By Dr. Rikki Racela, WCI Columnist

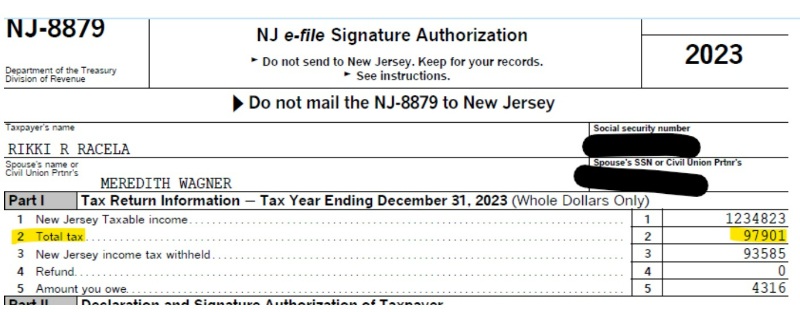

By Dr. Rikki Racela, WCI ColumnistThey say a picture is worth 1,000 words, so let the following picture of my state taxes owed explain why I hate New Jersey:

Yes, you read that right! No photoshopping, no deep faking. This picture shows that my wife and I owed close to $100,000 in New Jersey state tax. That’s a cool $1 million every 10 years going to the Garden State (yes, despite New Jersey having the stereotype of being overrun by pollution, overpopulation, urbanization, and The Sopranos, it is actually nicknamed the Garden State).

That is $100,000 per year not going toward retirements, not going to attaining our financial goals. That’s money we don’t get to blow on an all-inclusive vacation. Wait, check that . . . that’s 5-6 all-inclusive vacations for our family of four—instead of being on a beach sipping margaritas 5-6 weeks out of the year, the great state of New Jersey gets that money.

This wouldn’t be so bad if every state of the union had these same high taxes. But they don’t. If my wife and I were in Florida (or Texas, Tennessee, New Hampshire, South Dakota, Nevada, Washington, Alaska, or Wyoming), there would be no state income taxes.

All else being equal, we would have kept $100,000 more in our pocket to attain our financial goals; to FIRE and take less call (or stop paid work entirely); or, heck, just to blow on two Tesla Model Xs per year. To make matters even worse, New Jersey also has the highest property taxes, according to TurboTax.

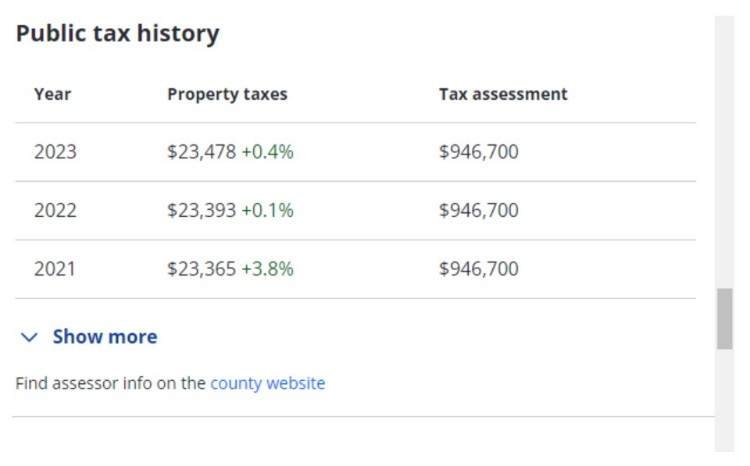

Check out the property taxes I pay on my house (bought for $1.2625 million in 2015):

Since I’m a financially literate WCI columnist, you might be asking yourself, “Why the heck does this so-called expert in physician finance stay in one of the worst states in terms of paying taxes and building wealth?” Great question! In the following paragraphs, I will try and justify why I (and thousands of other doctors not living in no income tax states) make the financially stupid move of not living and having a medical career in Texas, Tennessee, Florida, New Hampshire, South Dakota, Wyoming, Washington, Nevada, and Alaska.

But first, let’s take a look at the financial damage. Instead of going from the good, the bad, and the ugly—like the 1966 Clint Eastwood spaghetti western—we will go in reverse order.

The Ugly

My wife and I have not always made the crapload of income we do now. In fact, 2023 was incredibly busy for me in terms of consultations and hospital coverage, and my wife continued her old anesthesiology position, including taking full call with overnights and weekends (including the horrendous OB call that is the bane of anesthesiologists).

But let’s say for argument's sake that 2023 was typical for us where the $100,000 paid to New Jersey is the usual. Given our combined income was a little over a million dollars, that means about 10% of our blood, sweat, and tears working goes to the coffers of the Garden State. That’s half a day of freedom per five-day workweek that we don’t see. Add our call schedules to that 10%, and this really gets painful. I work one weekend a month covering my local hospital and rounding on patients, so that’s about one weekend a month where, instead of hanging with my kids, I’m working for the state. My wife’s previous position consisted of 30 weekday overnight calls and 20 weekend calls per year, so that’s about three overnights during the week and two weekends which are spent enriching the Garden State instead of tucking the kids into bed. Yes, time is money, and New Jersey takes a good portion of it.

Now, let’s look at how much money New Jersey is taking in terms of opportunity cost if that money had been invested for retirement. Let’s assume my wife and I would be working for the next 20 years until retirement and that if we weren’t in New Jersey, that $100,000 of tax would have been invested in our 100% equity allocation. Let's also assume a real rate of return of 7%. Using the future value function =FV(7%,20,100000,0,0), you get a value of $4,099,549.23!

Turns out our FI number is actually $4 million. So, we could have retired by simply investing what we pay in New Jersey state income tax. Obviously, we could have retired much quicker if we were living in a no income tax state. Currently, we are investing about $180,000 per year for retirement with a goal of $4 million in today’s dollars. Using the period financial calculation function =NPER(7%,-180000,0,4000000,0), we get about 14 years. If we just invested the New Jersey state income tax, then =NPER(7%,-280000,0,4000000,0) is about 10 years. That’s four more years of our lives that we must work until we retire because we live in the Garden State.

As long as we live in this state, my wife and I are delaying retirement for years that might equate to almost the entire elementary school years of our children, more than the middle school years, and about equivalent to their high school careers. That’s a lot of child time that we owe to New Jersey. And every tenth of our hard work is on behalf of New Jersey. This is the ugly part of being in this financially forsaken state.

More information here:

Saving for Your Future Stranger

What to Do If You’re Not on the Same Financial Page as Your Spouse

The Bad

It might not be as bad as the above, but the cost of property taxes is still financially painful (supposedly local property taxes also go toward supporting the school system and the local firefighters and police. The state believes it has the best schools, firefighters, police, public transportation, and road infrastructure in the nation because of its high state and local taxes). I mentioned above that we're paying $24,000 in property tax on my $1.2625 million house. As a comparison, here is a similarly priced property in Austin, Texas, which has been one of the hottest housing markets in the past several years:

Dude, seriously?!? That's about $8,000 less in property tax (in one of the hottest cities to live—according to US News and World Report, Austin ranks No. 9 in the Best Places to Live in the US in 2024-2025). It's expected that if a state has high income tax, it might have lower property taxes to compensate, and if a state has no income tax, it will make up that tax by charging much higher property tax. That's not the case with New Jersey, which has both high income state and property taxes.

If I were to invest that money for retirement =FV(7%,20,8000,0,0), it would equal about $325,000. By the way, there's no place in New Jersey that made the top 100 places to live. Stupid New Jersey!

More information here:

How My State Rewards My Kids for Working

Can You Work in One State and Live in Another?

The Good

After the above dissertation, you might be asking (and I ask myself every April 15), “Why does Rikki and his family stay in the Garden State?” The answer lies in the old adage you’ve likely heard over and over again: it’s because personal finance is personal.

Currently, my wife and I love our jobs here in the Garden State. As a busy neurologist, my hospital still allows me the autonomy to take important vacations with my family and provides a work environment that is manageable without an overburdening patient load. I get to almost set my own schedule, and the hospital I cover is just the right amount of busy. The colleagues I work with are top-notch and are always willing to cover for me. My wife also has just moved into a position where she now takes no call, no holidays, and no weekends. We have a beautiful house in a great neighborhood, and our kids have assimilated nicely into the school system with wonderful friends. Financially speaking, staying in NJ will follow the “one house, one spouse” rule where the costs of selling and buying another house are money down the drain.

As for the past, I am Filipino, a second-generation immigrant where my parents, highly educated with degrees in chemistry and chemical engineering, were unable to secure a job in their home country. Where do immigrants go looking for a better life for themselves and their families? The obvious answer is America, but the specific states are not so obvious.

According to the Census Bureau, the states with the most immigrants are California (26.5%), New Jersey (23.2%), New York (22.6%), and Florida (21.1%). New Jersey is an extremely friendly state for immigrants, which attracted a huge Filipino community that concentrated specifically in Jersey City. Around the time my parents came to this country, the Immigration Act of 1965 was passed, abolishing quotas for immigration where JFK was quoted as opening the country to “. . . those who can contribute most to this country—to its growth, to its strength, to its spirit.”

New Jersey happens to have an immense amount of hospitals within the state, and it's also right next to the cities of New York and Philadelphia. There is a huge pharma company presence headquartered here as well, and that meant jobs for tons of highly educated, English-speaking Filipinos, including my parents. Plus, my cousins and Filipino friends all have congregated in New Jersey. Leaving this state would mean leaving my parents, other extended family, and the Filipino community I grew up with and that holds a substantial place in my heart.

I met the love of my life here as well. She grew up by the Jersey Shore (yes, like the TV show) and also has substantial friends, including her best friend, who still reside in this state. We make frequent trips back to the Jersey Shore on nice weekends over the summer where she grew up. She went to college in New York City, so being close by to enjoy museums or Broadway shows with our kids holds some nostalgia for her.

A substantial portion of our state taxes goes to funding excellent public schools. This will benefit my two children immensely. Despite attending a random New Jersey public high school, I took a plethora of AP courses (including AP Chem, Calc BC, US History, English, Lit, Spanish, and Statistics). There were still a ton more offered that I didn’t take. And this random no-name, run-of-the-mill high school education made me competitive enough to be accepted to Princeton and prepared me for the academic rigors of college and medical school.

I can’t say that my career path would have gone down the crapper if I had attended a no income tax state public school. Some of you reading this column are awesome healthcare professionals who attended public school in these states (including the owner of WCI). But New Jersey and other income tax states spend so much more money on K-12 education. According to the Census Bureau, New Jersey spent $18 billion on educating 1.4 million K-12 students in 2022, while Florida spent $22 billion on educating 3.2 million students. Florida spent only a bit more than New Jersey to educate more than twice the amount of students. It’s hard to believe that this type of brute force spending didn’t benefit me somewhere in my New Jersey public school education.

But maybe the most important aspect of why I’m (maybe) OK with New Jersey state income taxes is that our family has benefited directly from health and wellness services that those taxes fund. My brother, who has a decade over me in age, has cerebral palsy. He was my inspiration to go into medicine and to choose neurology. As I grew up, I watched him benefit from services provided by the New Jersey Division of Developmental Disabilities, services that are funded by state tax money. From the braces and canes he used regularly to the special school he attended to the Job Shop program that eventually placed him as a page at our local town library (a position he still holds today), all these benefits didn’t cost my family a dime. They were all funded by New Jersey.

On my wife’s side, my mother-in-law, unfortunately being mentally ill, couldn't care for herself after her brother and primary caregiver passed away while my wife was in college. Having nowhere to go and unable to work due to illness, she resided in an assisted living facility funded by both Medicare and Medicaid, the latter of which takes significant funding from state taxes. I can’t say for sure how the experience of our family members would have been in a no income tax state, but I can for sure say that funding for these programs would not match New Jersey with its high state income taxes.

I must not hate New Jersey that much if I have a picture of this guy in my den.

Is This Like Home Country Bias?

Yes! More specifically, I am likely falling for the familiarity bias described by Amos Tversky and Daniel Kahneman. This would explain why investors prefer to have most of their asset allocation in domestic equities and bonds. Our brains hate to work harder to see if a new situation or object might be dangerous, so we prefer situations or objects that are more familiar. This had an evolutionary advantage where our ancestors would avoid potentially fatal scenarios by sticking to the familiar situations that they knew they had survived before. The processing of familiar things runs through the amygdala—a System 1 structure requiring minimal brain power and cognitive processing—while unfamiliar things run through the frontal and parietal cortical structures of the brain, areas associated with higher energy demanding System 2 processing.

Yes, staying in New Jersey helps me avoid the brain pain associated with moving, but unfortunately, my family and I pay the price. But I think it runs deeper than just decreasing the cognitive load by remaining in familiar surroundings. It’s the beautiful house and the wonderful town that my family has become integrated in, it’s the nostalgia of being in the state my wife and I grew up in, it’s the family and friends that still live within the state that I get to visit and remain in their lives and build memories.

And yes, it costs money, about $100,000 per year. But for my family and I, it’s worth it, and we are still hitting our financial goals. This is why I love New Jersey.

What do you think? Am I financially stupid for not practicing geoarbitrage? Is it worth it to live in a high income tax state? Does the familiarity of home justify delaying financial freedom? Do you have any other reasons to justify not being in a no income tax state?