You can find plenty of great reasons to own your own home, including the fact that you can have as many pets as you like, you can paint the walls whatever color you prefer, and the landlord can never throw you out on the street. Financially speaking, there are many significant benefits of owning a home. You can avoid paying rent, you can keep any price appreciation, and you can usually deduct mortgage interest and taxes. Most mortgage payments are fixed, so as the years go by, the mortgage actually gets cheaper on an after-inflation basis instead of increasing with inflation as rent generally does. For most people, a paid-off home reduces required minimum monthly income dramatically, which further reduces the need for disability insurance and life insurance. Plus, you get a larger portfolio nest egg.

However, there are periods in life when owning your home is not such a great financial move. As a general rule, it does not make sense to purchase a home if you will not be in it for at least five years. During a housing boom, you may break even in less time, but in a housing bust, it may take two or three times that for your home to return to its purchase price, much less break even on the deal.

Rookie home buyers nearly always underestimate the non-mortgage expenses of owning a home. These include the transaction costs of buying and selling (expect a roundtrip cost of 15% of the value of the home), maintenance costs (1%-4% of the value of the home each year), insurance, taxes, upgrades, furnishings, landscaping, lawn care, snow removal, and homeowner’s association fees.

Do not borrow as much as the lender will lend you. Just because you can make the payments doesn't mean you should.

A good rule of thumb is to keep your mortgage amount to no more than two times your gross income. In very expensive areas of the country, you may have to stretch that a bit (perhaps to 3x-4x but not 10x), but realize that comes with very real financial consequences—including working longer; having less in retirement or for college; and having less to spend on lifestyle stuff like vacations, automobiles, and toys.

It is a very rare physician who cannot dramatically improve their financial situation by moving inland from the West Coast or East Coast. Another good rule of thumb is to keep your total housing costs (mortgage, taxes, insurance, utilities, maintenance, etc.) to less than 20% of your gross income.

Since doctors need to save 20% of gross for retirement and may pay 30% of gross in taxes, they cannot spend the 30%-40% of gross on housing that a bank will lend them and expect to live “the good life.”

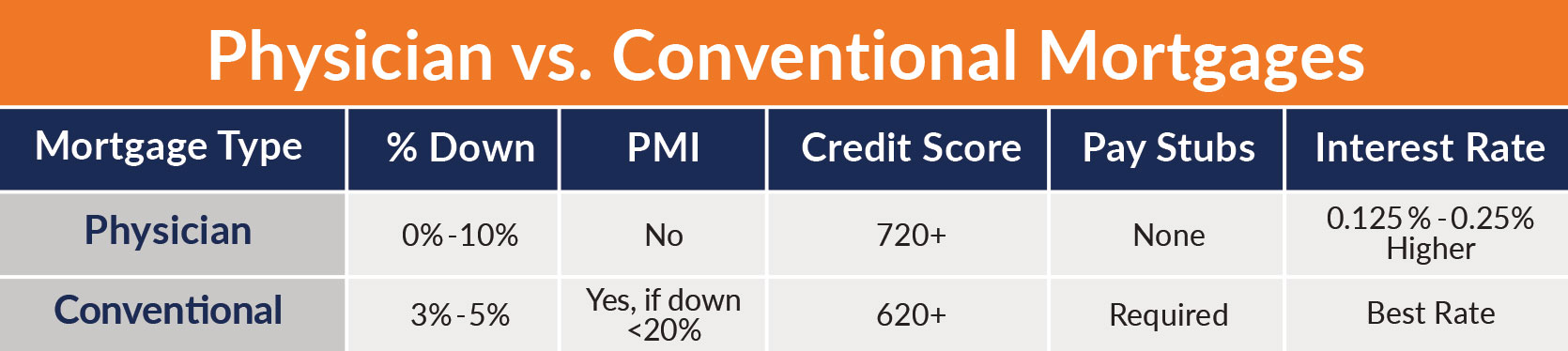

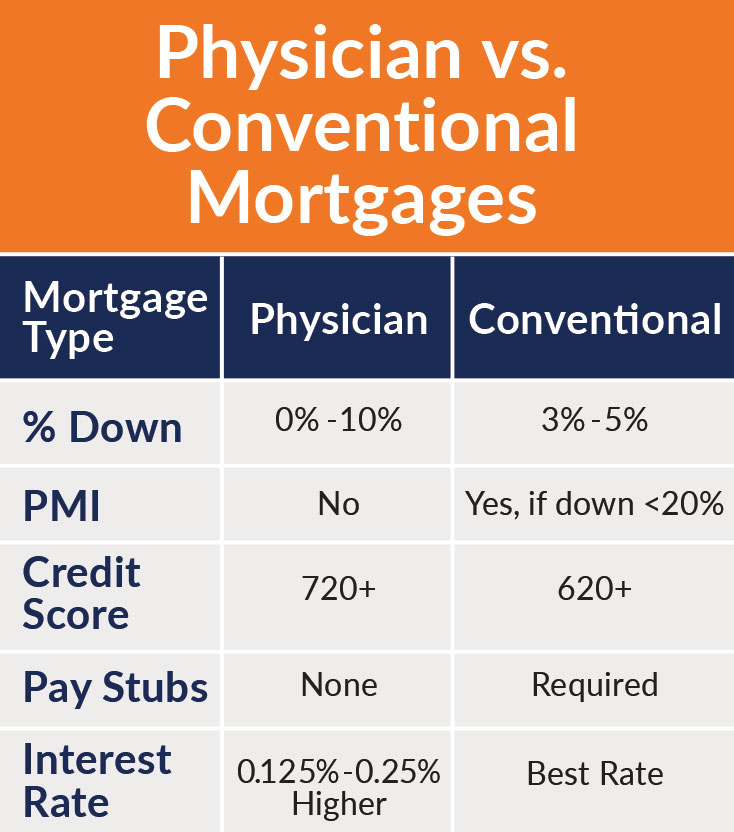

A physician or doctor mortgage is a special loan program that a lender puts in place to attract high-income clients by allowing healthcare professionals, such as doctors and dentists, to secure a mortgage with fewer restrictions than a conventional mortgage.

Common restrictions doctors run into are:

Enroll in WCI Financial Boot Camp, a FREE educational email series, and learn to convert your high income to wealth

You can unsubscribe anytime using the link at the bottom of any email.

If you've decided to buy a home and you are committed to living in an area for more than five years, you should give serious consideration to putting 20% down and getting a conventional mortgage. The improved monthly cash flow will allow you a great deal of financial freedom and the ability to invest (and even spend). You'll save hundreds of thousands of dollars on interest over the life of the loan—and it’s all a guaranteed return, unlike investing a potential down payment elsewhere. But if, for whatever reason, you're going to buy a home AND you can't or don't want to put down 20%, a doctor's loan is a reasonable option and at least as good as the other non-20%-down options.

Conventional mortgages are loans that are not guaranteed by the federal government. They are often the best choice for a mortgage, as they generally offer the most options (30-year fixed, 15-year fixed, ARMs, etc.), the lowest fees, and the lowest interest rates. However, conventional mortgages require proof of earnings and a substantial sum of money to put down. That money, of course, becomes unavailable to invest or pay down student loans.

Conventional LoansPhysician Loans

While everyone's situation is different, most medical residents probably shouldn't buy a house. Here are a bunch of reasons why.

There are three primary reasons that people refinance their mortgage: to lower their monthly payment, to lower their interest rate, or to take equity out of their home and use that cash for something else.

Remember, though, refinancing your mortgage is not a free service. You’ll have to pay many of the same fees you did when you got your original mortgage—including application fees, title insurance, appraisal fees, and closing costs. If your original mortgage has a prepayment penalty, you might get stuck with that as well.

The cost of refinancing a home can vary widely depending on the value of your home and how much money you are borrowing with the new loan. According to Freddie Mac, the average refinance involves paying about $5,000 in closing costs.

But if you can afford to potentially pay more money per month toward your house while cutting your mortgage length in half or if you want to pay less money per month on the same timeline as before with a lower interest rate, then, yes, refinancing your mortgage can be a great idea.

Refinancing your home can help you lower your monthly payment, reduce the overall cost of your home, or turn your home equity into cash that you can use. If you’re in a situation where you can accomplish any of these goals, you should definitely think about refinancing.

Even when purchasing a home makes sense, it is critical to realize that a home purchase is mostly a consumption item, not an investment. Larger homes require more money to heat, cool, maintain, furnish, landscape, insure, upgrade, and clean. Try to buy a home closer to what you truly need rather than everything you could possibly want. Although a mortgage lender may approve you for a home costing 4-5 times your gross salary, you would do well to make sure your mortgage is less than two times your gross income. If you make $300,000, the general rule is that your loan amount should be less than $600,000.

But rookie home buyers usually don’t realize how good their negotiating position is. While there are occasional seller’s markets, home buyers should understand that it’s a buyer’s market most of the time. If you can avoid falling in love with a house, you may be surprised at just how good of a deal you can get on a perfectly acceptable house.

Medical school may not have taught you about money, but we will.

We will never sell your information. Modify your preferences or unsubscribe at any time.

Get ready to take control of your financial life. You can do this, and we can help.

We won't sell your information. Modify your preferences or unsubscribe at any time.