By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderWCI readers love to get step-by-step instructions with great screenshots. They're actually hard posts to write, because, to do them well, it requires the writer to actually make the transaction (or to get screenshots from someone who has). When I do make transactions these days, I'm trying to be more cognizant and to remember to take screenshots. We make at least one donation to our Donor Advised Fund (DAF) at Vanguard Charitable each year; this time, I took screenshots.

Why Donate Appreciated Shares?

The reason to donate appreciated shares to charity instead of cash is that you get to double-dip on the tax benefits. You get a charitable donation deduction for the full value of publicly traded securities owned for at least a year, and neither you nor the charity has to pay the capital gains taxes on that appreciation. It's even better if they're shares that you have tax-loss harvested in the past. You get some extra losses but never pay on the gains when the market recovers. Given the 2022 market events, you may be surprised to hear that we actually had any appreciated shares that we had owned for at least a year. These shares were tax-loss harvested in March 2020, near the beginning of the pandemic, and they have appreciated a lot since then—even with that downturn.

How to Donate from Vanguard to Vanguard Charitable

Let's go through the process step-by-step, so you can see just how easy it is. The first time, you'll need to link your Vanguard account to your Vanguard Charitable account. That's fairly straightforward. It is covered in this post and on the Vanguard Charitable FAQ.

Once you have linked the accounts, making donations becomes even easier.

Note that you do not HAVE to use Vanguard Charitable. The Fidelity DAF doesn't require a minimum balance (Vanguard requires $25,000 to open its DAF), and Fidelity allows for smaller grants (a $50 minimum vs. Vanguard's $500 minimum).

I am told it is relatively easy to donate shares from Vanguard to the Fidelity DAF, although it probably is not as quick and smooth as using the Vanguard DAF.

First, you need to log in to your Vanguard (not Vanguard Charitable) account. You may need to click on the “personal investors” link to get to your dashboard. From there, click on the “Documents” link at the upper right.

It will open up a menu. Click on the link labeled “Tax forms & information.”

Scroll down to the bottom of the page, find the link labeled “Vanguard philanthropic center” and click it.

That will take you to this page.

Click either link; it goes to the same place. On the next page, select your DAF with a radio button and then hit “Next.” I guess maybe some people have more than one Vanguard Charitable DAF. We don't.

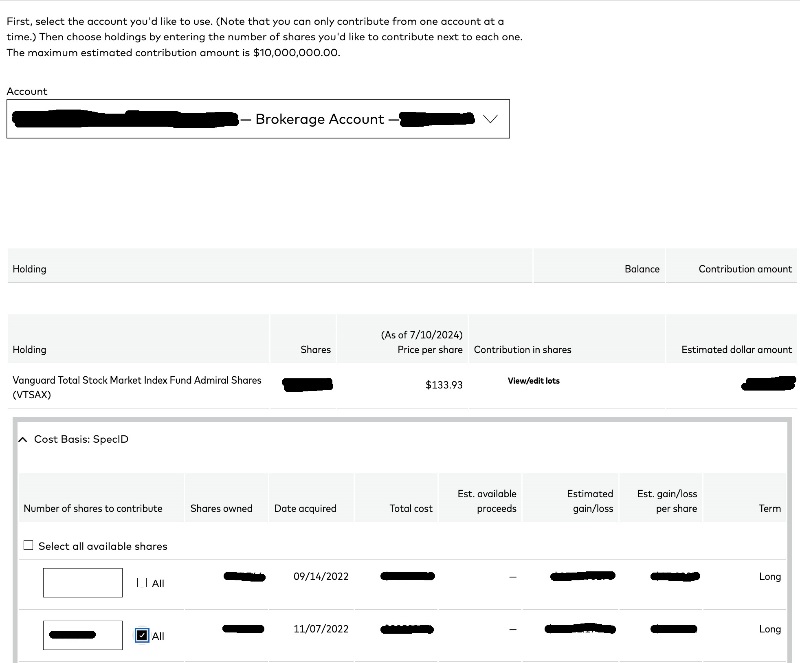

Now, we're getting into the action. Select which brokerage account you want to donate from with the drop-down menu. You'll need to accept a consent agreement if this is the first time. If this is a jointly owned account, the other person may have to give permission for you to donate from this account by logging into their account and checking their messages.

Now, you select the investment. Then, select the number of shares and hit the “Next” button.

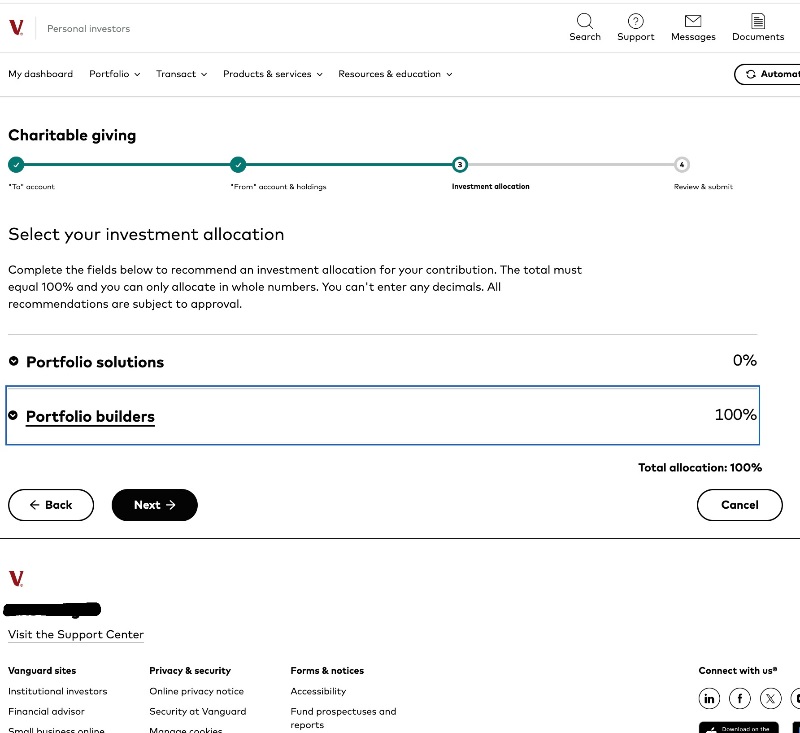

On the next page, you decide how to invest the money at Vanguard Charitable (and it tells you what your current asset allocation there is).

There are plenty of options.

If you just run your investments through Vanguard Charitable, like we do, you probably want to just leave it in cash until the grants are made. If you leave money in Vanguard Charitable long term, you should probably invest it in something besides cash.

Then, you can give even more to charity (although it won't increase your tax deduction). Hit “Next” when you're done.

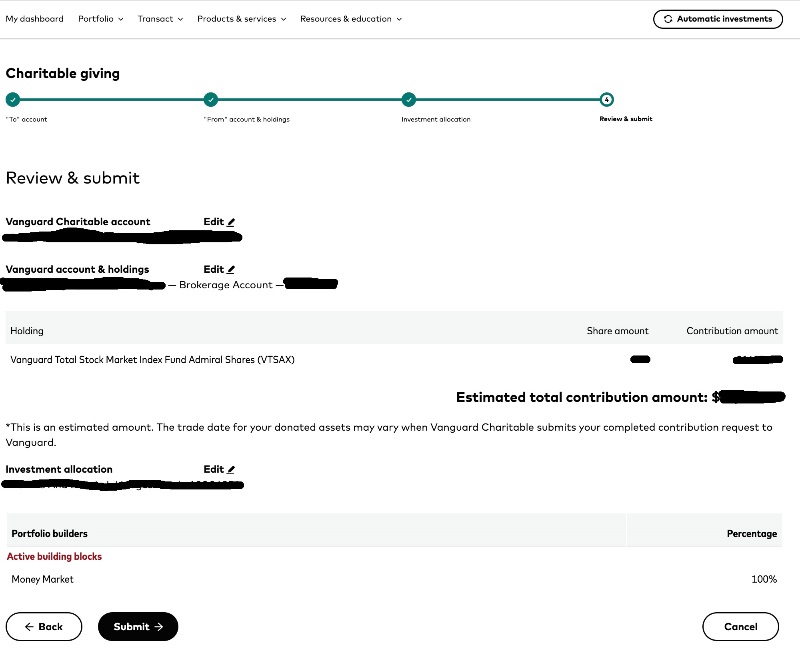

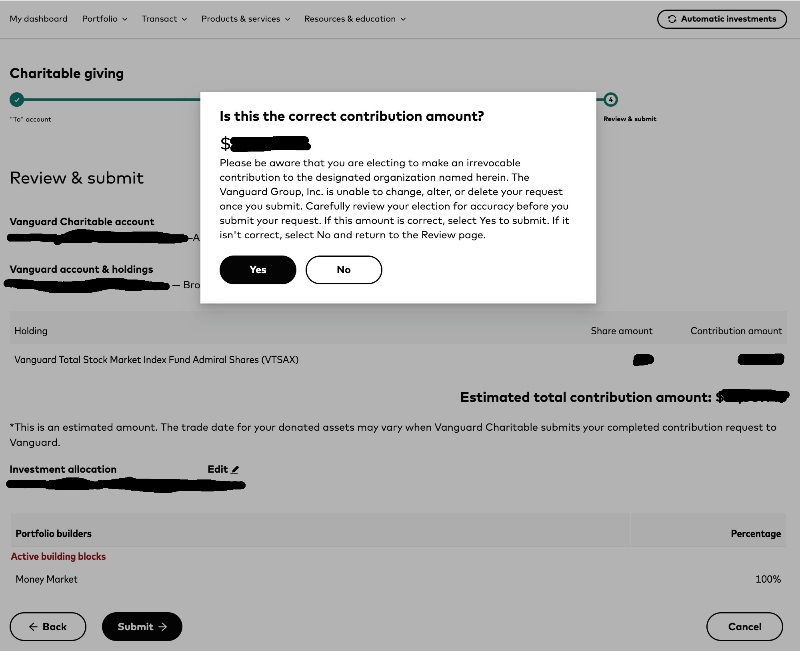

Next is the “Are you really sure you want to give this money away?” page. Note that the amount of the gift is only an estimate. It takes a day or two for this transaction to happen, so you'll end up with a charitable donation deduction that is slightly more or slightly less than the estimate, depending on market activity in that time period.

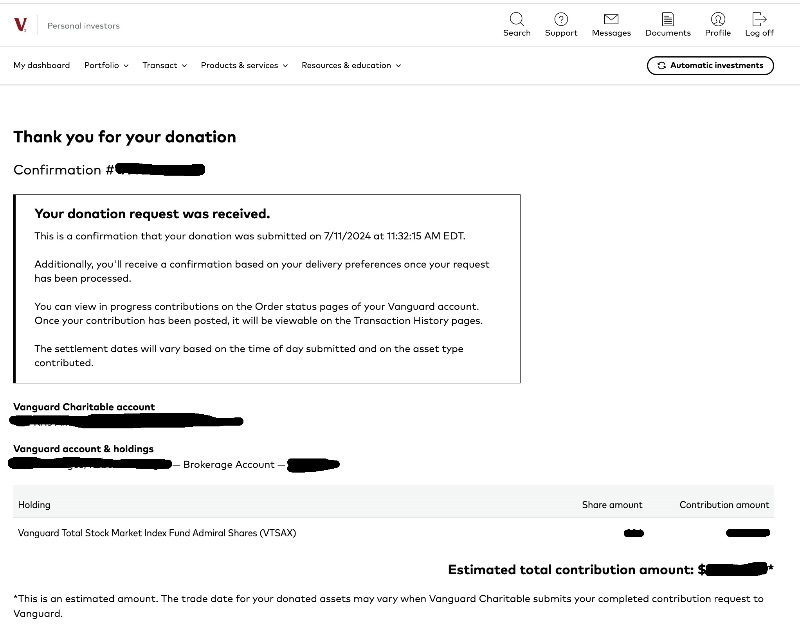

Last, you get the confirmation page. You're done! Well, almost. That money will appear at Vanguard Charitable in another day or two, and you can go in and designate grants to your favorite charities. While it only takes a few minutes for you to do your part online, expect 4-5 working days to get the check out the door at Vanguard Charitable and another week for your designated charities to get your donation.

Part 2 of this post will show you how to make grants from your Vanguard Charitable account. Donating appreciated shares to charity instead of cash saves you taxes, and, in turn, it allows you to give more to your favorite charities. Don't be intimidated by the process. Using a DAF simplifies the record-keeping and allows you to maintain anonymity throughout the process.

What do you think? Do you donate appreciated shares? Why or why not? How do you do it? How do you invest in your Vanguard Charitable account?