When US persons (citizens, green card holders, or tax residents) receive gifts or inheritances from a foreign person, it may feel like a welcome financial boost. As a doctor, your time is limited, and taxes may not be on top of your mind—especially when receiving a generous gift from parents back home to help with a wedding, pay for school, or buy a first home. But if you're a US person for tax purposes, receiving foreign gifts or inheritances can come with serious reporting requirements, even when there's no actual tax due. While such transfers may not be taxable, failure to properly disclose them can lead to severe penalties.

This post outlines the US tax implications, key filing requirements, and relevant legal authorities that apply when you receive a foreign gift or bequest.

Who Needs to Worry About This?

If you are a:

- US citizen or green card holder, or

- Foreign-born doctor working in the US on a visa but considered a US tax resident (e.g., H-1B, J-1 after substantial presence) . . .

. . . then you are likely required to report foreign gifts and accounts, even if you think the money is not “income.”

Scenario: A Gift from Family Back in the Home Country

Let’s say your parents in India send you $120,000 to help pay for your wedding or tuition. You didn’t earn it. It’s not income. But from a tax perspective, that’s considered a foreign gift, and it triggers US reporting requirements.

Key Filing Requirement: IRS Form 3520

US persons receiving foreign gifts may be required to file Form 3520. Failure to report such gifts can trigger a penalty of up to 25% of the gift amount.

- When it’s required: The filing of IRS Form 3520 is required when you receive more than $100,000 in a calendar year from a foreign individual (like your parents or relatives). The threshold is lower if the gift is from a foreign corporation or foreign partnership—a low $20,116 (2025 threshold).

- Deadline: Due at the time that the income tax return (including extensions) is due.

- Why it matters: Failing to file Form 3520 can result in penalties of up to 25% of the gift amount.

In addition to Form 3520 for a foreign gift, taxpayers are often surprised to know that accepting a foreign gift can lead to other filing requirements. Two such filings are: Foreign Bank Account Report (FBAR) and Foreign Account Tax Compliance Act (FATCA).

The FBAR requirement arises from the Bank Secrecy Act, not the Internal Revenue Code, and it is enforced under Title 31 of the US Code (§5314). It requires US persons to report foreign accounts exceeding $10,000 in aggregate at any time during the year.

FATCA reporting, on the other hand, is required to be reported on IRS Form 8938. Unlike FBAR, this form must be filed with the tax return if specified foreign financial assets exceed certain thresholds.

FBAR: Report Foreign Bank Accounts

If your family transfers funds into a joint or foreign bank account you can access—or if you hold signatory authority over a family account in your foreign country—you must file the FBAR (FinCEN Form 114) if the total foreign account balances exceed $10,000 at any time during the year.

The penalty for noncompliance is up to $10,000 per violation.

FATCA: IRS Form 8938

Some accounts that are reported on this form are similar to those reported on FBAR but are part of your income tax return with a much broader filing requirement.

It's required that you file if you are unmarried and have foreign assets worth $50,000 or more at year's end or $75,000+ at any point during the year. If you are married, the total value of assets is increased to more than $100,000 on the last day of the tax year or more than $150,000 at any time during the year. The thresholds are much higher for unmarried and married filers if living abroad.

Reportable assets for FATCA include:

- Foreign bank accounts

- Investment accounts

- Foreign pension or retirement accounts

- Some foreign gifts (e.g., trust interests)

More information here:

How Trump’s $100,000 H-1B Visa Fee Will Affect Doctors

A Foreign Gift May Not Be Taxable (But Still Reportable)

In general, you don’t need to pay tax on inheritances/gifts from nonresident family and parents for a wedding, an education, or on property gifted to you located overseas. Thus, most foreign gifts and inheritances are not subject to US income tax, but the failure to report can lead to penalties.

Case Study 1: Dr. L – Home Purchase Gift

Dr. L, a newly practicing cardiologist from Nigeria, received a $150,000 gift from her father to help purchase a home in the US. She did not report the gift on Form 3520 because she assumed gifts were not taxable in the US. A year later, she received a notice from the IRS assessing a $37,500 penalty—25% of the unreported gift. She ended up hiring a tax attorney and successfully reduced the penalty, but the process took over a year and cost thousands in legal fees.

Her case highlights a common issue: many foreign-born physicians unknowingly miss these filing obligations and don’t realize that reporting is required even when no tax is due. With proper guidance up front, she could have avoided the stress, penalty, and expense altogether.

Taxable Income from Gifted Assets

As noted earlier, while gifts received in cash from a non-resident relative or parent are generally non-taxable, the rules are different when the gift comes in the form of income-generating assets. Even though the gift itself is not taxed, any income earned from the gifted asset is fully taxable to the US recipient. This includes rental income from gifted property, dividends from gifted stocks, or interest income from gifted bonds. Capital gains are also taxable if you later sell the asset; you will be subject to US capital gains tax on the appreciation in value.

Case Study 2: George Inherited Real Estate and Missed Filings

In tax year 2022, George’s sister, who was a Czech citizen and lived in the Czech Republic, passed away and bequeathed him some property in the Czech Republic, consisting of a rental property house, several parcels of land, and a few deposit accounts in Czech banks. The total appraised value shown in the Czech Probate Report was about $500,000. After taking ownership of the house and the land, he sold them. George received the proceeds from the sale and deposited the money in his Czech bank account.

In this example, the final determinations are that George omitted the following filing requirements:

Capital Gain

- The sale of the inherited property was not reported in the year it occurred.

- The property was sold, and the potential capital gain must be reported on Form 1040.

- He must amend his return to report potential gain.

Form 3520

IRS Form 3520 needed to be reported in tax year 2022 for the foreign inheritance from a non-resident sibling.

Form 8938 (FATCA)

Form 8938 was required since the foreign account(s) held in the Czech Republic was > $50,000 (single) or > $100,000 (MFJ) at any point. His bank account was more than $500,000.

FBAR Required

FBAR was required in tax year 2022 since the foreign account(s) he held were greater than $10,000.

George was a self-preparer, and he opted not to hire professional help since he wanted to save on the tax preparation and advisory fees. In the end, he learned the hard way, and it cost him thousands of dollars to rectify his tax situation. Let’s discuss his omissions and potential penalties.

Omission #1 IRS Form 3520

George was unaware that he was required to prepare and file Form 3520 for the inheritance in tax year 2022. This is a requirement even though the acceptance of the gift was not a taxable event. Sadly, he did not discover this omission until three years after the gift.

The penalty for not reporting or for reporting Form 3520 late is up to 25% of the gift. It could be as much as $125,000 in penalties for George.

Omission #2 IRS Form 8938

FATCA reporting on IRS Form 8938 was required as George files as an MJF with total value of assets of more than $100,000 on the last day of the tax year or more than $150,000 at any time during the year. The $500,000 value of all foreign assets far exceeded the reporting limit.

The base penalty for not reporting Form 8938 is $10,000 for each 30-day period (or part thereof) with a maximum of up to $50,000. It is also worth noting that the statute of limitations stays open until the taxpayer is fully in compliance.

Omission #3 FBAR – FinCEN 114

FBAR is also required if the aggregate value of financial accounts exceeds $10,000 at any time during the calendar year. In this case, the taxpayer’s foreign account was well over the threshold. The penalty for non-willful violation is up to $10,000 per violation per year. Willful violation is about 10 times higher or 50% of the balance in the unreported account at the time of the violation per year. Criminal penalties could also apply for a fine of $250,000 a year and/or five years in prison.

Omission #4 Sale of Inherited Property and Reporting the Gain

The inheritance was a rental property, and even with a step up in basis with respect to the inherited properties, the taxpayer had capital gains taxes on the sales. That means he was required to amend the 2022 Form 1040 tax return to report the sale. Fortunately, George had a filing requirement and paid foreign taxes in the Czech Republic, so he could offset some of the US capital gains taxes against the foreign taxes paid to avoid double taxation.

The Bottom Line

In general, gifting may avoid gift tax, but it does not avoid income tax or capital gains tax on earnings from the gifted assets. Had George hired an international tax advisor, he would have avoided this debacle. He was smart enough to seek professional assistance, and we applied for the IRS streamline program to circumvent some of the various penalties that he faced.

More information here:

Landing a Physician Job in the US While on a J-1 Visa

IMG Financial Survival Guide to Residency in the US

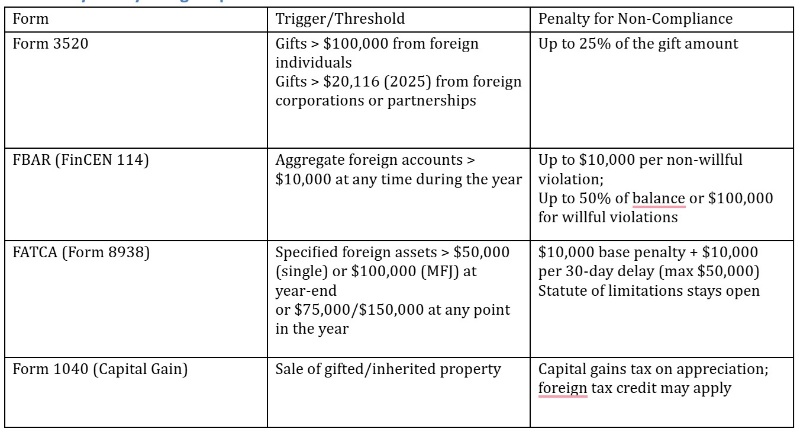

Summary of Key Filing Requirements and Penalties

Tips for Staying Compliant

1. Track all foreign gifts.

2. Ask your family to document gifts clearly.

3. Don’t ignore joint accounts abroad.

4. Use a tax advisor with international experience.

5. Plan ahead.

Common Myths

Myth: “It’s a gift, so there’s no tax.”

Reality: True—but you still may have to file Form 3520.

Myth: “It’s overseas, so the IRS won’t find out.”

Reality: FATCA requires foreign banks to report US account holders.

Myth: “I’m on a visa, so I’m not a US taxpayer.”

Reality: If you pass the substantial presence test, you are treated as a US resident for tax purposes.

Red Flags That May Trigger an IRS Inquiry

- You receive large wire transfers from overseas and don’t report Form 3520.

- Your name is added to a six-figure foreign bank account.

- You report foreign rental income but omit the FBAR or Form 8938.

Closing Thoughts and Takeaway

Doctors, especially those with family ties abroad, often find themselves in tax trouble—not because of bad intent, but because of a lack of awareness. If you have received a large gift or inheritance from overseas or you have access to a foreign bank account, don’t ignore the reporting requirements. Missing a form can result in penalties that exceed the value of the gift. If you are unsure about your obligations, consult a qualified tax advisor with international experience to avoid unnecessary penalties and make sure you are covered.

Did you know about all these IRS forms that need to be filled out if you receive a gift from abroad? Do you know anyone who was caught unaware? What happened?