Like most white coat investors, I want to know when and how I can retire. More specifically, I want to have a detailed and accurate understanding of the pathway to financial independence. As much as this knowledge facilitates an action plan, it reinforces prudent behavior and a sense of autonomy. Even more importantly, I see diligent financial planning, monitoring, and forecasting as habits that will allow my family choices and opportunities in the [nearish] future. Finding the best systems to aid in this process has been a wildly engaging and informative journey.

In Part I of A DIY Investor’s Guide to Retirement Calculators, I explored calculators and services of all stripes—simple, complex, spartan, and beautiful—and briefly explained their function and utility. I encouraged your feedback, and I was not disappointed. Pro tips and suggestions prompted me onward in my quest to find the best of the best. Fascinatingly, this exercise seems to be one that many, many investors have undertaken, one which has led to the creation of software like TCRP and Pralana. My goal in this synopsis is to bring you the best, so that you might thrash less than I have in searching for the best solution for your retirement planning needs.

I won’t be creating my own calculator. While I monitor my portfolio with a book of spreadsheets, there isn’t a cell in my body itching to write my own set of code. I do feel a need to employ a calculator, however, and I understand which features and functions are important to me. It must be robust enough to accurately project growth, spending, and contingencies. It must be utilitarian but intuitive, devoid of nudging advertisements, and trustworthy in its methodology and security. Finally, the value proposition must reflect my desire to remain at the helm of my portfolio management.

With that in mind, I bring to you Part Deux of retirement calculators. I will add a few reviews of what I believe (and what you have told me) are the bigger players and nifty newcomers in this space. I will present my method of analysis and provide a synopsis of why I believe these subjective metrics are important. Finally, I will share a living spreadsheet (I love spreadsheets) with calculators and resources that I have found helpful. This information sharing is enriched by your feedback and input, and I look forward to hearing your thoughts.

A Few More Calculator Reviews

ProjectionLab: This is a thoughtfully designed and elegantly presented online software package. In my trial, I found its interface to be among the very best of all I've encountered. Frankly, there is an Apple-esque appeal to it. Importantly to me, I felt as if this would be an easy tool for my wife to adopt in the event of my demise (or her finally having enough of me). Functionally, ProjectionLab performs well in cash flow and Monte Carlo simulations, with tax planning also baked in. Sharing (for instance, with a financial advisor or as a financial advisor) is readily done. I was also impressed with the robustness of security options. If one opts for a lifetime subscription ($799), they may then become a “private host,” which enables offline access to personal data and advanced encryption and authentication measures. The value proposition for a lifetime membership is lustrous. For an investor 10 years out from their early-ish retirement, this program is a steal (rivaled only by more rudimentary programs like The Complete Retirement Planner (TCRP), which have a much different user appeal). Otherwise, a premium membership (best for individuals who don’t require a lifetime membership) is a modest $9 per month. A Pro version (targeted at financial professionals managing multiple clients) costs $45 per month. Pound for pound, ProjectionLab is a comprehensive program that delivers remarkable functionality for a reasonable cost.

Pralana: This was perhaps the most requested review, and I can see why. Pralana is the result of the monumental efforts of two engineers: Stuart Matthews (whose bio picture is taken in front of an aircraft) and Charlie Stone (a graduate of West Point, an institution with 220 years of tradition unhampered by progress #GoAirForceBeatArmy). Jokes aside, the result of their work is impressive and laudable. I am fond of their origin story and ethos: they are math-oriented folks who encountered a common problem (retirement modeling) and sought to solve it in the simplest way (Excel). Pralana did not disappoint. For those familiar with Excel or any similar spreadsheet, Pralana is a natural progression. Full disclosure: I worked through Pralana Bronze, the free offering. Pralana Gold, the premium platform, is the standard for individuals opting for this software. Pralana is a fully integrated program that projects multiple income streams at modifiable points in the future. Tax strategies, charitable giving, and spousal survival are well within the scope of Pralana’s domain. The interface is rudimentary (though look for the web-based program to be shiny and new), but that also means simple. And what the Excel-based program lacks in intuitive input, the creators more than make up for in support and direction. Manuals and explanations on their forum are easily accessible. Professional versions are available to model multiple clients or if a user wants to model income for family members other than a spouse. Access to spreadsheets is free for Bronze, $99 for Gold. A subscription is required for the online tool, advertised at $119 per year.

Empower: A fascinating mix of banking, investing, planning, journalism, apping (a verb I’ve coined for using their app), and paid wealth management services, Empower's services range in price and dexterity, making it a one-stop shop for retirement planning and execution. Beyond the free calculators, I found it difficult to access their much-touted personal dashboard. While this dashboard does not live behind a paywall, I couldn’t proceed without providing banking information (which I was disinclined to do). In perusing its webpage, there are no advertisements. Instead, much like all of the banks and brokerage houses with calculators that I have reviewed, there are nifty links and segues into paid financial services. Without sampling these services and investment vehicles (which include everything from high-yield savings accounts to annuities), I cannot comment from a position of authority. I can merely reference positive endorsements from some readers of WCI and outlets like Investopedia and the Motley Fool. User reviews are generally positive, as well. For an investor seeking a comprehensive set of tools that dovetail nicely with advisor services—all nestled into a sleek, contemporary interface—this could be a winning option. Personally, it's too much nudging toward paid services for my taste (in fairness, so are all of the banks and brokerages). But it seems to be a reasonable option for reasonable investors.

Investor.gov: This is not a comprehensive retirement calculator. But for any investor looking to row their own boat, those new to the world of personal finance, and anyone looking for a “double-check” on their financial approach and resources, this site is a treasure trove. Created and maintained by the SEC (wait, don’t leave, hear me out!), the site provides simply written resources for investing basics. In addition to some rudimentary (but engaging) calculators, it also houses background information on all registered financial advisors. I can’t imagine why an up-and-up advisor wouldn’t be registered with the SEC, but I am sure there will be reasons detailed in the comments below. (As an aside, I was able to find all of my friends who work in finance registered on the site. I guess they aren’t charlatans, after all.) Being the SEC, there is a tool through which one can report fraudulent behavior, as well. I particularly appreciated the Ballpark E$timate tool, which is referenced on investor.gov but housed on the FINRA website. Further, the resources available to teachers, military members, and veterans are appreciated. While investor.gov doesn’t have everything one would need to DIY their financial independence planning, it will be a primary site to which I refer my family and friends who are new to financial planning and literacy (right after WCI, of course).

More information here:

Social Security Is Not Going Away (But You Might Have to Adjust Your Plans)

Retirement Income Strategies — And Here’s Our Plan for When We FIRE

The Calculator Score

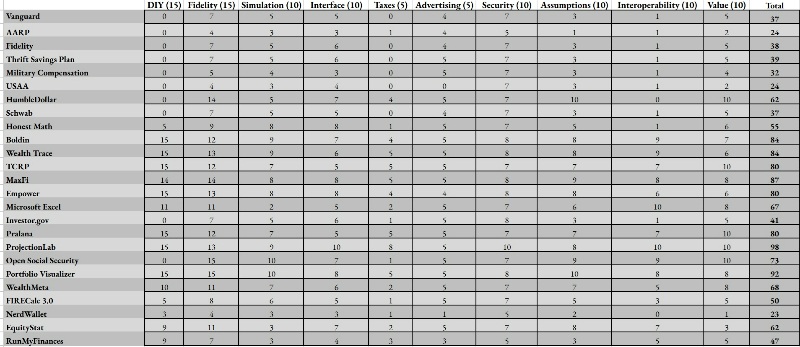

At the start of this column, I shared my needs, wants, and wishes in a retirement calculator. In the process of assessing each tool, I found it helpful to compare them based on a scoring system of my own creation. I went so far as to give it a dumb name like “The Chuck Score” or “The Calculator Calculator.” Seeing just how awful those were, I abandoned the effort, instead focusing on the 10 categories that comprise the 100-point system:

- DIY (15): Can a reasonably competent investor use this tool alone to navigate their retirement planning? For some, this may include paid financial services, as is possible with outfits like Boldin, WealthFront, Empower, and more. For others, a comprehensive calculator, such as TCRP or Pralana, has all the functions one needs. And for a very few savants, Excel may be all that is necessary. Full points were attributed for full functionality for my needs. Notably, some incredible resources on the list (thinking here of Jonathan Clement’s superb HumbleDollar) receive no points since they are not a calculator. This is purposeful: the scoring system is a metric of overall utility and, at a more granular level, a description of how well these resources serve the individual investor in comparison to alternatives.

- Fidelity (15): How accurate are the conclusions? What confidence can be placed in the tool? How comfortable would you be making changes to your retirement plans based on the calculator’s output or the content available on the resource? I’ve been amazed at the variation in predictive values between calculators. Even in my own spreadsheets, the breadth of projections is remarkable. Naturally, the only way to know how accurately a tool illustrated an outcome is for that outcome to have actually played out. However, in running thousands of simulations through dozens of calculators—most of which ran Monte Carlo simulations of varying sophistication—in addition to my own more rudimentary projections, I feel confident in calling out an incongruent conclusion (here’s looking at you, USAA and AARP). A score of 7 indicates the fidelity of a simple, free calculator. More points are given for calculators that take in specific portfolio data and those that have provisions for specific contingencies, such as income changes at various points in retirement.

- Simulation (10): Can the calculator accurately project the impact of events (windfalls, black swans, sequence of returns, etc.) at different points in the investing horizon? A higher score credits a calculator with advanced analytics. Like all of these subsets, this is subjective and imperfect—especially considering that I did not pay to review the more advanced features of the comprehensive calculators. That being said, I doubt many folks are going to take the time and money to test all of these. As such, it's beholden to the producers to convey the novelty of their system’s mechanism. Fancy math isn’t the only litmus test here, either: Mike Piper’s Open Social Security performs well here exactly because of the logic behind its conclusions.

- Interoperability (10): How well can the software integrate information from different sources? Can it be exchanged with a financial advisor or a different platform? Perhaps most importantly, could my loved ones (yes, a few people love me) take data from this platform and interpret it themselves? While more function doesn’t necessarily translate to a higher score, most comprehensive calculators perform very well here.

- Interface (10): How easy is the system to use? How supportive are the creators? How well can my family use it when I kick the bucket? This is also subjective! Some folks prefer the hard comfort of cells and Macros. Others prefer a more polished look. I scored based on my impression of each, and those that I felt my kids could navigate received higher scores.

- Tax assessment (5): Can the system model different tax strategies (such as Roth conversions or the order of withdrawal)? This is a fairly simple metric. I take it on the authority of WCI posters and the experience of others that the tax assessments within each are accurate and useful.

- Advertising (5): Is the user prodded to “upgrade” to a higher service level? Is the software riddled with sidebars and popups? Higher points are awarded for fewer advertisements.

- Security (10): How secure is the data imported to the site? Is the software downloaded to a personal computer, or is it web-based? Are accounts directly linked to the site, and if so, what protections are offered for privacy and security? As a disclaimer, I am not an information security expert. But if I felt uncomfortable going to a site without a VPN, then I probably wouldn’t be putting my information in it. A score of 5 is satisfactory. Conversely, those programs with data encryption and cold storage options (such as ProjectionLab) performed well in this category.

- Assumptions (10): How much does the calculator rely on assumptions to produce its results? How granularly does it query the user to avoid assumptions or at least specify them? Calculators that relied heavily on assumptions (simple calculators) scored lower, with a standard value of 3 for the widely available models. Those resources that either take in a great deal of personal data in their modeling (comprehensive calculators) or whose content is particularly well vetted (Investor.gov or HumbleDollar) scored higher.

- Value (10): Does the functionality of the program warrant the cost? Functionality and quality need not be expensive. A 1995 Honda Civic in fair order can get you across the country as well as a 2024 Ford F-250. The question is not necessarily “will this work” as much as “what works best for me?” And for Chuck Patterson, I want to pay as little as possible for an accurate system that can be easily interpreted (and maybe used) in the event of my demise.

Readers will notice immediately that this scoring system is subjective and weighted according to those factors that I prioritize highest. They can certainly be amended to fit yours, as well. As for further disclosures, please bear in mind that while some programs may have sponsorship affiliations with The White Coat Investor, I am not reimbursed by these companies for my remarks. Finally, this is by no means an exhaustive list, and I would greatly value your feedback with these and other honorably unmentioned calculators.

Thus, I leave you with a parting gift, one that invites criticism and is very much worthy of debate. Behold: the Patterson List, a completely subjective, inherently flawed, but mind-numbingly researched chart of some of the most commonly adopted retirement calculators. It is not comprehensive, and it doesn't even include all of the resources that were researched (just the ones I found most interesting and those by your request). I happily invite you to tell me where and how I was wrong, for the betterment of the readership

[EDITOR'S NOTE: Make sure to click to enlarge the image below.]

Winners and Losers

While a higher score may seem like an acknowledgement of superiority, I cannot stress enough that some fabulous resources score lower simply because they are not comprehensive. HumbleDollar, Investor.gov, and OpenSocialSecurity come to mind. With that said, there are some truly impressive platforms (and some that are not so much).

Highlighting the best of the best: ProjectionLab came in with a nearly perfect score. Its in-depth calculator, easy interface, and utility were exemplary. Boldin, WealthMeta, MaxFI, and WealthTrace would absolutely be adequate as comprehensive resources. Others, too, may prefer platforms like Empower. I would be remiss, once more, if I did not mention TCRP and Pralana. While the scores for these simpler programs are far lower than the bigger players, my financial house would be equally well served by an Excel-based program. This is a testament to the imperfection of the scoring system and the need for the individual investor to adjust it according to their needs and preferences.

There are sites that have less utility, and some that I would shy away from entirely. The major banks and brokerages all have their own simple calculators that lead to paid financial services. In and of itself, this is far from evil. But USAA’s conclusions and nudges were egregiously misleading. I won’t belabor this point, as it was addressed in Part I. I will simply reiterate that USAA, like all institutions, can be great at times and, at other times, well off base.

More information here:

A Doctor’s Review of the Retirement Income Style Awareness (RISA) Profile

The Best Way to Create a Retirement Income Plan (and a $1 Million Example)

The Bottom Line

Of the topics that I have covered in my time writing for WCI, this has provided the most torturous and engrossing rabbit holes. It has certainly given me an appreciation for the problem that many of us will face as we prepare to exit our primary careers: identifying the tools best suited to facilitate our financial goals. As Dr. Jim Dahle says in reference to financial success, there are many roads to Dublin. So, too, are there many tools that will help you find success in the latter portion of your investment career. It is my sincere hope that this series of columns makes that chore just a little bit easier.

What has been your experience with retirement calculators? What's your favorite? What's your least favorite? Do you have any other recommendations?