Some investors have discovered that their investment is not technically a mutual fund—neither a traditional mutual fund nor an Exchange Traded Fund (ETF). Instead, it's a Unit Investment Trust (UIT). And they start wondering exactly what a UIT is, how it is different from an ETF, and whether those differences really matter in their financial life.

Today, let's talk about UITs.

What Is a Unit Investment Trust (UIT)?

A UIT (while much better than a UTI) is a type of investment vehicle that holds a fixed portfolio of securities, such as stocks and bonds, and sells “redeemable units” (i.e., shares) to investors. Unlike a mutual fund, the UIT is a static portfolio held until a specific “termination date” that is not actively managed. So, its holdings don't change.

The UIT is created by a sponsor who selects and buys a portfolio of securities based on some sort of investment objective; then, they raise capital from investors by selling them the redeemable units. Then, it is just held until termination, at which point the securities are sold and returned to investors. Since there is no management happening, there are no ongoing management fees (although there is typically a creation and an operating fee). It is often possible to sell the shares back to the sponsor before the termination date.

How Is a Unit Investment Trust Different from a Closed-End Fund?

Most mutual funds are open-ended, meaning they get bigger and smaller as money is contributed or redeemed from the fund, and shares always trade at the Net Asset Value (NAV). However, some mutual funds are closed-ended. They don't get bigger or smaller and often sell at a slight premium or discount to NAV due to their illiquidity.

A UIT sure sounds an awful lot like a closed-end fund (CEF), doesn't it? However, there are two key differences:

- UITs have fixed, unmanaged portfolios. CEFs are actively managed.

- UITs have a termination date. CEFs trade indefinitely on an exchange.

More information here:

Separately Managed Accounts (SMAs): Are They Worth Your Money?

Buffered ETFs — What You Need to Know

What Are the Advantages of a Unit Investment Trust over an ETF?

UITs have some advantages over traditional open mutual funds, CEFs, and ETFs.

- No active management: Active management has generally been shown to be detrimental to investors long term. While many open mutual funds and ETFs are passively managed, too, many of them are not. All UITs are passively managed.

- Low expenses: Since there is no management, there is no management fee, lowering expenses. Those savings can be passed on to investors, although, to me, some operating costs still seem awfully similar to management fees.

- No “fire selling” in turbulent markets: When investors want to cash out of open mutual funds after a huge market drop, the manager is often forced to sell securities at a loss. That's not the case with CEFs, UITs, and ETFs, as these are either not redeemable (CEFs and UITs) or the shares have a different creation/destruction process (ETFs).

- Ability to buy at less than NAV: At times, CEFs and UITs can be purchased at a discount from NAV. That's never available with traditional mutual funds (which always trade at NAV) or ETFs (where the Authorized Participants will quickly arbitrage away any difference from NAV to eliminate discounts and premiums).

- Ability to “gear:” UITs can use leverage (borrowed money) in ways that are hard for mutual funds to do. UITs can invest borrowed money alongside their capital.

- Dividend smoothing: Mutual funds and ETFs must distribute all of their dividends to investors. UITs and CEFs can hold up to 15% of them and create a cash reserve. That reserve can be used to smooth dividend payments over time, making income more predictable.

What Are the Disadvantages of a Unit Investment Trust?

Naturally, UITs have disadvantages, too. There is a reason far more money is invested in traditional mutual funds and especially ETFs these days than in closed-end mutual funds and UITs.

- Lack of flexibility: The main disadvantage stems from the fixed, unmanaged portfolio structure. The fund cannot react as well to market changes. It doesn't rebalance.

- Lack of liquidity: You could possibly sell units back to the sponsor in a secondary market, but you also may be locked into the investment until termination or face significant liquidation fees. And since UITs often trade at a discount to NAV, there is a bit of a headwind when you pay NAV to get in to the investment.

- Upfront and ongoing fees: UITs are often sold with loads (commissions) by brokers. They can also charge substantial operating fees despite the lack of active management. This incentivizes brokers to recommend rolling over from one UIT to another, generating a new commission.

- Termination is a taxable event: You are no longer in control of when to end your investment. When the UIT terminates, you will get capital gains (hopefully) and have to pay taxes on them.

- Lack of diversification: UITs are sometimes not very diversified, and they are focused on a narrow sector of the market.

More information here:

Should Doctors Consider Angel Investing?

The Emotions Behind Short-Term Trading

What Are Some UITs I've Heard Of?

Some investors are surprised to learn that they own a UIT instead of an ETF. Here are some commonly owned ones.

SPY

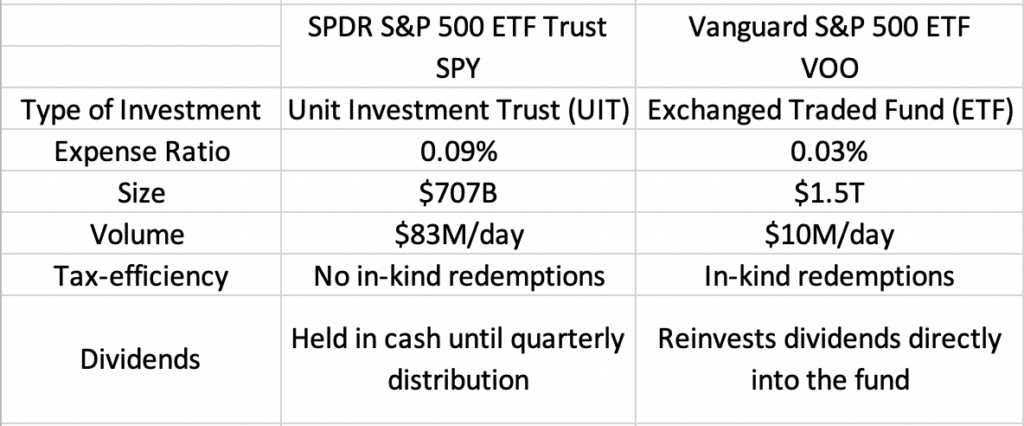

That's right, SPY (SPDR S&P 500 ETF Trust) is not actually an ETF. It's a UIT. It can be interesting to compare SPY with the Vanguard 500 Index ETF (VOO). SPY has higher trading volume and slightly lower bid-ask spreads, and so it might be preferred by high-frequency traders. But that ETF structure gives VOO the edge in pretty much every other way applicable to long-term investors.

SPY might be useful for short-term trading due to its higher volume and tighter bid-ask spreads, but VOO is the (admittedly only slightly) better long-term holding due to lower costs, better compounding, and higher tax-efficiency for those investing in taxable accounts.

QQQ

QQQ (Invesco QQQ Trust Series I) is also a UIT, not an ETF. I recently received an email from a WCIer on the topic:

“This may be too dense for WCI, but nevertheless I thought you may know the answer. I am, for odd reasons related to gifted investments from parents, holding some leveraged shares (QQQ). Shareholders are currently being asked to vote on a conversion from UIT to ETF format. I've been doing some googling, but it seems a bit opaque. From my scratch of the surface, it seems like a good move. And a reduction in the 0.20 ER would always be nice. But would welcome your explanation of the difference and thoughts on the matter at hand and in general.”

An ETF structure is more tax-efficient in the long term and is often cheaper than a UIT structure. UITs have been around much longer. The first was in the UK in 1931, created in response to the Great Depression and the related stock market crash. The first ETF wasn't created until 1990 in Canada. The first one traded on a US exchange is often listed as SPY—which, as we know, isn't technically an ETF as we define them today. The first Vanguard ETF was VTI (2001), and the first iShares (Blackrock now, but previously Morgan Stanley and Barclays) ETFs were launched in 1996 (bonds in 2002). Of note, QQQM is basically the same thing as QQQ, except it's a true ETF, not a UIT.

DIA

Why anyone would want an index fund/ETF that tracks the Dow Jones is beyond me, but apparently, back in the 1990s, some people did. DIA is still around, and you might have heard of it.

If My UIT Wants to Convert to an ETF, Should I Vote Yes?

Yes. Per this 2014 Business Insider article, there were only 8 “ETFs” (out of >8,500 ETFs that currently exist) that were actually UITs at that time:

- SPY

- QQQ

- MDY

- DIA

- ADRA

- ADRD

- ADRE

- ADRU

QQQ changed to a true ETF structure in December 2025 (lowering the ER from 0.20 to 0.18), and I suspect the others aren't very far behind. I see little advantage to the UIT structure compared to an ETF structure.

More information here:

How Do You Evaluate and Compare Mutual Funds and Exchange Traded Funds?

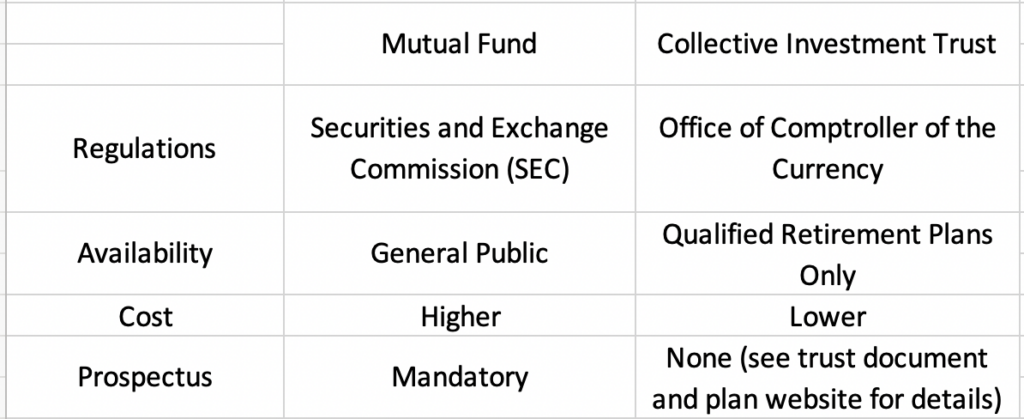

Is a Unit Investment Trust the Same as a Collective Investment Trust?

No. Two of the three words are the same, but since the third one is different, it has a totally different meaning. While a UIT is kind of a historical oddity with little advantage over an ETF and while only a few of them still exist, a Collective Investment Trust (CIT) is pretty common already and becoming more common in 401(k)s all across the country. There are certainly far more than eight of them out there. A CIT is a mutual fund alternative that only exists inside qualified retirement plans, like your 401(k). It's best to just consider it the same thing as a mutual fund, but a few minor differences, none of which are really bad, exist.

Bottom line, sometimes CITs are put into 401(k)s instead of mutual funds because they're slightly cheaper due to lower regulatory costs. Most of them are index funds or lifecycle-style balanced funds, which is generally a good thing for 401(k) participants. However, because they don't have ticker symbols like mutual funds and stocks, CITs can be a little harder to research on the internet (such as Morningstar and similar resources). More frequently, you'll just have to obtain and review the information provided by Human Resources at your company or the 401(k) provider to learn more about the investments.

What do you think? Would you vote to convert a UIT to an ETF? Why or why not? Does your 401(k) use funds or CITs?