The greatest financial risk for physicians is losing the ability to turn the knowledge and skills they spent a decade learning into a huge pile of money by working in their profession for decades. Insurance companies estimate that as many as 1 in 4 doctors will be disabled at some point during their career, which is why disability insurance is critical to your financial plan.

Protect your biggest asset, your income.

Select from the agents below. We are proud to partner with independent agents who will help you compare quotes from multiple insurance companies.

We have emailed you this info. This trusted team is working to find you discounts and the best coverage. They will reach out soon.

Important Medical Notice for Disability Insurance Applicants

WCI does not ask medical questions. However, when applying for disability insurance, please be aware that you will be asked to provide information by our vetted insurance partners regarding your medical history over the last 10 years. This includes any diagnoses, hospitalizations, surgeries, medications, and treatments for chronic conditions or mental health issues.

Accurate and complete disclosure is essential to avoid unnecessary declines and ensure your application is processed effectively. This information helps us match you with the appropriate coverage and provider, increasing the likelihood of a successful application.

Ready to get coverage in place today? Feel free to reach out to them directly.

The White Coat Investor is paid for making introductions to insurance agents. Insurance is complicated and you are responsible for researching, evaluating, and conducting your own due diligence on any agent and company with whom you transact business and on making sure you purchase the right policy for your situation. If you choose to purchase an insurance policy from any agent listed on any of our websites, White Coat Insurance Services, LLC may be named as an agent on the policy and be paid a portion of the commissions on your purchase.

Disability insurance gives you an income to live on if you become so disabled that you can no longer work. Essentially every high-income professional in their first decade or two out of school should own a policy.

The only exception is if you do not rely on your income to live. If you are already financially independent, it's OK not to buy a disability policy. If you aren’t and you don’t own one, you need to go get one . . . now.

Get a Quote

First, you need to gather up a few things:

Take this information and call an independent insurance agent who specializes in disability insurance for physicians and other high-income professionals.

Insuring against financial catastrophes provides you peace of mind to live a well-deserved life free from financial worries.

An independent agent means this agent can sell you a policy from many different companies, not just one. If it were just one, they would be a “captive” agent, not an “independent” agent.

Northwestern Mutual, for instance, is a company that uses captive agents. You can’t get a Northwestern Mutual disability policy from an independent agent, and you often won't be offered a policy from any other company by a Northwestern Mutual agent.

Going through an independent agent ensures you get the best price for the appropriate coverage.

After you provide a bit of personal information—your age, gender, health status, specialty, and state of residency—the independent agent works to find you the best policy options and then helps you compare them to your employer, specialty association, and the AMA group policies.

Thousands of WCI readers have used our recommended disability agents. They’ll treat you well, but if you have any issues, let us know and we’ll take them off the site.

Request a Quote

Take these principles and combine them with your agent’s recommendations. In the end, any disability insurance is better than no disability insurance, and if you go through this process, you will almost surely end up with a good policy.

Read every word in the policy and have your agent explain to you what they mean. Take notes, right on the policy document, to remind you later what you’ve been told.

Ask for a discount. If you buy from an agent who has worked with hundreds of doctors, they should offer you a “preferred producer multi-life” discount because the agent has already sold several policies to doctors working for your employer.

Be aware that disability insurance is more expensive for women, so men should generally buy a “gender-specific” policy and women should generally buy a “unisex” policy.

Many doctors may buy one of each—your agent will help you decide. Don’t worry, you don’t need to be an expert on disability insurance, but here are a few benefits of each type of policy to consider.

The most important part of any disability insurance policy—which you must go over word for word with your agent—is where it defines what a disability is and what it isn’t.

Life insurance is much easier in this regard; you’re either dead or you are not. This is not the case with disability. Getting disability payouts is an entire niche within the law and it all comes down to how the contract reads.

The strongest definition of disability is one that states that if you cannot work in your chosen occupation (defined as your specialty), the policy will pay out its full amount. You should look for the words Specialty-Specific and Own Occupation. Weaker definitions include “modified own occupation” and “any occupation.”

Most good policies also include a provision for a partial disability. That means if you can still work part of the time or you can still earn some money, the insurance company will help make up the difference. This is also an important aspect if your disability is only temporary.

As you gradually recover from the disability, a residual disability rider, which everyone should purchase, will ensure you get some financial assistance to make up for the lost income.

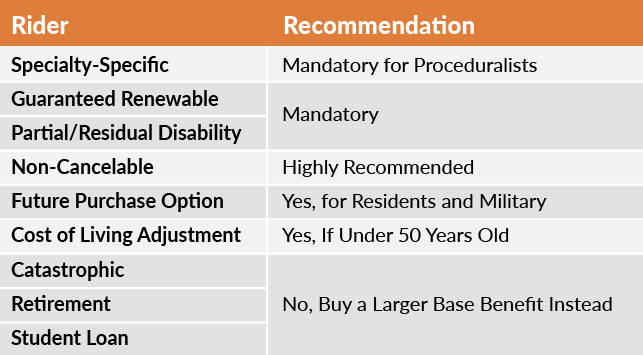

A disability insurance “rider” is an additional feature of a policy that may or may not add on to the premium amount.

In addition to a residual disability rider, there are other bells and whistles that may make sense for your specific circumstance.

This rider ensures that your payments will go up with inflation as the years go by. Be aware that this rider does not increase the initial disability payment you receive.

If the policy you bought in 2020 said it will pay you $10,000 a month if you get disabled, it will only pay you $10,000 that first month you get disabled whether that is in 2030 or 2040. But once it starts paying, it will gradually adjust upward.

For this reason, this rider should be considered mandatory in the first half of your career. However, since most policies only pay until age 65 or 67, it doesn’t make sense for someone in their 50s or 60s to buy it.

This rider allows you to buy more insurance later when your income goes up without having to prove you are still insurable (i.e., no questions or exams). It does not lock in the low price you received when you first bought the policy.

This is a smart rider to purchase when the company does not allow you to buy as much insurance as you need. For example, most residents and fellows are limited (by insurance company policy and by their inability to afford it) to buying less benefit than they really want to live on for the rest of their life.

For a resident, it makes sense to buy a future purchase option rider. But if you’re an attending in your peak earning years, just buy the amount you need and save money on the rider.

This basically says if you’re really, really disabled (i.e., can’t do at least two activities of daily living such as dressing or bathing), it will pay you extra. Sometimes, this rider is just a part of the policy (meaning you don’t have the choice to reject it and save some money).

As a general rule, you are better off using the money the rider would cost to just buy a larger benefit to start with.

Some companies allow you to buy a rider that, if you become disabled, pays you a monthly benefit to live on and also puts some additional money into a separate account for your retirement.

Since the investment options the company is likely to use are generally poor compared to what is available on the open market, this is a rider to skip. Of course, you need to make sure the benefit you have purchased is sufficiently large enough that you can live on it and also save for retirement (since the policy will only pay until you are in your mid-60s).

There are a few more terms used in the insurance world you should be aware of. A policy is one of three things—conditionally renewable, guaranteed renewable, or non-cancelable.

Conditionally Renewable: Insurance company can cancel the policy whenever it likes (but is very rare).

Guaranteed Renewable: Insurance company can raise your rates—so long as it raises the rates of everyone else that is like you with regards to age, state, or specialty—but cannot cancel the policy if you pay the premiums.

Non-Cancelable: Insurance company cannot raise rates at all and must renew the policy so long as you pay the premiums.

Obviously, the non-cancelable policy is the best option, but it is pretty rare for a company to raise rates. If you are offered a substantial discount for a policy that is only guaranteed renewable, consider taking it and putting the money toward another good cause.

As a general rule, insurance companies will allow you to buy enough insurance to replace 60% of your gross income. Since most high-income professionals are paying 15%–35% of their income toward taxes, that is usually MORE than enough income to live on.

Disability insurance benefits, unless the premiums were paid for by your employer, are completely tax-free to you.

If you already have a nest egg that by age 65 will be sufficient to provide your desired retirement, then you may need even less.

As a general rule, decide how much disability insurance to buy based on your actual expenses, not some percentage of your income. If you are spending $8,000 per month and need to put $3,000 per month toward retirement and $1,000 per month toward college, then you need a disability benefit of $12,000 per month whether you are earning $20,000 per month or $40,000 per month.

Exceptions to the rule: If you are already financially independent or can live off of your spouse’s income in the event of your disability, you may not need disability insurance at all.

Policies will often give you a choice of a waiting period—that period of time between the date of disability and the date when payments begin. You should have an emergency fund consisting of at least three months of expenses sitting around in a very safe place.

In the event of disability, use that money to live on for the first three months. This will allow you to choose a 90-day waiting period for your disability insurance policy rather than a more expensive 30-day period. There is not much of an additional discount for a 180-day period.

Do you have to work at some point in the rest of your life for financial reasons? If the answer to that question is yes, then you need disability insurance.

Getting disability insurance is not as exciting as investing, but it’s the critical first step in your journey to convert your high income into a high net worth.

Do not take the risk of not having disability insurance. Get a quote from a WCI-vetted disability insurance agent if you need to get the right coverage in place.

Get a Quote