By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderI am not Muslim, I do not speak Arabic, and I am certainly no expert on the Quran or Islamic investing. I have only spent five months of my life in a Muslim country, and I'm not sure I actually spoke to a single Muslim while I was there, locked down on one-quarter of a square mile on an Air Force base. Thus, there's a decent chance of an error somewhere in this post (which I'm sure will be rapidly corrected in the comments below).

However, this post about Halal investing is in response to a question I have been receiving regularly from white coat investors for years. I thought it was time to get something up on the blog about it. Even if you are not Muslim, you can hopefully find something interesting to take away from this post. As always, take what you find useful and leave the rest.

What Is Halal Investing?

Before we get too far, let's start with some definitions.

- Islam—Religion of the Muslims, a monotheistic faith regarded as revealed through Muhammed as the prophet of Allah

- Islamic—Relating to Islam

- Muslim—As a noun, a follower of Islam. As an adjective, relating to Muslims or their religion.

- Sharia—A set of Islamic religious laws that governs aspects of day-to-day life for Muslims in addition to religious rituals.

- Halal—Permissible, compliant with Islamic law

- Haram—Forbidden or proscribed by Islamic law

- Riba—To increase or exceed, referring to unequal exchanges or charges for borrowing—effectively interest, the paying or charging of which is considered a sin in Islam

- Maisir—Speculation or gambling, also considered a sin in Islam

- Sukuk—A Sharia-complaint bond-like instrument, aka “Islamic bonds”

- Zakat—An obligatory payment made annually under Islamic law on certain kinds of property and used for religious purposes, somewhat equivalent to “tithing” for Christians

- Sadaqah—A non-obligatory religious payment, somewhat equivalent to “offerings” for Christians

- Murabaha—The practice of paying (more) over time instead of paying interest

Whether you want to call it Islamic investing, Sharia investing, Sharia-compliant investing, or Halal investing, we're talking about the same thing here.

What Does the Quran Say About Investment?

What does Islam have to do with investing? Lots of religions are anti-debt, but none of them take it to the extreme that Islam does. The longest verse in the Quran is about debt:

“When you contract a debt for a stated term, put it down in writing . . . let the debtor dictate, and let him fear God, his Lord, and not diminish [the debt] at all. Call in two men as witnesses . . . Do not disdain to write the debt down, be it small or large, along with the time it falls due: this way is more equitable in God’s eyes, more reliable as testimony, and more likely to prevent doubts arising between you.” (2:282)

Another verse says:

“Allah will deprive usury of all blessing, but will give increase for deeds of charity.” (2:276)

More significantly, the prophet Muhammad said:

“If a man was killed in battle for the sake of Allah, then brought back to life and he owed a debt, he would not enter Paradise until his debt was paid off.”

“A dirham of Riba (interest) knowingly taken by a man is a sin worse than committing Zina (fornication) 36 times.”

Basically, devout Muslims don't do debt. They don't lend. They don't borrow. This wasn't too big of a deal until modern times. Most people didn't have much to do with debt until the last couple of centuries. However, in our modern financial world, avoiding debt and the interest that goes with it is becoming more and more difficult each year.

Devout Muslims find ways around it as best they can. For instance, they use “Islamic mortgages” to buy a house. You're not borrowing to buy that house; you're just paying more for it on an installment plan. No interest is involved. Semantics? Maybe. But it matters to them, so it matters to me. Paying for an expensive education such as medical or dental school can also be problematic, given that three-fourths of doctors graduate with student loans. It turns a lot of devout Muslims away from an expensive education, while others are lucky enough to have a well-to-do family member, obtain scholarships, or get money from riba-free charities. Or some just feel terribly guilty for a few years.

How Devout Are You?

In every religion, some people are more devout than others. Among Christians, some view a tithe as a strict mandatory contribution of 10% of everything they earn while others view it as any donation made to a church or even a non-church organization. Huge variation. There is some variation among Muslims as well. While all view interest as a bad thing, some might simply try to minimize it by borrowing as little as possible and paying it back as quickly as they can. Perhaps they stay away entirely from fixed-income investments like bonds and CDs, but they're OK with stocks, even for companies that carry debt or charge interest.

If you are a Muslim interested in investing, the first question I would ask is how strongly you feel about avoiding riba. If the answer is not that strongly, you have lots of options. If you are particularly devout on this point, your options will be much more limited.

More information here:

How Much Should I Tithe to My Church?

How to Give Away Money Better (Instead of Tithing)

What Is Sharia-Compliant or Halal Investing?

Sharia-compliant or Halal investing is simply investing in a way that is compliant with the laws and rules of Islam. That primarily means that you are not receiving riba.

What Is Riba?

Riba is interest. Technically, it refers to an unequal exchange, but the English word for what is being referred to is interest or, perhaps more negatively, usury. Accepting it is a more severe sin than fornication, according to the writings of the Prophet. Riba is generally forbidden in Islamic finance. That rules out most interest-bearing investments, including CDs, Treasury bills, bonds, savings accounts, money market funds, bond funds, preferred stock, convertible bonds, and the mutual funds that invest in these asset classes. There are alternatives to these low-risk investments that are acceptable to Muslims, including Islamic bank deposits and sukuk.

What Is Maisir (Maysir)?

Maisir is speculation or gambling. Maisir is forbidden in Islamic finance because it creates wealth from chance rather than productive activity. Sharia does not, however, prohibit the ordinary commercial speculation involved in a business enterprise, because commercial risk-taking is an integral part of Islamic finance transactions. Because of the prohibition against maisir, certain financial products—such as options, futures, and other derivatives—are not generally used in Islamic finance. A widely viewed exception is owning (not trading) stock options in a company that employs you.

Halal Investing Definition

Halal investing requires investment decisions to be made in accordance with Islamic principles. As a faith-based approach to investment management, investors often consider Halal investing to be a category of ethical or socially responsible investing.

Islamic Investing Principles

Practically speaking, four things are prohibited when it comes to investing in a Sharia-complaint way:

- Bonds and other interest-based investments (riba)

- Stocks in companies with high debt

- Stocks in companies in industries that do not adhere to Islamic principles, such as liquor, gambling, pornography, pork, insurance, and banks

- Derivatives such as options and futures (maisir)

Even Halal stocks may require you to pay “purification dues.” Essentially, you give the impure income away to charity. Typically, if a stock has less than 5% of its income from “impermissible sources,” it is considered OK to invest in, but you still have to pay purification dues on that impermissible income. If the dividend is 2% and 3% of the income is from impermissible sources, you would need to donate 2% * 3 % = 0.06% to charity. Interestingly, you don't have to pay purification dues on capital gains.

What Makes an Investment Halal?

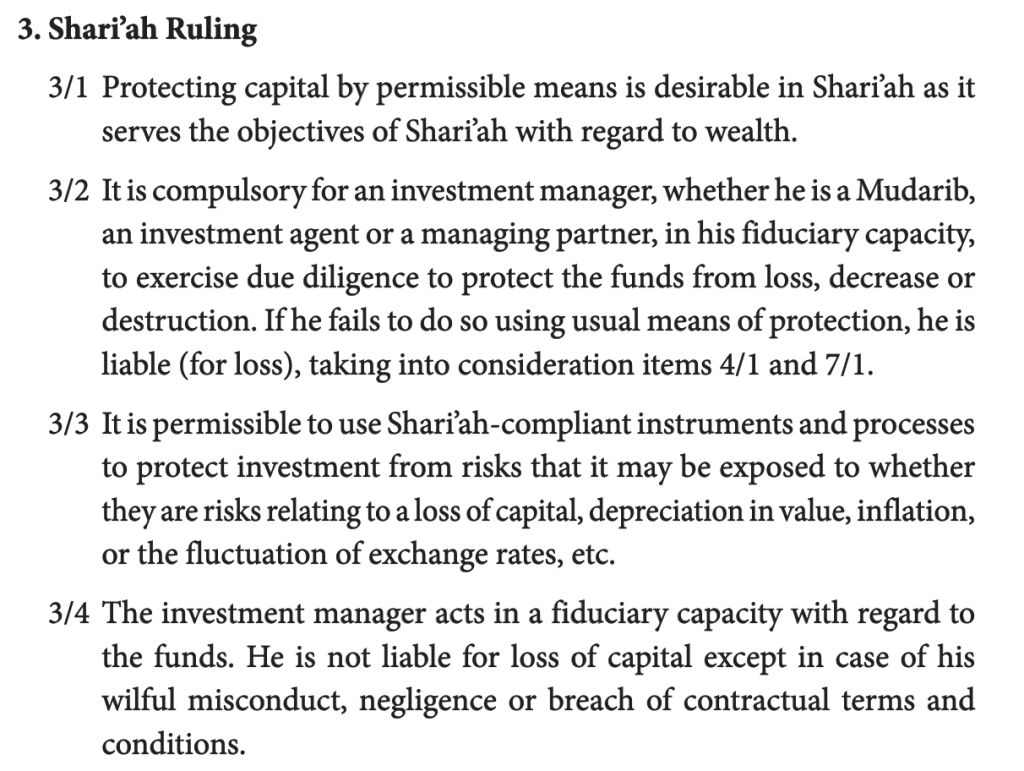

There is obviously a lot of gray area here. However, the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) was founded in 1990 to bring together Islamic scholars with extensive backgrounds in finance and transactions to issue some guidelines. The scholars are from all over the world and from different schools of thought. Their guidelines can help the individual Muslim decide if their investments are Halal. Don't worry, the guidelines are only 1,264 pages long. They deal with everything from the trading of currencies, commodities, commercial paper, Islamic insurance, the conversion of a traditional bank to an Islamic one, and earnest money. If you're looking for a comprehensive source of what's OK and what isn't, this is it. There's plenty of interesting stuff, such as the fact that Muslim financial professionals are required to be fiduciaries.

AAOIFI is not the only regulatory body. For instance, the “Shariah Advisory Council of Securities Commission Malaysia” announces when stocks are no longer Halal. If you sell these newly forbidden stocks right away, you get to keep your capital gains. If you wait, any additional gains are to be given to charity. Interestingly, if you're underwater when the stock becomes non-Halal, you are allowed to hold on to it until its share price gets back to what you paid for it.

Achieving Sharia Compliance

There are obviously a lot of rules to follow when the guidelines are 1,264 pages long. You can get help, though. In fact, CIMA (Certified Investment Management Analysts) offered four certificates in Islamic finance:

- Islamic commercial law

- Banking and Takaful

- Islamic capital markets and instruments

- Accounting for Islamic financial institutions

It might be worth it to you to hire a qualified advisor to help you maintain compliance with Sharia. No, I don't have a list, but CIMA might.

Difficulties in Islamic Investing

If you thought it was tough getting through medical school while remaining compliant, it doesn't get much easier once you are out and start investing for your future. The vast majority of investments out there are not Halal. If this all feels very hard to you, you're not alone. In fact, the whole concept behind Islamic finance and investing is a little murky. It has been criticized by Muslims and non-Muslims alike.

Even some Islamic financial scholars say the majority of Islamic banking and Islamic bonds are un-Islamic, and if that's what those who know it best are saying, what is the average Muslim to do? Do you just go by the labels and call it good? Do you have a responsibility to dig deeper? Is it even possible in today's world to be fully Sharia-compliant AND be a successful investor? How do you maintain diversification, keep costs down, and achieve excellent returns while also having to comply with 1,264 pages of guidelines and contradictory recommendations from authorities? Can you invest “normally” and just pay a little extra purification tax, Zakat, and Sadaqah to make up for it?

More information here:

Faith, Family, and Finances with Rogue Dad, MD

What the Bible Can Teach You About Money

Best Halal Investment Options

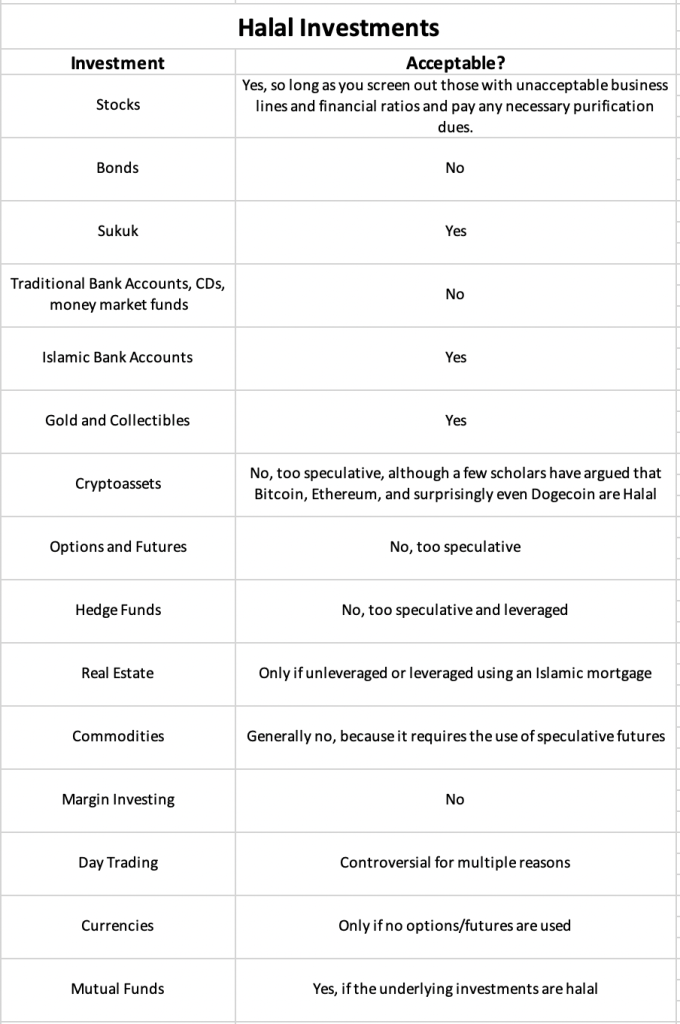

Let's review again what most think is OK and what most think is not OK.

What can you do? Here are your best options.

#1 Islamic Mutual Funds and ETFs

There are lots of Muslims in the world, and Wall Street wants to sell them investments just as much as anyone else. So, investments are designed to meet their needs. They're not always the best investments and they are rarely the cheapest, but that's the price you pay to get exactly what you want. It's a bit like Environmental, Social, Governance (ESG) investing. Higher expense ratios and generally lower performance. There is also a lot of overlap between these funds, and they tend to be pretty tech-heavy. Just as tech stocks seem to do well on ESG measures, they also tend to do well on Sharia measures. But there are a lot more funds than there used to be. Here are some funds to consider:

- SP Funds S&P 500 Sharia Industry Exclusions ETF

- SP Funds S&P Global REIT Sharia ETF

- SP Funds Dow Jones Global Sukuk ETF

- Wahed FTSE USA Shariah ETF

- Wahed Dow Jones Islamic World ETF

- iShares MSCI USA Islamic UCITS ETF

- iShares MSCI World Islamic UCITS ETF

- iShares MSCI EM Islamic UCITS ETF

- Wealthsimple Shariah World Equity Index ETF

- Almalia Sanlam Active Shariah Global Equity UCITS ETF

- HSBC Islamic Global Equity Index Fund

- Schroder Islamic Global Equity Fund

- Amana Mutual Funds (Growth – Income – Developing World – Participation)

- Oasis Crescent Funds

iShares is the one that jumps right out at me, but when I look at the Islamic US stocks ETF up there, I see that it charges 0.3%, contains only 125 stocks, and has over 20% of the portfolio in Microsoft. By comparison, VTI charges 0.03%, contains 3,941 stocks, and has < 5% of the fund in Microsoft. Performance-wise, the Islamic ETF has done just fine (better than both VTI and VUG over the last five years), but the track record isn't long.

I was very surprised to see a REIT ETF (SPRE) on this list. It seems to contain many of the typical big REITs, which I'm sure are using plenty of conventional leverage/mortgages. I'm not really sure how that is Sharia-compliant, given that its top holding is 43% leveraged. I wasn't surprised to see an expense ratio of 0.69, about six times as high as the Vanguard REIT Index ETF. Again, the track record is very short. VNQ outperformed SPRE by 3 percentage points in 2022, and though SPRE was ahead by a few percentage points in the first three quarters of 2023, VNQ outperformed SPRE by the end of the year.

#2 Pick Individual Stocks

I'm not a big fan of individual stocks, but if your definition of a Sharia-compliant stock is different from that of a mutual fund manager, you can build your own. There are lists of Sharia-compliant stock out there that you can use.

#3 Invest in Direct Real Estate

Whether you use an Islamic mortgage or none at all, direct real estate can be a great investment. It is going to be tough to find a syndication or fund that uses Islamic mortgages, though.

What About Workplace Retirement Accounts?

What if your employer offers you a 401(k), 403(b), or 457(b) that doesn't have any of these Islamic funds or ETFs in it? First, check to see if there is a “brokerage window” option, such as the Schwab PCRA in the 401(k). If there is, you should be able to just buy whatever ETF or stocks you please there. If not, I would suggest lobbying HR to add an Islamic fund or two. It might help if you suggest they are breaching their fiduciary duty by not providing that sort of investment, but I don't know that you would have a strong case to sue since most 401(k)s do not offer these new and untested funds. It might work better to argue that they are discriminating against you because of your religion. If they won't change the 401(k), you might just be out of luck. You will miss out on that asset protection, tax-protected growth, and possibly even the employer match.

Islamic finance is relatively new. However, it is becoming easier and easier every year to ensure your investments are aligned with your religion.

What do you think? Is your portfolio Sharia-compliant? What's in it? How difficult is it to maintain?