If no white coat investor ever had to borrow money again, that would be a wonderful accomplishment. However, that's just not realistic. Like with any other financial service (mortgage loans, student loans, car loans, etc.), WCI wants to make sure that if you have to borrow money with a personal loan, you borrow as little as possible for as short a time period as possible from the best companies in the industry. Here’s everything you need to know about personal loans.

Splash is another long-term WCI partner, and it has been very supportive of our mission for many years. Many WCIers have refinanced their student loans through Splash over the years. Splash is a lending platform; it will not be your final lender. Despite this, Jim found the application process to be extremely fast, well-oiled, and intuitive.

Splash can offer the lowest possible minimum loan ($600) with the lowest possible credit score (580) and a loan term of up to 84 months. The maximum loan amount is $100,000. It also loans to H-1B and O-1 visa holders in addition to citizens and residents. If you live in Maryland or Vermont, don't use Splash, but other states should be fine (although Ohio, New Mexico, and Massachusetts require higher minimum loan amounts of $5,000-$6,000). Splash specifically excludes auto and business loans. The lender that Splash connected Jim with (Upstream) did have a 5% origination fee.

SoFi is a well-known brand that has grown up alongside WCI. There are few companies whose C-suite Jim has physically sat down with and lobbied on your behalf for better physician-specific products. SoFi is one of them. He's proud to have helped convince them to offer student loan refinancing products that are appropriate for typical interns and residents to use mostly for their private loans. SoFi also offers lots of other great banking and investment products.

SoFi offers loans in the range of $5,000-$100,000 to citizens and residents in every state (although a few states have a higher minimum loan amount). It has a relatively high minimum FICO score of 680. Let's be honest, though. It is not that hard to get a credit score above 680 if you actually pay your bills for a reasonable period of time. There are no origination or pre-payment fees—or really fees of any kind. SoFi does not specifically exclude any particular use of the loans. As a very techy company, it has a slick and efficient user interface. Jim had his quote in about two minutes. It might take you three if you type slowly.

Credible, like Splash, is a lending platform that will automatically pair you up with lenders, including companies like SoFi. We've also been working with Credible for many years.

Credible lenders offer loans from $600-$100,000 to citizens and permanent residents with FICO scores of at least 640 in every state. When Jim applied, the lender he was paired with (Lightstream) did charge an origination fee, but even so, it had one of the lower interest rates he was offered.

Doc2Doc Lending is a physician-founded personal loan platform built exclusively for doctors. Founded by practicing physicians, Doc2Doc is designed around the real financial realities of medical training and early practice, offering flexible, human-centered financing without the friction of traditional banks.

Doc2Doc provides instant rate quotes and conditional approvals with no hard credit pull at the time of checking your rate, the application takes less than five minutes to complete online. Borrowers can choose 5-year or 7-year loan terms, with loan amounts up to $100,000 for practicing physicians and lower limits for those still in training.

Eligible borrowers include MD, DO, DPM, DDS, DMD, and MBBS, Optometrist, Pharmacist and Veterinarians, as well as fourth-year medical students who have matched. Doc2Doc lends to U.S. citizens, permanent residents, H-1B and O-1 visa holders, and international medical graduates (IMGs).

Minimum credit score requirements are 600 FICO for doctors in training and 650 FICO for practicing physicians. Credit-eligible borrowers pay no origination fees, and no checking account is required to apply or fund a loan. There are no prepayment penalties, and borrowers can receive an autopay interest rate discount of 0.25%.

Doc2Doc currently does not lend in Connecticut, Maine, or West Virginia and has higher minimum loan amounts ($7,000-$11,000) in Massachusetts and New Hampshire/New Mexico.

What continues to set Doc2Doc apart is its service model. Borrowers have access to 24/7 customer support via text, phone, live chat, or email, and the company is known for fast, high-touch communication from a team that understands physician finances firsthand. Doc2Doc holds a 4.9-star rating on Trustpilot, reflecting consistently strong borrower experiences.

Many companies “get” doctors—but Doc2Doc was built by them, and it shows in both the product design and the customer experience.

A personal loan is simply an unsecured loan used for various purposes. Typically, it is a relatively small amount of money ($5,000-$100,000) and for a relatively short period of time (3 months-7 years). It is generally a little harder to get than a credit card. But it generally provides a lower interest rate—usually fixed—and amortizes so the loan eventually goes away, even if you only pay the minimum payment (unlike credit card debt). There is usually no pre-payment penalty (but always read the fine print) and only sometimes an origination fee (again, read the fine print).

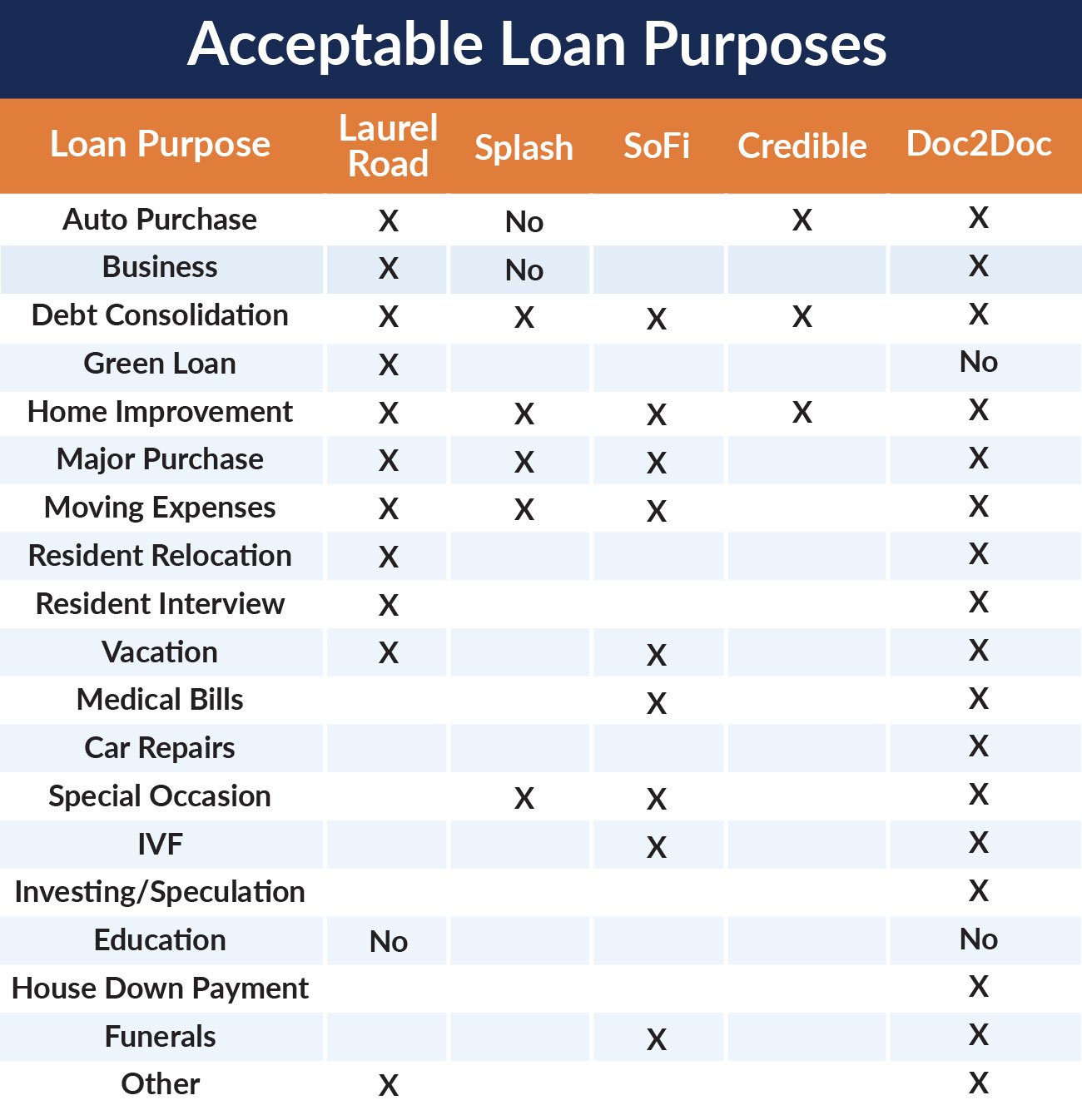

For doctors, personal loans are generally used to solve cash flow problems. The doctor will have the money soon but does not have the money now. Some very reasonable uses for these loans are residency/job interviews and relocation expenses.Although personal loans are far more flexible than student loans, car loans, and mortgages, companies actually want you to tell them why you need the loan. And if you answer the question wrong, they may not loan you the money. Yes, money is fungible (if you use your earned income for home improvements and then use the borrowed money for groceries, it's not like it's a grocery loan instead of a home improvement loan). But in the contracts you sign, it does specify the reason for the loan, and you're only supposed to use the loan money for that purpose. Interestingly enough, not every lender will lend you money for every purpose.

Here are the acceptable loan purposes for each of the companies with which WCI partners.