Suppose that a physician, whom we will call Dr. Sample, was having a nice lunch with friends at their yacht club in Greenwich, Connecticut, when the conversation turned to the subject of malpractice claims and liability protection. One of the doctor’s luncheon companions volunteered that he was in the process of establishing a Domestic Asset Protection Trust (DAPT) to help protect his assets. Dr. Sample was intrigued and wanted to learn more. After lunch, he made a call to his personal financial planner and asked, “Hey, can a DAPT protect my assets if I am sued?”

Understanding Personal and Financial Circumstances

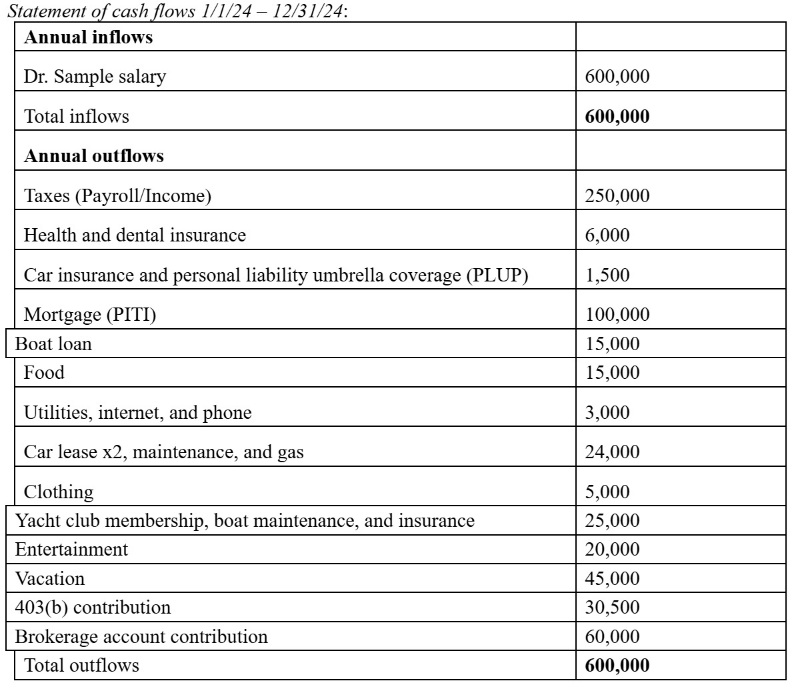

Dr. Sample is a 55-year-old cardiothoracic surgeon with an annual salary of $600,000. His spouse does not work. They have grown children who do not live at home.

- Economic information: Dr. Sample expects inflation to average 3% a year and for his salary to keep pace with inflation.

- Insurance information: Dr. Sample has professional malpractice and personal homeowner’s and car insurance fortified by a Personal Liability Umbrella Plan (PLUP).

- Investment information: Each year, Dr. Sample contributes the maximum to a qualified retirement plan at his nonprofit hospital. He also invests additional savings in a taxable brokerage account. Dr. Sample self-administered a questionnaire that determined a moderate level of risk tolerance in investments. His expected and required rate of return is 8%. He expects to become more conservative as he approaches retirement age.

- Retirement information: Dr. Sample plans to retire at age 67. At that time, he projects that his retirement plans and investments will replace 80% of his pre-retirement salary.

- Estate planning: Dr. Sample and his spouse have a will and no other estate planning documents.

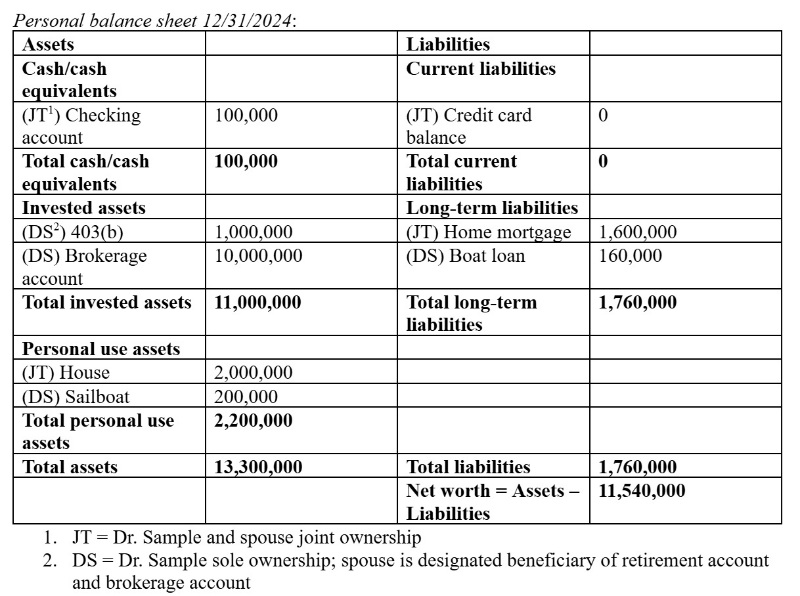

Dr. Sample’s financial planner produced a balance sheet and statement of cash flows as follows.

Identifying and Selecting Goals

- To protect assets from potential creditors during Dr. Sample's lifetime.

- To protect assets from creditors after Dr. Sample’s death and to enhance the lives of his spouse and children through their inheritances.

More information here:

10 Things You Want to Know About Medical Malpractice

What Is Social Inflation, and How Does It Impact the Rising Costs of Medical Malpractice Insurance?

Analyzing the Current Course of Action and Potential Alternative Courses of Action

While he has no known creditors, Dr. Sample would like to further protect his assets in the case of a future lawsuit. His current plan for creditor protection relies in large part on his professional and personal insurance policies. His qualified retirement account provides some creditor protection, as could cash value life insurance and annuities. Connecticut does not have robust homestead protection laws, and it does not allow married couples to title property as a tenancy by the entirety—both of which would offer additional creditor protection.

A Domestic Asset Protection Trust (DAPT) is another option to safeguard assets in the case of a future lawsuit. A DAPT allows a donor to transfer assets to an irrevocable trust established to provide future benefits to the donor and/or other family members. Traditionally, assets in a “self-settled” trust, where one person is both the donor and a beneficiary, would be available to pay claims of that donor’s future creditors. However, state law provides that a DAPT is exempt from this traditional rule, and the donor may also be a beneficiary of the trust without exposing the trust assets to future creditors.

Previously, donors seeking this type of creditor protection needed to establish trusts and transfer assets in far-off jurisdictions such as the Cook Islands or Nevis. Then, in 1997, Alaska passed legislation allowing DAPTs. The state legislature viewed its DAPT legislation as a means to generate trust business and the resulting state tax revenue while also protecting its citizens from the risks inherent in investing assets in overseas trusts. Since then, a number of other states have introduced DAPTs (including Utah, Hawaii, and Virginia) for similar reasons, seeking to generate additional state revenue while lowering the risk for their constituents who formerly needed to use foreign trusts.

While a DAPT may offer strong asset protection, these trusts do not protect assets from known creditors, and a trust-maker also must have sufficient funds available outside the DAPT to pay creditors in any lawsuits that had begun before the creation of the DAPT. Failure to do so would suggest the trust was a fraudulent transfer, and thus, it would be ineffective to shield assets from creditors. Planning ahead is crucial.

Developing and Presenting Recommendations

Connecticut is one of approximately 20 states with DAPT laws. By following Connecticut laws, Dr. Sample may create a DAPT and continue to have rights to benefit from assets that are transferred to the trust. Dr. Sample’s creditors, however, may not access assets that are owned by the trust. The trust will not protect “fraudulent conveyance” of assets from a known creditor before the transfer of assets.

Each state’s law varies for both the requirements for establishing a trust in that state and the creditor protection benefits available under that state’s law. Accordingly, Dr. Sample may consider the pros and cons of establishing a DAPT in Connecticut as opposed to another state. Typically, establishing a DAPT in a given state requires that the donor name a trustee and/or investment manager in that state.

Finally, it is crucial to note that if the donor is a beneficiary of a DAPT, the trust may not be effective to remove assets from the donor’s gross estate at death and, thus, might not reduce any estate tax payable at that time. Other forms of trusts may accomplish the goal of tax avoidance, but those trusts may require the donor to give up more control over and “enjoyment” from the trust than a DAPT does. For example, to exclude a trust from possible estate tax liability, the donor typically cannot be a beneficiary. Trusts may differ in tax consequences, an issue Dr. Sample should discuss with his financial planner and a qualified estate planning attorney.

More information here:

How Physicians Can Prevent Getting Sued

How to Survive a Medical Malpractice Lawsuit

Implementing a Plan

Dr. Sample may engage the services of a skilled estate planning lawyer to design and draft a DAPT, a discussion which should include the pros and cons of establishing a trust under Connecticut law vs. the law of another state. Once a jurisdiction is chosen, Dr. Sample will assign a trustee who is a state resident or a trust company bank with a place of business in the chosen state. Trust assets might include Dr. Sample’s brokerage account and perhaps even his recreational asset, the sailboat. A DAPT may also be funded with a variety of other assets—including cash, limited liability companies (LLCs), real estate, intellectual property, and business assets.

Creating a DAPT is a complex strategy that could easily generate $10,000 or more in legal fees to establish, plus thousands of dollars each year for administration. With a net worth of over $10 million and a higher risk for lawsuits in his surgical specialty, Dr. Sample may well determine these fees to be a reasonable price to pay for the protection afforded by a DAPT.

Monitoring Progress and Updating

After the trust is implemented, the trustee will be responsible for overseeing the investment of the trust assets, record-keeping and administration, and making distributions to Dr. Sample and/or the other beneficiaries of the trust. In addition to receiving creditor-protection benefits and options for estate planning, Dr. Sample can benefit from professional management and the oversight of his trust funds.

The Bottom Line

A DAPT is one potential option for Dr. Sample to accomplish his main goal of asset protection, and it may contribute to preserving his financial legacy. Dr. Sample should further discuss the concept with financial, tax, and/or legal advisors and carefully consider the pros and cons of establishing a DAPT in Connecticut or another jurisdiction.

Do you use a DAPT? What are the benefits for you? Are there any downsides?

Disclosures: Marc Brodsky, MD, is a Registered Representative with Avantax Wealth Management Inc. Securities offered through Avantax Investment Services Inc., Member FINRA, SIPC. Investment advisory services offered through Avantax Advisory Services Inc., 3200 Olympus Blvd., Suite 100, Dallas, TX 75019. 972-870-6000. The Avantax family of companies exclusively provide financial products and services through its financial representatives. Although Avantax Wealth Management Inc. does not provide or supervise tax or accounting services, Avantax Representatives may offer these services through their independent outside business. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth Management Inc. or its subsidiaries. This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investments & Insurance Products are not insured by the FDIC or any federal government agency, are not deposits of or guaranteed by the bank or any bank affiliate, and may lose value. Jeffrey A. Cooper is not affiliated with Avantax.