By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderThis is a depressing topic to think about, a depressing post to write, and I'm sure a depressing post to read. I hope nobody ever needs the information in this post. However, statistically speaking, there are some white coat investors out there who will need this post.

In July 2023, a prominent, but young, surgeon was gunned down in an exam room by a patient, leaving his wife and two small children behind. Most young doctors know about The White Coat Investor, so I checked our email list. Sure enough, there was an address on the list with the surgeon's last name and first initial, and our software showed the same hometown for the email address as the deceased. The software also showed he had opened an email from us the day before he was shot. I scanned through the emails he had opened, and I saw at least three in the prior year that included an admonition to buy term life insurance.

He had clearly been a devoted white coat investor since at least 2019. I sent an email to his address, offering condolences to his wife and an offer for the white coat investor community to be of assistance in any way we could. I wasn't sure if it would ever be seen, but it seemed like the right thing to do.

The Importance of Term Life Insurance

As I thought about this terrible incident over the next day or two, I figured a post like this needed to be written. As doctors, we know people die all the time. Sometimes, it is the result of an act of violence. Sometimes, it is an accident. Sometimes, it's just an illness. Financially speaking, it's a massive tragedy to lose an income at any time, but it is particularly bad early in a career when others are depending on your income. There is likely a lot of debt and a relatively small amount of savings.

Thus, the importance of owning a big fat term life insurance policy. How much life insurance should you buy? A large enough policy to replace the earner, financially speaking. That means enough to pay for college. Enough to pay off the mortgage. Enough to support the remaining partner for a number of years and perhaps even for the rest of his or her life. That's a big policy. Certainly, it'd be a seven-figure amount and $3 million-$5 million for many white coat investors. The most we ever carried on me was $2.25 million. But even if one has $3 million, it really doesn't go all that far for a young family that was expecting to have a $500,000 income for the next 30 years. Still, your family will be a whole lot better off with a few million than nothing, so if anyone else depends on your income, go buy a big fat term life policy. This week.

What to Do If Your Doctor Spouse Dies Young

The rest of this post will function as a checklist of what to do should the worst happen.

#1 Do Nothing

There is almost no financial task that has to be done in the first few days or even weeks. You have had an incredibly traumatic thing happen to you. Gather friends and family. Grieve. Get through the funeral. Don't expect things to get back to normal. They won't, and that's OK. In fact, most financial advisors recommend you make no major financial decisions in the next year, and I think that's good advice.

#2 Collect What You Are Owed

Get a copy of the death certificate. Make multiple copies. You will need it to take care of a bunch of financial tasks over the next year or so. But the first ones should simply be getting what you are owed. Since most jobs pay in arrears, you probably have a paycheck or two still coming. Make sure you get them. Find out about all of the life insurance policies that are out there. That may include a small one through the employer. Show the companies the death certificate, and they should get you the death benefits relatively quickly—usually within two weeks and almost always within two months. They may balk if the policy is relatively new (less than two years old) and your spouse died by suicide. If you feel you are being treated unfairly, get an attorney. Get your $225 from Social Security. It might not be much, but it beats a kick in the teeth.

#3 Start Social Security Survivor Benefits

Social Security isn't just a retirement income program. It is also a disability program and a survivor benefit program. If your spouse has at least 40 quarterly credits (10 years of paid work earning at least $6,560 per year), they will definitely qualify for this benefit. But if they're young, they may not need that many credits. The minimum is six credits in the prior three years. Sometimes, the funeral home will report the death to Social Security, but if you need to do it yourself, the number is 1-800-772-1213. It's open 11 hours a day Monday through Friday.

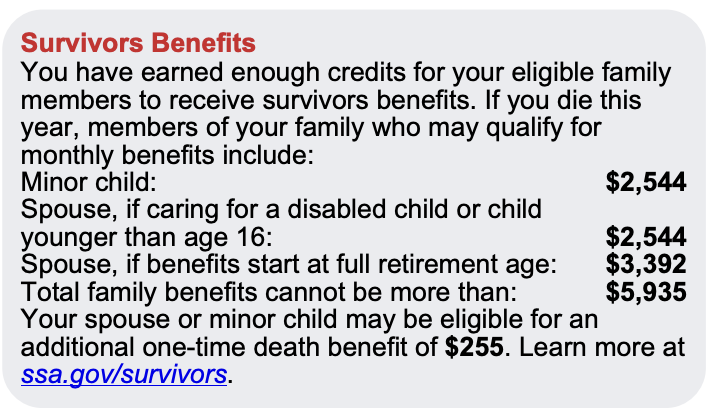

The benefit varies by how much your spouse had paid into the program and whether you have children under 16. Once the youngest is 16, the benefit stops until the surviving spouse hits retirement age. If you're curious what the survivor benefit would be, take a look at your latest Social Security statement. Here's what mine looks like, and I suspect most mid-career doctors have a statement that looks similar.

I have two children under 16, so my family would get the maximum family benefit of $5,935 per month ($71,220 per year). That's hardly insignificant. However, when my 15-year-old turns 16, that would drop to $5,088 per month, and a few years after that when the youngest turns 16, it would drop to $0.

#4 Roll Retirement Accounts into Your Name

There are multiple options of what to do with your deceased spouse's retirement accounts, but most of the time as a young spouse you are going to want to just roll them into your own retirement accounts. Exceptions include if you are trying to do a Backdoor Roth IRA each year and have no 401(k) to roll your spouse's tax-deferred accounts into or if you actually need or want to spend that money before retirement age. This all assumes, of course, that YOU are the beneficiary of the retirement accounts. Most of the time you will be, and if there is no other beneficiary and nothing weird is specified in the will, they'll come to you eventually.

#5 Deal with the Will

Lots of the things you own were probably jointly owned—the house, the main bank accounts, the taxable investing accounts, the cars. You don't have to do anything with them. But anything that's in just your spouse's name technically goes through probate. If you had a simple “I love you” will, what belonged to your spouse will soon be yours . . . as soon as it goes through probate. Which could take a year. If there was no will at all, the intestacy laws in every state give priority to the surviving spouse. But not everybody has a simple will. You could be disinherited. You'd better check.

#6 Start Working on a New Financial Plan

At some point, you're going to need to deal with the finances in a major way. At that point, you've found everything and received everything coming to you. You lost a huge source of income, but you probably have a new, smaller source of income and a large lump sum of money. Your tax bill probably dropped dramatically, too. You'll need to figure out how these new financial realities interact with your new life.

Like any financial plan, the best place to start is determining where you are. That means making a balance sheet (assets and liabilities) and an income sheet (income and expenses). If you're lucky, there are lots of assets and no liabilities, and the income exceeds the expenses. But I suspect most young doctor families who just lost the doctor are not in this situation. Keep in mind that some liabilities get wiped out pretty quickly. Federal student loans go away at death. Sometimes private student loans go away, too. Read the fine print. However, many private student loans are subtracted from the estate before it is inherited. I don't think that they would typically go after jointly owned assets, but I would expect the creditors to want their share of the ones owned only by your spouse and now your spouse's estate.

If your spouse owned a practice or partnership of some kind, any debt associated with that probably disappeared when the practice or partnership was sold. Hopefully, that sale left you a lump sum to add to the nest egg.

Once you know where you stand, you can subtract any income you have (such as Social Security survivor benefits and any paid work you are now doing) from your expenses. Any amount of expenses above and beyond that will need to be paid for by the nest egg. The larger the percentage of the next egg you are spending each year, the less time it will last. If you can take out less than 4% or so, it will likely last the rest of your life. But if you are withdrawing 10% a year, don't be surprised when the money is gone in a decade or two. That might be OK if it gets you to other retirement assets and Social Security. You just have to run the numbers.

#7 Mortgages and 529s

Just like everybody else who stresses over whether to pay off debt or invest, those with a lump sum and a mortgage face a dilemma. Do you take a chunk of those life insurance proceeds and use it to pay off the mortgage so you own the home free and clear? Or do you continue to pay the mortgage bit by bit while leaving the money invested? There is no right answer, but many people buy enough life insurance to pay off the mortgage immediately at death and still leave plenty for the spouse to live on. Paying off the mortgage improves cash flow and lessens the need for income. Leaving the money invested maximizes future flexibility and potentially out-earns the mortgage rate, although at the cost of worsened cash flow.

A similar dilemma exists when it comes to paying for the kid's college. Do you throw $100,000 or even $200,000 into a 529 for each kid, or do you leave the money in a typical taxable investing account to maximize future flexibility? There is no right answer.

#8 Lifestyle Changes

While you should not make any big changes (move, change jobs) in the first few months or even in the first year, you may realize once you run the numbers that your current lifestyle is not sustainable. You may have to downsize, just like many divorcees who go from two incomes and one household to two incomes and two households. If that is the case, it's better to do it earlier than later—before the nest egg has been decimated by a mortgage that's too expensive. You may also find yourself selling a car; getting rid of recreational toys; going on fewer vacations; or, more commonly for stay at home parents, going back to school and/or work yourself.

More information here:

Preparing for Tragedy: Ensuring Your Partner Can Manage Without You

Financial Aspects of Losing Your Spouse

Becoming a young widow or widower is always a tragedy. But there is a path forward. Hopefully, you find some of the above information useful.

What do you think? Have you ever been in this situation? What do you wish someone had told you about the process? How much life insurance do you carry and why?