It is not much different to do a Backdoor Roth IRA at Fidelity than it is at Vanguard, Charles Schwab, or anywhere else. The first step, of course, is making sure you have both a traditional IRA and a Roth IRA at Fidelity. It should only take a few minutes to open those. Start with the traditional IRA.

Step 1: Contribute to Fidelity Traditional IRA

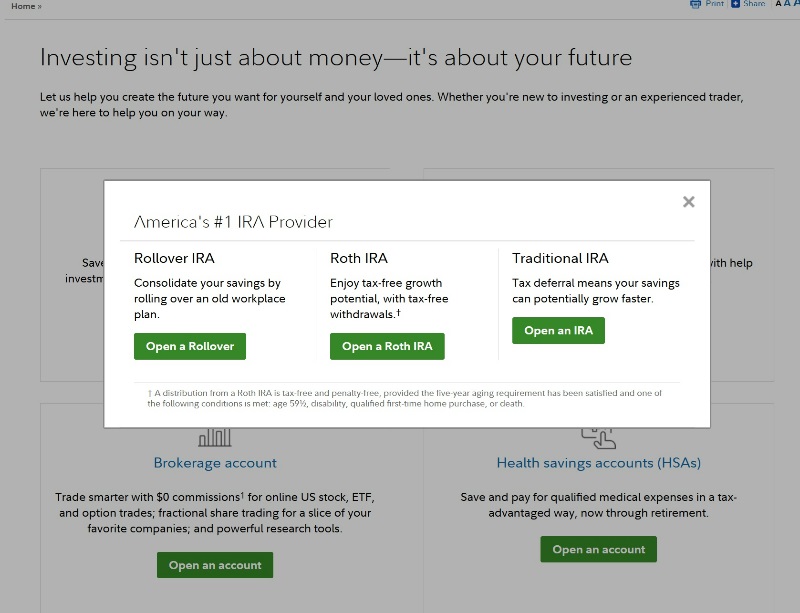

First, log in to Fidelity. Then, click on “Open an account” at the top.

Select “Open an account” in the Retirement & IRAs section, and on the next page, select “Open an IRA” in the Traditional IRA section.

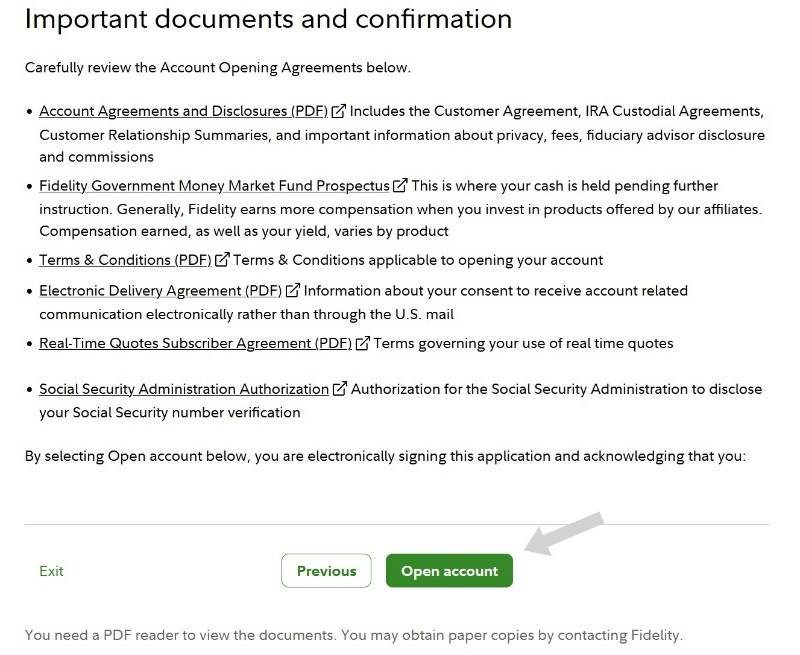

After inputting your personal information, look over the “Important documents” and open the account. Easy peasy.

You should now see it on the left side of the screen with your other Fidelity accounts.

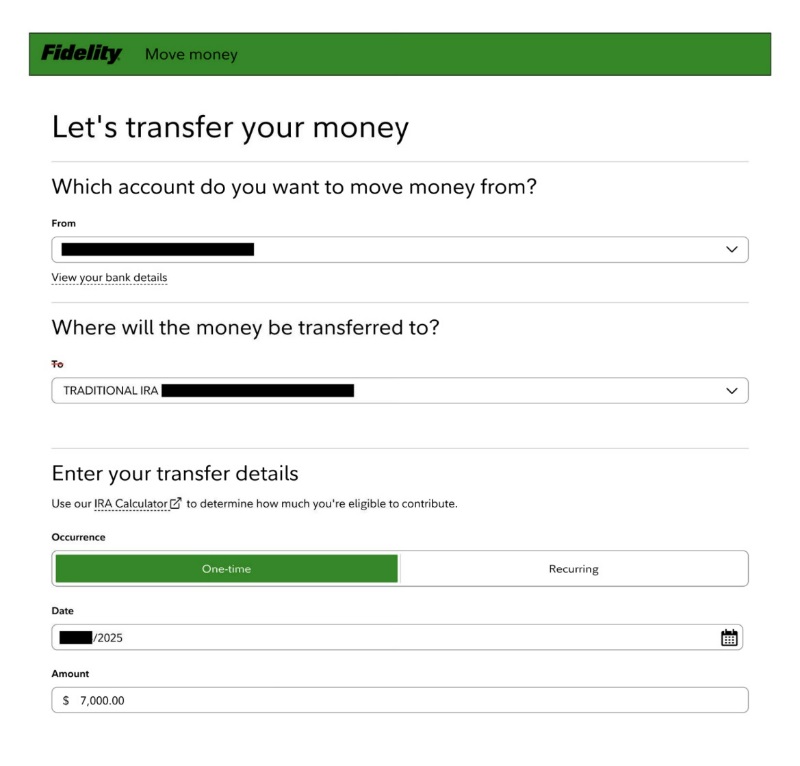

Next, you'll need to fund that traditional IRA. It's easiest to just transfer it from your checking account. Hit “Continue” at the bottom of the page.

Now you have money in your traditional IRA. You'll probably need to leave it in the traditional IRA for at least a few business days (or what Fidelity calls “an extended hold period”) until you can see that money is actually in the account. Below is an old screenshot with the $6,000 total, but be aware that you can transfer as much as $7,500 [2026 — visit our annual numbers page to get the most up-to-date figures] into your Roth IRA via the Backdoor method in 2026.

Now you have money in your traditional IRA. You'll probably need to leave it in the traditional IRA for at least a few business days (or what Fidelity calls “an extended hold period”) until you can see that money is actually in the account. Below is an old screenshot with the $6,000 total, but be aware that you can transfer as much as $7,500 [2026 — visit our annual numbers page to get the most up-to-date figures] into your Roth IRA via the Backdoor method in 2026.

Now, you just need to convert it to a Roth IRA.

Step 2: Convert Fidelity Traditional IRA to Roth IRA

If you don't yet have a Roth IRA at Fidelity, you can open up one from the exact same place you opened up the traditional IRA. This time, click “Open a Roth IRA.”

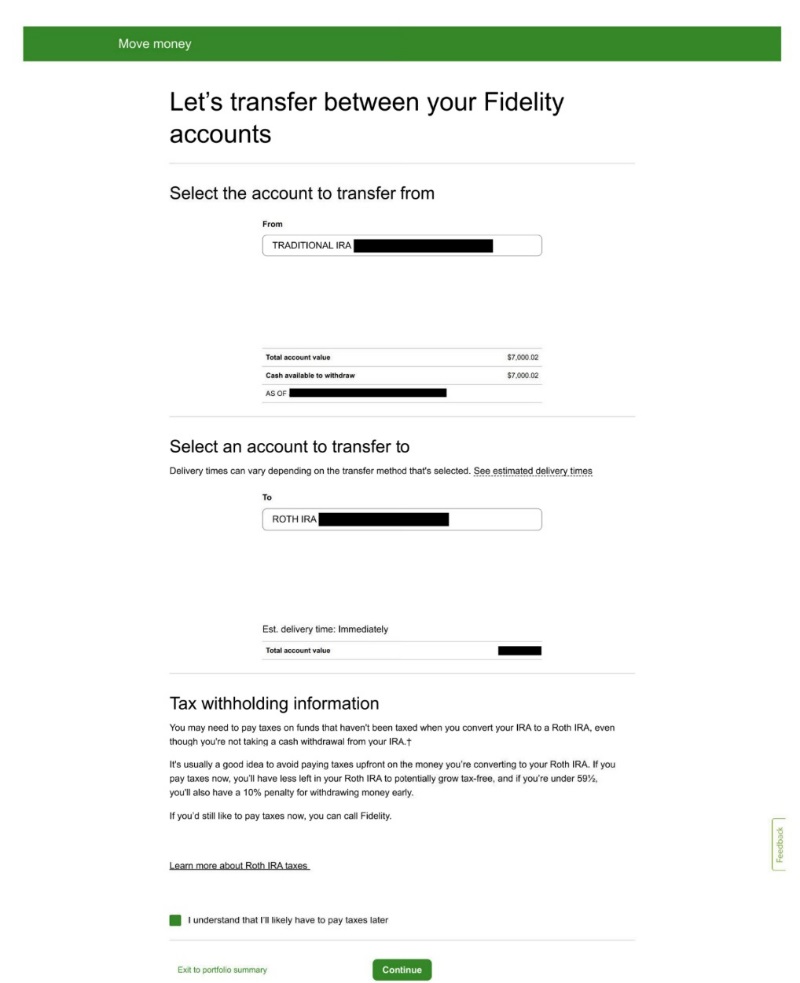

Log back in when the money appears in the Traditional IRA and hit “Transfer” at the top.

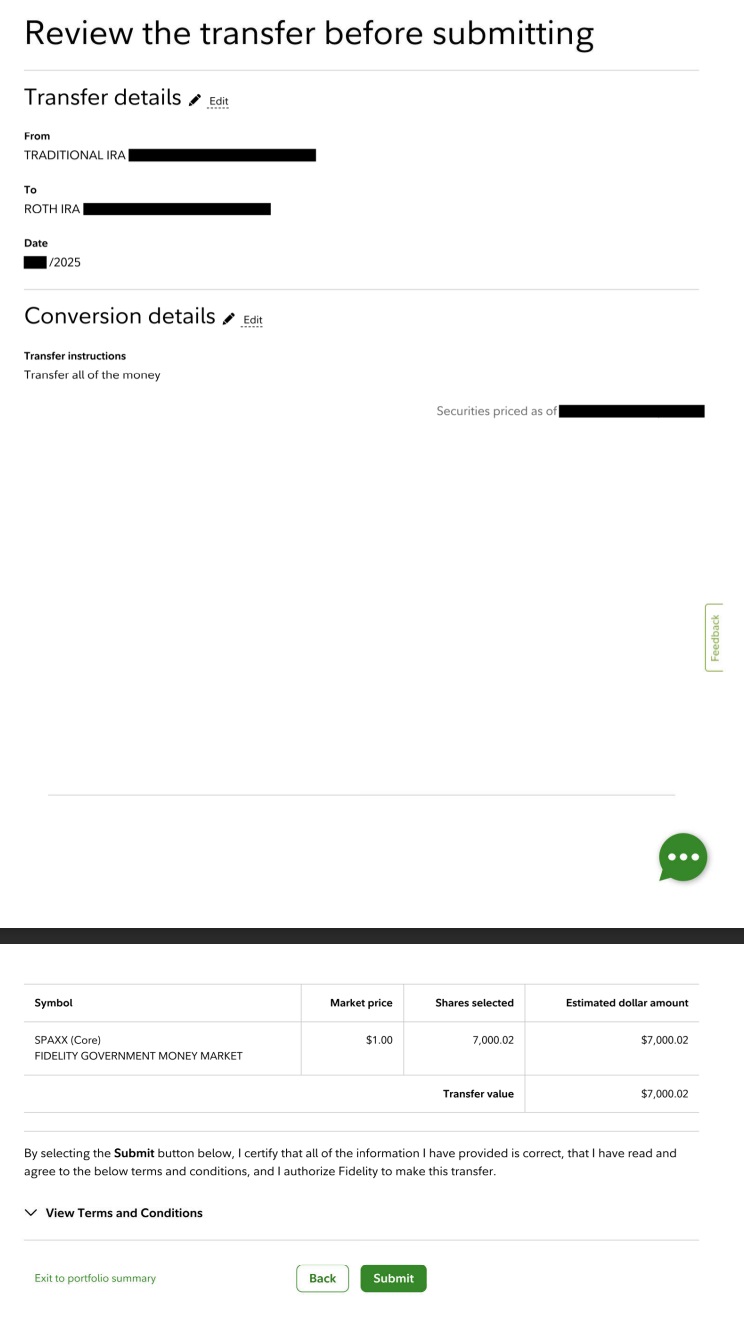

Just transfer the $7,500 from your traditional IRA to your Roth IRA. If there are a few extra cents that you made from interest in the account, don't worry about it. Again, keep in mind that this is an older screenshot with a different amount of money in it. The maximum for 2026 is $7,500.

Do not have taxes withheld because there will not be any due.

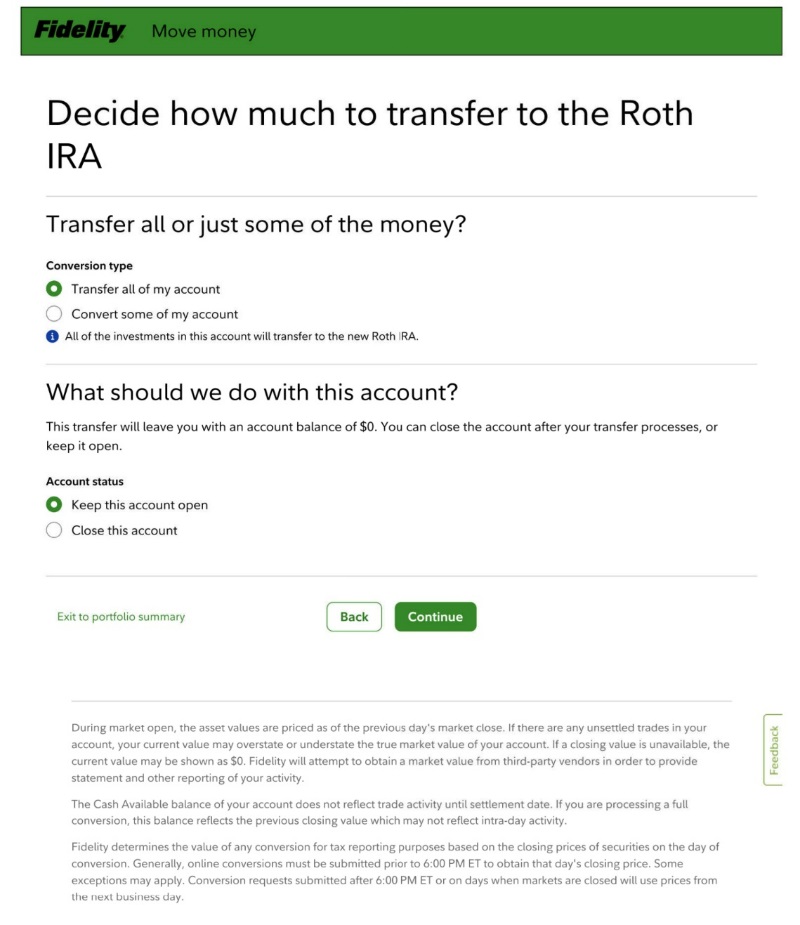

Convert the entire balance. Be sure to leave the account open for next year.

Step 3: Choose Your Fidelity Roth IRA Investments

You can now invest it into your preferred investment within the Roth IRA in the usual manner.

If you have a question about the Backdoor Roth IRA (and not Fidelity specifically), you should FIRST read this very in-depth Backdoor Roth IRA Tutorial before asking your question in the comments below. I promise you there is a 99% chance your question has been answered there.

What do you think? Do you do your Backdoor Roth IRA at Fidelity? Why or why not?