs. Previously owned bonds become more valuable, and the bond fund comes out ahead. Over the long run, these two occurrences tend to cancel each other out for the long-term investor. In fact, rising interest rates are actually good for long-term investors, so long as they are investing for a period longer than the duration of the bond.

But some bond investors don't like the possibility of losing principal and convince themselves that they should invest in individual bonds despite the advantages of a bond fund.

More information here:

VWIUX vs. FMBIX: Which Bond Fund Is Best?

“But I Can Get a Higher Yield with Individual Bonds!”

Individual bond advocates sometimes say they can get a higher yield with individual bonds than they can get with a bond fund. Maybe. Maybe not. Let's explore seven reasons why this thinking is a mistake.

#1 Looking at the Wrong Yield

Sometimes investors are looking at the coupon yield instead of the yield to maturity. This occurs when they buy a “premium bond.” A premium bond is a bond that you pay extra for because it offers a higher yield than new bonds being issued. Instead of paying $100 for the bond, you may be paying $125. Once you adjust the yield for the higher price you are paying, it is equivalent to the yields being offered on new issues. You really need to know what you're doing when you buy individual bonds. If you want to play bond fund manager in your spare time, you need to at least have a rudimentary knowledge of how the bond marketplace works.

The yield you care about is the Yield to Maturity, i.e. what yield are you going to achieve if you pay the current price for the bond and hold it until it matures, assuming that it does not default. With some bonds that allow the borrower to pay the loan back early (a callable bond), you need to look at the “Yield to Worst,” which is like the Yield to Maturity adjusted for what happens if they pay it off early. Only rarely should you care about the coupon yield, which is what its yield to maturity was on the day it was issued.

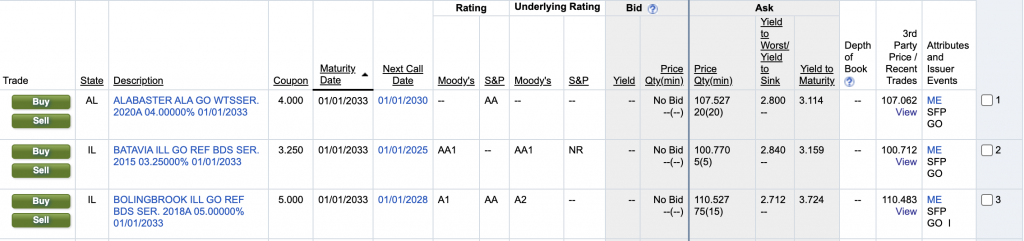

Here is a screenshot from Fidelity's brokerage site. If you don't know what every term on this page means, you have no business buying individual bonds. Listed here are three bonds. In the first column, you decide if you want to buy or sell. The second column tells you the state in which the muni bond was issued. The next column is a description of the bond, i.e. who issued it, when it was issued, what the coupon on the bond is, and when it matures. In this case, the first listed bond was issued by the government of Alabaster, Alabama, as a “general obligation bond” in 2020, and it matures in January 2033. The fourth column is the coupon, and the fifth column lists the maturity date. The sixth column is the next opportunity for Alabaster to call the bond. The seventh through tenth columns are ratings for the bonds and the bond issuer by Moody's and S&P, the two most prominent bond rating agencies.

The next five columns are the bid (what someone is willing to pay for the bond if you'll sell them one) and the ask (how much someone is willing to sell the bond to you). There is a spread between these two prices and for most municipal bonds—a very large spread. Note that the Yield to Worst (or Yield to Sink) is significantly lower than the Yield to Maturity in this callable bond. If it gets called in 2030 instead of paying interest until 2033, it will have a yield that is 0.314% lower. Depth of book is a rating of liquidity. The next column shows the most recent price at which it traded (which could be weeks ago; these aren't stocks). The last column talks about attributes of the bonds such as ME (material events), SFP (sinking fund protection), and GO (general obligation)

My point is that you shouldn't consider this a 4% bond. You should consider it a 2.8% bond, and naive investors may not.

#2 Not Considering Default Risk

Another mistake bond investors make is only looking at the yield. They may see a muni bond yielding 4% and then look at Vanguard's muni fund and see that it only yields 3.5%, and then they go buy the individual bond without ever looking under the hood. Perhaps that individual bond is rated A+. That sounds good, right? Maybe in school, but on the S&P bond rating scale, it's the fifth category from the top. The average grade of the bonds in the Vanguard Intermediate Municipal Bond Fund is two grades higher. You shouldn't be surprised to see that you can get a higher yield if you're willing to take on more default risk.

#3 Not Considering Term Risk

How about a bond with a maturity of 15 years? Should that bond have a higher yield or a lower yield than a muni bond fund with an average maturity of eight years? Higher. That's no free lunch; you're getting paid more because you're taking on more term risk. Compare apples to apples. Compare a bond fund with an average maturity of 15 years to an individual bond with a maturity of 15 years. (Or better yet, use duration.)

#4 Not Accounting for Illiquidity

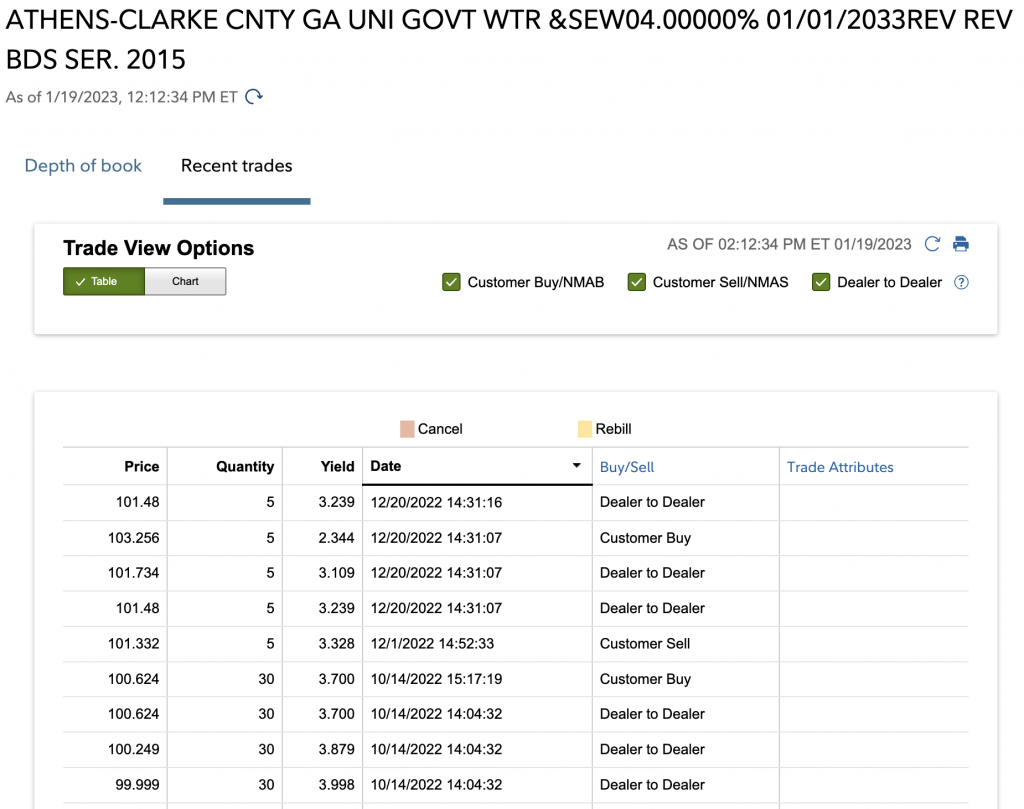

People who have traded stocks and/or ETFs are used to a very high degree of liquidity in the markets. The individual bond markets are not nearly as liquid. Every bond is a different security, even if issued by the same company or government entity. Some of them trade incredibly rarely, not multiple times a second like in the stock market. They might not even trade every month. Consider this bond:

This screenshot was taken on January 19, 2023. This bond had not traded at all in the prior month, and even then, it was just a few bonds ($500). Before that? Two months prior, and that was only $3,000. Imagine you want to unload 500 ($50,000) of these. Imagine what kind of spread or commission you are going to have to pay a bond dealer to take those off your hands. Essentially, if you have to sell muni bonds before maturity, you are going to do so at fire sale prices. Now, that might be an opportunity for you if you can provide that liquidity to someone else, but keep in mind the fact that if you can't turn around and sell it easily for what you just bought it for, that makes it less valuable. You need to adjust for that.

#5 Not Accounting for the Value of Your Time

I already spend more time managing investments than I would like, given that my investments are spread over four 401(k)s, three Roth 401(k)s, a defined benefit plan, two Roth IRAs, four UTMAs, four custodial Roth IRAs, 38 529 college savings accounts, two brokerage accounts (one in a trust), a savings account, three TreasuryDirect accounts, an HSA, and a DAF. Mix in nine asset classes, and it's not exactly straightforward. Many other docs have similarly complex portfolios. Now you want to start picking individual securities? How exactly are you going to decide which individual munis to buy and which to pass on? Are you going to research local governments all over the country? How do you plan to do that? How much time will it take? What is the value of your time exactly?

As a doc, your time might be worth $250 an hour. If you spend an hour trying to decide whether to buy $10,000 of a given municipal bond and you end up eking out an extra 0.3% in yield for doing so, you haven't earned $30; you've lost $220. And if you want to pay a professional to do this for you, what are they going to charge? A 1% AUM? Now they have to get an extra 1% just to make up for their cost before they can start earning you anything. Don't you think you'd be better off paying a Vanguard bond fund manager a few basis points to do it for you?

Maybe you think you can just buy small lots (5-30 bonds) and make an extra high yield by providing liquidity and then holding to maturity. Now, imagine you have a $5 million portfolio, 20% of which is in muni bonds. If you're buying $500-$3,000 at a time, how many times will you need to buy muni bonds to get $1 million invested? Oh, about 500 times. Imagine the complexity and time you will spend dealing with those 500 bond lots. It's bananas for a doctor to spend their time doing this and think they're coming out ahead. Go do another surgery each year and just use a muni bond fund.

#6 Not Accounting for the Lack of Diversification

With Treasury bonds, it's fine to buy individual bonds. By purchasing new issues at auction, you avoid any bid-ask spreads, commissions, or expense ratios. Since all Treasuries are issued by the same entity, there is no additional diversification against default risk by using a fund. You're just getting convenience and liquidity. If you're willing to give those up, perhaps you can eke out a few more basis points of return and ensure you don't lose principal and that will be worth it to you. Laddering the bonds may reduce the consequences of the illiquidity (and even if you have to sell Treasuries, at least the spread is much smaller than with muni bonds).

But you want to do this with corporates or munis? Do you have any idea how many of these you will need to buy to get the same amount of diversification you can get in a good muni bond fund? My preferred Vanguard muni bond fund (VWITX, but I use VTEAX as a tax-loss harvesting partner) has more than 13,000 bonds in it. How many are you planning to buy? Eight? Twelve? Thirty? Even 500 isn't close to the same thing. Getting a higher yield? Maybe that's because you're taking on more risk.

#7 Not Thinking About the Spread

The spread (the difference between the bid and the ask prices) is a huge deal in muni bonds. You can't even figure out what the spread is for many muni bonds. But when you can, it's usually huge.

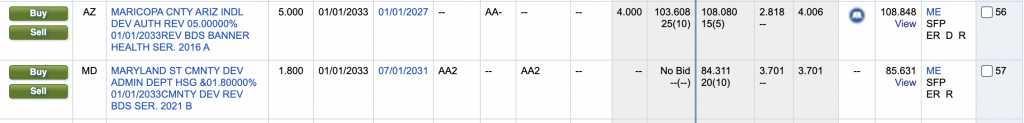

This Maricopa County bond is one of the few I could find on Fidelity's brokerage site that actually has a bid price. Take a look at the bid price ($103.608) and the ask price ($108.080). That's a 4.31% difference on a bond with a Yield to Worst of only 2.818%. It takes a year and a half just to earn back the spread. Compare that to the spread on the Vanguard Total Stock Market Index ETF. That'd be $0.01 (or less). Institutions moving large amounts of bonds might just get a better deal on these spreads than you can as an individual doc. Getting a higher yield may not be so great if the higher yield is more than eaten up by the spread. If you aren't taking the spread into account when dealing with municipal bonds, you're probably making a mistake.

More information here:

Municipal Bonds: How Much Is Safe?

Should I Use a State-Specific Municipal Bond Fund?

The 2 Reasons to Buy Individual Bonds Aren't Very Good

The first reason one might want to buy individual bonds is to save the expense ratio. Expense ratios are so trivial these days it is hard to justify the hassle unless you give up nothing else (like diversification) to get it.

The second reason is that you want to avoid losing principal because you think rates are going to continually rise during the life of the bond. If you are so sure about this, why would you buy a bond at all? Just leave your money in cash and buy bonds when your crystal ball tells you interest rates are going to start going down. Even if you admit you have no idea what interest rates are going to do and you just don't want to ever lose principal, look at everything you have to give up to get that guarantee. Worth it? Probably not for most.

What do you think? Do you buy individual muni bonds? Why or why not?