Long-time readers know I am a huge fan of waiting until 70 to take Social Security. Obviously, there are exceptions to this general advice (i.e., sometimes it makes sense for the lower earner in a couple to take it earlier, those with lower life expectancy should take it earlier, etc.)—it's all heavily explored elsewhere on this blog. However, none of that is actually the main issue of waiting until 70 to take Social Security.

The Problem with Waiting Until Age 70

The real problem is that too many people assume they need to work longer or spend less until they get to age 70. That is NOT what I mean when I say delay Social Security. In fact, I think it's actually a disaster if that happens.

When people first retire, they enter what are called the “go-go years” (followed by the “slow-go years” and the “no-go years”). You actually want to spend MORE money, at least in inflation-adjusted dollars, in those first few retired years than you do later. And if you retire earlier, that just means you get more of the go-go years. Feeling like you can't spend more until you hit age 70 (the later go-go years and perhaps into the slow-go years) is a real problem.

So, how can you wait until 70 for Social Security but still spend more in the years before then? Well, you have to have other money. Forty percent of retirees are living on just Social Security. For you to retire before 70 and delay Social Security until 70, you have to have some other source of spending money. Maybe that's an inheritance or a working spouse or something, but for most WCIers it is (and should be) a nest egg. You know, that big pot of money you spent your life acquiring. Building a nest egg that will support you when you're done working is actually the greatest financial task of your life. These nest eggs are usually seven figures, often in the $2 million-$5 million range and sometimes even more than $5 million. That's what you spend while waiting to get your Social Security check at age 70.

In this post, we're going to talk about exactly how to do that.

More information here:

8 Things You Must Know About Social Security

The Consequences of Ignoring Social Security

What Will Social Security Actually Pay?

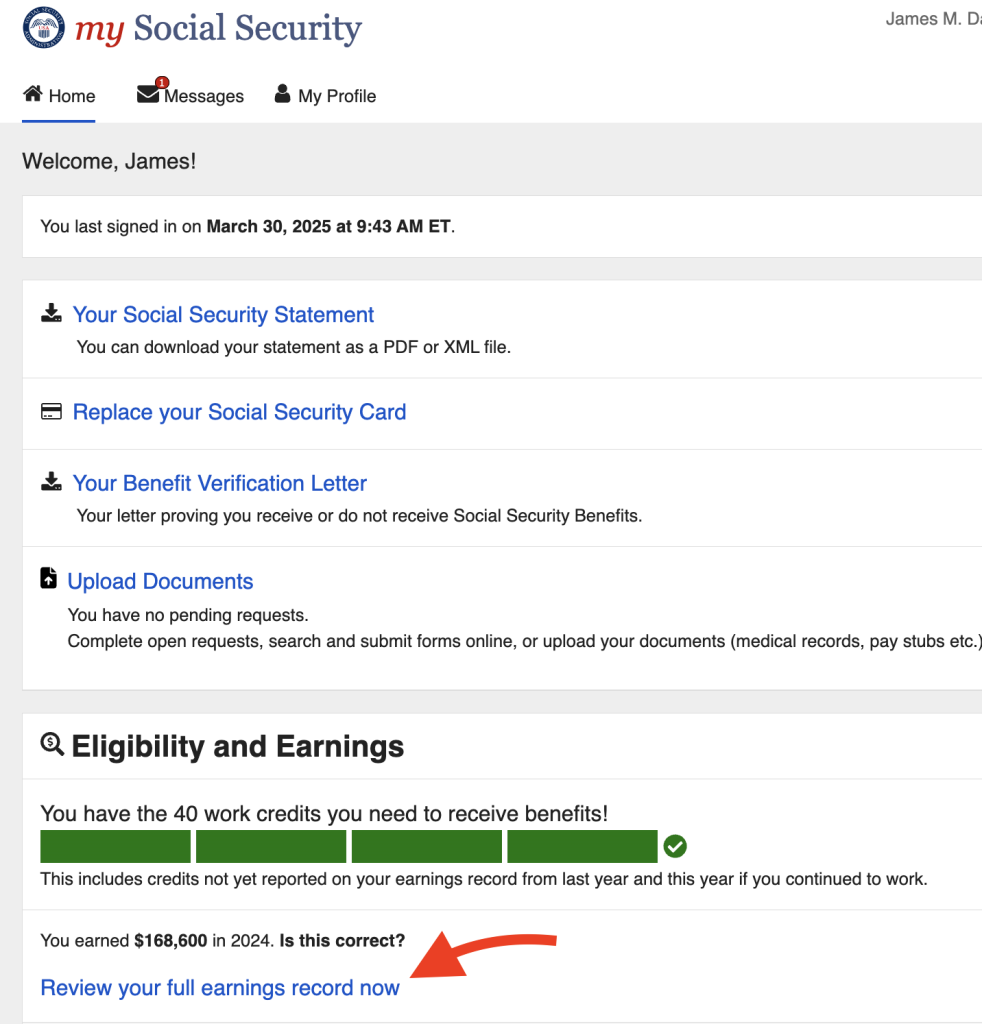

Essentially, you're trying to use some portion of your nest egg to replace Social Security from the date of retirement until age 70, when you begin taking Social Security. An important variable in that calculation is the amount Social Security will actually pay you. You would think this would be an easy number to find since we all get Social Security statements every year, right? Here's the chart from a recent one of mine.

This kind of does a good job of demonstrating why it's smart to wait until age 70 to start Social Security. That total of $4,521 is way more money than $2,423 (87% more!), especially considering this is likely the only guaranteed source of inflation-adjusted income available to you. However, it's totally misleading. The chart in your statement assumes you will work until the date your benefits begin. The age 62 number assumes I'll work until 62, and the age 70 number assumes I'll work until 70, paying into the Social Security system the entire time. If you retire at 60, your benefits probably won't be that large.

So, the first task is figuring out what your Social Security benefits will actually be. That requires a visit to two sites. The first is the Social Security website. You log in using a login.gov account, which you hopefully already have. If not, go get one first. Once you get there, you find your earnings record by clicking on “Review your full earnings record now.” (red arrow)

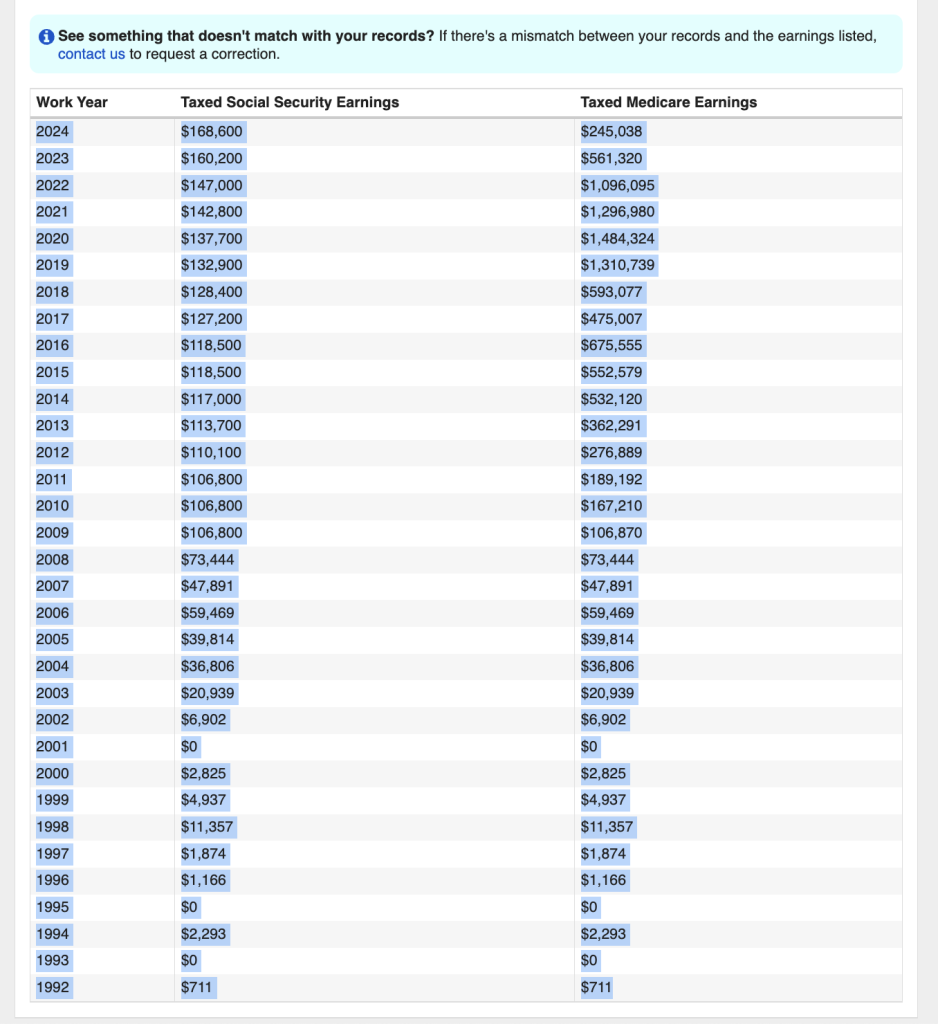

Your actual record will probably look a lot like mine . . .

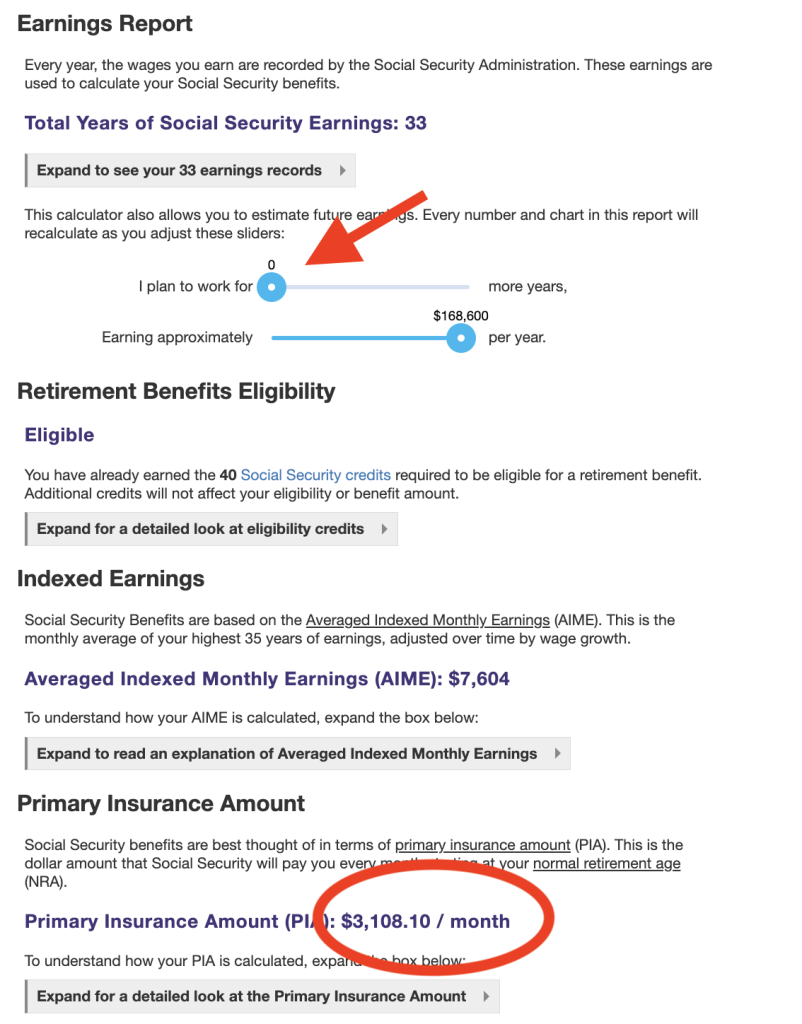

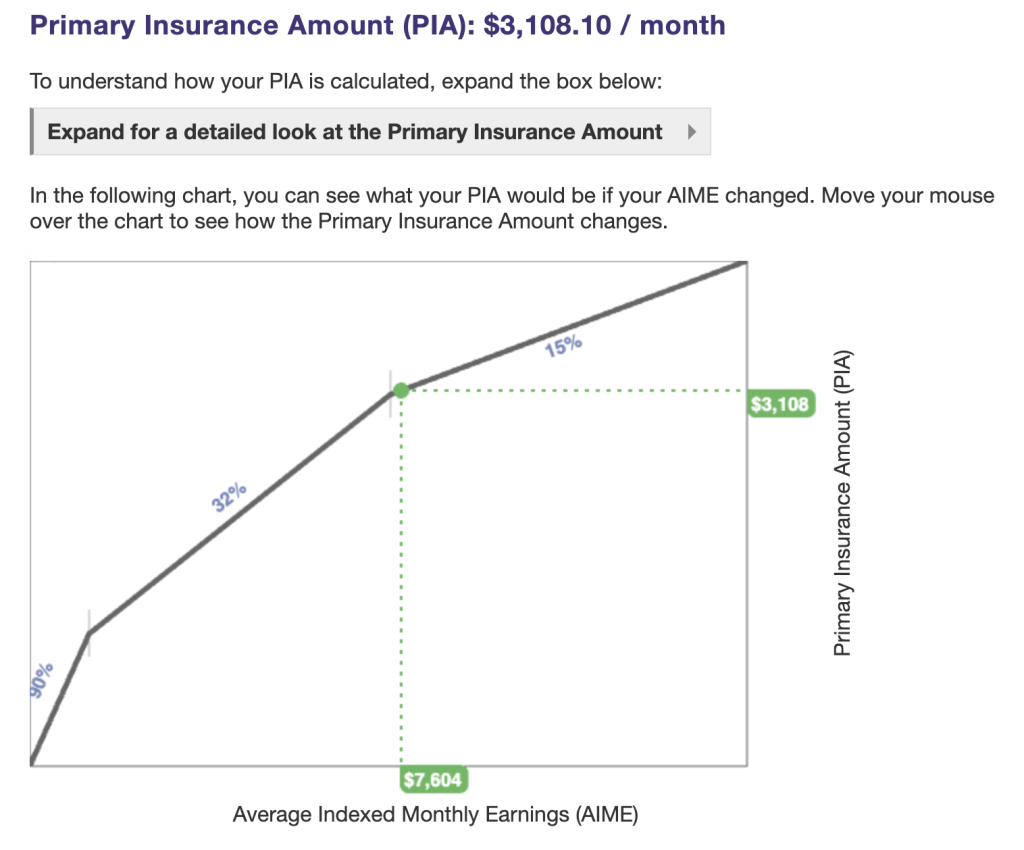

. . . which you then copy and paste into a box at https://ssa.tools/calculator. That will then spit out your Primary Insurance Amount, or PIA (in the red circle below).

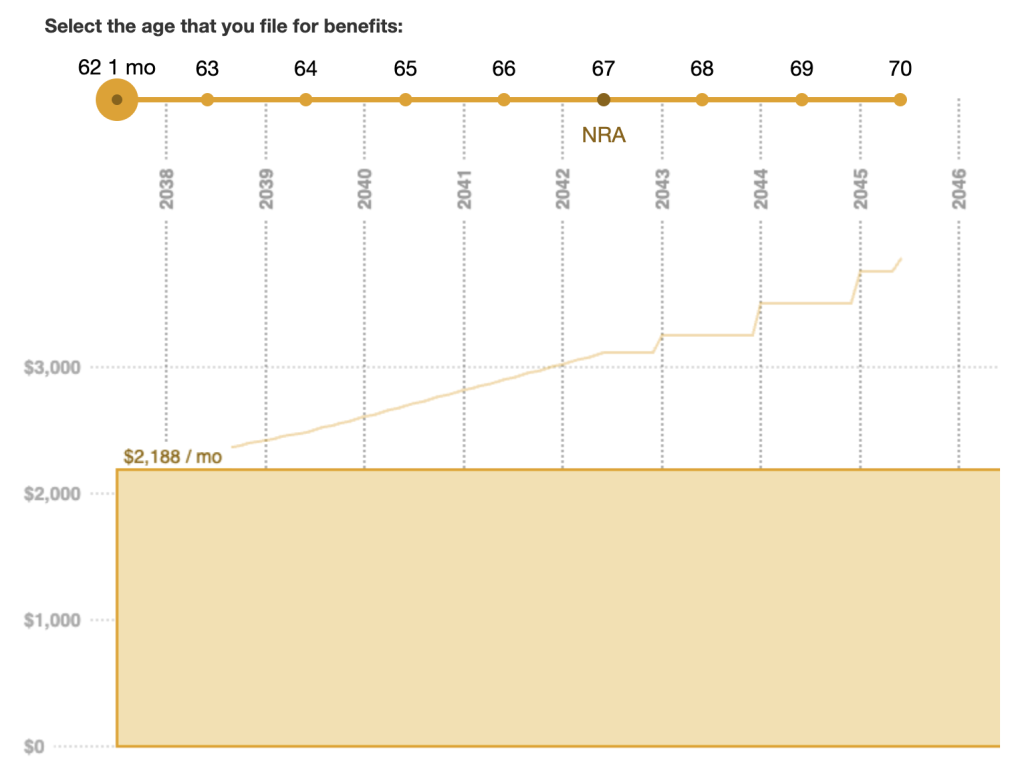

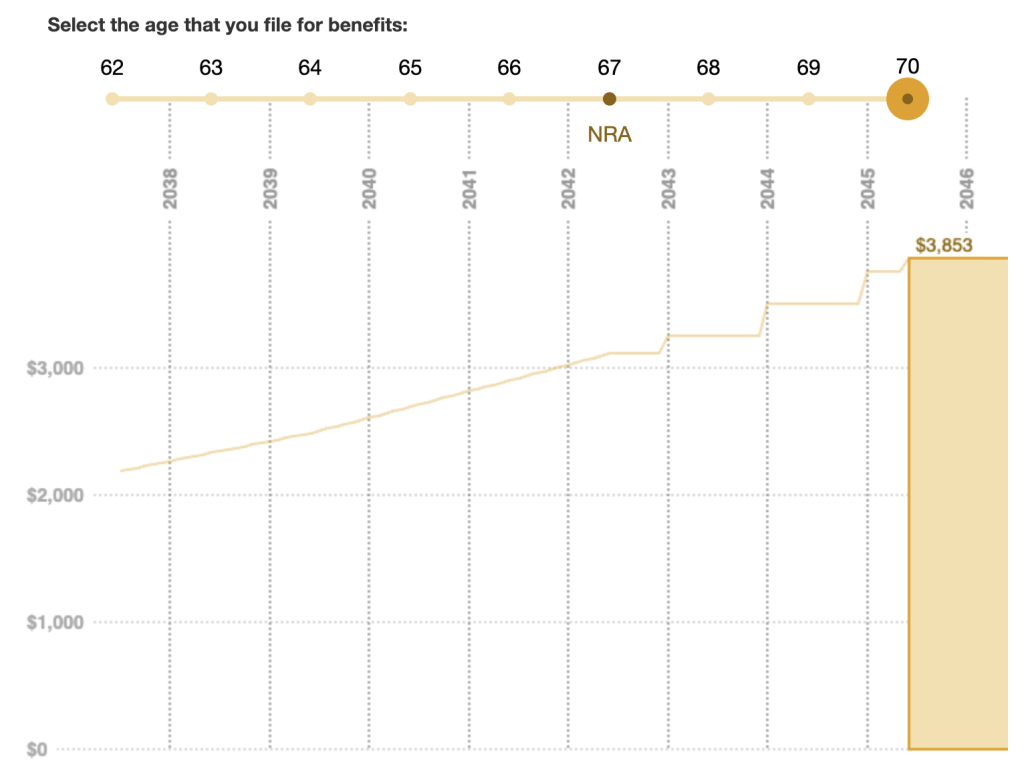

My PIA this year is $3,108. Once you have that, you change the slider (red arrow) on that same calculator page to working zero more years, and it'll then allow the option to use a lower slider on the page to figure out what your benefit would be at age 62 and at age 70 if you never work (and pay Social Security taxes) again.

In my case, it'd be $2,188 at age 62 and $3,853 at age 70. This assumes I quit working today, just before turning 50, which was the month I wrote this post. Note that this is less than the $2,423 (age 62) and $4,521 (age 70) I would get if I kept working and paying into Social Security for 12-20 more years.

Another cool thing on that little calculator is to see where you are on the “bend points” chart.

Once you're past the second bend point, like I am, the bang for your buck on additional Social Security contributions is not very good. Even if I work full-time for 12 more years and pay six figures more into Social Security, my monthly benefit will only go up $250 a month.

Another great free online Social Security resource is Mike Piper's excellent OpenSocialSecurity.com, which will actually provide some recommendations about when to take Social Security.

A Few Adjustments and Assumptions

If I retired now at age 50, my actual benefit amount at age 70 will be just $3,853 per month, or $46,236 per year. Let's assume half of my benefit is more than Katie's benefit (it's not actually true anymore, but let's not make this more complicated), so that's really $69,354 per year we'll start getting at 70. OK, technically mine will start coming in before hers, but we're going to ignore that for simplicity. We're not quitting work this year either.

Let's do a hypothetical. Let's say we're going to work until age 60 and that our combined benefit at age 70 if we do that is $75,000 per year. THAT is the number we need to cover from age 60 to age 70, and we need to do it in an inflation-adjusted way.

More information here:

5 Reasons to Not Give Up on Social Security

What's the Best Age to Take Social Security?

How to Cover the Gap

Now, let's say we have a $4 million nest egg. If we were 70 and thought 4.5% was a reasonable withdrawal rate and we were getting $75,000 a year from Social Security, we could spend $4 million x 4.5% = $180,000 + $75,000 = $255,000 per year. That $255,000 needs to cover EVERYTHING—including advisory fees, taxes, and charitable giving, not just our living expenses. But we're not 70 in this hypothetical example. We're 60. And that Social Security payment isn't coming for another decade. What do we do in the meantime? There are a few options, some of which are better than others.

#1 Keep It in Cash

The first option is to take out that money from the portfolio and put it in cash. Since $75,000 per year for 10 years is $750,000, you take that money out of your portfolio and stick it in a high-yield savings account or a nice money market fund at Vanguard, Fidelity, or Schwab. Every year, you pull $75,000 out of that account (or every month, you pull $75,000/12 = $6,250 out of the account) and spend it. You can also spend part of the remaining nest egg. Since we're starting at a younger age, let's use a 4% withdrawal rate—4% * ($4,000,000 – $750,000) = $130,000 + $75,000 = $205,000. That's what you can spend the year you retire at age 60, with $75,000 coming out of the $750,000 Social Security replacement fund and the other $130,000 coming out of the remaining $3.25 million portfolio.

What's the problem with this solution? Leaving money in cash for a decade might cause substantial cash drag on your overall portfolio returns. Not to mention, that's a lot of exposure to high inflation. You could withdraw the $75,000 each year plus the earnings from the prior year, but that's not exactly equal to inflation, especially since the annual earnings would go down as the fund is depleted or as interest rates change.

#2 Liability Matching Portfolios

Perhaps a more sophisticated approach is a liability matching portfolio. Instead of just sticking all the Social Security replacement money into a money market fund, what if you divided it into 10 buckets/years and bought a Certificate of Deposit (CD) or a Treasury bond that matures EXACTLY when you need that money? You put 1/10th in cash, 1/10th in a one-year CD or Treasury bond, 1/10th in a two-year CD or Treasury bond, 1/10th in a three-year CD or Treasury bond, and so forth. Then each year, you get whatever that CD or bond is worth PLUS (if you're careful with the accounting) exactly what it paid out in interest over the previous year(s). Theoretically, you'll make more than just cash rates on this money, AND the earnings on it will help make up for inflation over the years.

#3 A TIPS Ladder

The pros out there have been chuckling as they read the last couple of paragraphs.

“What a knucklehead! Why would anyone do this with cash, CDs, or nominal Treasuries when TIPS are available?”

Great question.

Although not necessarily the simplest way, the academically correct way to do it is with Treasury Inflation Protected Securities (TIPS). It'd be 1/10th in cash, 1/10th in a one-year TIPS, 1/10th in a two-year TIPS, 1/10th in a three-year TIPS, and so forth. You no longer need the interest to keep up with inflation; you will get that automatically with the inflation adjustments in the TIPS. You could put that interest into your nest egg or just have it be part of that 4% of the nest egg you're spending each year. You'll owe taxes on both the interest and the inflation adjustments (including some taxes on phantom income), but you can adjust for that.

A TIPS ladder to me is clearly the best way to deal with this issue, and the less you have in your nest egg, the better a solution it is for you.

More information here:

A Framework for Thinking About Retirement Income

Addressing Your Complaints

OK, that seems simple enough, right? But I hear a few complaints out there. Let's address them directly.

I Can't Spend as Much

The first one sounds something like this: “But if I wait until 70, I can spend $255,000, not just $205,000. Why wouldn't I do that?”

Don't be silly. If you wait until age 70 to retire, you can probably spend FAR MORE than $255,000 per year. Not only do you get to leave that $750,000 in the portfolio, but you get another 10 years of compounding. Plus, there are another 10 years of contributing to Social Security, resulting in a higher benefit than $75,000, and another 10 years of contributing to your nest egg. Yes, if you wait until age 70 to retire, you can spend more than $205,000. In fact, you'll be able to spend more than $255,000. It wouldn't surprise me if you could spend more than $400,000 or even $500,000. That's just the effect of more time in the accumulation phase.

But there's a cost. That cost is 10 years of work. And 10 fewer years in retirement. To make matters worse, all 10 of those years are likely go-go years. It's your choice. As boxing great George Foreman said, “The question isn't at what age I want to retire; it's at what income.”

But That's Complicated

Another complaint I hear is that it is a lot of work to build a TIPS ladder. Yes, it's much easier to just dump money into a TIPS mutual fund or ETF. Or even that money market fund. But I think the guarantees are probably worth it, particularly if that Social Security replacement fund is a large part of your nest egg (1/3 or more). There are even websites to help you set up a TIPS ladder, such as Tipsladder.com. You don't even have to open a clunky TreasuryDirect account; you can just buy the TIPS at your brokerage at Vanguard, Fidelity, or Schwab. You can even do it in retirement accounts if you want, although you'll have to manage the tax consequences of withdrawals from a tax-deferred account. And if this is all just too hard, maybe you should hire a financial advisor to help. We have plenty of good financial planners/asset managers to recommend. They're not free, but they do give good advice at a fair price.

I'm Going to Ignore Social Security

A lot of people worry that Social Security is in political peril. While I do not share that worry, given its popularity, it's not impossible that benefits would be reduced or even disappear. The problem with ignoring it, however, is that it may result in you oversaving, underspending, or working longer than you would prefer. I figure that even if you're a super pessimist, don't assume Social Security won't be there; just discount it by 25%. Even when Social Security “runs out of money” in a decade or so, there will still be enough taxes to pay 75% of currently promised benefits without any changes to the program.

If our hypothetical couple simply takes 4% of that nest egg from age 60, without any sort of Social Security fund, they'll be spending $4,000,000 * 4% = $160,000 instead of the $205,000 I think they should be spending. That's 22% less. And off the top too, so it's all the fun stuff.

If you, like most, should delay your Social Security benefit to age 70, I hope you now understand how to live/spend/withdraw between your retirement date and age 70.

What do you think? When do you plan to retire? When do you plan to claim Social Security? What is your plan between those dates?