One of the ultimate reasons to be financially literate is not only to buy the luxuries of life, but also your time. To that end, my wife, following our written financial plan, recently changed jobs from a full-time anesthesia higher pay call position to a lower pay four days per week, no holiday, no call, no weekends position (my guess is that is 0.8 FTE, although as a neurologist, I don’t fully understand how anesthesiologists calculate their FTEs). That equals more time for herself and for the kids, and it also promotes career longevity by avoiding burnout.

The new hospital's benefits are fantastic, including a nice 401(k) and access to a non-governmental 457(b). But now it was decision time. Should we actually contribute to this account?

To 457, or not to 457? That was the question.

The following is how we came to the decision of whether to contribute to the 457 plan.

What the Heck Is a 457(b)?

First things first, let’s go over what in the world a 457(b) is. Briefly, a 457 is a retirement vehicle named after section 457 in the tax code, where compensation is deferred and held by your employer; yet you can invest the money despite it not technically being yours. The employer then promises to pay you the money upon separation from employment on a schedule determined by the rules of the plan. Since it is deferred compensation and that money is technically not paid to you, that money MIGHT be subject to the company’s creditors if it goes bankrupt—and you might not get the money you are owed in the event of said bankruptcy.

I say MIGHT, because 457s come in two varieties: governmental and non-governmental plans. The money you “contribute” (“defer” is the more proper term) in governmental 457 plans is technically held in a trust, like 401(k)s and 403(b)s, so it is not subject to the governmental entities' creditors. Non-governmental 457s are still on your employer’s balance sheet and are not protected in the event of bankruptcy. Northwell Health, my wife's new employer, is not a government entity, so its 457 falls under the non-governmental type.

Based on the above information on what 457(b) plans are and how they are structured, we come to three main considerations when deciding on contributing to the non-governmental 457 plan:

- Will Northwell go belly-up (and our deferred contributions with it)?

- What are the distribution options?

- Are there low-cost index investment options available in the 457?

Let's take these questions one by one.

Will Northwell Go Bankrupt?

Everybody’s crystal ball is cloudy on Northwell's (or any company’s) bankruptcy prospects, but to try to make it a little clearer, I researched Northwell’s credit ratings. A quick Google search showed the following:

“Northwell Health has received credit ratings from major agencies:

-

Fitch Ratings: A- with a Stable Outlook.

-

S&P Global Ratings: A- with a Stable Outlook.

-

Moody's: A3 with a Stable Outlook.”

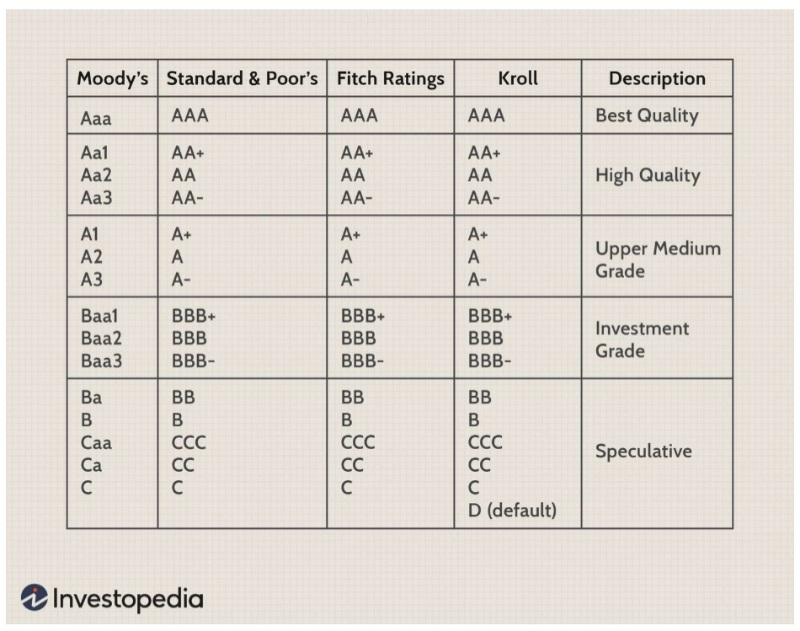

For those uninitiated to what these ratings mean, here is a nice chart, via Investopedia:

Looking at the chart, it seems the current financial health of Northwell is a level above the acceptable investment grade rating, making us feel safe that bankruptcy is not in Northwell’s near future. Using another Google search of Northwell’s past credit ratings, I found they have been similar, dating back to 2016 with the major credit agencies. With this information in mind, my wife and I felt that the future financial stability of Northwell—and the chances of getting our 457 money back—was secure. We would have been more nervous about contributing if Northwell had only been investment grade, and we definitely would not contribute to the 457 if Northwell were in the speculative range. As a point of reference, some companies with similar ratings as Northwell include Bank of America, Citigroup, Hyundai, PNC, and Best Buy.

One painfully interesting scenario we considered is what we'd do if Northwell’s credit ratings went south in the future. What if its credit ratings started dipping into the speculative range? We agreed we'd stop making contributions. But what about the money still locked up in the 457? At that point, Meredith would seriously consider leaving Northwell preemptively before it went bankrupt. She assumes that her currently wonderful job would likely turn sour since her employer would be fighting for its financial life, cutting support staff, compromising on the cost of proper equipment maintenance, and overloading physician workloads.

At that point, we would take the lump sum distribution from the 457, which unfortunately would mean we would not have gotten any tax rate arbitrage. But hey, at least our money would be safe in our pockets. Hopefully, this doomsday scenario will not occur. Luckily, given our research above, Northwell has a history of excellent financial management in order to treat its physicians and workers phenomenally and deliver exceptional patient care.

It is important to note, though, that you can’t just go by the name and reputation of a hospital as a proxy for future financial health. You could deliver the best care in the world and still go bankrupt. Look at the famous hospital known as St. Vincent’s, the third-oldest hospital in New York City and a beacon of cutting-edge care and research during the AIDS epidemic. It went bankrupt and closed its doors in 2010. Another famous hospital in Philadelphia, Hahnemann Hospital, where Jack Bogle had his life-saving heart surgery, went bankrupt in 2019. Apparently, neither fame nor the quality of care delivered keeps your hospital and attached 457 money safe.

In case you were wondering about the credit ratings in relation to the failure of Steward Health Care, it got a consistent B credit rating throughout its existence. As you can see above, that is a “speculative” rating with a high risk of bankruptcy. And unlike buying a bond, where you get compensated with a higher yield, investing in your 457 has no such compensation, meaning that it's very important that your hospital or health system has at least an investment grade credit rating. Anything less than that, and you are taking on extra uncompensated risk.

Distribution Options

Another important factor when deciding to use your non-governmental 457 is the distribution options. Poor distribution options can really screw you out of a lot of money. Imagine you start using this retirement vehicle at the beginning of your career and get a tax deferral at the 32% tax bracket. Years later, you marry another high-income earner. That 457 has grown to $1 milllion, and you decide to leave your job for one that pays more. As you leave your job, you unfortunately find out that the only distribution option you have is to take all that 457 money out in one lump sum.

Imagine the extra money you and your spouse are making, and add on the distribution of the 457 in one big chunk. What tax bracket would you be in? That’s right, it pushes you into the 37% tax bracket, the highest. Now, you have to pay 5% more in tax for your contributions, but that money was always at risk of disappearing if your hospital had gone bankrupt. If you had just invested in taxable, the highest long-term capital gain rate (don’t forget NIIT) would have been 23.8%, not 37%!

How much is the lost money to Uncle Sam in our example above? For simplicity's sake, let's say that instead of 457 contributions, you would have just invested in taxable and used long term cap gain rates in retirement—the highest rate would have been 23.8% (highest LTCG bracket + NIIT). Let’s say there were $500,000 in contributions at the 32% tax bracket, and the rest was growth. We have $500,000 x (37%-32%) + $500,000 x (37%-23.8%) = $2,500 + $66,000= $68,500. You paid Uncle Sam an extra tip of $68,500 because of stupid 457 distribution options. That’s a heck of a tip. Now, you can see how distribution options are of utmost importance.

Initially verifying Northwell’s distribution options was a little confusing. The Northwell 457 is serviced by Transamerica, and there was a document on its website outlining the details of the plan, saying that you could choose a distribution date after separation from Northwell at anytime. I thought this was great. Why not choose a date 21 years from now when both of us are sure to be retired? But then I tried to verify this information by going to the Summary Plan Document on Northwell’s HR website. Combing through different documents online, I finally found a document entitled 457. What I read on the SPD was quite different, and if I was reading it right, the 457 money had to be distributed over five years from the separation of service. It had been written in 2017, so already I was suspicious of the applicability of this old Summary Plan Document.

There was another document regarding a 457 update, but it had no mention of changing the distribution options. Given the disparity, I scheduled a phone call with the Transamerica rep familiar with Northwell’s plan. He kindly verified that you didn’t need to take immediate distributions when separating from Northwell. Instead, as mentioned on the 457 summary sheet, you could, upon separation, elect a date in the future, no later than the RMD date, to start distributions. Also, there was no limit on what time period the distributions had to occur. We could have it distributed over 100 years if we wanted. Since we'd want to spread distributions so we didn't enter the highest tax bracket, this was awesome news.

When my wife eventually leaves Northwell (hopefully not for a while!), we likely will choose a date for distribution when I retire at 65. None of us will be making a high income, and we will be in lower tax brackets. The distribution options of the 457 fit well with our written financial plans.

The Investment Options

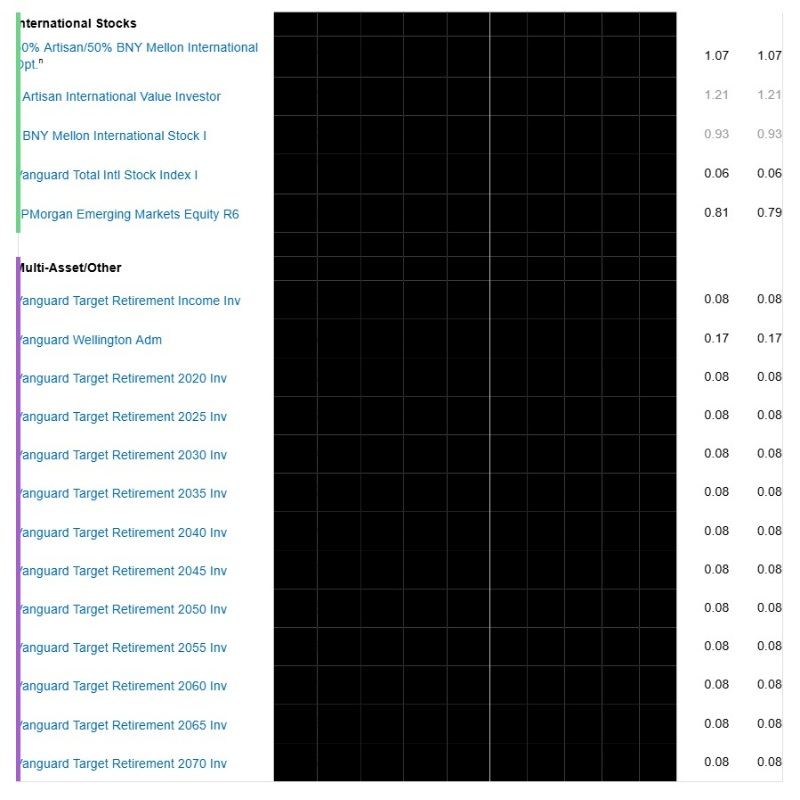

The investment options of any retirement plan are incredibly important but especially for a non-governmental 457, where the money is not even yours until distribution. The following are the investment options in Meredith’s 457:

Looking at these investment options, there are plenty of wealth-stealing, actively managed, might-as-well-light-your-money-on-fire funds here. I wrote previously about how the most important factor regarding your investment options is the expense ratios. As Jack Bogle says, “Fees matter! You get what you DON’T pay for.” Every fund not named Vanguard sucks in this 457. I purposely blacked out the historical returns because IT DOES NOT MATTER! My rule is that every fund above 0.3% in expense ratio should be treated like toxic waste and avoided.

Famed financial blogger Nick Maggiulli even argued for not investing in your retirement account if only high-fee funds are offered because these high fees eat up the tax protection of a retirement account, where you would have been better off investing in low-cost index funds in a taxable account. Luckily, every option with the name Vanguard is, as we would expect from Vanguard, awesome. Also quite important is that these low-cost funds fit within our chosen asset allocation of 50% total US, 25% total international, and 25% small cap value. We chose to invest in the Vanguard Institutional Index (with an ER of 0.02%), the Vanguard Extended Market Index (ER 0.04%), and the Vanguard Total International Index (ER 0.06%). With expense ratios that low, we are undoubtedly going to maximize the amount of wealth for retirement.

More information here:

Practical Considerations for Optimal Utilization of Non-Governmental 457(b)s

A Disparaging Tidbit on New Jersey

I have written before about how not-so-awesome the taxes are here in New Jersey. Here’s another whammy for us NJ residents regarding 457 contributions. This is copied and pasted from the state's Division of Taxation website:

“The wages you report for federal tax purposes may be different than the wages you report for New Jersey purposes. For example:

New Jersey does not allow you to exclude from wages amounts you contribute to deferred compensation and retirement plans, other than 401(k) Plans. Specific plans that New Jersey does not allow taxpayers to exclude contributions to include, but are not limited to, plans under I.R.C. § 403(b), I.R.C. § 457, 409A, I.R.C. § 414(h), SEP, Federal Thrift Savings Funds, or Individual Retirement Accounts. Employer contributions to these plans receive tax-deferred treatment. In addition, both employee and employer contributions to SIMPLE IRAs, SEP, and SARSEP plans are included in taxable wages (neither receive tax-deferred treatment).”

What?!? Yep, we are still state taxed on 457 contributions, despite it not technically being our money (it's still in the pocket of the hospital system). You've got to love this greedy state. When New Jersey got its nickname, people thought they saw gardens; actually, if they looked closer, those were fields of tax dollars ready to be collected by the state.

Behavioral Barriers

Given my neurology background, I can’t help but mention some of the behavioral biases that were running through our brains when properly evaluating the Northwell 457(b). This included familiarity bias, status quo bias, availability/saliency bias, representative bias, and analysis paralysis.

Familiarity Bias: I remember applying to Northwell for neurology residency when it was still known as North Shore-LIJ. My wife and I see signs for Northwell all over the place in New York and New Jersey. Our minds are biased to feel comfortable with the familiar. But this should not have any bearing on our decision. We must look at the cold, hard math and not use the warm fuzzies of the familiar.

Status Quo Bias: Would we meet our goals by just staying the course and not using this account? Likely yes, but this should not be a reason not to utilize the 457. It would be so much easier just to ignore this account and come up with thoughts of, “It’s exposed to Northwell’s creditors,” or other excuses to not spend time evaluating whether to contribute. But this is wrong. We should put in the effort to see if this account could help reach our financial goals.

Availability Bias: WCI recently mentioned the failure of Steward Health, inadvertently creating an availability bias about the dangers of health systems failing and having 457 money possibly going “POOF!”

Representative Bias: This ties into what I mentioned about Steward Health and St Vincent’s and Hahnemann hospitals, where we might think, “Oh shoot, all health systems can fail like Steward/St. Vincent’s/Hahnemann. I can’t invest in the 457!” This would shortcut the decision to not invest in the Northwell 457, ignoring the credit rating research I outlined above and instead replacing Northwell with an image of these previously failed hospital systems.

Analysis Paralysis: I could have spent years researching credit ratings of Northwell along with the failures of other hospital systems and their respective credit ratings. But this would have gotten me nowhere. Just like the experiment where you sold more jam when fewer varieties were on display, I had to limit my analysis or end up not utilizing the 457 at all.

More information here:

Wife vs. Husband: A Retirement Account Showdown

Saving for Your Future Stranger

To 457, or Not to 457?

My poor attempt to sound Shakespearean, “Whether 'tis better to invest in the 457, and maybe suffer the slings and arrows of hospital bankruptcy or distributions at higher tax brackets, or to take arms against this sea of troubles, and not invest in the 457.” We decided to invest in the Northwell non-governmental 457, given the low risk of bankruptcy, the excellent distribution options where we likely won’t be in higher tax brackets, and the low-cost index funds offered that fit into our overall asset allocation.

We will max out the 457 of $24,500 [2026 — visit our annual numbers page to get the most up-to-date figures] instead of putting that money in our taxable brokerage account, and we have updated our written financial plan accordingly. I hope the above helps you decide whether to 457 or not if the opportunity should arise.

What do you think? Did I miss anything in the to 457 or not to 457 analysis? Do you think my wife and I are making the correct decision?