By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI Founder[AUTHOR'S NOTE: After reading this post, Katie said I should put a disclaimer on the top of it that we're really going to get into the weeds today and if you're looking for basic investing information, this is a post you should skip.]

I received an email the other day:

“I was wondering your opinion on Avantis funds compared to Vanguard index funds. I primarily use Vanguard index funds and a sprinkling of PRIMECAP funds. But I was recently listening to Paul Merriman, and he seems to be a fan of Avantis funds and using factor-based investing.

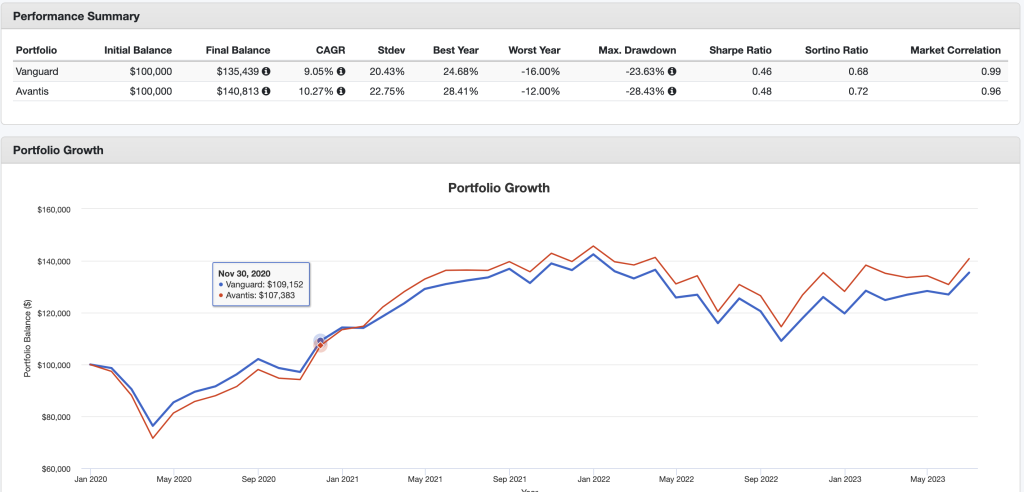

I was comparing (using PortfolioVisualizer) two portfolios. One portfolio with Vanguard index funds (VOO – 60%; VBR – 20%; VXUS – 20%) compared to [Avantis] (AVUS – 60%; AVUV – 20%; AVDE – 20%). This is close to an apples to apples portfolio using Vanguard ETFs and comparable Avantis ETFs. The returns over the longest period of time where data was available have the Avantis portfolio ahead by decent amount. Yes, the Avantis funds have a higher expense ratio, but it is not very high for an actively managed fund. For example, AVUS has ER of 0.15%. The one issue is the data only goes back to January 2020, as that is how far back data for AVUS goes. This analysis is for January 2020-June 2023 due to data constraints.

Just wondering your thoughts on this and with Avantis funds for a portion of the portfolio—for example, the small cap value and international portion of a portfolio. These asset classes are where I saw a larger difference in returns with Avantis funds compared to Vanguard.”

Avantis = DFA ETFs

The best way for those who have been around a long time to think about Avantis is “DFA ETFs.” You can learn more about Dimensional Fund Advisors LP (DFA) in a similar post I did way back in 2013 (DFA vs. Vanguard). For those who have not been around for a long time, DFA is a for-profit mutual fund company that attempted to enhance the concept of an index fund with various improvements. It was a huge believer in the tilting of a portfolio toward the small and value factors (and now the profitability factor). This controversial topic (along with specific discussions about DFA and its funds) used to be commonplace on the Bogleheads forum. However, given the underperformance of small and value over the last 15 years or so and the fact that DFA failed to get into the ETF game when it should have has led to much less discussion.

Apparently, some of the people at DFA were not happy that DFA stuck to its original plan of traditional mutual funds distributed via specifically educated advisors, so they left and started Avantis. Consider the principals.

CIO Eduardo Repetto, PhD: Prior to Avantis Investors' establishment in 2019, Eduardo was co-chief executive officer, co-chief investment officer, and director at DFA until 2017. While at DFA, Eduardo provided oversight across the investment, client service, marketing, and operational functions of DFA. He also oversaw its day-to-day operations and directed the engineering and execution of investment portfolios, and he was involved in the design, development, and delivery of research that informed the firm's investment approach as well as its application through portfolio management and trading.

COO Pat Keating, CFA, CPA: Prior to Avantis Investors' establishment in 2019, Pat served as chief operating officer at DFA, including all of their subsidiary companies globally, from 2003-2017. Pat oversaw DFA’s day-to-day business and managed growth plans and capital investment.

Chief Investment Strategist Phil McInnis: Prior to Avantis Investors' establishment in 2019, Phil was a vice president and head of portfolio solutions at DFA in Austin, where he oversaw a team charged with developing content to explain Dimensional's investment approach and helping clients on topics related to asset allocation, manager evaluation, and risk budgeting.

Senior Portfolio Manager Daniel Ong, CFA: Daniel served as a senior portfolio manager and vice president at DFA for 14 years. His responsibilities included managing international developed and emerging markets equity strategies, leading the emerging markets equity desk, and engaging with clients.

Senior Portfolio Manager Ted Randall: Prior to Avantis Investors' establishment in 2019, Ted served as vice president and portfolio manager for domestic and international equity strategies at DFA. In this role, Ted served as portfolio manager and portfolio advocate for 11 US and non-US developed, emerging market, and blended asset allocation mutual funds and separately managed accounts.

I could go on, but that is five of the first seven on the “Our Team” page on the website. It's the DFA folks, but now they have left DFA and are working with American Century to use those same principles to do low-cost, index-like ETFs.

In response, DFA converted six of its funds to ETFs in 2020 (the first Avantis funds opened in 2019). It now has 2-3 dozen of its own. Maybe the DFA marketing folks went to Avantis too because I wasn't aware of this until after I had actually written the first draft of this article. The DFA track record looks longer than the Avantis one, because DFA converted its funds to ETFs. Maybe a future article will be on DFA vs. Avantis, because there are some slight differences in the factors they use.

The Advantage of ETFs

Avantis (ETFs) has three big advantages over DFA (funds). The first is that these ETFs are available more broadly than DFA funds ever were. You can buy them in any brokerage or IRA account, commission-free at the main places like Vanguard, Schwab, and Fidelity. If your 401(k) has a brokerage window option, you can even buy them there.

Second, ETFs are generally more tax-efficient than traditional mutual funds, EXCEPT for those mutual funds at Vanguard that are paired with an ETF share class. If you're investing in a taxable account, this is a significant advantage of Avantis over DFA, although it's not really any particular advantage over Vanguard.

Finally, for the most part, you could not use DFA funds unless you hired a financial advisor to manage your money. And the typical fee for these “DFA advisors” was 1% of assets under management (AUM). Any comparison always had to take into account that 1% cost. When I ran the numbers, I never concluded that it was worth it to pay 1% JUST to get DFA funds. However, I figured if someone was going to use an advisor, they ought to get one who can use the DFA funds, particularly if they believed in the small and value factors.

But I was fine using DFA funds in the Utah 529 where I did not have to pay that price. I've actually been running a “natural experiment” there for many years as 25% of my kids' 529s is invested in the Vanguard Small Value fund and 25% is invested in the DFA Small Value fund. This experiment has been running since January 2014, and DFA is currently ahead (as of July 2023) 9.05% to 7.47% per year. Vanguard has actually won six of the nine years, though. Basically, the DFA fund is smaller and more value-y than the Vanguard fund, so when small and value do well, DFA does better. When they don't, Vanguard does better.

More information here:

Which Small Cap Value Funds Are Best for You?

What Exactly Does Avantis Do Differently?

So what exactly is Avantis (and, prior to that, DFA) doing differently from Vanguard? Well, it's a little hard to tell exactly. When you look at the brochure, it says things like this:

“#1 Financial Science Lays the Foundation Our investment process is based on an academically supported, market-tested framework that aims to identify securities with higher expected returns based on their current market prices and other company financial information.”

I don't know what that means, but it sounds like active management and a lot of backtesting. Not so sure I want THAT based on the data for active managers. But they might just be saying they tilt to small and value. You can get more information from the prospectus of the funds. While there is a heavy emphasis on the size, value, and profitability factors, it is clear that this is active management. Here's what the prospectuses for the small value funds say:

“The fund seeks securities of companies that it expects to have higher returns by placing an enhanced emphasis on securities of companies with smaller market capitalizations and securities of companies with higher profitability and value characteristics. Conversely, the fund seeks to underweight or exclude securities it expects to have lower returns, such as securities of larger companies with lower levels of profitability and less attractive value characteristics. To identify small capitalization companies with higher profitability and value characteristics, the portfolio managers use reported and/or estimated company financials and market data including, but not limited to, shares outstanding, book value and its components, cash flows from operations, and accruals. The portfolio managers define ‘value characteristics' mainly as adjusted book/price ratio (though other price to fundamental ratios may be considered). The portfolio managers define ‘profitability' mainly as adjusted cash from operations to book value ratio (though other ratios may be considered). The portfolio managers may also consider other factors when selecting a security, including industry classification, the past performance of the security relative to other securities, its liquidity, its float, and tax, governance or cost considerations, among others.

When portfolio managers identify securities with the desired capitalization, profitability, value, and past performance characteristics, they seek to include these securities in the broadly diversified portfolio. To determine the weight of a security within the portfolio, the portfolio managers use the market capitalization of the security relative to that of other eligible securities as a baseline, then overweight or underweight the security based on the characteristics described above. The portfolio managers may dispose of a security if it no longer has the desired market capitalization, profitability, or value characteristics. When determining whether to dispose of a security, the portfolio managers will also consider, among other things, relative past performance, costs, and taxes. The portfolio managers review the criteria for inclusion in the portfolio on a regular basis to maintain a focus on the desired broad set of non-US companies . . .

The fund is an actively managed exchange-traded fund (ETF) that does not seek to replicate the performance of a specified index. The portfolio managers continually analyze market and financial data to make buy, sell, and hold decisions. When buying or selling a security, the portfolio managers may consider the trade-off between expected returns of the security and implementation or tax costs of the trade in an attempt to gain trading efficiencies, avoid unnecessary risk, and enhance fund performance.”

This is classic “smart-beta” stuff. A bit more “quant” than “passive” but with a lot of the characteristics of passive (low-cost, broadly diversified, low turnover, disciplined).

“#2 Process Designed for Consistency As part of our portfolio management and trading processes, we analyze whether the benefits of a trade overcome its associated costs and risks. We seek to methodically harness return premiums while managing implementation costs and aiming to mitigate portfolio risks to generate enhanced returns over time.”

Well, that's what DFA claims is one of its big advantages over a “normal” index fund. By not being “strict” about indexing, it tries to eke out some little advantages by avoiding expensive trades.

“#3 Enable Investors to Build Customized Asset Allocations All Avantis Investors strategies use the same academically sound risk/return framework uniquely designed for Avantis investors. We use our understanding of investors’ needs to deliver transparent investment strategies that work well inside a broader asset allocation.”

That's mostly just investment gobbledygook, but transparency is good.

“#4 Cost Conscious Scalable, efficient portfolio construction and engineering allows for broadly diversified solutions with low rebalancing costs, capital gains and fees. We expect to pass these savings on to our investors through lower management fees.”

Well, that's a good thing. We know that the reason passive investing beats active management most of the time is because of its much lower costs. To give active management the best possible chance to win in the long run, you have to keep costs low. When you look at the Avantis ETFs I'd consider using, you can see the costs are way less than industry mutual fund averages for actively managed funds (something like 1%).

- US Equity (AVUS): 0.15%

- US Small Cap Value (AVUV): 0.25%

- International Equity (AVDE): 0.23%

- International Small Value (AVDV): 0.36%

- Emerging Markets Equity (AVEM): 0.33%

- Emerging Markets Value (AVES): 0.36%

Obviously, these ERs are not as low as those at Vanguard, but they're not ridiculous. They're not high enough that they're OBVIOUSLY going to keep these funds from beating a typical index fund. Expense ratios matter, but at a certain point, they're not the most important thing.

Should You Use Avantis ETFs?

Let's get to the question that has been rattling around in your head since you clicked on this article. Should you use Avantis ETFs, and if so, how and which ones?

Short Track Record

The first reason NOT to use these ETFs is that they're brand new. As I write this article, their funds range from five days to four years old. A year or two is not a track record for active management; it's just a random blip of data.

Active Management

The second reason not to use Avantis ETFs is simply that they incorporate at least a little bit of active management. The data on active management when it comes to stocks is incredibly depressing and one-sided. If you really believe a little active management is good, why wouldn't more be even better?

Performance Comes and Goes But Expenses Are Forever

The third reason not to use Avantis ETFs is the additional expense. While the ER differences might be small (for example, AVUS is 0.15% while VTI is 0.03%), that's still a 12 basis point hurdle that the Avantis strategies must overcome before it can start earning real alpha. It's even larger in other asset classes. For example, AVUV is 0.25% but VBR is 0.07%, an 18 basis point difference. Since Avantis, like DFA, is a for-profit company and Vanguard is mutually owned, some chunk of that difference is profit, while the rest is additional cost and a lot less economy of scale.

Securities Lending

A fourth reason to avoid Avantis is securities lending. While Vanguard investors get to keep 98%+ of the income from securities lending by the fund, Avantis investors only get 90%. That's more than some companies but still less than Vanguard.

Tax-Efficiency

Vanguard index funds and their ETF equivalents are very, very tax-efficient. Does Avantis do just as well? It's a little hard to compare apples to apples here, but the most recent VTI prospectus shows a five-year pre-tax return of 8.72% and an after-tax return after paying the tax on distributions of 6.82%. That's a loss of 21.8% to taxes. The most recent AVUS prospectus (for a different time period) shows a loss of 21.8%, essentially a tie. But given that most Avantis funds have a bit more of a value tilt, you would expect lower tax efficiency.

The Track Record Does Show a Difference

With those five downsides, why would an informed passive investor choose to use an Avantis ETF over a Vanguard one? The main reason is that they expect higher performance. So far that seems to be the case, as demonstrated by my emailer. It's easy enough to do a few comparisons myself, though. Let's compare VTI to AVUS. Three-year data is available at Morningstar.

- VTI: 13.33

- AVUS: 16.04

Whoa! That's a big difference. You don't get that just from “indexing better. ” We'd better look under the hood.

As of this writing, VTI owned 3,854 stocks and had 3% turnover. AVUS had 2,331 stocks and 4% turnover. VTI had an average market cap of $134 billion and a P/E ratio of 19.34 while AVUS had an average market cap of $68 billion and a P/E ratio of 15.34. In short, AVUS is smaller and more value-y than VTI. Is that the reason for the outperformance? Well, the three-year return for VBR (Vanguard's small value fund) is 18.65% per year, so those tilts likely explain most, if not all, of the AVUS outperformance. Small and value have outperformed over the last three years.

Let's compare the small cap value offerings between Vanguard and Avantis:

- VBR: 18.65% per year for the last three years, $5.16 billion average market cap, 11.72 PE ratio

- AVUV: 27.25% per year for the last three years, $2.33 billion average market cap, 8.70 PE ratio

This is kind of the same story we always saw with DFA. When small and value did well, DFA outperformed Vanguard because it had larger small and value tilts. When small and value didn't do well, Vanguard outperformed DFA. What happens in the long term really comes down to what you believe will happen with small and value factors.

But you do have an alternative. You can simply tilt MORE with a Vanguard-based portfolio than an Avantis-based portfolio. Instead of a ratio of 4:1 total stock market to small value, perhaps you could tilt 3:1 and get the same benefit, all while enjoying lower expenses. At any rate, the fact that these tilts are embedded in the Avantis funds makes it very hard to compare apples to apples when evaluating the value of anything else it's doing besides tilting toward factors.

The addition of the profitability factor confuses things a bit more but, thus far, seems to be a good thing.

Getting Access to Other Asset Classes

Vanguard doesn't offer a fund or ETF for international small value or emerging markets value. If those are important asset classes to you, it would make sense to use the Avantis ETF for that asset class.

More information here:

People Still Believe in Active Management?

How I Might Use Avantis ETFs

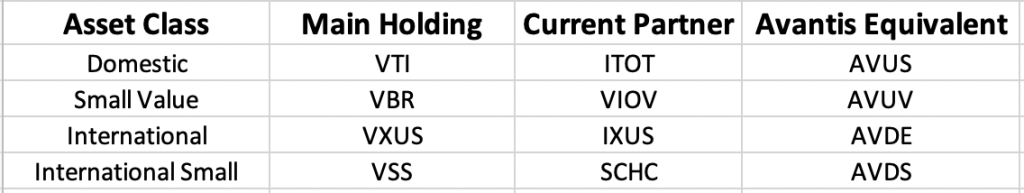

I'm not quite ready to abandon my long-term use of Vanguard ETFs/funds based just on short-term data, but since most of my portfolio is now in a taxable account, I actually need two ETFs for each asset class for when I tax-loss harvest. Maybe I should consider using the Avantis ETFs instead of what I am using now for a tax-loss harvesting partner.

Let's look at each of these one by one.

Domestic

We've already looked pretty carefully at VTI and AVUS here. We know that they have significantly different portfolios in that AVUS has a much smaller and more value-y portfolio. That's not the case with ITOT. ITOT has a three-year performance that is almost exactly the same as VTI. If I used AVUS as a TLHing partner, I would be changing my tilts significantly. That's not really something I want to do, so I'll stick with ITOT.

Small Value

Small value is a lot trickier, as I've written about before. VIOV is much smaller and a little more value-y than VBR, so swapping those changes my factor exposure significantly. AVUV would have a similar issue. AVUV is more value-y than VIOV, but VIOV is smaller. VIOV (0.15%) is more expensive than VBR (0.07%) already, so the additional expense of AVUV (0.25%) isn't as big of a deal. Performance data gives the nod to AVUV (27.25% vs 19.17% per year for the last three years) so I think I may just start using AVUV instead of VIOV. I'll have to spend some more time thinking about whether I want to use it as my main holding (and possibly decrease my tilt percentages, currently 25:15 VTI:VBR). I passed on hyper-small and value-y RZV years ago, but AVUV is significantly more diversified than RZV.

International

VXUS and IXUS are extremely similar funds, and they make excellent tax-loss harvesting partners. The main problem with using AVDE is that it is a developed country-only fund. There is little to no emerging markets exposure. So, if I wanted to use it as my partner, I would have to combine it with an emerging markets fund such as VWO or AVEM. I don't want that complexity. I'll stick with VXUS and IXUS.

International Small

Our original investment plan, written way back in residency, said this about international small and international small value asset classes:

“We will tilt the portfolio toward mid-cap and small-cap stocks in an effort to increase returns so long as reasonably priced investments are available, both domestically and internationally

We will tilt the portfolio slightly toward value stocks, both domestically and internationally. This will be maintained by the purchase of specific value stock mutual funds if necessary and so long as reasonably priced investments are available.”

In 2006, there were no reasonable international small and international value options, so we did not tilt at all internationally. When Vanguard came out with its international small fund in 2009, we quickly added it to our portfolio. But still, over the years, I have not yet found a really great passive international small cap value fund. I knew DFA had one, but I wasn't willing to hire an advisor to get it. Is AVDV the fund I've been waiting for? Should it simply replace VSS as our main holding? Should it replace SCHC as the tax-loss harvesting partner? Let's take a look at it in detail.

- VSS includes both developed and emerging markets, costs 0.o7%, and contains a small but not a value tilt. The PE ratio is 12, and the average market cap is $1.72 billion. The three-year performance is 6.84%. It holds 4,224 stocks, and it has a turnover of 17%.

- SCHC only includes developed markets, costs 0.11%, and contains a small but not a value tilt. The PE ratio is 11.9, and the average market cap is $2.0 billion. The three-year performance is 6.41%. It holds 2,221 stocks, and it has a turnover of 18%.

- AVDV only includes developed markets, costs 0.36%, and contains a small and a value tilt. The PE ratio is 7.75, and the average market cap is $1.62 billion. The three-year performance is 12.64%. It holds 1,329 stocks, and it has a turnover of 21%.

That's a pretty serious performance difference. It's hard to know how to attribute that. It could be the lack of EM exposure, as EM has underperformed in the last few years. But if that were the main reason, you would expect SCHC to have beaten VSS, which it did not. It may very well be the value tilt. We know value outperformed the domestic market over the last three years, and comparing the Avantis International fund to the Avantis International Large Value fund, we see that occurred internationally too, at least over the last year. Some of the outperformance may also be the Avantis active management strategies minus the additional cost of those strategies.

But this is all enough for us to at least think about swapping, and I'm talking about our main holding, not just our tax-loss harvesting partner. It's hard to get perfect here. You either have to leave out EM, or you have to skip the value tilt. And the additional cost (29 basis points) is pretty large. At any rate, even if we wanted AVDV, this asset class is entirely in taxable for us now. Swapping would involve realizing six figures in capital gains, using up a significant part of the tax losses we're carrying forward in case we sell the house or The White Coat Investor. VSS would become a legacy holding for us, and we'd start using it for charitable donations. So, we'd probably just start with new money going into AVDV for now. But it'll be nice to have something stock-related to discuss during our monthly financial meetings. It's been a long time since that happened. We also have to be careful that we're not just performance-chasing, because performance has a bad habit of disappearing on us just as we start chasing it. Now that DFA also has ETFs, one could also use the Avantis AND the DFA ETFs as tax-loss harvesting partners.

Avantis funds are a great new option for savvy investors and worth a careful look. While the expenses are higher than Vanguard index funds/ETFs, the tilting and execution just might be worth the price.

What do you think? Do you use Avantis ETFs? Are you considering changing? Why or why not?