We sold all of our I Savings Bonds as part of an effort to simplify our financial lives (see #14 in Simplifying Your Financial Life). It wasn't as bad as I expected. This post will explain how you can sell your savings bonds.

What Is an I Bond?

The US government offers two types of savings bonds: EE Bonds (nominal) and I Bonds (inflation-adjusted). You purchase both of them directly from the government at the TreasuryDirect website. I Bonds are a type of inflation-indexed bond, somewhat similar to TIPS. But you can never lose principal on them, you don't get phantom income from them, and you don't pay any taxes on them until you sell. Like EE bonds, you have to own them for at least one year, and you give up three months of interest if you sell them after an ownership period of less than five years.

You can hold the bond for as long as 30 years. I Bonds have two components to their yield—a fixed interest rate and an inflation adjustment tied to the Consumer Price Index for Urban Consumers (CPI-U). So when inflation was high back in 2022-2023, I Bonds looked particularly attractive as investments. At one point, they were paying over 9% risk-free while stocks were tanking. FOMO kicked in, and we decided to make our financial lives more complex to earn 9% on a very small part of our portfolio.

More information here:

I Bonds and TIPS: Which Inflation-Indexed Bond Should You Buy Now?

Why Are You Selling Your I Bonds?

I Bonds sound pretty awesome, right? Why would anyone want to sell them?

The main problem with I Bonds is that you can only buy $10,000 per year of them. That's fine if you have a relatively small portfolio and start early to invest in them each year. After two decades, you could have something close to a $250,000 portfolio in them. But they just don't work very well in larger portfolios. The limitation is actually per person or entity, meaning you and your spouse and your trusts and your businesses can all buy $10,000 worth of I Bonds each year. That's what we did for a few years starting in 2021.

But you have to manage a separate account for each entity. And even when you add it all up, it still wasn't enough money to move the needle for us, so we decided to simplify. By dumping I Bonds and transferring the handful of individual TIPS owned in one of the TreasuryDirect accounts, we could close three financial accounts. The good news is that the dumping of the I Bonds is WAY easier and faster than the transfer of the TIPS to our Vanguard brokerage account. It took less than five minutes total to sell all the I Bonds across three different accounts. We'll just move that money into the TIPS ETF (SCHP) we use to keep the portfolio balanced.

Note that there is a relatively new method of buying “unlimited” I Bonds (via a gift box), but it initially appeared to me that you can still only deliver $10,000 to a recipient per year. It still would take 30 years to deliver $300,000 worth of I Bonds to your spouse, even if you can buy them all up front. And since they only last 30 years, it's clearly not unlimited, even if it does make I Bonds a little better option for some people.

However, in further correspondence with a WCIer, he informed me that, at least currently, there is no annual limit on how many I Bonds can be delivered in a year, although you can only deliver $10,000 per day. I asked him to submit a guest post on it. In reading more on the TreasuryDirect Gift Box FAQ, there are a few other hassles to know about, but it appears that you can buy an unlimited amount of I Bonds right now via this loophole. I wouldn't be surprised to see it close, and we're still happy to eliminate three accounts from our lives, even if the main reason we're dumping these I Bonds apparently does have a workaround. But this could definitely change the calculus for others, at least as long as this loophole remains open. Hopefully, it just gets expanded rather than closed.

How to Sell Your I Bonds

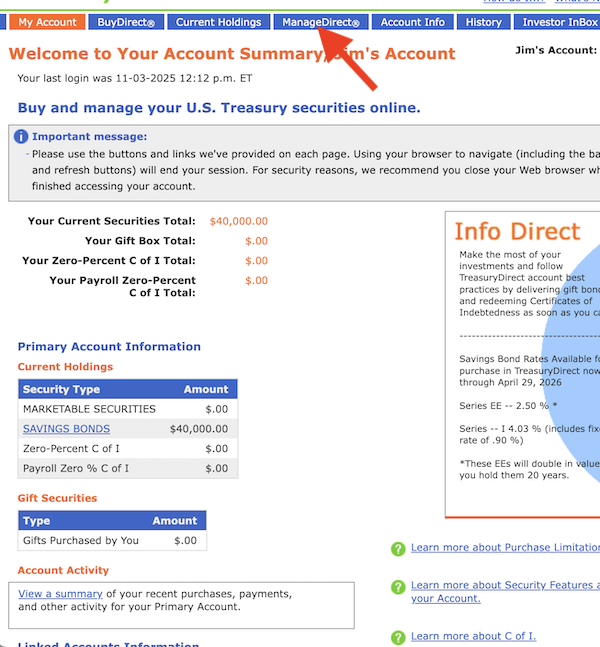

Log in to your TreasuryDirect account using your username, the “OTP” emailed to you, and your password. Your screen should look like this.

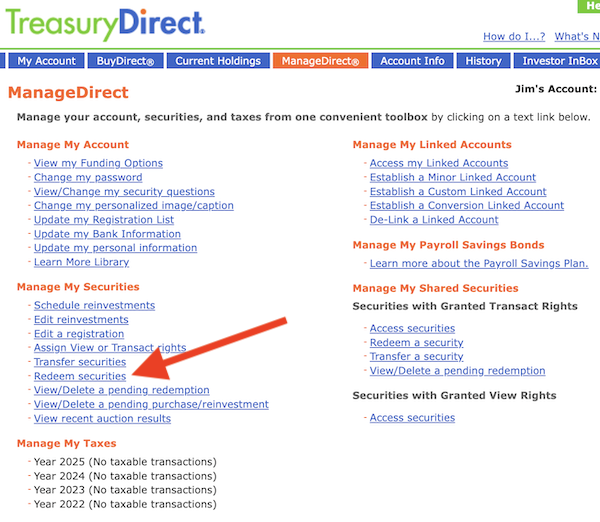

Click on the “ManageDirect” link, and it'll take you to this screen:

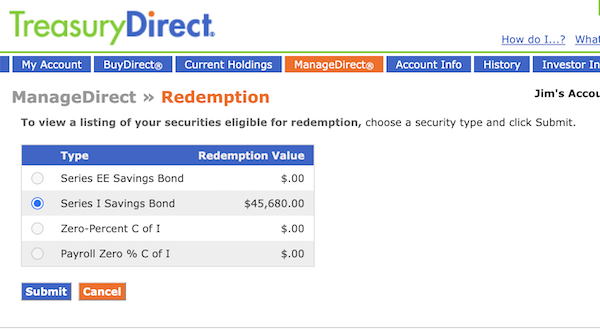

Click on “Redeem securities,” and you'll go here:

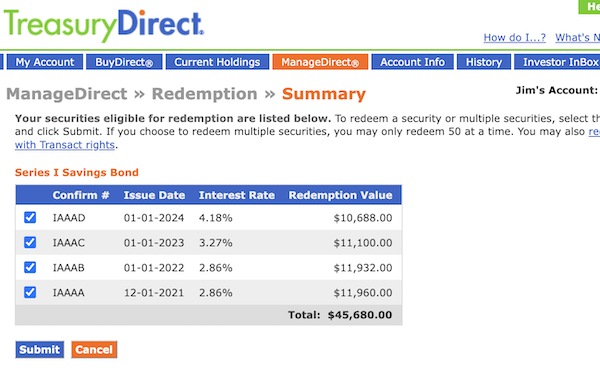

Click on what you want to sell—in this case, the I Bonds, which are all this account owned—and hit “Submit” and you go here:

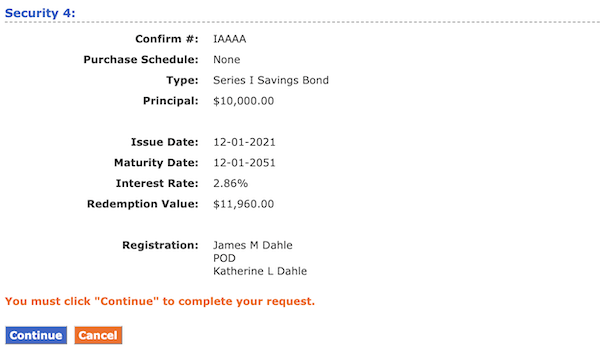

Click the ones you want to sell (all of them in my case), and hit “Submit.” It then gives you a big, long page, the bottom of which looks like this.

Hit “Continue,” and you get a similar page, the bottom of which looks like this:

And you hit “Submit.” Voila—your I Bonds are sold, at least the ones in this account. The confirmation page shows that the money will go to your linked bank account within two business days.

Easy peasy. For all the complaints one hears about dealing with TreasuryDirect, this might be the easiest thing I've ever done there. I cleaned out three accounts in less than five minutes. I'm sure it'll take months to transfer those individual TIPS to Vanguard, though (it took most of a week just to get the Medallion Signature Guarantee required for the paperwork). I guess the alternative is to maintain the TreasuryDirect account we have until they all mature over the next 5-10 years, but I'd rather put in the work now just to avoid ever having to log in again to TreasuryDirect to check on them.

More information here:

How Did We Do with I Bonds?

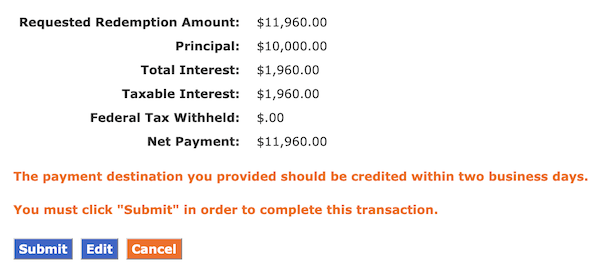

We've now gone round-trip with our I Bond investments. Here are the details from the investing spreadsheet:

We started buying them four years ago, bought some more each January, and sold them all after owning them more than one year but less than five years (so we lost three months of interest for each one). We paid no taxes on earnings as they grew, but now that we've sold, we owe federal income taxes at ordinary income tax rates.

Our total gain was $15,080, for an annualized return of 4.32% before tax. After applying our marginal tax rate of 37% + 3.8% = 40.8%, we earned $8,927.36, an after-tax return of 2.62% per year. Considering inflation over that time period was an annualized 4.18%, it's a little hard to get super excited about that return. Especially if you compare it to large growth US stocks over that time period. I am excited to get rid of three accounts, though.

What do you think? Do you have questions about the process? Are you keeping your I Bonds, or do you want to sell them?